A Firsthand View From Singapore

Coming back from a Southeast Asia trip, I had some Starbucks breakfasts on the go and, most notably, had my first chance to grab coffee and a snack from Luckin Coffee (LKNCY) in Singapore. Reason enough to put on the investor glasses and conduct a check on the rocket-like rise of the Chinese coffee chain. I will also draw parallels to Starbucks (SBUX). Since the coffee (house) market is incredibly fast-paced and competitive, I will refrain from investing in either of the two in my buy-and-hold-dominated portfolio. Nevertheless, read on as I simplify the landscape for you.

Apples to Oranges: Personal Experience

For those unfamiliar with Luckin Coffee, you will not find a person to place your order with. Luckin Coffee’s order logic is fully digitized. You order from the app or via the order terminal in front of the store and simply pick up your order number. We paid roughly 10 euros, or $12, for two long blacks and two cheesecakes, which I would categorize as a rather cheap airport coffee and snack. The cheesecake came pre-packaged, so do not expect fresh breakfast from Luckin Coffee—that is not what they are up to.

Firsthand experience at Singapore airport (Author)

Funnily, our $6 per person ticket places us very close to the overall customer average, as I have calculated myself. During Q3-25, Luckin Coffee reported RMB 15,287 million in total net store sales, equating to roughly $2,140 million. This breaks down to a revenue of $77 thousand per store during the quarter (calculated based on 26 thousand stores at the beginning of the period and 29 thousand stores at the end of the period). This translates to a daily run rate of a little less than $900 per store per day, assuming 90 opening days during the quarter. Luckin Coffee reported more than 112 million monthly transacting customers during the quarter, which breaks down to around 140 customers served per store per day (assuming 30 opening days a month). As a result, I calculate the average ticket for the quarter at $6.35. Remember: ours was $6 per person.

Now, let us contrast the experience to Starbucks’ model and conclude that they are—on purpose—entirely different. Starbucks does not want you to grab-and-go (anymore). Under CEO Niccol, the company is trying to go back to its roots and become more of a dine-in coffeehouse again, offering seating spaces and atmosphere. You still place your order with a human “barista” at Starbucks, and you are still asked for your name in most stores. And lastly, Starbucks still has a showcase with a variety of (at least supposedly) fresher breakfast options. As a result, Starbucks’ simple implied average quarterly revenue per store was $242 thousand lately, ignoring different operating models like licensed vs. company-operated, as both companies combine these two. That is three times that of a Luckin Coffee shop.

Different Growth Dynamics

Therefore, any Starbucks-to-Luckin Coffee comparison is not a pure apples-to-apples assessment. Nevertheless, not all former Starbucks customers seem to need a coffeehouse with “rich” breakfast and therefore turn to the quicker and cheaper Luckin Coffee concept.

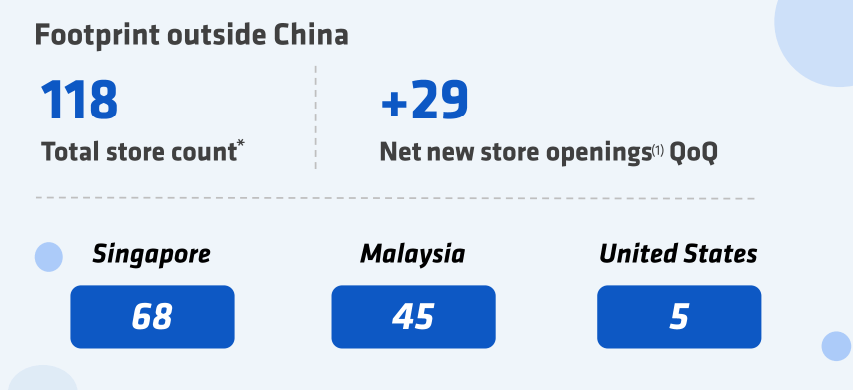

As of today, Luckin Coffee is still effectively a China pure play with only 0.4% of stores being outside of China. With that, let us start by looking at the Chinese market dynamics first, although Luckin Coffee’s international expansion will likely become an essential future growth driver if successfully executed.

