Introduction

After more than a decade working in Colombia in the agriculture sector, coffee became an unavoidable part of my professional life. Through USAID-supported projects in regions such as Meta, and Cauca, I was able to see firsthand how Colombia’s coffee industry has expanded well beyond its traditional heartland in the Eje Cafetero. This evolution has not been limited to those areas.

The department of Huila, in particular, has significantly strengthened its position as a producer of high-quality Arabica coffee, gaining international recognition. Other regions like the department of Meta, especially in San Juan de Arama, and Lejanias, have been gaining relevance in terms of the production and quality of Arabica coffee, but still need more expansion and incentives; however, the scenario is promising.

While coffee remains a vital source of income for hundreds of thousands of rural families (549,000 families)-National Federation of Coffee Growers of Colombia, my experience in Colombia also revealed how fragile the sector truly is. Production outcomes can change quickly from one season to the next due to the weather volatility, aging plantations, rising input costs, and persistent disease pressure.

This story strongly influences how I view the global coffee market today. Coffee is increasingly less about volume growth and more about resilience, origin diversification, and quality differentiation. As the market looks toward 2026, these factors are becoming central to price formation, particularly in Arabica coffee, where supply constraints and production risks remain difficult to resolve in the short term.

Global context

According to the USDA, global coffee production for the 2024/2025 season is projected at approximately 175 million 60-kg bags, led by Brazil, Vietnam, and Colombia. Brazil accounts for approximately 64.7 million bags, which represent 37% of global production, building its extensive dominance in the market. Colombia, meanwhile, continues to be globally recognized for producing high-quality Arabica coffee.

Coffee prices have already trended higher in recent years, yet many of the structural challenges in key producing countries remain unresolved. Climate risks, labor constraints, and capital requirements continue to weigh on supply stability. For this reason, I believe Arabica prices could remain structurally supported through 2026, with further upside potential if production risks intensify.

Investment Thesis

I am bullish on Arabica coffee prices through 2026. While prices have already risen meaningfully in recent years, I believe they remain fundamentally supported by persistent supply-side fragility, long agricultural renovation cycles, and structurally strong demand for high-quality Arabica coffee.

Unlike many agricultural commodities where higher prices quickly incentivize supply growth, coffee responds slowly. Climate volatility, aging plantations, labor constraints, and disease pressure continue to limit production flexibility in key origins such as Brazil, Colombia, other countries of Central America, including Honduras. As a result, even modest disruptions can have an outsized impact on global supply.

In this environment, Arabica coffee prices appear more likely to remain elevated or move higher than to revert quickly to long-term historical averages.

Why Arabica Prices Remain Supported

My constructive outlook for Arabica coffee through 2026 is based on four key factors:

1. Production risks remain elevated in key countries

Brazil represents nearly one-third of the global coffee supply (37%), and production depends heavily on rainfall and temperature. Irregular rains, heat waves, and rising input costs have reduced the ability of producers to maintain consistent yields.

In Latin America, including Colombia, Honduras, Guatemala, many small farmers operating with not more than 1.5 hectares, still rely on old trees, limited renovation, and struggle with diseases such as coffee leaf rust. Although a renovation program exists, the progress is low. However, in Colombia, the opening of other areas of coffee production can help to sustain and increase production.

2. Renovation cycles take years, not months

A renovated coffee farm typically needs:

- 3-4 years before the production becomes significantly

- 5-7 years to reach full productivity

This means that the renovation process has accelerated today for many factors, and an improvement in the agricultural practices, it will not immediately change the global supply.

3. Global demand for Arabica remains strong

Despite higher retail prices, demand for higher-quality Arabica coffee has remained steady in North America, Europe, and Asia. Especially, coffee consumption continues to grow, according to World Population Review, and consumers remain loyal to established flavor profiles and origins.

4. Production research and sustainable technologies

Ongoing research and the gradual adoption of improved agricultural practices are helping farmers address some long-standing challenges in coffee production. These efforts may increase yields per hectare over time, but their impact is incremental and uneven across regions, limiting their ability to quickly compensate for broader supply risks.

