IGLB owns a portfolio of long-term investment grade corporate bonds. Investors of IGLB can earn an attractive 5.43%-yielding bond interest. IGLB’s fund price may significantly decline if recession fear mounts.

IGLB ETF: Income Investors Should Start Accumulating Now

Introduction

Bond market had a challenging 2022 as the Federal Reserve aggressively hiked its rate. Will the fixed income market continue to underperform in the rest of 2023? What is the impact on the bond market and especially on investment grade bonds? We will analyze iShares 10+ Year Investment Grade Corporate Bond ETF (NYSEARCA:IGLB) and provide our recommendations.

ETF Overview

IGLB invests in long-term investment grade corporate bonds in the United States. The fund has not performed well in 2022 and is likely to continue to rangebound in the near term. Looking forward to the second half of 2023 and early 2024, an economic recession may trigger a market selloff, and investment grade bonds will likely be impacted negatively. However, income investors should treat this selloff as a good opportunity to accumulate more shares.

Fund Analysis

IGLB has been rangebound in the first 4 months of 2023

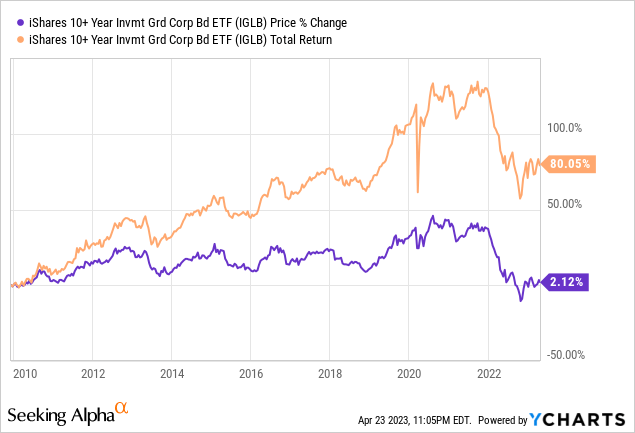

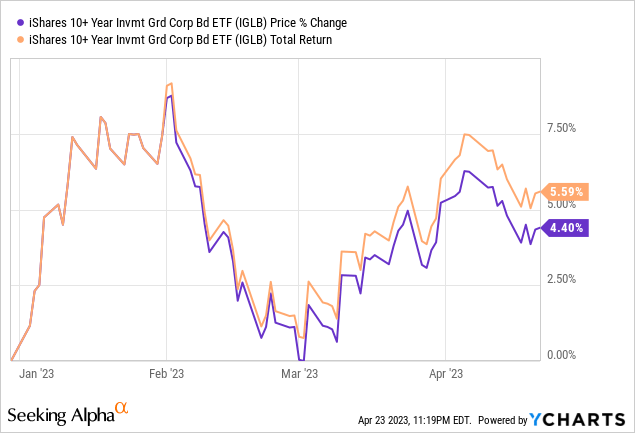

Both Investment grade corporate bonds and government bonds have not performed well last year. IGLB was not without exception. The fund has delivered a total loss of 25.73% for the entire 2022. The Federal Reserve's aggressive rate hike last year to combat persistently high inflation was likely the primary cause behind this decline. Since long-term bonds are much more sensitive to rate changes and that IGLB has a weighted average maturity year of 22.6 years, it is not surprising that the aggressive rate increase had a detrimental impact on its fund price. The fund has since rangebound in the first 4 months of 2023 as the Federal Reserve has indicated that they may be near the end of this rate hike cycle. In fact, as the chart below shows, IGLB has delivered a total return of 5.59% since the beginning of this year.

Should investors start accumulating IGLB?

