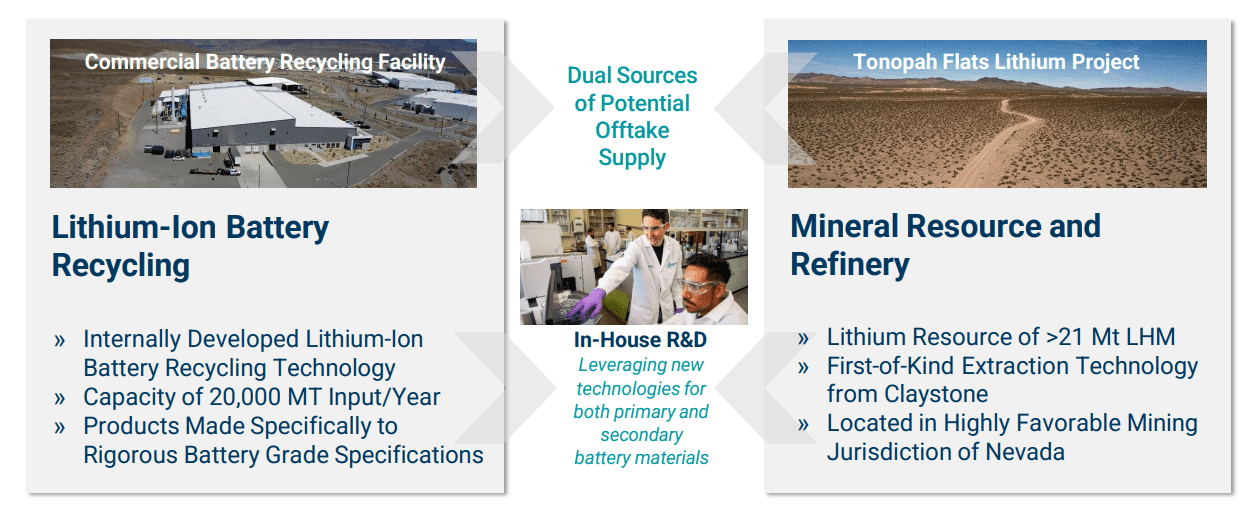

American Battery Technology Company (ABAT) is a battery materials company attempting to build a closed-loop supply chain for lithium-ion batteries. The business is divided into two main segments: the recycling division that takes in scrap and end-of-life batteries, converting them back into usable resources (black mass and battery-grade salts), and the Tonopah Flats lithium claystone project. The best way to put it is that the company is an early-stage industrial ramp, and the equity is very dependent on the company achieving a recycling process that can scale.

