Introduction

In recent months, I have increasingly discussed the new world order. Note that I’m not capitalizing it, as I am not referring to the conspiracy theory that there’s one big shadow government ruling the world, but the phenomenon that the global political order is changing.

Here’s the difference:

Google Search

The most recent article I wrote on this topic was published less than a month ago, when I discussed the situation surrounding President Trump looking to acquire Greenland, the comments from Canada’s Prime Minister Mark Carney when it comes to shifting power, and other developments that hint at new power dynamics.

While I admit that discussing the new world order truly makes for catchy titles, I am not here to entertain but to help you make more educated investment decisions—food for thought, so to speak.

To me, this is one of the most important topics in global politics. See, this isn’t about telling you who to vote for, explaining what the best economic model is, or what I think is best, but about covering geopolitical developments that have a big impact on markets, supply chains, and, on a long-term basis, even our daily lives.

Hence, I’m going to do things a bit differently. Today, we’ll look specifically at the situation between China and the United States. We will discuss what is changing and, more importantly, how we can benefit from that.

So, as we have a lot to discuss, let’s get right to it!

A “Messy Divorce” That Requires Our Attention

“Messy Divorce” wasn’t something I came up with. That was part of a recent Wall Street Journal title about this very topic. However, just like the content of that article, I thought it was the perfect description of a very serious economic/political development.

In order to understand what is going on and why that matters to us, we need to take a few steps back. Essentially, both China and the U.S. are now mainly acting based on national security interests. Neither China nor the U.S. has a big benefit from being entirely decoupled from each other. And, to be honest, I don’t expect that to happen.

The U.S. is still the biggest consumer market in the world, while China has become a giant in various supply chains, including cheap consumer goods, renewable power, and many others.

However, the relationship is changing. That’s what matters.

The biggest change is that China isn’t what many call a “junior partner.” Initially, when China became a booming economy, it was the cheap labor of the West. While that is still the case, the economy is becoming more independent. If I had to summarize this situation, I would make the case that China is now looking to become a bigger competitor of the U.S., including with more international control over supply chains, resources, and partners.

