Introduction

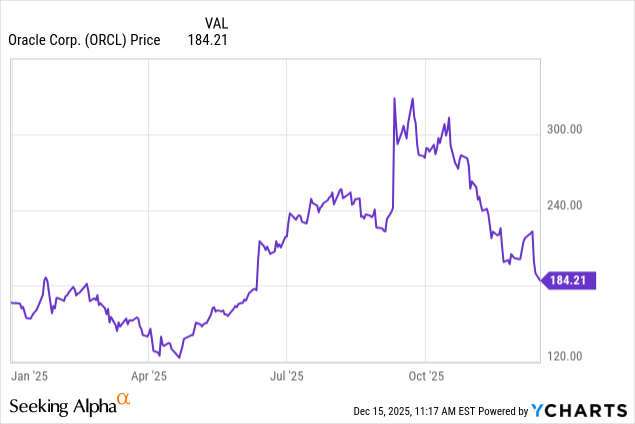

It is insane to look at Oracle Corporation (ORCL) right now and realize that the stock is up only 10% year-to-date, which is a staggering underperformance relative to how we were feeling only a couple of months back, when Oracle stock was surging and the company seemed untouchable.

In general, the stock of this company had a sharp rise from about $150 per share to more than $300 per share, effectively doubling its value – but then something went wrong, and the narrative completely fractured. And the funny thing is, what went wrong was the same thing that went right before this. The reason is the enormous number of contracts to fulfill, or the backlog that this company has accumulated. The market has suddenly realized that Oracle cannot simply make up these services out of thin air, and that it must invest an absolute fortune into its infrastructure to fulfill that demand. Another major concern is that OpenAI is supposed to fulfill the majority of those orders.

For Oracle to be able to lock in that backlog in the form of earnings, they will need to spend billions of dollars, and investors, of course, are worried. The market is right to be nervous about this whole setup because the capital intensity here is frightening.

The Plunge After The Surge

On these earnings, we have seen that Remaining Performance Obligations, or RPO of Oracle, was at more than half a trillion dollars (specifically 523 billion), and it was up an incredible 433% from last year, which on paper sounds like the greatest growth story in the history of software. However, what is funny is that the management underlined that it was driven by contracts signed with Meta Platforms (META), Nvidia (NVDA), and others, as they continue to diversify their customer backlog. They seemingly refused to mention the name of OpenAI, likely because they know it has become a trigger for market anxiety:

Remaining performance obligations, or RPO, ended the quarter at $523.3 billion, up 433% from last year and up $68 billion since the end of August, driven by contracts signed with Meta, Nvidia and others as we continue to diversify our customer backlog.

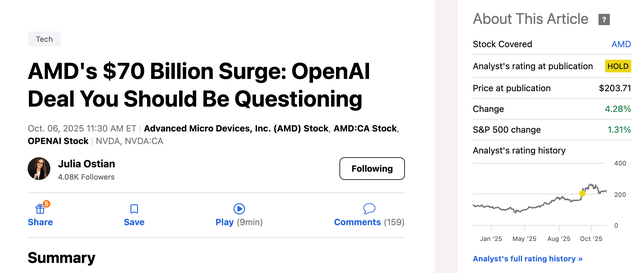

The market is finally waking up to the fact that OpenAI (OPENAI) might not be in the pristine financial shape many assumed. I have been skeptical of this situation for months. I follow the AI space closely, and my caution here isn’t new. Back when Advanced Micro Devices (AMD) exploded on the news of its own deal with OpenAI, I wrote an article breaking down the situation. Despite being a shareholder of AMD, I gave the stock a Hold rating because I felt the hype was detaching from reality.

AMD Coverage

That call proved to be correct. Since then, AMD surged higher only to pull back significantly, and it is currently sitting on gains of just ~4% while the S&P 500 (SP500) has moved about 1.3%. In that October 6th article (written when Oracle was trading near its all-time highs of ~$300), I described the problem of simultaneous contracts between OpenAI, Nvidia, Oracle, Broadcom (AVGO), and AMD like:

What has been happening around OpenAI lately, with its simultaneous contracts with Nvidia, Oracle, Broadcom, and now AMD, has started to look like an inflated web of promises built on circular financing. The financial engineering behind it starts looking fragile, and I am not sure OpenAI will be able to stand up to all of those promises.