Thesis Summary

Overall, these factors suggest that Arabica coffee prices are likely to remain structurally supported through 2026, particularly if weather conditions become more challenging in key producing regions. Slow supply responses, persistent production risks, and steady demand for quality coffee continue to underpin the market.

Catalysts

A key medium-term catalyst for the coffee market is the accelerating shift toward mandatory traceability and compliance across Latin American coffee value chains. Recent initiatives involving multilateral institutions, governments, and industry stakeholders seek to strengthen farm-to-cup transparency, particularly in regions dominated by smallholder Arabica farms around 1.5 hectares.

While these efforts are often presented as sustainability-driven, the market implication is structural. Traceability is becoming a gatekeeper for export market access, especially for premium Arabica shipments into Europe and North America, which seek tighter deforestation and ESG-related regulations-Environmental, Social, and Governance. Producers unable to document origin, land use, and production practices risk being excluded from higher-value market channels.

This dynamic is likely to tighten effective supply, not by reducing total output, but by filtering out non-compliant volumes. Countries with established, institutional frameworks and strong reputations for quality, such as Colombia and select Brazilian regions, are better positioned to meet these requirements, reinforcing origin-based premiums.

For investors, this trend supports price resilience in Arabica futures, particularly ICE Arabica Coffee [KC], which serves as the global benchmark. Futures prices reflect real-time- supply- demand dynamics, incorporating weather risk, production cycles, and origin-specific quality premiums without the stabilizing effect of corporate earnings or brand diversification.

The catalyst becomes more significant if compliance costs rise faster than adaptation capacity, especially when combined with ongoing climate and production risks.

As we move toward 2026, coffee market dynamics are increasingly shaped not only by harvest size, but also by who can prove compliance, transparency, and sustainability, a shift that structurally favors premium Arabica pricing.

Valuation and Data

When evaluating the broader coffee investment theme, it is important to distinguish between direct commodity exposure and equity-based exposure, as each reflects different valuation drivers and risk profiles.

Coffee Futures Exposure (ICE Arabica-KC)

For investors seeking direct exposure to Arabica coffee prices, ICE Arabica coffee futures [KC] provide the most transparent and widely referenced benchmark. Futures contracts directly reflect changes in physical supply and demand conditions, weather risk, and production expectations, without the stabilizing influence of corporate earnings or brand diversification.

Over the past several years, ICE Arabica coffee futures have delivered strong medium-term performance relative to several agricultural peers, although returns have come with the elevated volatility typical of weather-sensitive soft commodities. This volatility reflects the sensitivity of the market to climate shocks, disease pressure, and slow supply responses across key producing regions.

From a valuation perspective, Arabica prices remain above long-term historical averages, but this premium appears tied to structural supply fragility rather than speculative excess. Renovation cycles, climate volatility, labor constraints, and disease pressure continue to limit how quickly global supply can respond to higher prices.

From a valuation standpoint, Arabica prices remain above long-term historical averages, but this premium appears tied to structural supply fragility rather than speculative excess. Renovation cycles, climate volatility, labor constraints, and disease pressure limit how quickly global supply can respond to higher prices. For instance, recent USDA data show a notable decline in Brazil’s projected 2025/26 Arabica output, tightening global supply conditions. (Source: USDA Coffee Semi-annual Brazil Production Report).

A meaningful reversion toward historical averages would likely require clear and sustained evidence of supply recovery, particularly in Brazil and Colombia.

At the same time, market analysis highlights that adverse weather and supply disruption in major origins have pushed Arabica futures to multi-year highs, underscoring fundamental supply stress.

Colombia, the world’s third-largest coffee producer, and the first in high-quality, also faces structural production risks. According to the latest USDA Coffee Semi-Annual Report for Colombia, marketing year 2025/2026 production is forecast at about 13.8 million 60-kg bags of green bean equivalent (GBE), down from the strong 2024/25 levels as plantations show signs of exhaustion and weather variability weighs on yields. (Source: USDA Coffee Semi-Annual-Colombia).

