The Tesla (TSLA) valuation premium relative to other US mega cap stocks is the highest it has ever been. The stock is obviously no longer trading on expectations of automotive revenues, but on hopes that autonomous driving, energy storage, and robotics will deliver. However, at a record USD1.5tn valuation, equivalent to 2.5% of the entire S&P500, the premium that investors are putting on the stock is extremely high. Assuming a 10% required rate of return, Tesla’s free cash flows would likely have to rise to almost USD150bn over the next five years to make the stock a worthwhile buy today. For comparison, the company made just over USD4bn over the past 12 months when adjusting for stock based compensation, despite being in business for over 20 years. Another 50% stock price decline is increasingly likely.

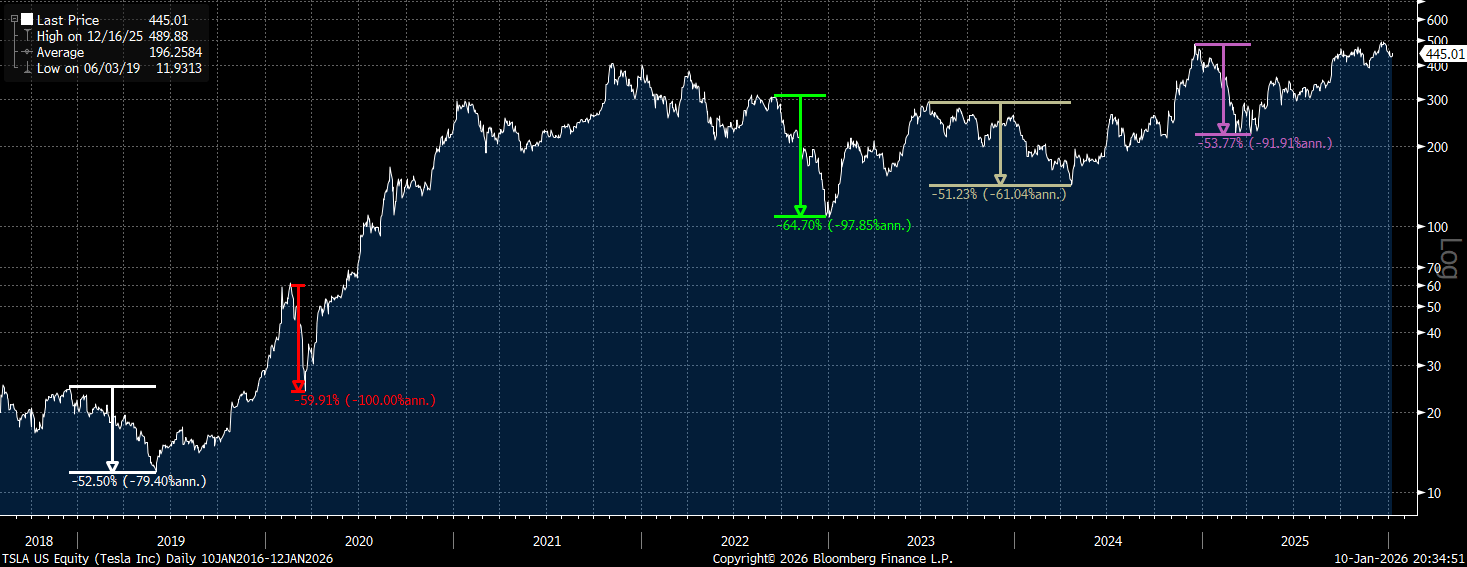

Tesla Stock Price With 50% Drawdowns (Bloomberg)

Falling Deliveries Contrast With Rising Stock

Tesla’s stock price, which has risen by around 100% since its April lows, is in sharp contrast with the company’s falling vehicle deliveries. Tesla delivered 1.64 million vehicles in 2025, down 9% from 2024, while the Q4 figures showed an even sharper decline of 16% y/y. On a per share basis, taking into account significant share issuance, sales in dollar terms are no higher than they were in mid-2023. Meanwhile, earnings per share are down 62% from their 2023 peak, in large part due to the collapse in gross margins, which have fallen from 27% in 2022 to just 17% currently. Not only is Tesla losing market share to BYD, it is also now operating with lower gross margins, with BYD managing to sustain gross margins of 18.5% in the latest quarter. With BYD trading at just 1x sales versus 15x for Tesla, clearly Tesla investors are looking past the vehicle business and focusing more on hopes of Elon Musk’s future technological innovations.