Luckin Coffee international footprint (Luckin Coffee)

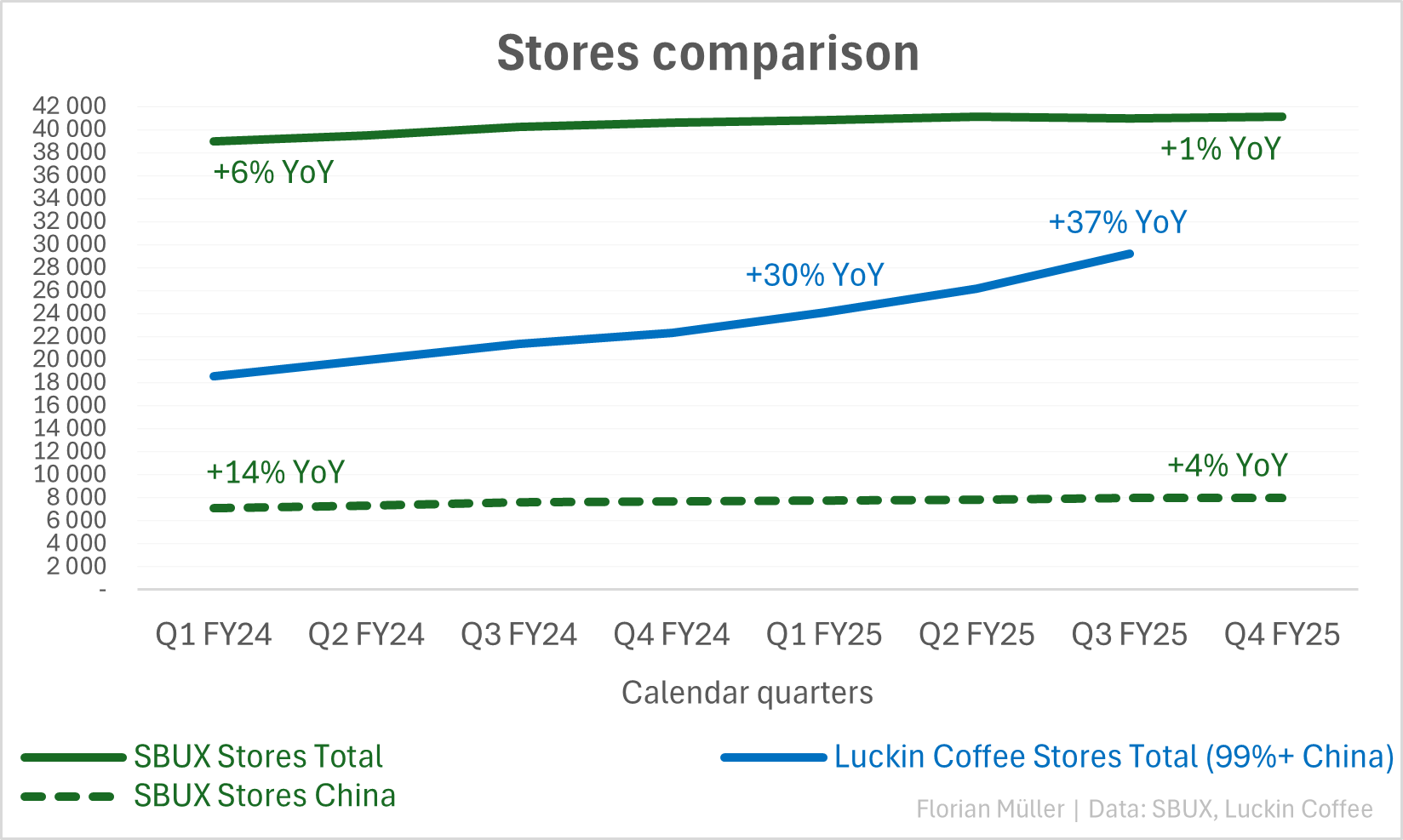

Starbucks’ store count growth has decelerated from 6% two years ago to 1% just recently, with China store count growth slowing from 14% to 4%. Conversely, Luckin Coffee’s store count growth is accelerating rapidly to a YoY rate of 37%, as per its latest reported quarter. During calendar quarter 4 [CQ4], Starbucks grew revenue per store by 4% YoY, while Luckin Coffee’s comparable metric increased by 12% YoY during the latest available CQ3.

Store dynamics SBUX & Luckin Coffee (Author | Data: SBUX, Luckin Coffee)

To be fair, Starbucks’ strategy as the bigger player who has already been longer in the market is now to weed out underperforming stores and build fewer yet bigger ones that instead support the coffeehouse culture with seating spaces, while Luckin Coffee’s strategy seems to be purely quantitative penetration now.

Chinese Rivals and Why Sky-High Coffee Prices Were Negligible

Let us therefore bring the imperfect Starbucks-to-Luckin Coffee comparison to an end for the moment and instead touch on the players hunting for Luckin Coffee’s lunch. These include Cotti Coffee, founded by former Luckin Coffee executives who had left in the wake of the 2020 accounting scandal, and Manner Coffee. Cotti Coffee aimed for 50,000 stores by 2025, although there are no official numbers available yet confirming that the goal was reached. Compare that to Luckin Coffee’s 29,214 stores as of Q4-25 and China’s 88 thousand branded coffee shops in total. “The pace of coffee store growth is nearly double that of the U.S.,” SA News Editor Clark Schultz reported. Manner Coffee is in preparation for a potential IPO in 2026 and the peer group as a whole is engaged in a notable price war for market shares. This shows in pressured operating margins, in part also driven by delivery expenses, reflecting app-subventions to gain customers.

