As of June 2022, Vanguard Short-Term Corporate Bond ETF (VCSH) had 5% of its assets parked in bonds issued by Canadian companies. Nearly 80% of this stake was issued by the six largest Canadian banks, and most, if not all, of that debt is bail-in-able. Bail-in debt can be converted from bonds into equity by Canadian regulators if they determine the issuer is no longer viable.

This VCSH example highlights two important points. First, core U.S. bond funds often have exposure to U.S.-dollar-denominated bonds issued by foreign entities, also known as Yankee bonds. Second, some of this exposure carries an equity conversion trigger clause that may not be familiar to U.S. investors.

What exactly is bail-in debt, and how did it find its way into indexed portfolios that exclude convertible bonds and contingent capital securities? In this article, I provide a brief background of these instruments, break down how they work, and explain the implications for investors in broad U.S. index-tracking bond funds. While many of these convertible features are not likely to be as scary as they sound, they might be more prevalent in portfolios than investors realize.

The Lay of the Land

These securities are not a recent or novel invention. As part of the Basel III reforms that started in 2009, the concept of bail-in capital was introduced by the Financial Stability Board as a response to the 2008 global financial crisis. Concerns about future taxpayer-funded bailouts of banks spurred the proposal to shift the burden onto the banks’ bondholders instead. Global systematically important banks, or G-SIBs, are required to have a minimum layer of loss-absorbing capital that sits above its common equity and below secured deposits in its capital stack. The most important feature of this layer is that it must be written down or converted into equity when regulators determine the issuer is no longer viable. This provides regulatory bodies with the ability to aid the bank’s financial strength without tapping public funding, hence the moniker “bail-in.”

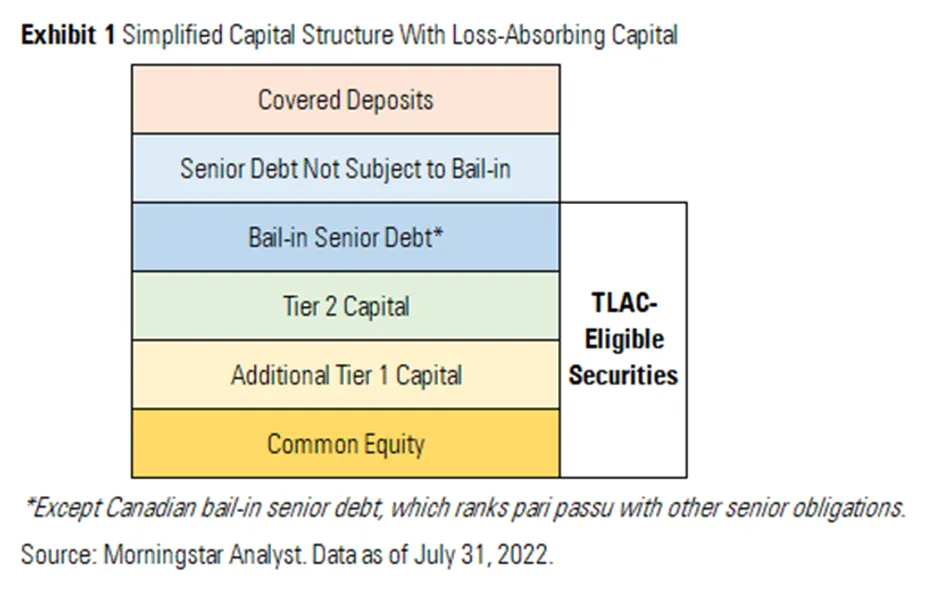

Securities qualifying for this layer include common equity, Additional Tier 1, and Tier 2 debt, as well as any senior bonds that are subordinated to other unsecured senior debt. To meet this requirement, large banks around the world have started issuing new classes of debt with this distinct conversion clause. The soft compliance deadline for the first implementation phase is 2019, by which point the banks must have a minimum total loss-absorbing capacity, or TLAC, of 16% of their risk-weighted assets, or RWA. The final deadline was January 2022, with the final TLAC ratio of 18%.

Against the backdrop of this global effort, the European Union has also developed its own version of the requirement: the minimum requirement for own funds and eligible liabilities, or MREL. This requirement extends to most European banks, including medium-sized domestic banks. Thus, regulatory bodies set thresholds for each bank on a case-by-case basis, with a compliance deadline of January 2024.

Adoption of the bail-in framework followed suit in Canada and Australia. Canada formally signed a bail-in regime into law for its domestic systematically important banks, or D-SIBs, in 2018 with a compliance deadline in 2021. Australia recently finalized its standards for its D-SIBs with an effective date of 2024.

The Federal Reserve adopted TLAC requirements for U.S.-based G-SIBs in 2016, with the same 2019/2022 compliance timelines. Currently, most U.S.-based G-SIBs are well-positioned with regards to their minimum TLAC ratio, often with a substantial surplus. Notably, G-SIBs in the United States meet these requirements with only common equity and long-term-debt that can be converted into equity at the nonviability point. Unlike the other countries above, however, the U.S. has yet to implement its own version of these standards on domestic banks. Thus, the immediate implications are small for U.S. investors with only domestic bond exposure, as issuance of bail-in debt is unlikely to ramp up.

Why Does It Matter?

For investors with exposure to Yankee corporate bonds or international bonds through U.S. bond funds, however, there might be more than meets the eye. Before we move any further, it’s important to lay out the distinctions between bail-in debt and more commonly known traditional contingent convertible bonds, or CoCos. These differences determine the securities’ market behavior as well as their eligibility for inclusion in some funds’ portfolios.