What the financials say

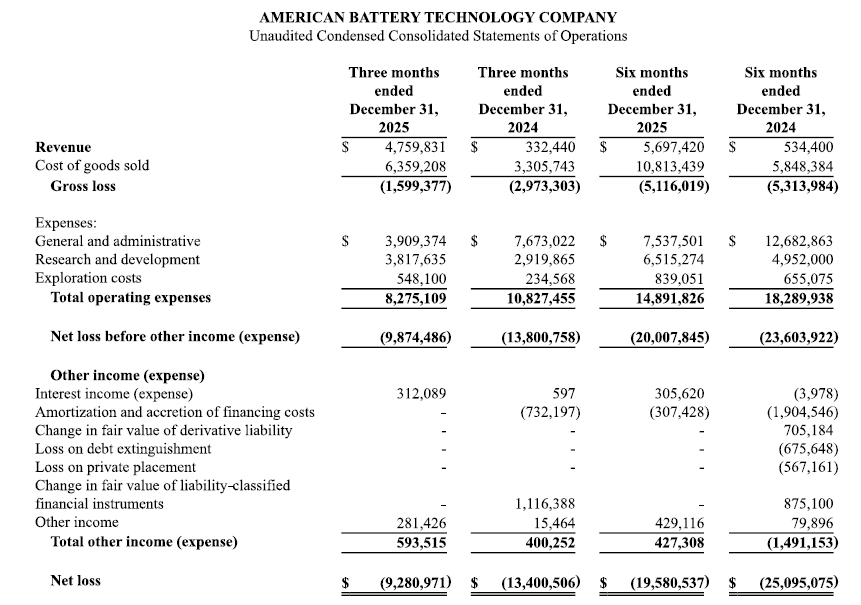

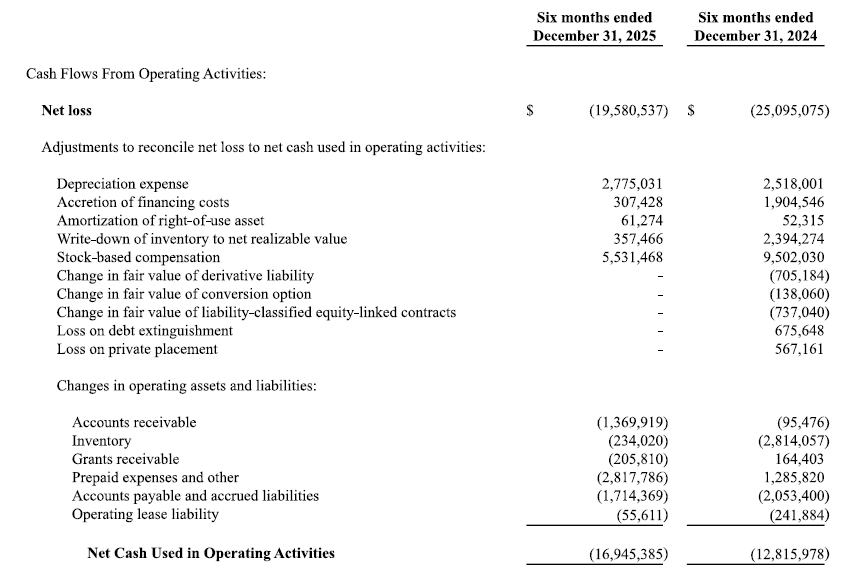

The revenue is still very small, meaning the company is still in its early stages developing the business; nevertheless, they achieved around $5.7M in revenue in the six months ending in December 2025, the net loss being $19.6M. The operating cash flow was negative $17M, while the cash was $48M after raising close to $45M in capital. This gives the company a couple of quarters of runway.

All in all, financials are basically telling us that the company is still in investment mode with enough liquidity for a couple of quarters, but further dilution, I believe, is clearly on the table.

The real edge: process, not geology

The market keeps paying a lot of attention to government grants in the sector; however, my view is that the P&L will be defined by the process throughput: more tons in the right spec.

We need to bear in mind that the company takes in manufacturing scrap and end-of-life EV/UPS packs as sources for products like intermediates (like black-mass, Cu, and steel) and battery-grade salts that can be used in new batteries. We can break this down into two main steps. First, we get the safe discharge of packs into cell teardown in order to get the materials sorted. This serves to strip the low-value mass (plastics, foils) from the overall product. Removing the junk and impurities upfront is a big step towards less tonnage and fewer contaminants hitting the wet chemistry train. This is a must-have in order to drop costs.

The second step is targeted hydrometallurgy, where you leach and purify in order to pull lithium first and then Ni/Co/Mn where they might be present. It usually involves a controlled leach, then separating liquids from solids, controlling the impurities, and solvent extraction to dry it down to a battery-grade mass. Getting high-yield LiOH from LFP black mass with low costs is a must-have. It means lifting ASPs while dropping rework costs.

Selling the black mass is a low-margin business, which gets us to the battery-grade salts—that’s where the higher margins live. Getting hold of this entire process and fine-tuning it to achieve high-margin battery salts is the key aspect of the whole operation. Therefore, keeping reagent consumption under check, minimizing energy per ton, and rework to a minimum are the main factors driving operating performance.

Geopolitics helps, but won’t replace execution

The most recent drama around Greenland is a clear flag that we are getting into a resources race. The US is clearly trying to onshore the critical materials midstream, and you can also see this in the grant programs and tax credits associated with these activities. But this is just one dimension. American Battery will be evaluated on the ability to deliver materials on spec and productivity. So, yes, we are seeing tailwinds in the industry, but the company still needs to deliver.