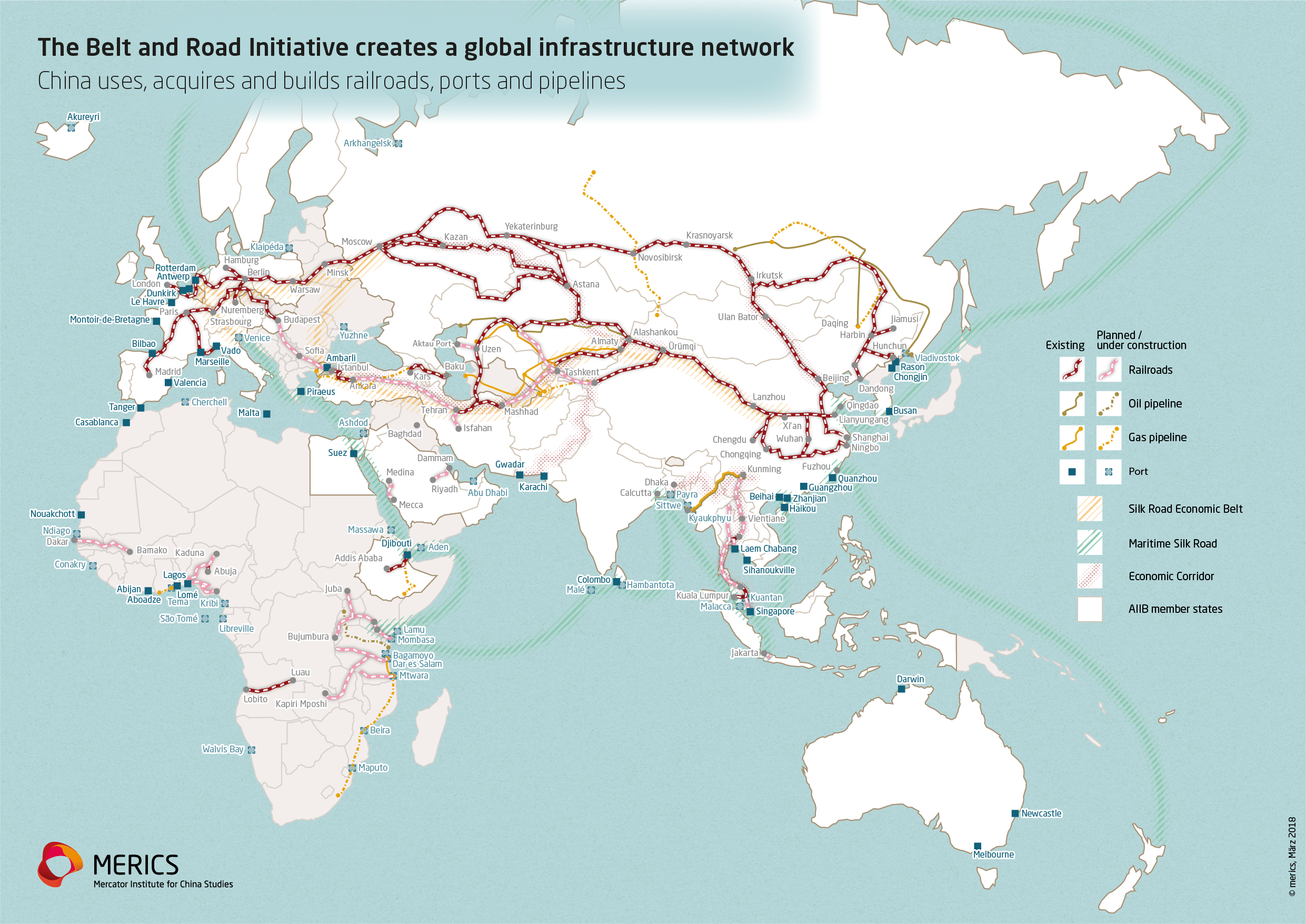

For example, roughly 13 years ago, the Belt and Road Initiative was started, which focused on trade routes and partnerships. According to the Wikipedia page of this project, all countries that joined accounted for 75% of the global population.

Interestingly enough, as we can see above, this is mainly focused on land-based relationships, whereas the U.S. dominates global waterways, which are a much more effective way of shipping goods. I’m bringing this up because the U.S. is now even more focused on protecting that power through its Restoring America’s Maritime Dominance executive orders. This includes building more ships and improving the industrial base.

It’s such a great example of how it’s all connected (military, industrial power, and global trade).

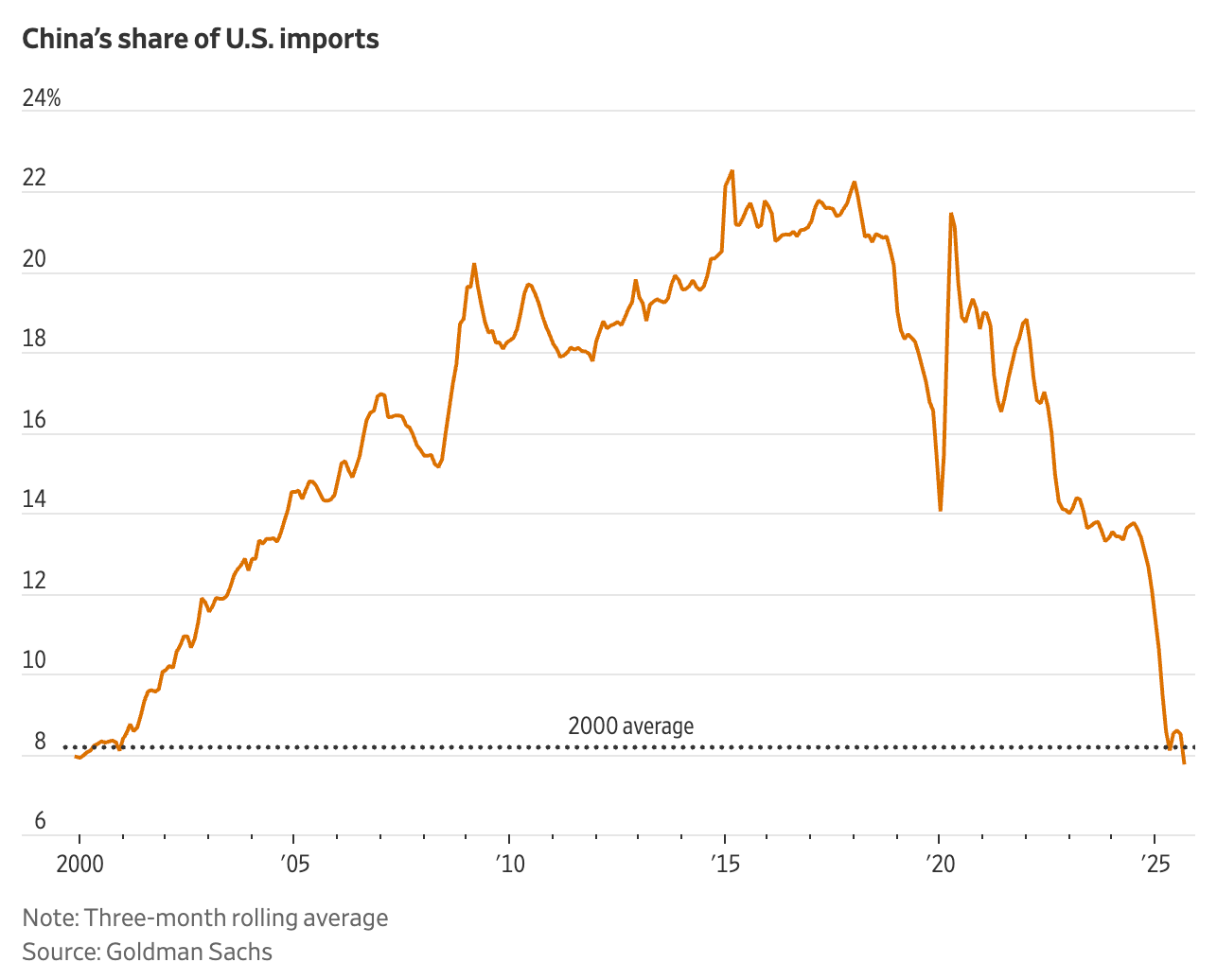

Moreover, we are all aware of the recent trade wars between the U.S. and China. Roughly one year ago, it was one of the factors that caused the market to weaken. Since then, trade has changed, as China accounts for just 7.5% of U.S. imports. As we can see below, that’s the lowest in more than 20 years.