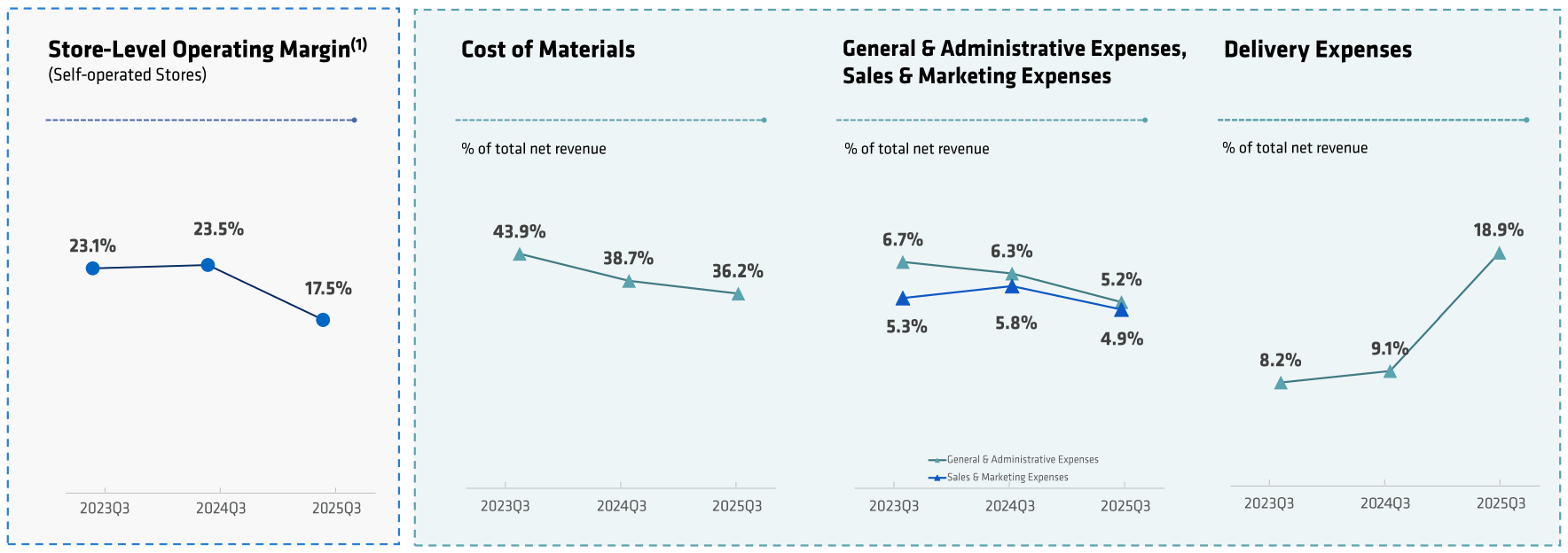

Luckin Coffee margins & costs (Luckin Coffee)

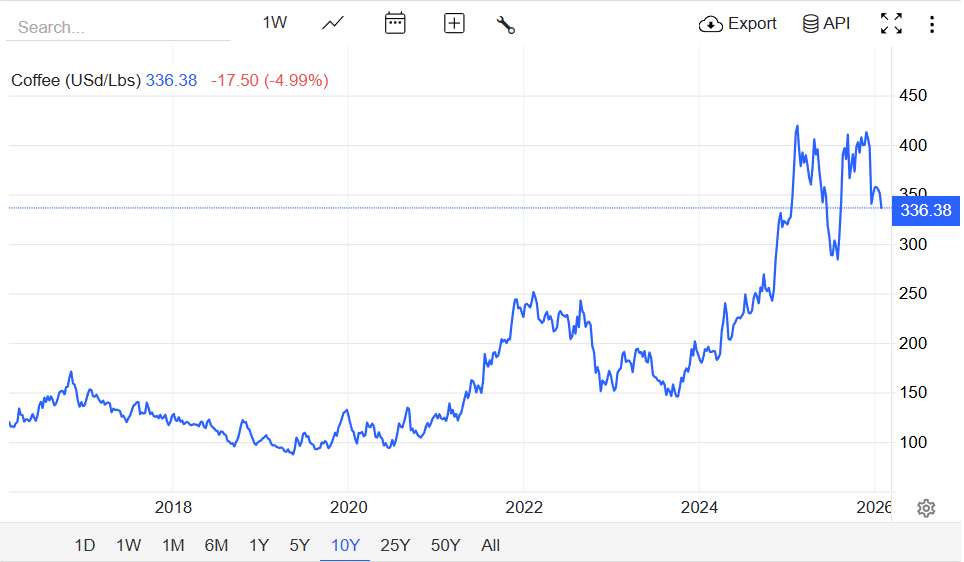

Interestingly, however, high coffee prices in recent years did not affect coffee shop companies’ gross margins too much, indicating that, curiously, coffee as a raw material is not even the biggest needle mover for these businesses. At best, recent coffee price drops could even be accretive to margins.

Coffee prices (raw) (Trading Economics)

Brand Premium Versus Competition Discount

Turning to valuation, Luckin Coffee’s TTM free cash flow of $682 million, as calculated by subtracting capex from operating cash flow, compares to a market-derived enterprise value of $10.4 billion, equating to a 15x EV/FCF multiple. Starbucks’ comparable metric is 55x, given TTM FCF of $2.3 billion and an enterprise value of $129 billion.