As a result of the Federal Reserve's aggressive rate hike last year, IGLB's current 30-day SEC yield of 5.43% is quite attractive. We have not seen this good of a yield in a long time. Given that we are now near the end of this rate hike cycle, one may wonder whether this is a good time to start buying IGLB. Here, we will offer our insights:

1) It will take time for the inflation to cool down

The reality is that taming inflation is going to be a difficult task. The U.S. economy has been quite resilient even after the aggressive rate hike last year, and we still have a strong job market. Although inflation has clearly passed the peak reached in mid-2022, it is still quite persistent. Given the stickiness of inflation, a rate decline is unlikely to happen this year. In fact, the Federal Reserve has indicated numerous times that they are not ready to lower the rate. The only exception to this is that a severe economic recession (e.g., a financial crisis) occurs, and in that case, the Federal Reserve may have no choice but to lower the rate. Meanwhile, since prices of bonds usually have an inverse correlation to the rates and that the Federal Reserve is unlikely to lower the rate in the near term due to a resilient economy, it is unlikely that we will see a meaningful recovery to IGLB's fund price this year.

2) Expect a negative spike to occur

No products found.

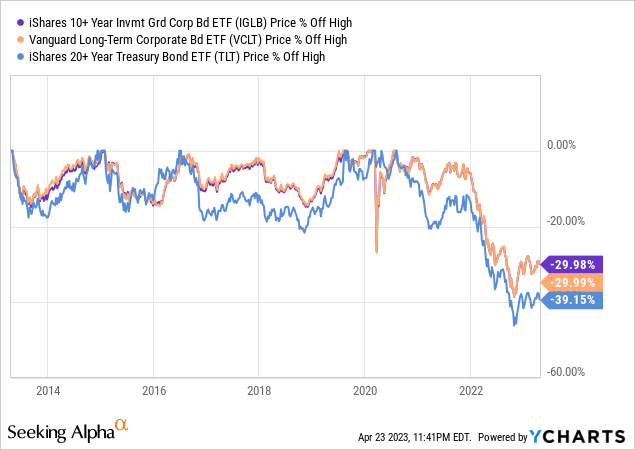

Although IGLB's portfolio consists of high-quality investment grade corporate bonds, the market still perceives it as a somewhat riskier assets than U.S. treasuries. There is no problem owning IGLB if the economy is in expansion mode. However, if the economy is contracting or if the market fear escalates (e.g., fear of a recession, or fear of a financial crisis), even investment grade corporate bonds may experience a sharp price decline. We expect that the market fear will eventually drive IGLB's fund price lower as the economy will eventually head for a recession, especially if the Federal Reserve keeps its rate elevated for the rest of 2023. The timing of a recession to occur may be in the second half of 2023 or the first half of 2024.

We have seen this market selloff in investment grade corporate bonds in past recessions. As the chart below shows, IGLB's fund price suffered a decline of over 25% during the outbreak of COVID-19 in 2020. Since IGLB's inception was in December 2009, we do not have its chart for the Great Recession. However, other investment grade corporate bonds also exhibit similar negative spikes during the Great Recession. Therefore, we believe a negative spike of IGLB's fund price is likely in the upcoming recession.

3) If your goal is solely for a fixed income, now is a good time to start accumulating

What should you do in this environment? If your goal is solely to receive bond interest in the long run, we think this is a good time to start accumulating. Since we cannot predict the bottom, we think the best strategy is to gradually accumulate shares of IGLB. Its current price is relatively low compared to the historical average already. Meanwhile, investors should be able to earn an attractive interest income with yield of 5.43%. Investors should especially take advantage of the negative spike that will occur during an economic recession. As can be seen from its past history, this negative spike usually doesn't last very long.

No products found.

4) If your goal is to park your money, consider U.S. treasuries instead

However, if one's goal is to park the fund here and wait for better opportunities, especially during an economic recession in the equity market, this is not the fund to park your cash. This is because a negative spike in its fund price means that you will not be able to take advantage of the equity market sell-off by selling IGLB and switch to other equity ETFs or stocks. You are better off buying treasury funds instead.

Investor Takeaway

For investors wishing to own a quality portfolio of bonds, IGLB is a good choice. You should take advantage of its current attractive yield and the possible upcoming recession to gradually accumulate. However, if your goal is to park the money in the interim and switch to equities during an economic recession, this fund is not the one to go to as it will also decline in a market selloff. You should consider owning treasury funds instead.