However, the tricky part is that these numbers are tricky to analyze, as China has shifted its production to other countries. This includes Mexico and a wide range of Southeast Asian countries. China invests in these nations and uses them as a base for exports to the U.S.

It’s a slow process. The same goes for economic reshoring, as the WSJ quote below shows quite well:

Some businesses have moved production from China to the U.S. to avoid tariffs, but the flow is still modest. Mexico and Southeast Asian nations are more common destinations for manufacturers leaving China.

About 9% of Ohio manufacturers in a recent survey said they had reshored some production to the U.S. in 2025, up from 4% in 2021. About 60% of the reshoring in 2025 relocated from China, according to the Manufacturing Advocacy and Growth Network, a nonprofit that conducted the survey. – WSJ

This is one of the reasons why trade wars tend to be messy, as it’s not straightforward taxation on a nation like China. Trade routes have become incredibly complex.

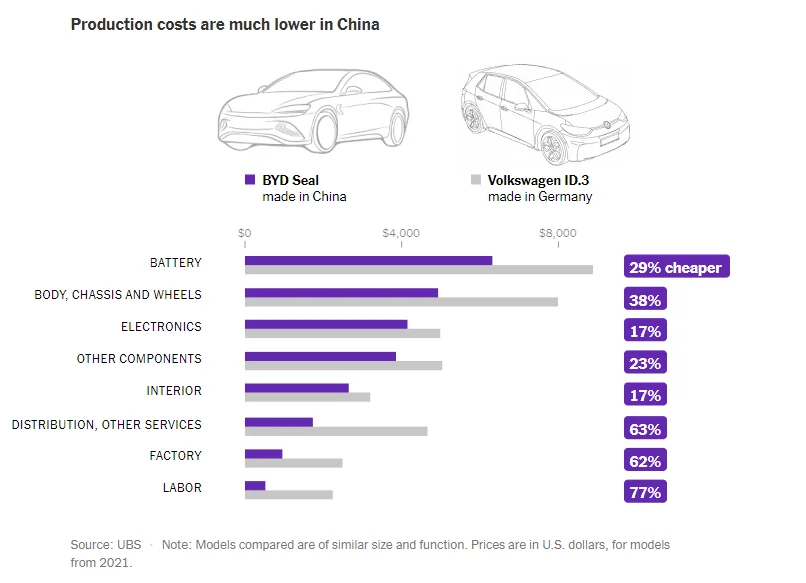

Speaking of complexity, because China is now more than just the world’s factory, it is moving into high-tech areas. This includes cars. As someone who was born in Germany, I have always followed its car industry, which used to be one of the biggest in the world. This included massive exports to China, where consumers loved to own a fancy German car.

According to World Population Review, China produced 26 million cars in 2023 (this excludes commercial vehicles). Germany produced 4.1 million cars. In 2021, China produced 21.4 million cars.

In other words, they added Germany’s entire 2023 production between 2021 and 2023.

Back in 2021, it became a bit more obvious that China had figured out how to build cars itself. They also enjoyed supply chain dominance, as some of you may know. By 2030, it’s estimated that China could control more than 50% of rare-earth element production and almost 80% of refining capacity. The reason I brought up 2021 is that back then, China’s electric cars were significantly cheaper than German electric cars. That’s another advantage.

One of the reasons why I majored in Purchasing & Supply Management is because of just how important supply chains are. These are truly the best examples.

Now, China is moving into other areas as well, including AI. The U.S. and China are in an AI race, as dramatic as that may sound. That’s why China is buying NVIDIA’s (NVDA) H200 chips. These are not the most advanced, which keeps China from getting access to the best products yet still allows the U.S. to benefit from its innovation.

In general, China is becoming very creative to offset risks from export controls, as the quote below shows:

Piotech is experimenting with a workaround for a Chinese weakness in chipmaking. Because the U.S. prevents China from acquiring the most advanced lithography machines needed to shrink chips horizontally, Beijing is betting on Piotech’s “vertical stacking” method, which allows different types of chips—like memory and processors—to be layered on top of each other to increase power and efficiency without needing the smallest, most restricted transistors. – WSJ

And then there’s agriculture.