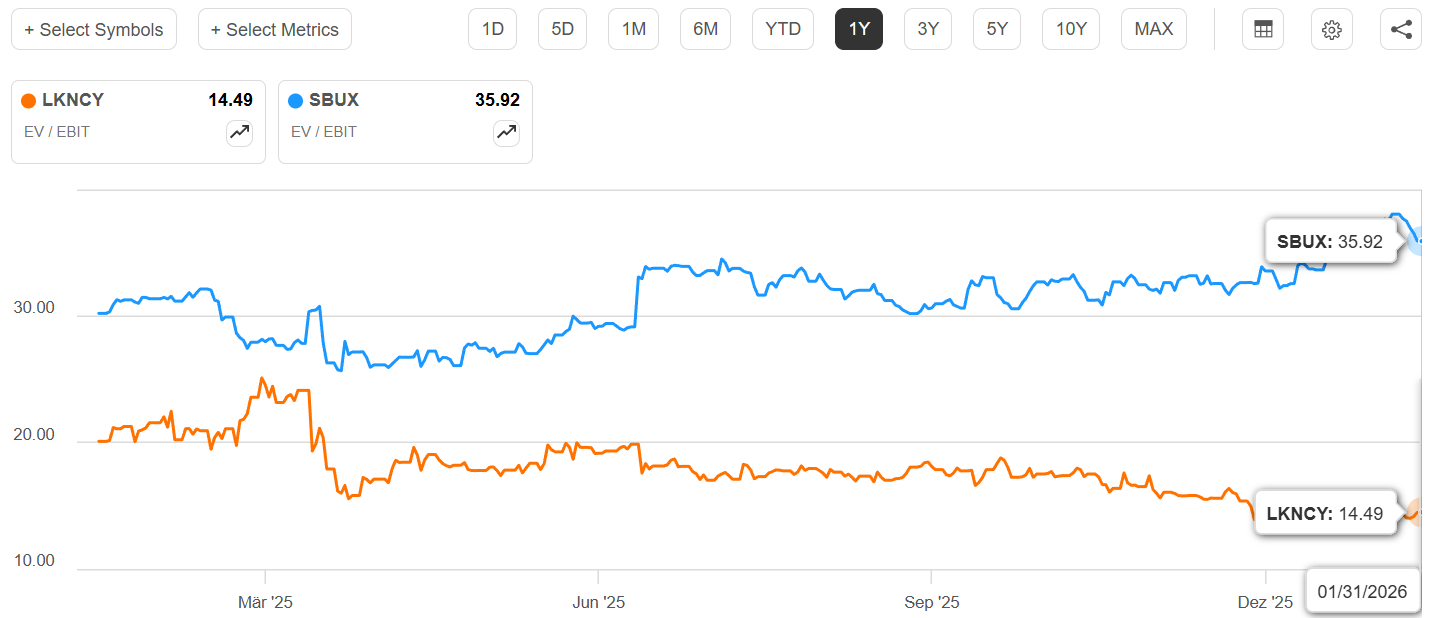

Comparing EV/EBIT, Starbucks also enjoys a clear premium with a multiple of 36x over Luckin Coffee’s 14x. And finally, looking at forward P/E for 2027, for which a reasonable amount of analysts’ estimates is available, Starbucks is expected to come down to 31x, while Luckin Coffee’s forward multiple is 12x.

Valuation comparison of SBUX & Luckin Coffee (Seeking Alpha)

Regardless of how we put it, Starbucks is roughly 3x more expensive than Luckin Coffee, despite growing significantly slower. From this standpoint alone, Luckin Coffee appears to be the more attractive investing option by far.

Good Coffee, Tough Business

Luckin Coffee’s multiples are likely compressed by significant price and expansion wars amid Chinese competitors as well as some still-lasting reputational damage from the accounting scandal in 2020. While I would not put too much weight into the latter anymore at this stage, competition and the fast-paced nature of the coffee shop landscape are what really keep me from getting involved in the field. On the other hand, the intense competition is an expression of the attractiveness of the category. Were I to choose, I would probably prefer Luckin Coffee over Starbucks now. Nevertheless, I will refrain from taking a stake in either of them and watch from the sidelines—with a hot cup of whatever shop I stumble across.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.