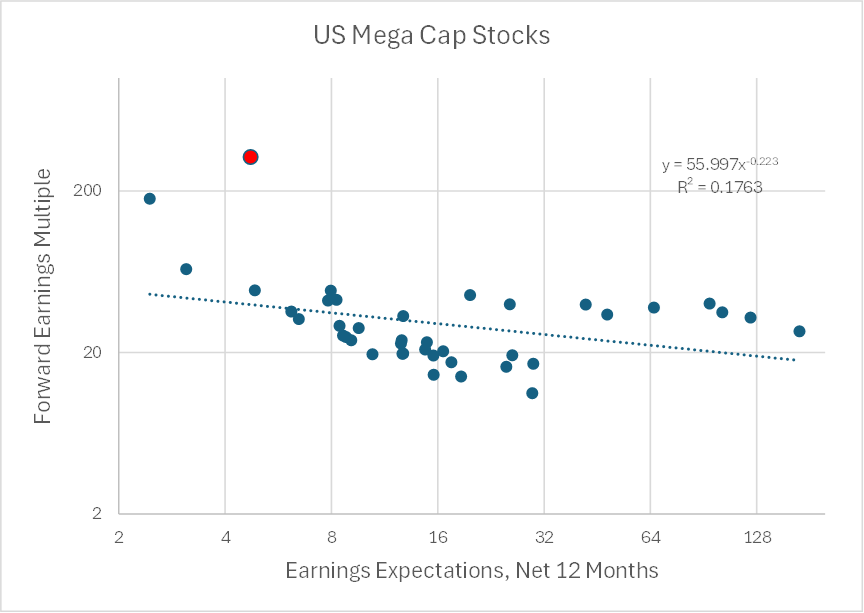

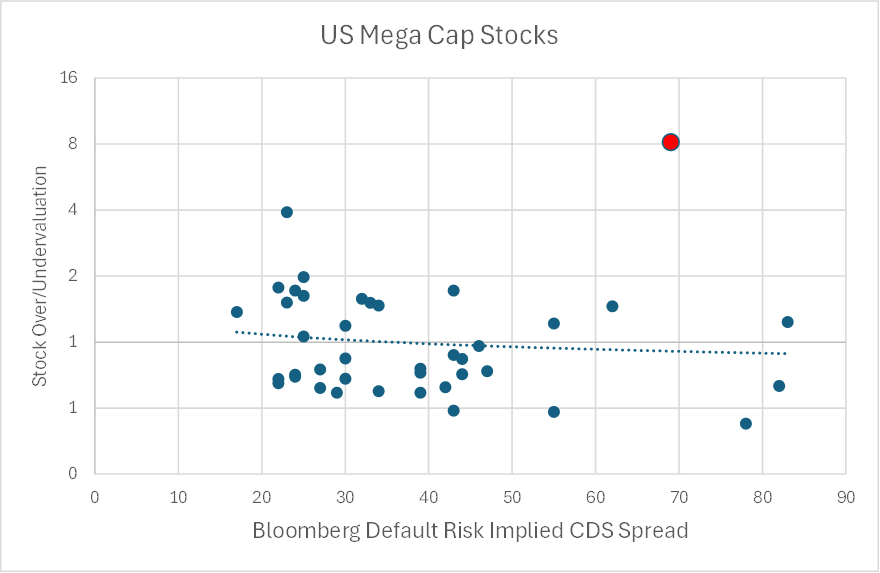

An Outlier Among Mega Cap Stocks

Investors should be well aware of the inverse correlation between earnings and valuation multiples. This inverse correlation is seen in the chart below, which compares market earnings (calculated using an average of forward free cash flows and net income) with the valuation multiples that investors currently apply to those future earnings. As you can see, Tesla stands out like a sore thumb, with its current multiple over 8x fair value, followed by Palantir (PLTR) at 4x.

For most stocks that are overvalued on this metric, their low default risk can in part explain it. Companies like Apple (AAPL), Alphabet (GOOG) (GOOGL), and Microsoft (MSFT) are somewhat justifiably ‘overvalued’ based on the above metric, as they have negligible default risk. However, in the case of Tesla, default risk, according to the Bloomberg Issuer Default Risk Implied CDS Spread, is among the highest of the group. When we add in the extra variable of default risk, its overvaluation rises to 9x.