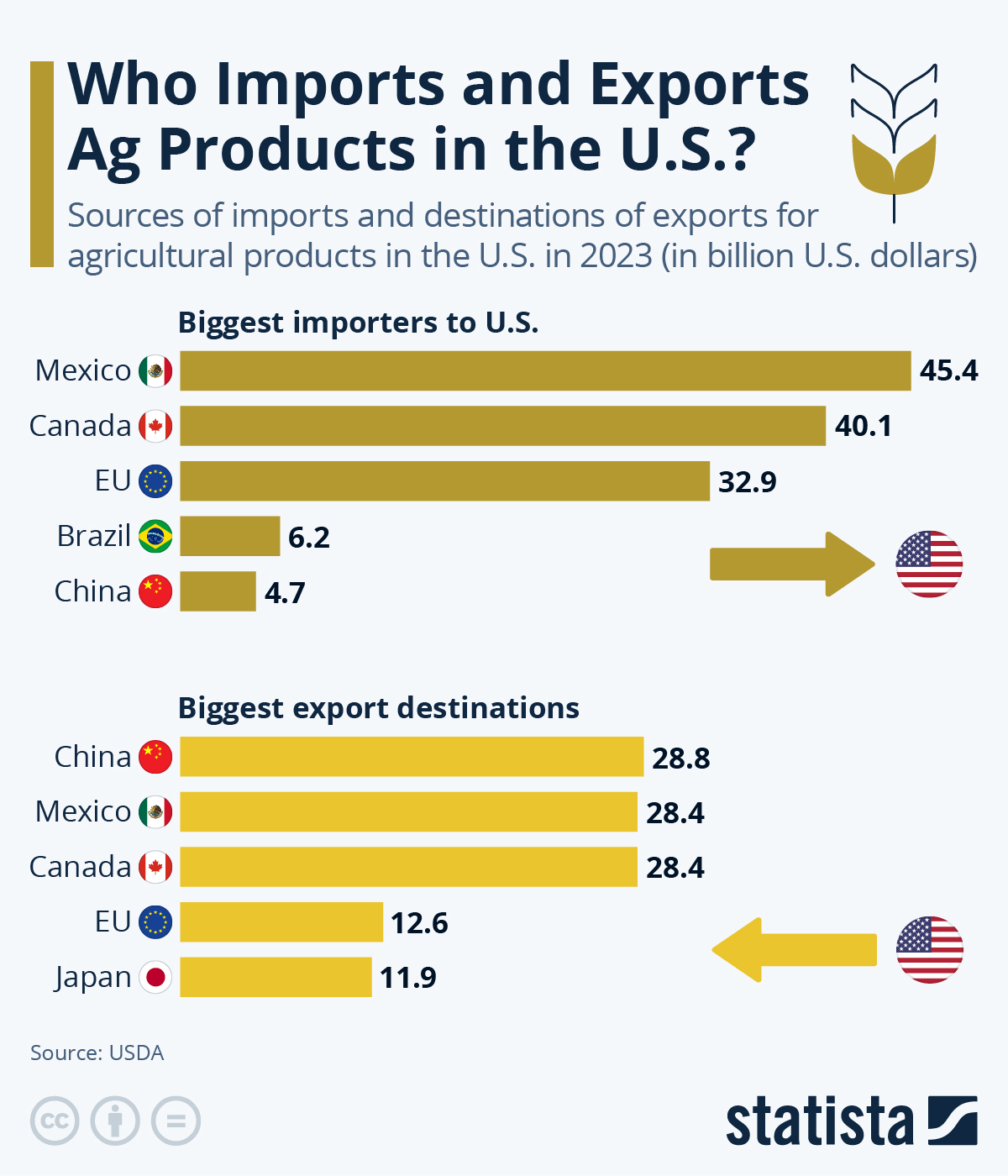

China is very important for American farmers, as it accounted for close to 30% of U.S. farm exports in 2023 (the most recent visualization I could find). While that number may be a bit different now, the main takeaway is just how important China is for American farmers.

