Advisor use of model portfolios continues to grow. Nearly $350 billion follows model portfolios as of March 2022, up 22% from nine months earlier despite considerable market volatility, as reported in Morningstar’s recently published 2022 Model Portfolio Landscape.

Model providers have been actively trying to capture the growing demand. Since Morningstar’s model portfolio database was launched in 2019, nearly 2,000 individual model portfolios have been reported, and more than a third of those were new launches.

Morningstar manager research analysts have not been idle either. As of May 31, 2022, we assign Morningstar Analyst Ratings to 94 model portfolio series covering 508 individual portfolios, up from 12 series and 68 portfolios as of March 2020. Advisors and individuals can use the Analyst Rating as a starting point for their due diligence efforts when navigating models.

The Morningstar Analyst Rating is a forward-looking, qualitative rating that Morningstar’s manager research analysts assign based on their assessment of a strategy’s investment merits. The ratings range across Gold, Silver, Bronze, Neutral, and Negative. The highest ratings go to strategies that analysts conclude will outperform their Morningstar Category benchmarks over a full market cycle on a risk-adjusted basis net of fees. Neutral- and Negative-rated strategies are those that analysts expect to underperform.

In March 2019, Morningstar began assigning Analyst Ratings for separate accounts that represented models. In 2021, we expanded the eligible universe to include hypothetical models to better reflect advisors’ opportunity sets and help them assess their options.

What You’ve Been Looking For: Our Top Picks

The exhibit below illustrates the seven series that earn the coveted Gold rating.

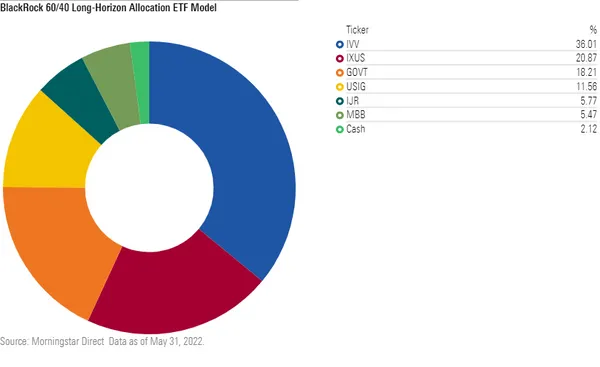

Both of BlackRock's Gold-rated series benefit from a dedicated model portfolio team, strong underlying exchange-traded funds, and research-driven processes. BlackRock Long-Horizon ETF focuses on the team’s longer-term views (typically those with greater than a one-year time horizon) that inform its strategic asset-allocation decisions. The Target Allocation ETF series uses those as a starting point and features the team’s deliberate and thoughtful tactical views to take advantage of shorter-term opportunities.

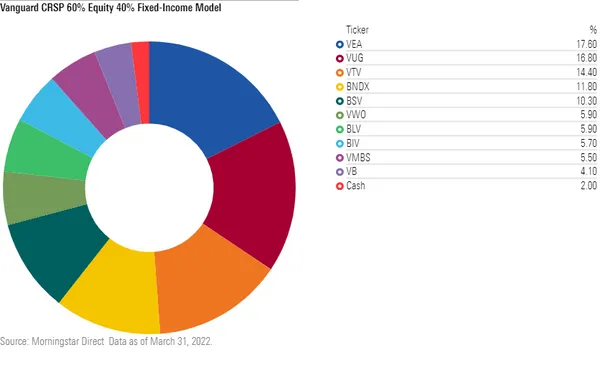

The Vanguard Core series and its sibling CRSP, S&P, and Russell series also offer topnotch, highly diversified underlying index-based funds. The latter three were upgraded to Gold from Silver in June 2022. These four-model series each offer the same broad exposure to global stocks and bonds at the portfolio level. Their simplicity and low costs should prove hard to beat over the long term.

- New Store Stock

- Rivan, Maria (Author)

- English (Publication Language)

- 208 Pages - 04/14/2020 (Publication Date) -...

- Elevate Your Vision : An Enhanced Vision Board...

- Experience a new level of quality with our...

- Our vision board kit for women offers hand-picked,...

- Whether it’s a gift vision board for teens,...

- At Lamare, our mission is to help women plan and...

- National Geographic Special - 2017-1-20 SIP...

- English (Publication Language)

- 128 Pages - 01/20/2017 (Publication Date) -...

The Core series offers a slim lineup of the firm’s four total U.S. and international stock and bond ETFs. The sibling series use more-granular exposures and offer a choice of equity index provider. Advisor and client preference should determine which of the four to use. The portfolios should be expected to perform very similarly going forward.

For an exhaustive list of Morningstar’s analyst-rated model portfolio series, see the Appendix of the 2022 Model Portfolio Landscape.

How Have Our Model Picks Performed?

At the end of April 2022, 43 model portfolios spanning seven Morningstar Categories had a Morningstar Analyst Rating for at least three years. It is a small sample size and a short track record, but the early results are promising.

Our initial coverage focused on separate accounts that were representative of model portfolios, which we view as the manager’s “golden copy” of the model.

We use the capital asset pricing model to evaluate an investment’s performance versus its Morningstar Category benchmark. Strategies that outperform using this methodology will have positive alpha compared with their category benchmark. Alpha is the excess return not explained by the strategy’s beta, or systematic risk, compared with the benchmark.

- Amazon Kindle Edition

- Baldacci, David (Author)

- English (Publication Language)

- 487 Pages - 04/16/2024 (Publication Date) - Grand...

- Amazon Kindle Edition

- Hannah, Kristin (Author)

- English (Publication Language)

- 472 Pages - 02/06/2024 (Publication Date) - St....

- Amazon Kindle Edition

- Elston, Ashley (Author)

- English (Publication Language)

- 348 Pages - 01/02/2024 (Publication Date) - Pamela...

The Morningstar Analyst Rating has done a good job of sorting models based on our conviction that they could outperform their category benchmarks thus far. On average, Silver-rated models outperformed Bronze-rated models and Neutral-rated models had slightly negative alpha versus their category benchmarks.