The inverted yield curve is bearish short-term, but bullish long-term.

Don’t Fight The Fed: Inverted Yield Curve Means Lower Future Inflation

While inverted yield curves have always preceded recession, this time it might be a sign of easing inflation. The US has never entered a recession with 3.5% unemployment. Given the mixed signals from the yield curve, inflation, and employment, investors can use a barbell approach to protect the downside while leaving room for upside potential

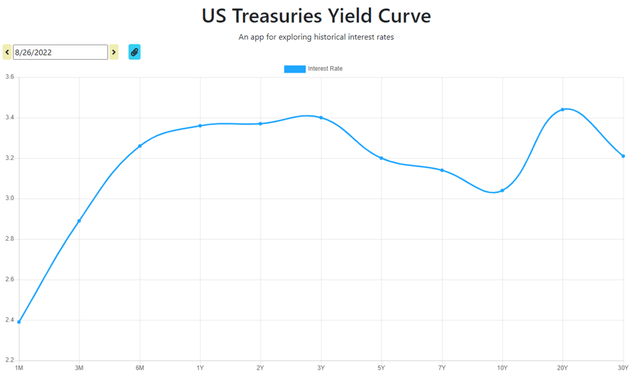

The inversion of the yield curve between the 2-year Treasury and 10-year Treasury can be interpreted in several ways. Typically, yield curve inversions that last as long as this one precedes economic recessions. This is due to the expectation that economic growth will be lower in the future and interest rates reflect this expectation: Higher growth today that will erode to lower levels should be reflected in the Treasury market. However, in today’s market, while a recession is possible, the reason for the yield curve inversion may be more a reflection of inflation expectations, not growth expectations. In other words, with high inflation today and the expectation of lower inflation in the near future, it makes sense that the nominal yield curve would be inverted to reflect this. After all, yields are composed on credit risk and liquidity risk combined with a premium for time to maturity and expected inflation.

That being said, there are significant challenges in the near future. The prospect of recession is real with slowing GDP numbers, stocks priced for either no or a short shallow recession despite the imminent onset of quantitative tightening, and of course the old leading indicator of the yield curve. Stocks appear priced for steady or slowly growing earnings versus an economic downturn. Maybe this is the correct valuation, but with high inflation and a Fed committed to price stability (lowering inflation), this may be optimistic, at least in the near term. Starting next month, the Fed will allow about $90 billion of debt to roll off its balance sheet in an attempt to shrink its size while also tightening monetary conditions to reduce inflation. The exact impact of this is unclear, but it is reasonable to expect higher interest rates across the board and increased stock market volatility (i.e. downward pressure on stocks, but with a lot of intraday swings.)

So, while my take longer term is that the inverted yield curve reflects falling inflation, which is a tailwind for the economy in the long-term, the short-term is uncertain (as always.) Because of this uncertainty, I think it is worth trying a barbell approach: keep some dry powder while also taking some high potential bets.

Know what you own and why you own it. This is always true, but during periods of uncertainty, periods the investing public have never personally experienced, this is more true than ever. If you do not understand why you own a position, in an individual stock or ETF, it is time to examine it closely and consider reallocating that capital to either a lower risk reserve and/or high beta position. In an extreme environment, with higher expected volatility, it makes sense to take more polarized positions.

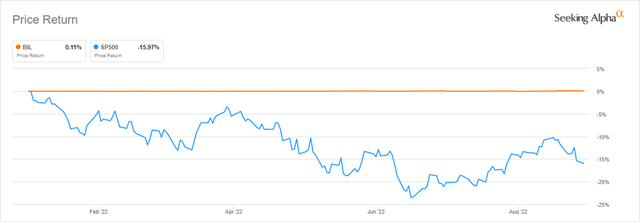

So how should investors position their portfolios in this environment? I think most would be well-served by implementing a barbell approach in which effectively zero risk (ignoring inflation risk of course) positions are paired with solid large cap and tech names that are well off their highs, regardless of low or higher beta.

Barbell Approach

To preserve capital and create a reserve that can be deployed opportunistically, I suggest raising a little cash and holdings it in money market funds, or but better yet, T-bills. Because most retail investors won’t be able to do this efficiently, I suggest parking cash in the SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL). This will serve as the conservative side of the barbell. The current SEC yield is about 1.7% and has an expense ratio of 0.136%.

The opposite side of the barbell will include speculative, high beta positions, and other stocks and sectors that are well off their highs. At the most extreme end is investing large cap tech. I am often a fan of this area of the market because it offers the greatest promise for long-term real returns. The broadest approach to capturing this is through the Invesco QQQ Trust (QQQ). The fund provides exposure to about 100 large cap tech names for a mere 0.20%. As it is market cap weighted, it is to be expected that the largest holdings are Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Tesla (TSLA), and Alphabet (GOOGL). These five companies not only represent a large share of the index and fund, but also generate a non-trivial amount of wealth and value for the overall U.S. economy.

- New Store Stock

- Rivan, Maria (Author)

- English (Publication Language)

- 208 Pages - 04/14/2020 (Publication Date) -...

- Elevate Your Vision : An Enhanced Vision Board...

- Experience a new level of quality with our...

- Our vision board kit for women offers hand-picked,...

- Whether it’s a gift vision board for teens,...

- At Lamare, our mission is to help women plan and...

- National Geographic Special - 2017-1-20 SIP...

- English (Publication Language)

- 128 Pages - 01/20/2017 (Publication Date) -...