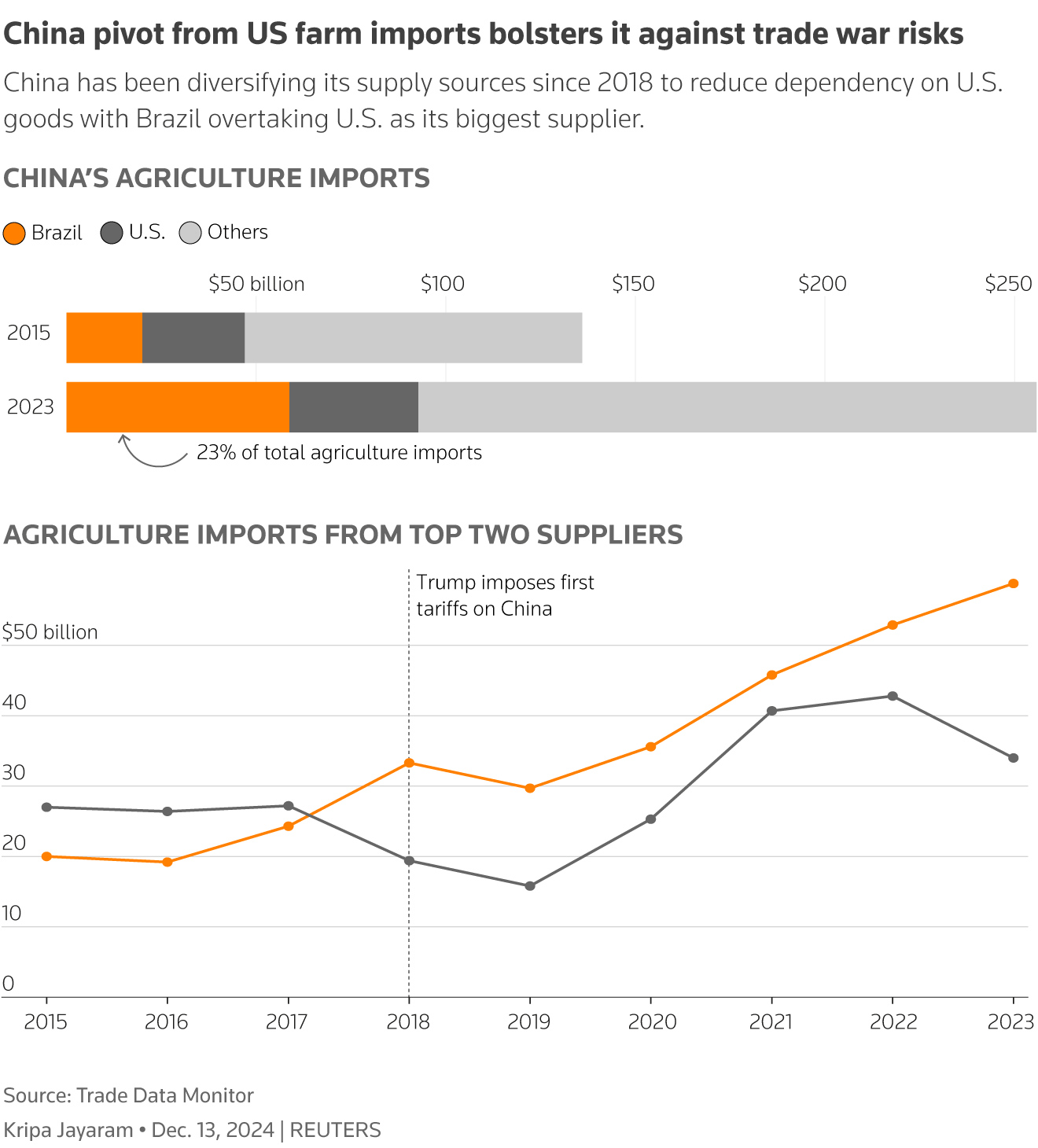

However, that’s just a part of the picture. Using newer data, we see that China has massively boosted agricultural imports. The U.S. wasn’t the beneficiary, though, as Brazil and other nations got most of the new “contracts.”

As much as China would like to be self-sufficient, it has to buy key crops like soybeans and corn to feed its pigs and other animals. I would call it China’s strategic Achilles’ heel.

It’s looking to solve that issue without giving the U.S. an advantage:

Perhaps the ultimate geopolitical chip in modern trade is soybeans. Although China is self-sufficient in staples like rice and wheat, its massive pork industry remains dependent on foreign soybeans for over 80% of its feed. If trade routes are blocked, the price of pork – the primary protein for 1.4 billion people – skyrockets, risking domestic instability.

[…] Now, it’s increasingly incentivizing production at home, even as it maintains a 25 million-ton annual U.S. purchase commitment as a tactical anchor for the current trade truce. – WSJ

And then there’s energy. In order to grow its economy and support AI’s massive energy needs, China is investing aggressively in every form of energy you can think of. A few days ago, Euronews reported that China brought 78 gigawatts of new coal power online. That’s almost 8x the power demand of New York City from coal alone.

Even as China’s expansion of solar and wind power raced ahead in 2025, the Asian giant opened many more coal power plants than it had in recent years – raising concern about whether the world’s largest emitter will reduce carbon emissions enough to limit climate change.

More than 50 large coal units – individual boiler and turbine sets with generating capacity of 1 gigawatt or more – were commissioned in 2025, up from fewer than 20 a year over the previous decade, a research report released on 3 February says. Depending on energy use, 1 gigawatt can power from several hundred thousand to more than 2 million homes.

Overall, China brought 78 gigawatts of new coal power capacity online, a sharp uptick from previous years, according to the joint report by the Centre for Research on Energy and Clean Air, which studies air pollution and its impacts, and Global Energy Monitor, which develops databases tracking energy trends. – Euronews

So, what does all of this mean?

First of all, China is trying to become much more influential as a geopolitical player. Second, China is increasingly successful in doing so, as it now dominates various supply chains, including rare earth metals. Third, China is going from being a mass consumer of German cars to an export competitor.

They spent decades learning how it’s done. Now, they are doing it themselves.

Here’s Where to Look for Value

Now comes the part where I provide food for thought for anyone looking for actionable ideas.

