The year in the market has been quite the ride. Big tech and AI have dominated headlines and indices. And yes, shifts are afoot in the technology landscape, which rightfully deserve their weightings in investments, funds, and portfolios. The capex spending of hyperscalers—Google (GOOG) (GOOGL), Meta (META), Microsoft (MSFT) and Amazon (AMZN) — is mirroring this changing technology landscape. However, the energy sector is broadly meeting the moment of increasing energy demand owing to fundamental growth in the U.S. and around the globe.

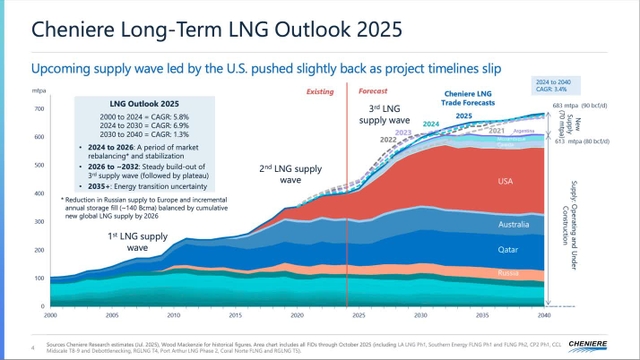

The U.S. grid is going to have more electrons flowing through it in the future. These investments are being made now, reflected in the $1 trillion of capital spending by publicly traded utilities up to 2029. Energy demand is also global, with U.S. LNG supply increasing in the next five years, comprising a solid trajectory for natural gas. Remember, oil and gas are depletable resources that must be produced continuously, steadily, and efficiently. U.S. shale has that down to a fine art and science. And meanwhile, nuclear, renewables and other sources are added to the mix to complete the offering.

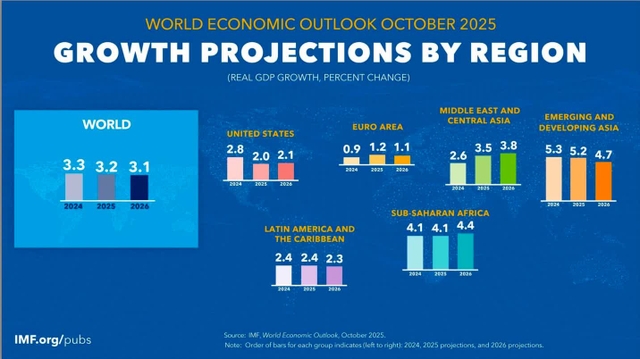

What does that mean? Generally, economic growth is increasing in the U.S., and around the globe, as economies modernize according to their pathways. The growing regions globally have been on the radar for many years now, and projections have proved out. The trade and tariff episodes are being digested. One net result has been other countries making bets in our tech and energy sectors. Actually, upward of $2 trillion has been announced by Europe, Japan, UAE, Saudi Arabia, South Korea, and others.

Are we in a bubble?

Equities Rise (Fed Energy conference, Macro talk )

The looming question through the second half of the year was: “are we in a bubble?” From a Dec. 4 event in San Francisco, chipmaker AMD’s (AMD) CEO Lisa Su stated:

“We are not in a bubble. This is the most transformative tech of a lifetime and its early days—we haven’t (even) gotten started.”

She sees so much demand for the tech and that the cash flow is there (from her supply side position). Considering the models of 12 months ago, people are completing more complex tasks (speaking about AI use). She said they would be doing more if there was more capacity and power wasn’t a constraint. She expects the data center segment to grow considerably at AMD.

The entire AI value chain is spreading—vertically, horizontally, with many unknown knowns concerning the rate of diffusion and adoption. It’s particularly expansive across model makers, hyperscalers and data center developers to utilities and energy players. Some have considered the mega deals between big tech, chipmakers and modelmakers to be circular, with tens of billions flowing between clients and customers. Most recently, Anthropic committed to purchasing $30 billion of Microsoft Azure compute capacity and to contract additional capacity up to 1 gigawatt. Anthropic is also committing to 1 gigawatt of compute capacity with Nvidia’s (NVDA) Grace Blackwell and Vera Rubin systems.

AI models are advancing and differentiating themselves. At a Silicon Valley event in Dec. I attended, cofounder Daneila Amodei said that significant research goes into a model’s character and its guardrails, an area in which Anthropic displays leadership. It’s why Microsoft is partnering with them for enterprise applications and ventures.

Microsoft will provide broader access to Claude’s frontier models for businesses, through Microsoft’s Azure AI Foundry. This will make Claude the only frontier LLM model available on all three of the world’s most prominent cloud services— Microsoft Azure, Google Cloud, and Amazon Web Services (AWS). Nvidia and Microsoft are committing to invest up to $10 billion and up to $5 billion, respectively, in Anthropic. These are commitments in partnership and platform development.

Modelmaker Anthropic has managed to spend less resources than competitors but also attract and forge new partnerships with the likes of Microsoft, AWS, and Nvidia. Anthropic expects revenue to scale in accordance with scaling trajectories, and “these scaling laws have held surprisingly stable” Amodei mentioned. At Wired Magazine’s event, she noted that models are still getting smarter, not plateauing at present, with revenue continuing on the same curve.

AI Scaling Laws (Anthropic scaling laws interpreted)

Given the hundreds of billions, possibly trillions, required to scale AI and its infrastructure in the next five years or so, consortia are necessary and happening. It’s equally true on the financing side.

