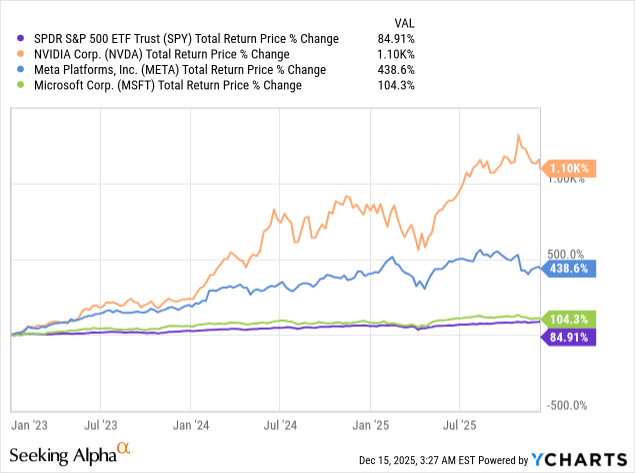

2026 Market Outlook: The S&P 500 (SPX) has been on a roll over the past several years, led primarily by the boom in optimism over AI, with stocks like Nvidia (NVDA), Meta Platforms (META), and Microsoft (MSFT) leading the index higher.

However, valuations have gotten to a point where AI is going to have to meet an extremely high bar for growth and deliver very strong returns on investment, given the vast amount of capital poured into a particularly big spend on data centers and other related infrastructure build-out necessary for AI to achieve its promise.

When you combine this sort of extreme market optimism with increasing strains on the economy from high levels of debt on consumers, corporations, and the government, as well as growing geopolitical risks, I have an overall bearish outlook on the S&P 500 for 2026, expecting it to end the year slightly down from current levels to around 6,800, primarily from valuation multiple compression due to multiples getting too far ahead of themselves right now. Instead, I expect capital to rotate toward real assets, with sectors like precious metals (GLTR) and midstream infrastructure (AMLP) outperforming. In this article, I will detail why this is my outlook for the market in 2026.

Signs Of Growing Economic Fragility

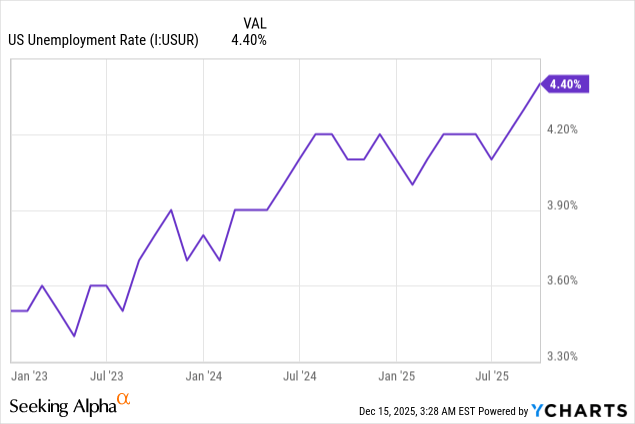

The U.S. economy is showing some signs of economic weakness, though you certainly would not know that by looking at the stock market right now. Inflation remains well above the Fed’s long-term 2% target level. The labor market is showing some signs of weakness, with the unemployment rate up over the past year.

Additionally, consumer debt is at historically high levels, and delinquencies are also increasing. Perhaps most critically of all, the U.S. government is running persistently huge fiscal deficits, which have the national debt growing faster than the economy is right now. Therefore, the economy has numerous growing signs of fragility that could plunge it into recession if AI fails to live up to its promise, and at the very least make the current lofty valuation multiples look relatively unattractive on a risk-adjusted basis.

Monetary Policy, Rates, And Valuation Extremes

Another major factor heading into 2026 that will impact how the markets perform is in the area of monetary policy and where the Federal Reserve goes with short-term interest rates. At the moment, there is a bias toward cutting interest rates, as the market is currently pricing in a likelihood of at least one rate cut next year and over a 70% chance that there will be at least two rate cuts in 2026. Additionally, quantitative tightening is ending despite the Fed’s balance sheet still remaining huge.

That said, the long end of the yield curve still remains vulnerable to moving higher due to heavy Treasury (TLT) issuance to deal with the federal debt and persistent deficits, as well as the fact that foreign buyers have been declining, especially as China and Japan are reducing their dollar holdings. At the same time, the Fed pivoting away from quantitative tightening and starting to buy Treasuries once again will help offset some of this pressure. However, it still should not be assumed that just because the Fed is cutting short-term rates, long-term rates are going to follow them lower.

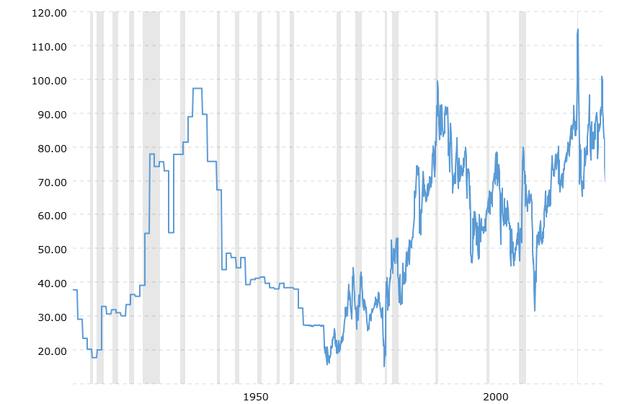

Additionally, the market’s valuation multiples are sky-high based on multiple metrics. In particular, the Buffett indicator, the price-to-earnings model, the price-to-sales model, and the mean reversion model all indicate that the market is strongly overvalued right now, while the interest rate model also signals that it is overvalued. Not only that, but the yield curve model is flashing a very high recession risk signal right now, which is far from a guarantee that we are headed for a recession, but it should be kept in account. Moreover, Howard Marks recently observed that whenever the market has reached its current price-to-earnings ratio, over the next decade, it always generated real annualized returns of near 0%, meaning that we could very well be headed for a lost decade, or at the very least a lost half decade here in the remainder of the 2020s.