Note that I am painting with a very broad brush here. That’s simply because we are dealing with a massive trend that will take decades and impact almost every single supply chain in some way. This is not the kind of thesis where something very specific is happening, and one or two companies will benefit from it. This is a slow process that will have winners and losers over time.

For starters, focus on economic reshoring. This is a theme supported by both Democrats and Republicans. As most of you will know, both the Biden and the Trump administrations had their ways to boost these efforts. Biden had the Inflation Reduction Act (among others), while President Trump was a bit more aggressive when it came to using tariffs.

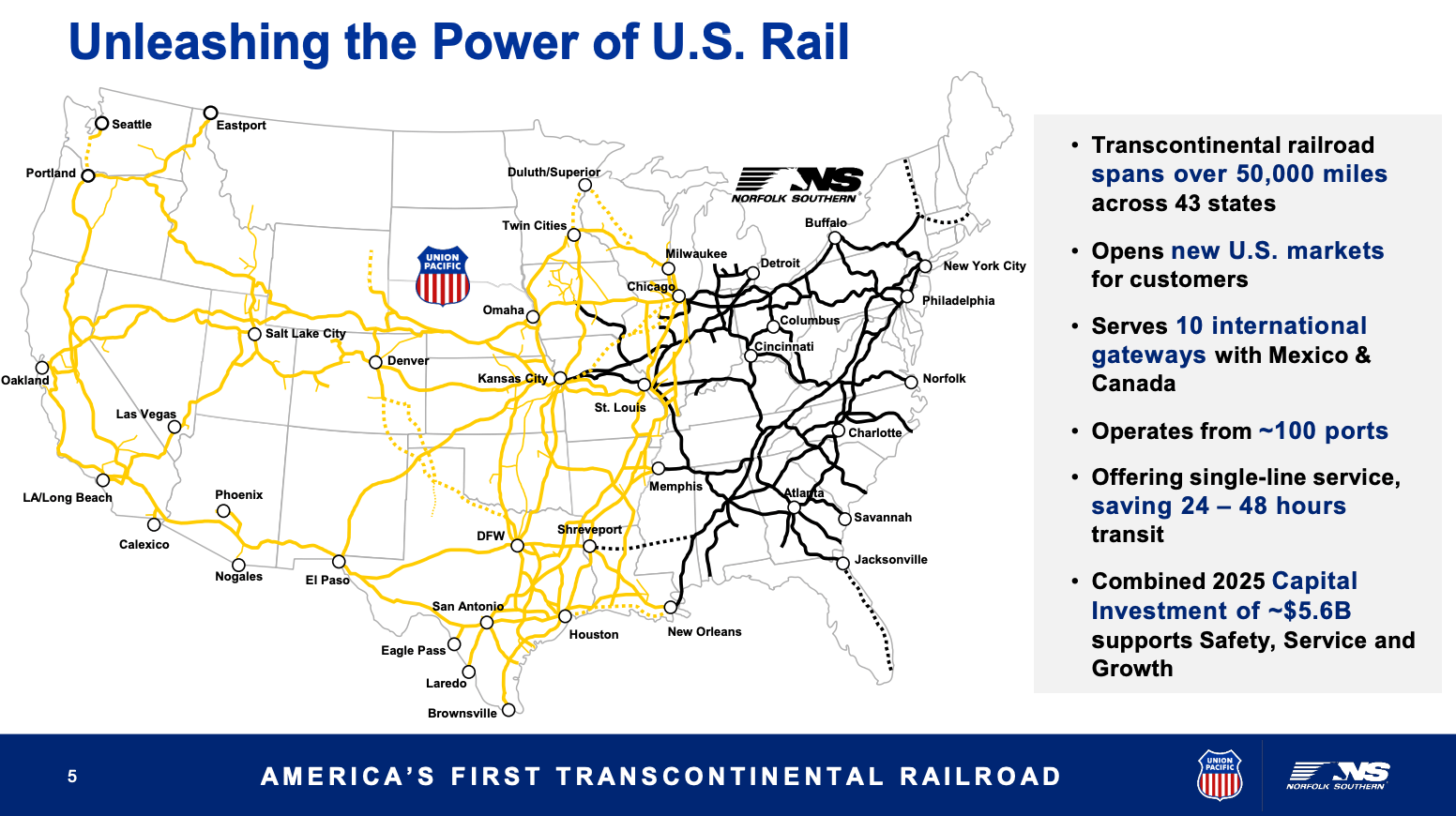

Here, I love transportation companies, especially Union Pacific (UNP), which is waiting for legal approval to buy Norfolk Southern (NSC). They could create the first (coast-to-coast) Transcontinental Railroad in the U.S. This would be a huge strategic advantage, as it makes shipping goods from one coast to the other much more efficient. This reduces costs and time.

It also shifts strategic importance. Now, it can be easier for shippers to shift port destinations (for whatever reason), as re-routing is more efficient.