Risks

As we have seen, the main risk for the company is the process being successful, which means the biggest hurdle is execution. The company needs to lift the throughput and increase the first-pass yield on the production process in order to reduce COGS and upgrade the company’s profitability to a level that warrants a re-rate.

However, that is not the only risk. A lot has been said about contracts and grant programs. In fact, contract quality is an important aspect. MOUs don’t bank, and the company needs binding contracts that bring visibility to the revenue timeline. On the other hand, we have also seen that grants are a great thing to announce, but also carry the risk of being cancelled and increasing the cost of capital assumptions overnight.

Another important risk is the working capital position. A lot of working capital tends to get trapped during ramps, as the company carries more black-mass inventory, in-process goods, and receivables. If we add commodity swings and longer collection terms, we get a longer conversion cycle. This will look bad in the income statement, as operating cash outflow stays big even with revenues growing. In a scenario like this, the stock will likely get punished.

Valuation

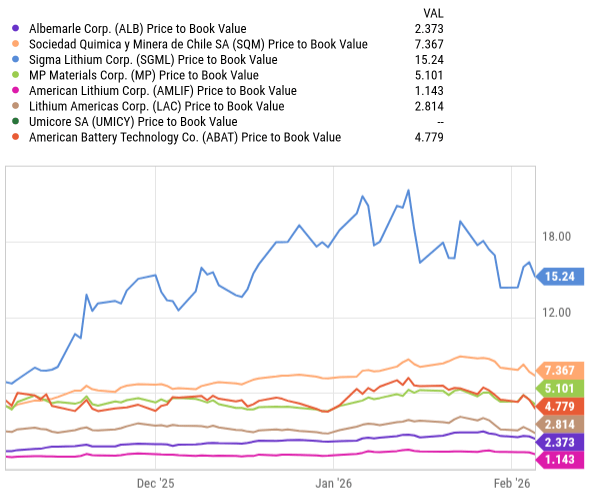

The company is still very early on in its ramping process, revenue is still very small, and losses are big. This means most valuation ratios are impossible to apply. Arguably, in this scenario, the P/BV multiple is the least bad tool to employ.

The P/BV has a lot of insufficiencies, ranging from intangibles and IP not being properly captured to not capturing the underlying unit economics picture. Nevertheless, in this case it is better than nothing, and when paired with future releases on the state of the ramp, we will be able to draw better conclusions.

YCharts

All-in-all, at 4.8x book, the market is basically saying that the plant being built plus the IP and option (Tonopah and potential contracts) will provide good returns later on. The valuation is close to MP Materials (MP), which I consider optionality for strategic policy. Therefore, I consider the company broadly in line with peers on a P/BV basis, but obviously, we will need to keep monitoring the industrial ramp to form stronger conclusions.

Wrapping up

American Battery Company is an “industrial ramp” plus “strategic resources policy” optionality play. The market will keep pricing it as a lottery ticket until the Nevada recycling line proves its worth. In other words, we need to see throughput up and first-pass battery-grade materials up. That would mean revenue scaling quickly hand in hand with margins expanding.

Therefore, the bull case is the company becoming the low-cost converter of messy waste into battery-grade materials. This is especially important for lithium as LFP becomes the norm. If they get to his point, they don’t need heroic lithium prices; the scale and process will do the hard work.

On the other hand, the bear case is also simple. If the ramp stalls, cash burn stays high, which means further dilution, and the stock price stays trapped.