My thesis was that the entire ecosystem felt like a house of cards, where everyone was lending money to everyone else to buy chips from one another. For me, the Oracle-OpenAI deal was the perfect example of why investors shouldn’t blindly trust this circular financing model, so I stayed away from Oracle for exactly this reason, and while the brutality of the market’s reaction has been surprising, the direction is not. Now we are seeing reports of data center delays and skyrocketing costs for Credit Default Swaps (CDS) on Oracle debt. This tells us clearly that the “smart money” in the bond market is getting nervous about Oracle’s ability to pay for the massive infrastructure buildout required to fulfill these promises.

Financial Results

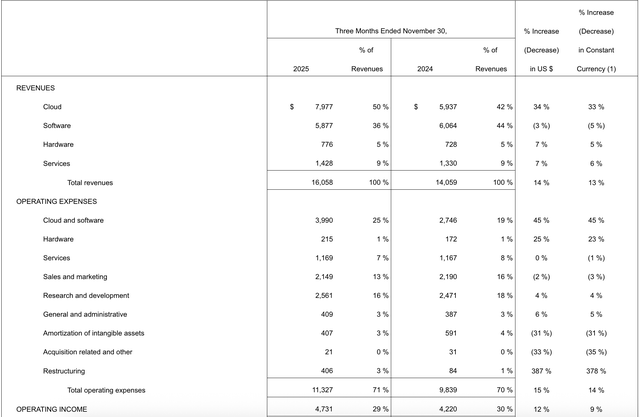

When we look only at the numbers reported in the recent earnings and ignore all the fuzz and buzz of the market, we see a company that is growing but at a cost that is difficult to comprehend. Total revenues for the quarter were $16.1 billion, up 13% year-over-year, which is a decent acceleration and continues their trend of double-digit growth. Total cloud revenue surged by 33% to $8 billion. And this is actually a huge deal because it means that cloud revenue now makes up half of Oracle’s entire business, a milestone they have been chasing for quite a long time. But what is even more impressive is the Cloud Infrastructure specifically, which flew up 66% to $4.1 billion, with GPU-related revenue absolutely exploding by 177%. So this basically confirms that the demand for AI compute is real and that Oracle is actually managing to win business against much larger competitors. The demand is already there, standing right in front of them, and now the only thing left is to actually go and take it.

Total cloud revenue, which includes both applications and infrastructure, was up 33% at $8 billion representing a significant acceleration from the 24% growth rate reported last year. Cloud revenue now accounts for half of Oracle’s overall revenue. Cloud infrastructure revenue was $4.1 billion, up 66% with GPU-related revenue growing 177%. Oracle’s Cloud Infrastructure businesses continue to grow much faster than our competitors. Cloud database services revenue was up 30% with Autonomous Database revenue up 43% and Multicloud consumption up 817%.

2026 Second Quarter Financial Results

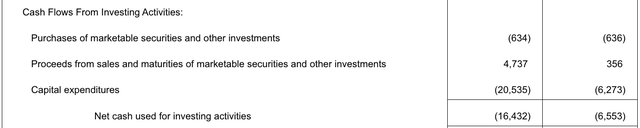

On the positive side, they recognized a pre-tax gain of $2.7 billion in the quarter stemming from the sale of their interest in Ampere, which, I think, is a strategically intelligent move because it signals they are moving toward chip neutrality and want to work closely with all CPU and GPU suppliers rather than competing with them. But even with that one-time gain, the operating cash flow in Q2 was $2.1 billion while free cash flow was actually a negative $10 billion due to that massive CapEx spend, and that is a number that should make any fundamental investor think about the sustainability of this spending spree.