While both CoCos and bail-in debt can be either written down or converted to equity, their trigger clauses are different. Traditional CoCos—those that were around before the introduction of Basel III—mostly have a predetermined trigger mechanism, such as one based on the issuer’s capital ratio or balance sheet. By contrast, the TLAC-eligible bail-in debt can be triggered only at the discretion of regulatory authorities when the issuer is deemed no longer viable. As the term CoCos refers to a broad class of contingent convertible securities, some newly issued CoCos carry a discretionary trigger to help their issuer meet aforementioned regulatory requirements. While the terminologies can be confusing, the most important distinction to remember is the trigger clause.

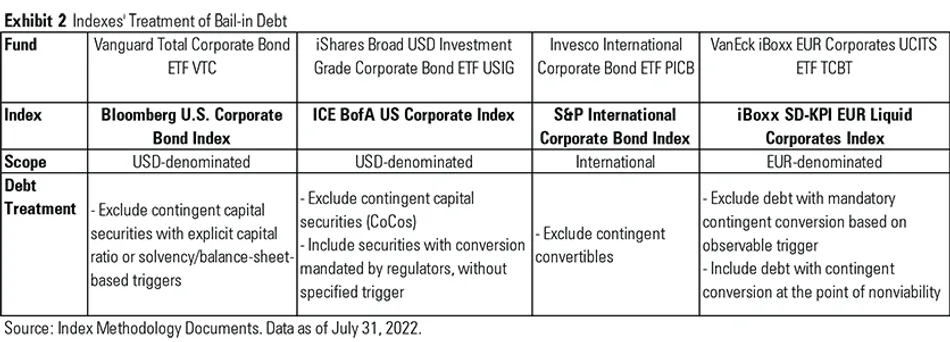

Currently, most major fixed-income index providers, such as Bloomberg, ICE, S&P, and Markit iBoxx, exclude contingent capital securities with prespecified or mechanical triggers from their broad-based indexes. However, bail-in debt with a nonviability/discretionary trigger may still make its way into these indexes. This is true for both international corporate bond indexes and broad U.S. bond indexes that hold Yankee bonds. For instance, the ICE BofA U.S. Corporate Index, which underlies iShares Broad USD Investment Grade Corporate Bond ETF (USIG), includes securities that have no pre-specified trigger clause but instead convert at the discretion of regulators.

No products found.

In practice, most CoCos with mechanical triggers will be converted when the issuer experiences distress but before it enters resolution, whereas bail-in debt’s conversion is triggered when the issuer is deemed nonviable, ensuring sufficient capital for the insolvency process without using public funds. Because of the earlier conversion point and higher threshold, investors tend to see CoCos with mechanical triggers as riskier than bail-in debt.

Should You Be Worried?

While an index portfolio might not hold the riskier type of convertible debt, there’s still reason for concern. The degree of concern depends on the level of exposure to bonds issued by international banks and the country or jurisdiction to which your issuer belongs. Each country has its own framework for these securities, which can affect their risk levels.

The Canadian market, characterized by the dominance of its six biggest banks, has the most expansive proportion of securities qualifying as bail-in capital. All unsecured debt issued after September 2018 by D-SIBs with a 400-plus days initial maturity are subject to the bail-in regime. Canada’s six D-SIBs, two of which are classified as G-SIBs as well, have been phasing out legacy non-bail-in-able bonds and replacing them with bail-in debt. As the financials sector makes up nearly 40% of the Canadian corporate bond market and is dominated by these six banks, this is a significant shift. While bail-in bonds will be the new norm, Canada’s D-SIBs are established franchises with strong balance sheets, courtesy of Canada’s stringent capital requirements. Distress to the point of nonviability is a highly unlikely scenario, as their high visibility also means increased regulatory scrutiny and potential intervention prior to reaching nonviability.

On the other hand, European banks can still issue non-bail-in debt as long as the issuer satisfies the requirements for TLAC and MREL. While Canadian senior bail-in debt ranks pari passu with legacy non-bail-in senior debt, European senior bail-in debt ranks below their non-bail-in counterparts, either contractually, statutorily, or structurally. Investors’ appetites have grown for these bonds in recent years because of low interest rates and stable markets, but the lower seniority carries additional risk that will likely deter investors when markets turn south and credit spreads widen.

Thus, investors command a premium from European bail-in debt, while the Canadian bail-in debt premium has flattened since their introduction. Because the higher cost of capital is not attractive to the issuer, bail-in issuance in Europe will likely plateau once banks meet their capital requirements. As a result, their share in a broad index portfolio will likely not increase much past current levels.

In addition, Canada allows only for equity conversion of bail-in debt, whereas the European framework allows regulators to either write them down or convert them to equity. For instance, Banco Popular’s collapse in 2017 necessitated the write-down of its Tier 1 capital, including Additional Tier 1 debt, and conversion of its Tier 2 debt into equity.

Conclusion

To the extent that these risks are being reflected in the securities’ credit ratings and their valuations, investors with broadly diversified portfolios need not worry about them disproportionately. Credit rating organizations convey the conversion risk inherent to these securities by notching their ratings down from their non-bail-in counterpart or the issuer’s overall rating. Banks’ support rating floors have also been downgraded to reflect the lack of governmental support, although most banks have retained their same overall ratings.

No products found.

Even in the event that this convertible feature comes into play—and there’s no guarantee investors are aware of the full risk—their limited weight in U.S. bond funds should not have a substantial impact on investors’ portfolios. These instruments are not taking up a significant portion of the assets in broad market-value-weighted funds, even in many international-bond funds. Nonetheless, it’s critical to perform due diligence on investments, even when holding unassuming broad index bond funds. Otherwise, investors may one day find unpleasant surprises in their bond funds.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.