When attending an AI Summit at Oklahoma State University in April 2025, where big tech, AI model developers, high-level government officials, and energy players convened, the emphatic need for capacity was mentioned by Anthropic, Google, Amazon’s AWS and Meta. At the beginning of the year, the first Stargate projects had been announced shortly after Trump’s inauguration. Less than one year later, firms are finding their positions in these new developments. Part of Stargate Abilene is energized. The pace of data center and AI infrastructure development is moving at a clip. Much economic activity flows from this.

In energy, partnerships are happening to meet the challenge to power the way in which people are using technology and will in the future. Big energy players like GE Vernova (GEV) and NextEra have staked their claims in different ways too. GE Vernova is manufacturing vital equipment like gas turbines and forging select partnerships. NextEra is focused on multi-source energy infrastructure build-outs with top hyperscalers. They are also diving deeper into using AI and their digital-firm partnerships to unlock the future. Currently, NextEra (NEE) is targeting 15 GW geared toward data centers for 2035. The firm will spend capex of $74 billion to 2029 in a highly diversified manner.

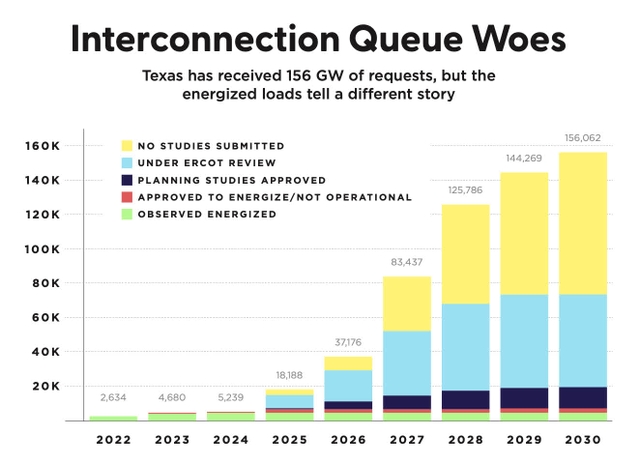

Connecting to the Texas Grid (ERCOT and author J. Warren interpretation)

[Note: This is for illustration about large load hook ups, data centers, from an article I’ll pin in comments. Also see how and why capacity from crypto firm facilities is being leveraged for high-performance compute capacity.]

Competitors continue to change the landscape in technology and energy. The recent new announcement by startup Unconventional AI, with Bezos a funder, is gunning for “a novel, more energy-efficient computer for AI,” according to a Bloomberg report. The startup has a $4.5 billion valuation. A semiconductor expert and AI startup founder, Tyson Tuttle said, “new people will come,” in an August interview. They absolutely are. I’ve been quasi-pitched by several AI startups in the last few months at events. Legacy players are retooling too and re-strategizing, such as Intel in partnership with Nvidia. I wouldn’t count anyone out.

Patiently Expect the Unexpected

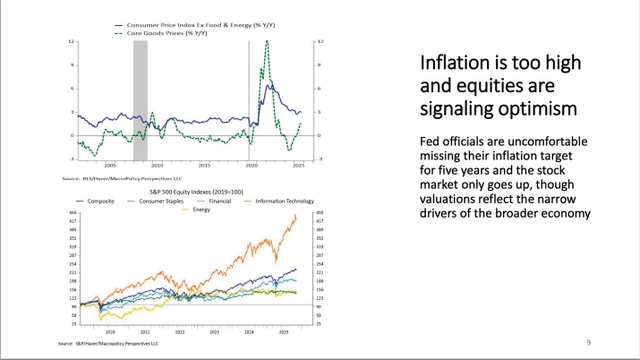

My outlook for the market is cautiously optimistic as it attempts to digest a new normal. To “normalize” what’s happening, according to the charts, holding a composite of the market is a reasonable strategy. On Jan. 1, the S&P 500 was around 5,880 and stands at 6,870 (Dec. 11), nearly a 1,000-point increase, or roughly 16%. That’s roughly 8 times U.S. GDP growth of 2%. Info tech is roughly one-third of the S&P, dragging the market down nearly 13% in Q1 2025 and then boosting it again.

Noodling it out: I’d shoot for 7,100, with modest gains to other sectors, including info tech. That shaves down the P/E to 27 from 29 and accounts for 5% growth of EPS. In a slightly more positive case scenario and continued decent market vibes, then 7,250. However, mid-term election outcomes and any geopolitical events of a market-breaking nature could affect the mood.

The market reflects the collective belief of the value of firms’ economic activity, but there is a lot of noise too. To date, the belief and expectation that has accompanied info tech and price-to-earnings has the market at ~29, a historical high. However, top hyperscalers Amazon at 47, Apple 38, and Microsoft 34, are the outliers, compared to Nvidia, Meta and Alphabet/Google, just below the S&P average. There’s a case of continued positive vibes that gets us to 8,100. My vibe says take a middling 7,600. If you add in a possible SpaceX IPO (SPACE), we could add a 200 lift to the index.

[Sourced from Kantar (Top 100 Most Valuable Global Brands) and Mendonca, Pereira, Godinho (2004). Rankings for 2020-2025 based on Kantar BrandZ valuations.]

The info tech and energy sectors, with continued capex will benefit the rest of the economy. Inflation is troubling, but the Fed will likely stay in a slightly constrictive zone ahead. Loosening interest rates adds fuel to the equity fires. Hopefully, we’ll find the happy Goldilocks sweet spot. It is hard to argue with perception though, as reflected in the world’s most valuable brands. It’s not just about the number. I’ll call the Goldilocks number of 7,600, with a happier market of 7,800.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.