To compliment this high beta exposure, I always like to include consumer staples. Consumer staples, the companies, but not always the stocks, perform consistently well in almost economic environment. These businesses maintain stable revenue and margins due to the inelasticity of their product and service offerings. Rather than purchase Coca-Cola (KO) and Procter & Gamble (PG) as I have personally, for others it might make more sense to gain broader exposure through the Consumers Staples Select Sector SPDR ETF (XLP). The XLP provides exposure to about 33 names in the sector well beyond the two listed above, although they represent about 25% of the fund.

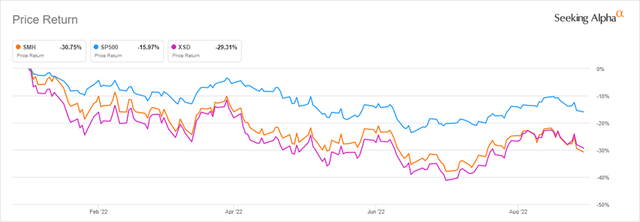

Beaten Down Semis

For those looking to be a little more opportunistic in this environment, I am looking at the semiconductors. I am long-term bullish on the sector despite some limitations in the space as described in a recent article. The majors in the industry have generally performed poorly recently despite improving future prospects. What are these improving future prospects? First is the alleviation of supply chain issues, followed by the recent bill signed by President Biden that encourages bringing chip manufacturing back to the U.S. by dangling $10s of billions of incentives, and finally, the secular demand for increasing computing power. As I described in that previous article, the major chip makers are running up against physical limitations to progress that will need to be resolved. Intel (INTC), NVIDIA (NVDA), Microsoft (MSFT), Alphabet, and Meta Platforms (META) have already made significant investments in new technologies ranging from GPUs to graphene to quantum computing. As always, picking winners and losers in the space can be tricky. It is a tough truth to swallow that you made the right call, but didn’t capitalize on it. Because of this, I suggest gaining a broad exposure to this out of favor space. While I personally like Intel and have had a position in the company for a decade, I suggest new entrants to consider either the VanEck Semiconductor ETF (SMH) or the SPDR S&P Semiconductor ETF (XSD). Of these two funds, the VanEck Semiconductor is the purer play, with both having the same expense ratio of 0.35%.

Looking Through Rose Colored Glasses

For those that believe that there will be no recession, falling inflation, and stable unemployment, something that might be described as an overly optimistic outcome, then I suggest not only getting long tech through QQQ, but also looking at homebuilders that have been dragged through the mud in recent months. The SPDR Homebuilders ETF (XHB) is lower by over 28% year-to-date despite booming new home demand, recently tempered by rising mortgage rates. If you think this situation is temporary or have a longer-term perspective, then buying homebuilders makes sense. The market will adjust and normalize at 5-6% 30-year mortgage rates and life will move on. When it does, the U.S. will once again find itself in an enormous housing deficit that can only be resolved with new construction. After the beating the XHB has taken, this might be an interesting place to park a small allocation of capital in anticipation of a long-term recovery.

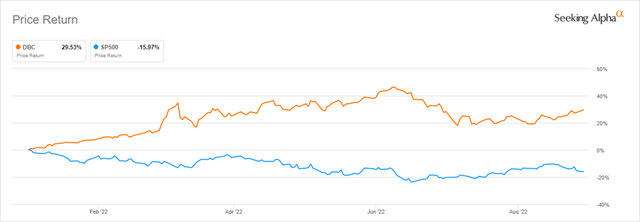

If we enter the unfortunate situation of stagflation, in which we have low/slowing growth with persistently high inflation, then increasing exposure to commodities might make sense. While I gain this exposure through the Invesco DB Commodity Index Tracking ETF (DBC), I fear that the recession component would dominate the inflation at that point. In other words, I believe that stagflation is a lower probability event than recession, so while commodities might be expected to perform well in stagflation, that might not be the case for recession. For recession, I suggest referencing a previous article I published, “Preparing for the Next Recession.” Otherwise, I believe the above scenarios are more likely.

Fairytale Outcome (An aside)

- Amazon Kindle Edition

- Baldacci, David (Author)

- English (Publication Language)

- 487 Pages - 04/16/2024 (Publication Date) - Grand...

- Amazon Kindle Edition

- Hannah, Kristin (Author)

- English (Publication Language)

- 472 Pages - 02/06/2024 (Publication Date) - St....

- Amazon Kindle Edition

- Elston, Ashley (Author)

- English (Publication Language)

- 348 Pages - 01/02/2024 (Publication Date) - Pamela...

Imagine being able to invest in 1982, but didn't know what the next 40 years would bring. What would you do? Would you complain about high interest rates, inflation, and stagnate economic growth? Probably. That’s why there aren’t more wealthy Boomers. What they didn’t see is that it was the investment opportunity of a lifetime, right at the beginning of their best earnings years, and a lot of them missed the opportunity. Sorry, but that was a 40-year bull market in stocks, bonds, and real estate. You could have bought anything and gotten rich. Some did. So how does the current environment compare? Am I too optimistic or naïve? We’ll see.

Final Thoughts

As an optimist I try to see the best in a situation or at least the path back to prosperity. I believe that this is the only way to invest long-term. Short-term circumstances can dominate one’s perspective’s on current fears and opportunities. To balance these conflicting ideas, I suggest investors position portfolios for the long-term while at the same time be able to hold the ballast necessary to weather any storm. That is the ultimate objective of this article. Investors should generally stay fully invested, but in the event that fear and emotions overtake objective reasoning, raising cash and tilting the portfolio in a different way probably makes sense. While it might not always produce the greatest expected returns, it will help investors avoid making emotional errors that can cause catastrophic damage to long-term returns. As always (and should be recommended by your advisor), any tilts within your portfolio allocations should be sized in a way that aligns with your risk tolerance and preferences. I look forward to your feedback in the comment section below.