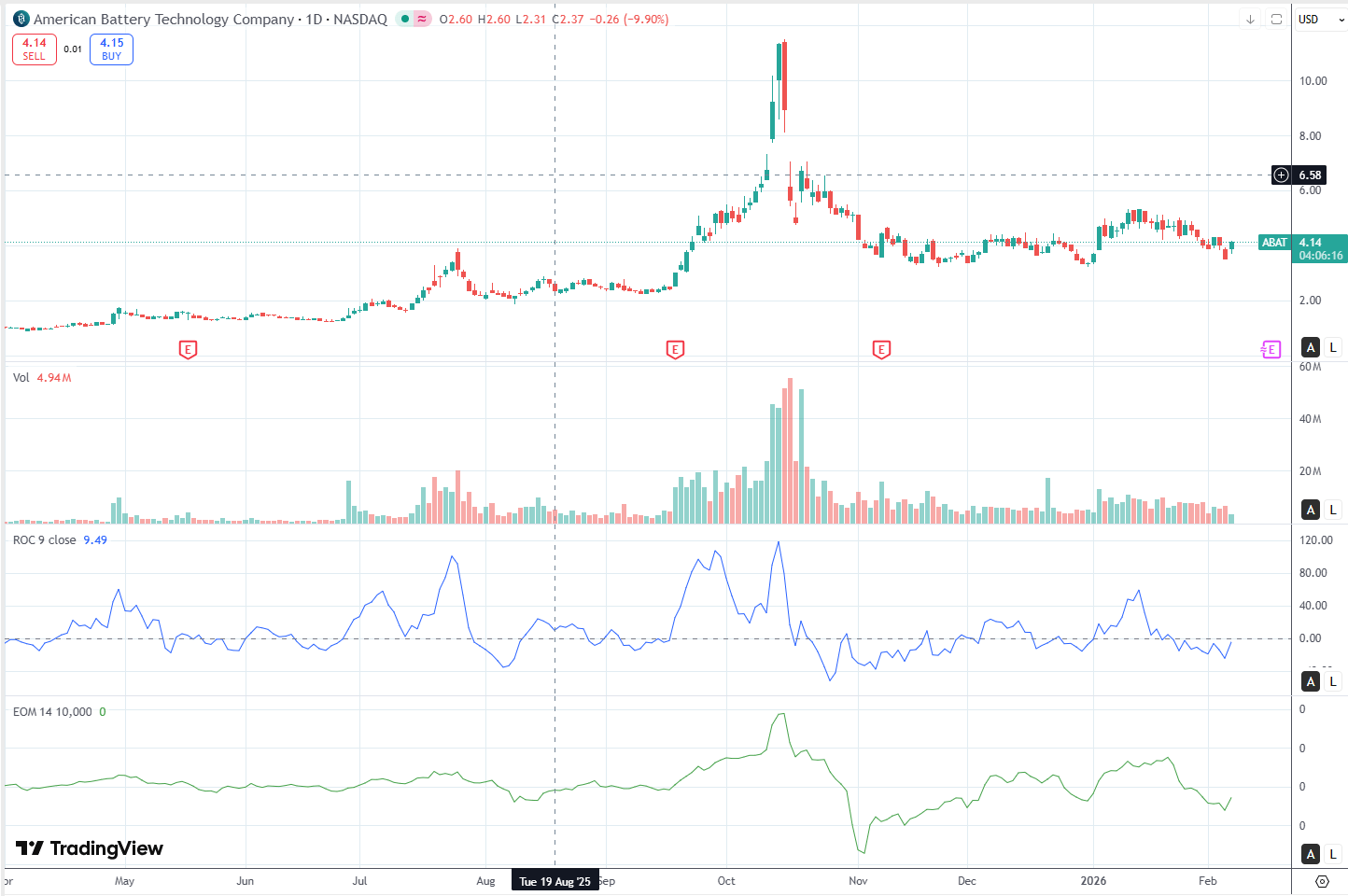

Looking at the most recent price action, we can see that the last October spike was a news-driven markup followed by a blowoff top and markdown. Nevertheless, after that, the stock price has been doing something positive: it stopped going down and seems to be building a base.

Around the $4.1 level, the stock seems to be building a base. The price suggests a “test the lows/build cause” phase; therefore, this is not a “buy the breakout” yet, but neither is it a death spiral. We can boil it down to a “stock waiting for a catalyst” moniker. In my opinion, a new test on a breakout will happen at the $5.3 level. On the other hand, losing the $3.6 support means the base is failing, and we are back in hope mode.

All-in-all, this is a “prove the process” story of a stock building a base after a hard unwind. If I were really bullish, I would own it inside the base and then control my risk with discipline. Since I am mostly in wait-and-see mode, I would rather wait for a breakout around the $5.5 level, and then, if it stays above, I would make my move. In any case, I will be following any release on the Nevada operations with a focus on tons processed and first-pass battery-grade yields.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.