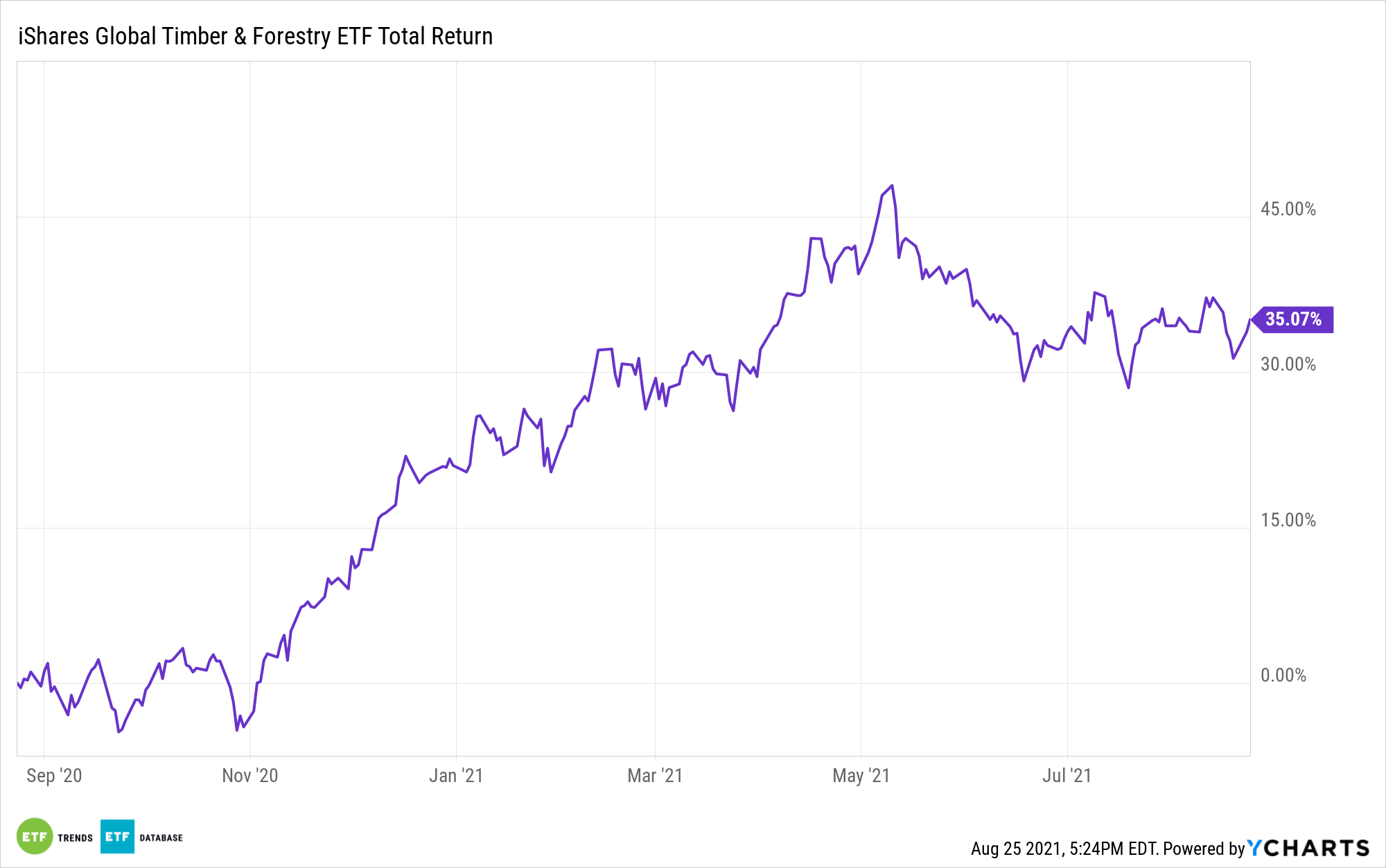

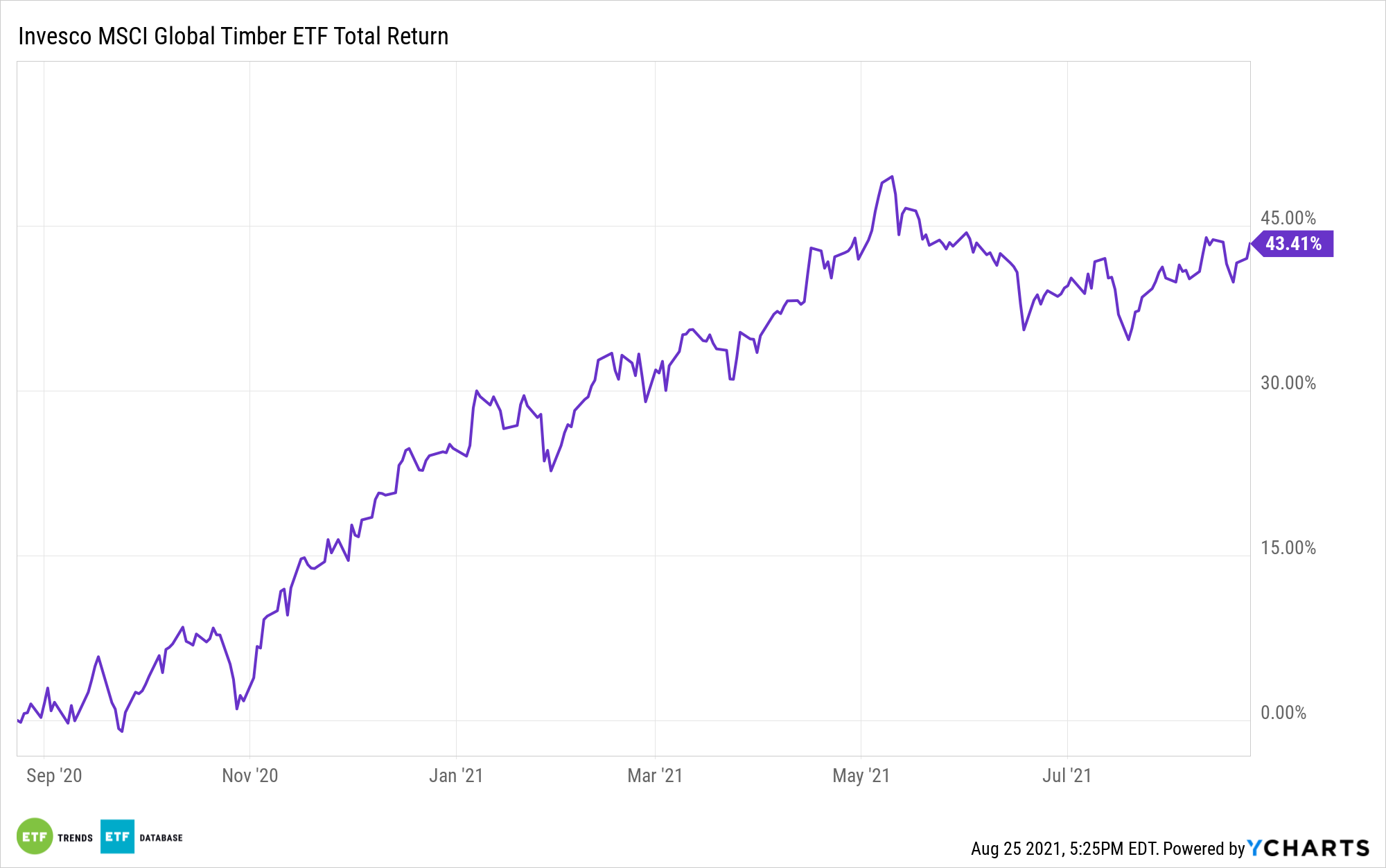

The lumber industry and sector-related exchange traded funds may have faltered as lumber prices plunged, but the woodcutters may enjoy a seasonal rebound with homebuilders picking up the pace toward the end of the year. During the past three months, the iShares Global Timber & Forestry ETF (WOOD) fell 3.6% and the Invesco MSCI Global Timber ETF (CUT) dipped 0.2%.

Source: Original Postress-this.php?">Timber Sector ETFs Could Enjoy a Seasonal Boost Ahead

Over the past two decades, lumber prices and sector-related companies typically weakened in September before rallying into the new year, according to a Bloomberg analysis of seasonality patterns, and RBC Capital Markets analyst Paul Quinn believed that this time around wouldn’t be any different.

“We see a positive setup for the traditional seasonal trade, where shares will typically bottom around mid-to-late October before rallying in anticipation of the upcoming building season,” Quinn said in a note to clients, adding that demand for wood products will rise once homeowners return from summer holidays and reduce spending on leisure activities.

Lumber futures surged over 300% over the year that ended mid-May as increased do-it-yourself renovations during the lockdowns and low-mortgage rates fueled demand for home purchases. However, producers ramped up supply and home centers stocked up, but demand rapidly declined, dragging down futures prices by over 70%. Meanwhile, lumber dealers have been forced to liquidate their inventories.

Lumber producers are now trading at a “meaningful discount,” and the worst of the selling may have already passed, Quinn said in a separate report.

“Although lumber stocks are likely to remain under pressure until pricing starts to increase, we think that the worst of the declines are over and that it is a good time to start getting up to speed on the sector,” Quinn added.

The lumber sector-related ETFs are also trading at a discount relative to the broader markets. For example, WOOD shows a 8.1 price-to-earnings and 1.4 price-to-book while CUT has a 11.7 P/E and 1.9 P/B, according to Morningstar data.

For more news, information, and strategy, visit ETF Trends.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.