Coffee Equities

Pure-play coffee equities are limited, but recent corporate activity highlights growing confidence in coffee’s long-term fundamentals. The acquisition of JDE Peet’s by Keurig Dr Pepper, with plans to spin off a standalone coffee-focused company, valued JDE Peet’s at a significant premium to its prior trading levels. This transaction signals strategic confidence in global coffee demand and pricing power. (Source: Financial Times coverage of the KPD/JDE Peet’s deal; Investopedia – deal overview).

Comparison and Interpretation

From an investor’s perspective, direct exposure to ICE Arabica coffee futures [KC] provides the most immediate sensitivity to Arabica price movements, but comes with higher volatility and no dividend income.

Overall, the coffee theme currently shows mixed but coherent pricing signals:

- Futures markets reflect volatility and ongoing supply risk,

- Coffee equities reflect brand strength and long-term demand, often at premium multiples typical of consumer staples.

Given the persistent supply-side challenges and the increasing importance of quality, traceability, and origin premiums, current pricing levels appear fundamentally supported rather than stretched, particularly for Arabica-focused exposure.

Technical Analysis

Even though my professional background is rooted in agricultural production rather than financial charting, I have learned over the years that agricultural commodities often follow patterns closely tied to the production cycle. Coffee behaves the same way. When production risks increase, markets often react well before harvest outcomes become official.

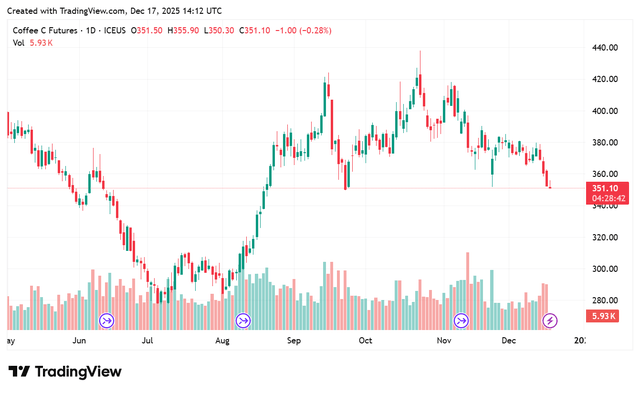

As shown in Figure 1, price action does not indicate a market in collapse. Instead, it suggests a market adjusting to ongoing uncertainty. If weather conditions in Brazil or Colombia deteriorate, this consolidation could break to the upside, as traders tend to react quickly to negative production signals. Conversely, improved rainfall and stronger production expectations could trigger short-term price corrections.

Overall, with supply risks still present across key producing regions, Arabica prices appear more likely to remain supported unless there is clear and sustained evidence of a broad production recovery.

Figure 1. ICE Arabica Coffee Futures (KC1!) – 1-Year Price Chart (TradingView/ICE Futures U.S.)

The chart shows Arabica futures consolidating after a period of elevated volatility, suggesting the market is digesting production uncertainty rather than signaling a breakdown. (Source: TradingView/ICE Futures U.S.)

Risks

Although I lean bullish, several risks could weaken the outlook:

- Weather improvements in Brazil, leading to higher-than-expected harvests

- Demand reduction, if consumers shift away from premium coffees

- Stronger U.S. dollar, which typically pressures commodity prices

- ETF tracking limitations, especially during volatile markets

- Rapid renovation across key countries

Although unlikely in the short term, simultaneous improvements in Brazil, Colombia, and Central America would ease supply pressure.

Conclusion

Looking toward 2026, the Arabica coffee market remains shaped by slow supply responses, persistent production risks, and rising compliance requirements that favor quality over volume. While prices are no longer cheap, they appear fundamentally supported by structural constraints rather than short-term speculation.

In this context, Arabica pricing continues to reflect a market where resilience, origin, and quality increasingly drive value, leaving limited room for a rapid, sustained, supply-driven price correction.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.