Investors Require An Unprecedented Rise In Earnings

Tesla’s highly uncertain future suggests that anyone willing to assume the risk of significant capital loss should, in theory, require a high rate of return. If we assume the required rate of return for Tesla investors is 10%, investors must be anticipating wildly ambitious earnings figures over the coming years to justify their bullish outlook. Under reasonable assumptions for terminal growth and long-term required rates of return, Tesla could generate USD147bn in earnings five years from now and still turn out to be a poor investment.

| Current Market Cap | $1.5trn |

| Required Rate of Return | 10% |

| FCF Yield in 5 years | 6% |

| Terminal Growth Rate | 4% |

| Required Market Cap in 5 Years | $2.45trn |

| Required FCF in 5 years | $147bn |

To see why, consider the assumptions in the table above. The terminal growth rate is defined as the growth rate of earnings that the company will be able to achieve over the long term once it reaches its peak market share, which I have assumed to be 4% in line with my outlook for nominal GDP growth. Based on an RRR of 10%, this would mean the stock would have to trade at an earnings yield of around 6% or a multiple of around 17x. Finally, I assume that the company manages to reach its peak market share in just 5 years. Under these assumptions, Tesla’s market cap would have to rise to almost USD2.5tn by the end of 2030, requiring USD150bn in earnings. This is all the more fantastic given that free cash flows (ex stock-based compensation) are expected to decline to just USD1.5bn over the next 12 months, according to Wall Street analysts.

The Most Overvalued Mega Cap According To Wall Street Analysts

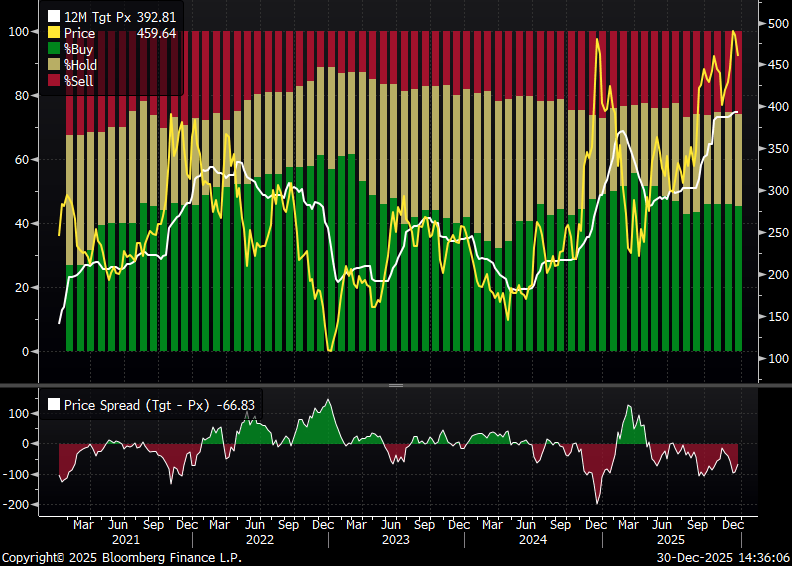

With such poor forward free cash flow expectations, it is no wonder that Wall Street analysts are pessimistic on Tesla’s stock. Among US mega-cap stocks, Tesla is seen as the most overvalued, with a median price target of $434, almost 10% below current levels. This compares with an average expected upside of almost 10% for the remainder of the group. Bulls will, of course, argue that the analyst community has been wrong and persistently too pessimistic for years. However, the last two times there were this many bearish analysts on the stock, it lost over half its value.

Analyst Recommendations (Bloomberg)

Avoiding Worst Case Scenarios

I firmly believe that when it comes to investing, too little attention is paid to avoiding worst-case scenarios. The reason stocks have performed so well over the long term is because investors need to be compensated for the risk of owning assets that lose value during economic downturns. In the case of Tesla, if the AI boom turns out to be less productive than expected, not only is the stock likely to suffer greatly, but the entire market and the overall economy are also likely to turn sour. With a Beta to the market of over 1.8x, Tesla bulls, particularly those who are buying on leverage, are extremely exposed to AI not delivering as hoped.

Summary

While betting against Elon Musk has been a losing bet for a long time, I believe the optimism priced into Tesla’s stock is too extreme. Not only does Tesla stand out as the most expensive mega cap stock by far, investors should also require a higher than average rate of return given its high beta and non-negligible default risk. The stock has experienced declines of over 50% on five different occasions over the past six years, and another such decline looks increasingly likely.

.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.