All in, total revenues for the quarter were $16.1 billion, up 13% and higher than the 9% growth reported in Q2 last year, continuing our trend of accelerating total revenue growth. Operating income grew 8% to $6.7 billion. Non-GAAP EPS was $2.26, up 51%, while GAAP EPS was $2.10, up 86%. We recognized a pretax gain of $2.7 billion in the quarter stemming from the sale of our interest in Ampere.

However, the cost to “take” this growth is becoming the primary concern for investors because CapEx hit $12 billion in the quarter alone, reflecting the massive investments being made to support this accelerating growth. Management even admitted that fiscal 2026 CapEx will be about $15 billion higher than they forecasted just after Q1, which is a staggering increase in capital requirements in such a short period.

However, given the added RPO this quarter that can be monetized quickly starting next year. We now expect fiscal 2026 CapEx will be about $15 billion higher than we forecasted after Q1. Finally, we are confident that our customer backlog is at a healthy level and that we have the operational and financial strength to execute successfully.

Valuation

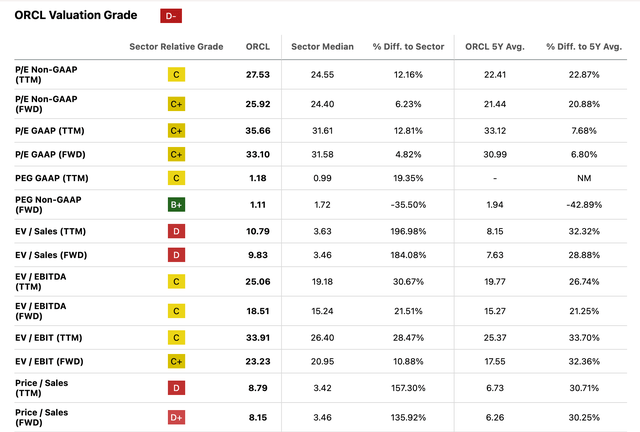

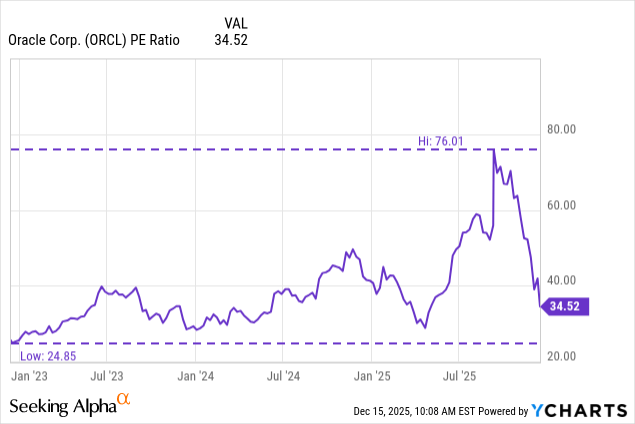

If we take a look at Oracle’s valuation metrics over the last three years, we see that the company is finally not that expensive relative to its own history. The lowest trailing 12-month P/E ratio in this period was 25x, while the highest (during the peak of the recent mania) reached 76x. Right now, we are sitting at about 35x. It is not the lowest level, of course, but it is a significant retreat from the highs.

Now, if you are asking if the stock can go down further, the answer is definitely yes. When we compare the P/E ratios on both a forward and trailing basis to the broader sector, the stock still looks slightly overvalued.

However, if we look at the PEG (price to earnings divided by growth) ratio on a forward basis, we see a very interesting divergence: it suggests the stock is 35% undervalued. This implies that if the growth actually materializes (meaning if Oracle is successful in raising capital and investing it efficiently), then the current price is actually cheap.