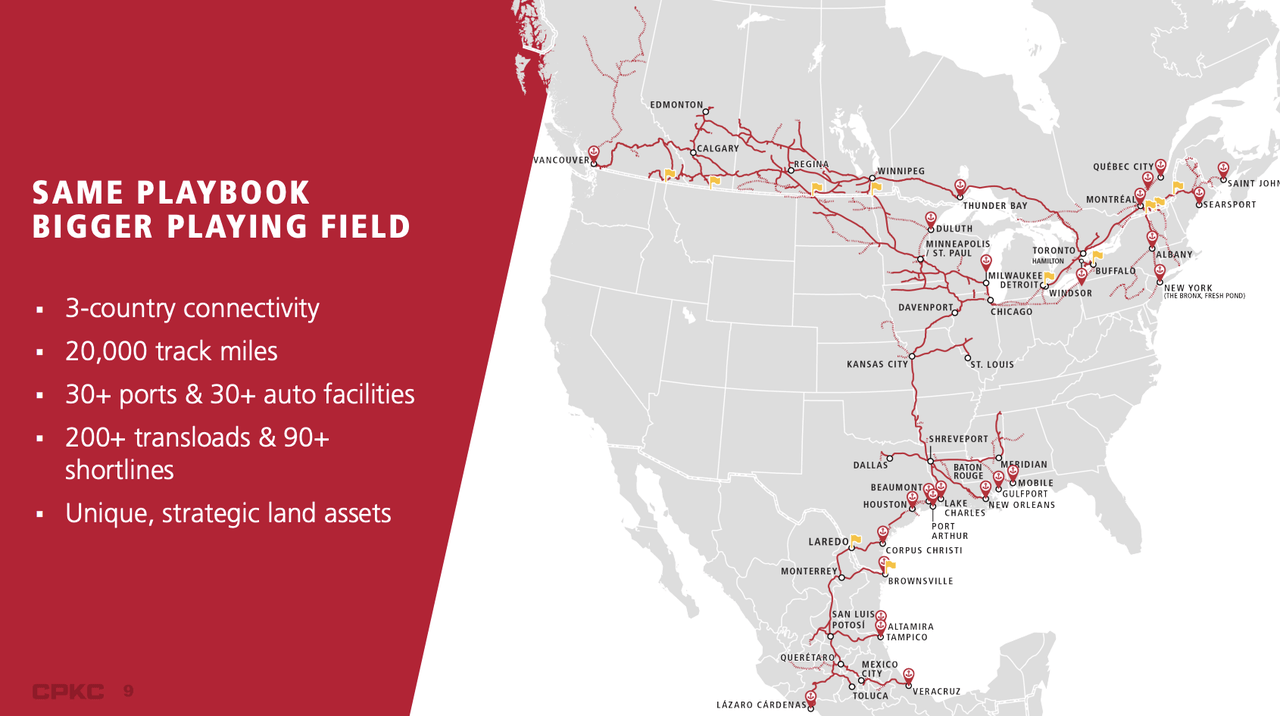

I also own Canadian Pacific Kansas City (CP), which is the first railroad to connect all three North American nations through its own network. This obviously includes Mexico, a nation that has low labor costs and is used for re-shoring automotive production (among others).

It also applies to industrial-focused transportation companies like Old Dominion Freight Line (ODFL), XPO (XPO), and Saia (SAIA).

Moreover, companies like Rockwell Automation (ROK) and Teradyne (TER) are key for robotics, infrastructure, and general industrial CapEx. They are key to a stronger industrial base.

There are also stocks I would avoid. Personally, I would avoid companies in the tech sector with increasing competition from China. This includes chips that China can potentially replicate or simply compete with by finding its own solutions. In my view, this does not include NVIDIA but equipment makers like Applied Materials (AMAT). If China ramps up spending on equipment and R&D, pricing may come under pressure.

Again, this is food for thought. I am not telling you to sell AMAT.

I am also avoiding car companies. Although I am convinced that the U.S. market will not be flooded by Chinese cars, in general, I am avoiding the space due to new, low-cost competition from China. The only car company I like is Ferrari (RACE), which sells ultra-luxury collector vehicles. This isn’t about getting good mileage.

Moreover, in agriculture, I’m also more careful. If China subsidizes farmers and moves to other nations for imports, U.S. farmers will be in an increasingly tough spot. However, this comes with opportunities. One way to offset risks is by improving margins.