The Concentration Risk Inside The Index

An additional risk for the market is the fact that the S&P 500 (SPY) is becoming increasingly concentrated in AI-related megacap tech stocks, as well as fast-growing players like Palantir Technologies (PLTR). This means that if the AI narrative fails to live up to the current hype and market sentiment turns, it will have an outsized impact on the S&P 500. Effectively, this means that by investing in the index, investors are not achieving nearly as much diversification as they once did. Therefore, the S&P 500’s fate is increasingly tied to the outcomes for the AI industry. At the same time, the valuation is such that anything less than a very impressive future for AI will lead to very poor market performance over the long term.

Therefore, 2026 does not even need to bring about a recession or a major black hole for the S&P 500 to decline, because the market has priced in so much future growth already. Therefore, I think the market could potentially shift to focusing more on return on investment from AI instead of simply investments for the future and additional excitement about where AI is going, which could, in turn, result in weak performance of the S&P 500.

Geopolitics And The Taiwan Risk

Additionally, I think that as the year progresses and 2027 draws near, there will be a growing focus on the potential for China to invade Taiwan if it does not move against them already this next year. This is because the CIA has reported that Xi Jinping has ordered the People’s Liberation Army to be ready to invade Taiwan by 2027.

Based on accounts from leading U.S. military experts and authorities, the threat from China could be imminent, and the PLA appears to be ready to meet its 2027 timeline, if not before then. Therefore, I think the market, which has up until now largely ignored this risk in its valuation of companies, will likely start to take this risk much more seriously. This could also have a particularly profound impact on the S&P 500, given that Taiwan is the advanced semiconductor production capital of the world (TSM), and if the supply of advanced semiconductor chips were disrupted, it would significantly hurt leading AI companies, especially NVDA and Advanced Micro Devices (AMD), as well as those companies dependent on NVDA chips.

Why Real Assets Could Shine In 2026

While I foresee a poor overall result for the S&P 500 in 2026, I expect precious metals to outperform next year. While silver (SLV) and gold (GLD) had a very strong run this year, I expect them to continue to outperform. Silver will likely continue to outperform due to its structural supply deficits and strong industrial demand for silver, thanks to significant production of solar panels, electric vehicles, semiconductors, and AI-related electrification. Silver will also continue to enjoy jewelry and investment-based demand due to the fact that it remains undervalued versus gold on a historical basis.

Meanwhile, gold will also likely continue to enjoy strong performance because of demand from central banks that appears to not be slowing down anytime soon, as the global economy continues to de-dollarize. Additionally, as the focus shifts toward risks in East Asia, with tensions simmering between China and Japan, the Philippines, Taiwan, and the United States, gold will likely enjoy strong demand as a geopolitical hedge both in Western markets as well as in China, as savers and institutions increasingly put weight on the importance of protecting their wealth with traditional safe havens rather than betting big on continued outsized performance in equity markets. Not only that, but cash will likely become an increasingly less popular safe haven, and bonds (AGG) will become an increasingly less favorable store of wealth because of the persistent government spending deficits, which threaten to erode the value of fiat currencies over time.

Midstream As A Defensive Income Winner

I also think that midstream will perform well because it is quite defensively positioned with its long-duration fixed-fee contracts and limited commodity price sensitivity. At the same time, it is also inflation-resistant due to inflation-linked escalators in many of its contracts, and these businesses often generally have strong investment-grade balance sheets with leverage at cycle lows. Best of all, they offer very attractive and sustainable yields that enjoy favorable tax treatment in most cases.

Additionally, there are some leading MLPs that are bringing a lot of projects online in the coming quarters that will enable them to dramatically increase their EBITDA while reducing their leverage and CapEx, thereby enabling them to pivot toward more aggressive capital returns to investors. One of the biggest examples of these is Enterprise Products Partners (EPD), and as a result, I think that it could have a strong 2026 to 2027 ahead of it, which, given its status as one of the largest midstream businesses, could help lift the entire sector higher.

Risk To The Thesis And Investor Takeaway

Of course, there are always reasons why the S&P 500 could continue to rise next year. One of these is simply continued strong market momentum fueled by the bullish AI trade. This could become even more the case if AI continues to advance at a brisk pace, with major advances in large language models and AI-linked robotics.

Additionally, there have been a lot of announced investments in the U.S. that should begin to flow in and be felt over the next 3–12 months. If this indeed takes place, and lifts the economy with it, inflation comes down as AI productivity enhancements begin to take greater effect, and at the same time, tariffs continue to bring in significant sums of revenue, some of the pressures on the national deficit could be lifted. The bond market may cheer this development, leading to lower long-term interest rates, which in turn could help support the S&P 500’s lofty valuation multiple.

However, while this is certainly a possible outcome, I think it is unlikely for the reasons mentioned in this article. As a result, I think the S&P 500 is going to have a flat-ish to slightly down 2026. While I think that midstream is going to have a strong year, precious metals should also continue to deliver attractive returns.

Therefore, some of my very largest positions right now include gold and silver bullion leases, as well as significant positions in numerous midstream infrastructure companies in my portfolio. I expect these two large bets to help fuel continued outperformance in 2026 at High Yield Investor. Let me know in the comment section below what you think is in store for the S&P 500 next year and what factors you are going to be paying most attention to.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.