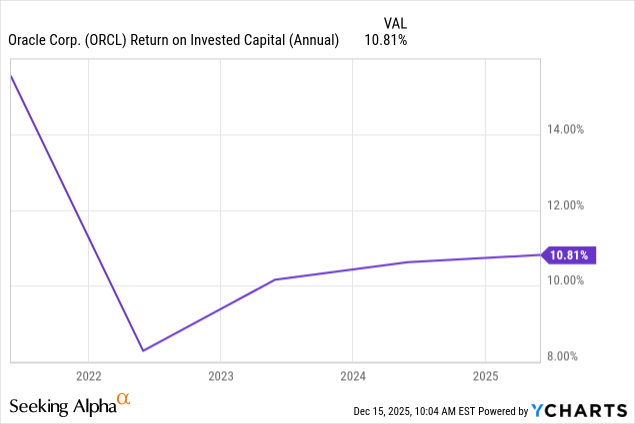

We also need to look at capital efficiency. Return on Invested Capital (ROIC) currently sits at about 10%. It is not even close to Nvidia, but it is not a bad level to be at, and importantly, it is definitely higher than their Weighted Average Cost of Capital (WACC), which is always a good sign. I actually think there is a real possibility for ROIC to increase as the company invests in this AI infrastructure, provided they can avoid the delays and cost overruns that often plague projects of this magnitude.

Risks

The stock has been really volatile, and I have never really liked this whole setup with OpenAI. It seems the company already realizes this is a liability. They tried not to even mention OpenAI on the earnings call. Instead, they kept underlining that they have contracts with other companies that have real cash and are ready to pay, likely because they know the market is skeptical of the “circular financing” risk I mentioned earlier.

It is interesting to watch them pivot, but we need to pay attention to the fact that this company is highly leveraged. Total debt at the moment is enormous, over $100 billion, depending on how you account for recent borrowings. While cash on hand has increased to about $19 billion, that increase largely came from external funding. In other words, they took on more debt just to raise the cash needed to invest in infrastructure.

2026 Second Quarter Financial Results

This brings us to the core problem with Oracle’s current business model. Oracle has a huge backlog, most of which comes from OpenAI (perhaps around $300 billion). Its business model isn’t working in a way where you get paid and then build the product. They must build all the expensive infrastructure first, and only then can they hope to sell it. This places all the risk completely on the shareholders of an already leveraged company that will likely need to raise more debt every quarter just to sustain this buildout.

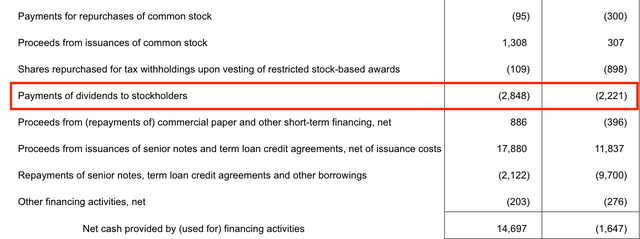

Finally, the fate of the dividend is unclear. For shareholders who have stuck with Oracle for the income, there is a chance that the dividend could be cut. The company spends a significant sum on dividends every year, and it would help them immensely if they could redirect that money into CapEx and R&D instead. Cutting the dividend would be a desperate step and would definitely send the stock even lower because the market would hate it, but mathematically, given the cash burn we are seeing, it might actually be the smart thing to do.

2026 Second Quarter Financial Results

Conclusion

Despite all these structural risks, it does appear that Oracle may have been slightly oversold in this recent panic, but I certainly wouldn’t be jumping “all in” right at this specific moment. However, I am considering opening a small position, just to get some skin in the game, while I wait to see how the future unfolds.

I am being cautious because I see the potential for an even larger downside from these current levels. I am fairly certain the stock could revisit the levels we saw in early 2025, around $160 per share. And let’s not forget that when the market dropped sharply in April, Oracle plunged as low as $120. Those levels are not impossible to revisit if the broader market continues to punish high-flying tech stocks, or if a major market correction appears.

Right now, Oracle is caught in the middle of investors’ growing wariness about the “AI bubble.” Until that sentiment shifts, I don’t expect the stock to really start booming or flying again. I expect these choppy conditions to continue for some time, likely through the holidays and perhaps into the first couple of months of next year. So, is there a real need to run out and aggressively buy the stock right now? In my opinion, no.

I might open a small position to take advantage of this immediate market overreaction, but I am keeping the vast majority of my capital with myself, waiting for a larger dip to add more aggressively.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.