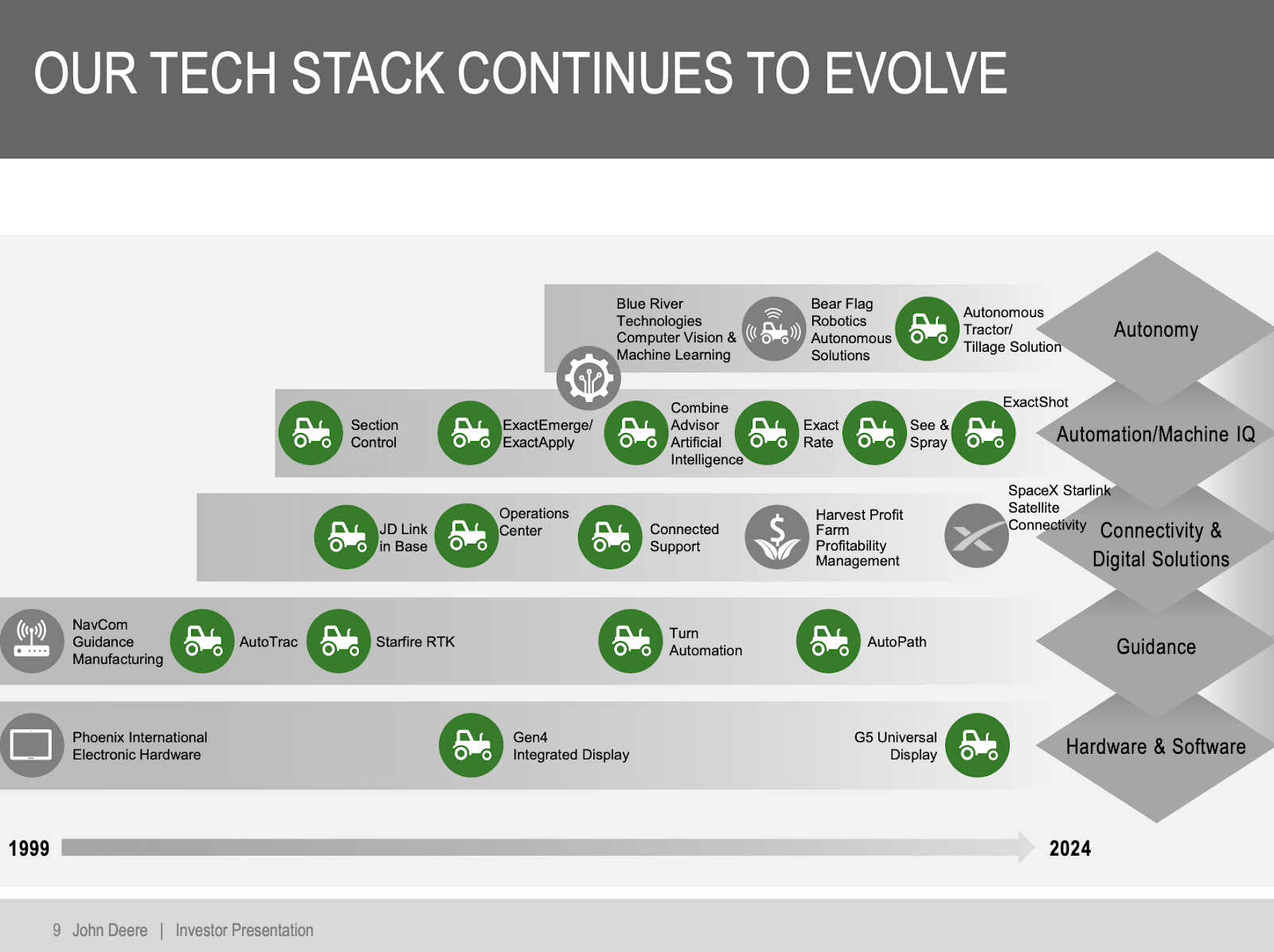

That’s why I like Deere & Company (DE), as it’s the largest public tractor and equipment company with a huge focus on yield improvements. Moreover, in light of improving cyclical growth expectations (see the ISM Manufacturing Index), I’m bullish on machinery in general.

Another company I want to give you is Trimble (TRMB). This is a company I will give a lot more attention to in the future, as I love its business model. Essentially, it uses hardware and software to connect the real world to the digital world.

For example, it connects field hardware to the cloud for information analysis. Its hardware can be retrofitted even onto old farm equipment from any major producer and help farmers to massively reduce operating expenses. This also applies to industrial processes in other areas.

And then there are companies that own skilled employees and come with services for the grid, data centers, factory construction, HVAC services, and more. These are EMCOR Group (EME), Comfort Systems USA (FIX), and Quanta Services (PWR). I like all of them, although I would prefer to buy them at a lower price.

And, as I already promised, I’ll keep readers up to date on this.

For now, this is my bottom line:

Takeaway

I’m increasingly talking about the new world order, as it’s an extremely critical development. While I do not make the case that the U.S. is losing power or that the end of the dollar reserve currency status is imminent, I am seeing major shifts in global power.

This includes China’s efforts to become a superpower with a bigger reach, stronger supply chain control, higher-value exports, and a low-risk food chain. All of this comes with opportunities for investors, as I see bullish tailwinds for infrastructure, transportation, supply chain optimization, defense (I discussed this in my prior article), and agriculture.

This is a slow wave, but when done correctly, I think there’s a lot of alpha to be found here for long-term investors.

I’ll keep you up to date!

Risks to Keep in Mind

The single biggest risk here is that all companies I mentioned are still standalone companies prone to economic cycles, management risks, and disruption. Before you put any capital to work, be aware that this is a long-term thesis. If I’m right, alpha will come slowly. This isn’t a price-discovery story where a stock suddenly pops 20% because the market finds out it benefits from economic reshoring

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.