PBJ invests in U.S. food and beverage companies.While the headline IRR is on the lower side, it is not a very volatile ETF, and it is also inexpensive.The valuation would suggest that even if inflation persists and PBJ's portfolio struggles to pass on the costs, the fund is still likely to beat inflation over the longer run.PBJ is a defensive bet, and probably only appealing to more risk-averse investors. It is however reasonably priced on the basis of earnings power and seems like a safe bet over the long run.

PBJ: Defensive Consumer Staples Fund With Potential To Protect Against Inflation (PBJ)

Invesco Dynamic Food & Beverage ETF (NYSEARCA:NYSEARCA:PBJ) is an exchange-traded fund that provides investors with exposure to U.S. food and beverage companies. The fund invests in accord with its benchmark index, the Dynamic Food & Beverage Intellidex Index. The methodology of the index is based on 30 U.S. food and beverage companies:

These are companies that are principally engaged in the manufacture, sale or distribution of food and beverage products, agricultural products and products related to the development of new food technologies. These companies may include consumer manufacturing of agricultural inputs like livestock and crops, as well as processed food and beverage products; food and beverage stores such as grocery stores, supermarkets, wholesale distributors of grocery items; and food and beverage services like restaurants, bars, snack bars, coffeehouses and other establishments providing food and refreshment. Companies with focused operations as tobacco growers and manufacturers, or pet supplies stores are specifically excluded from this universe.

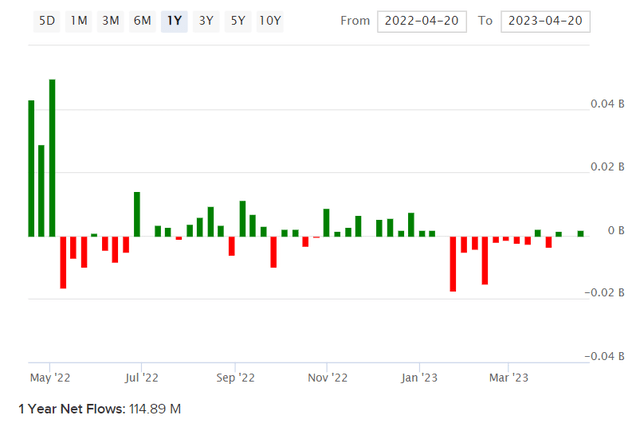

The fund carries an expense ratio of 0.63% as at the time of writing, with 31 holdings as of April 21, 2023. Invesco also report a median bid/ask spread as of recent being 0.09%, which is an indication of good liquidity (not costly to transact in the ETF's shares). According to ETFDB.com, PBJ has assets under management of circa $330 million. This follows a generally positive year of inflows (+$115 million).

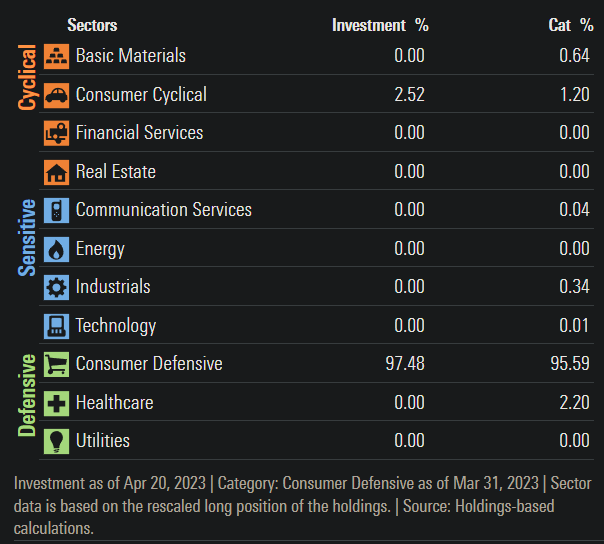

However, bear in mind that these flows were mostly front-loaded, and net fund flows are starting to see negative signs more recently. I think the falls in equity markets and general risk-off activity over the past year or so probably helped to support the demand for consumer staples stocks, which is essentially what food and beverage companies are. Morningstar report the sector exposures as follows (“Consumer Defensive” being 97% of the fund):

Morningstar's consensus analyst estimate for three- to five-year earnings ratio for the fund is 12.57%, with a forward price/earnings ratio of 16.60x and a price/book ratio of 2.48x. This is as of April 20, 2023. However, given that Invesco offer more data, I will use their trailing and forward price/earnings ratios of 17.25x and 17.05x, respectively, as of the end of March 2023, with a price/book ratio of 2.62x.

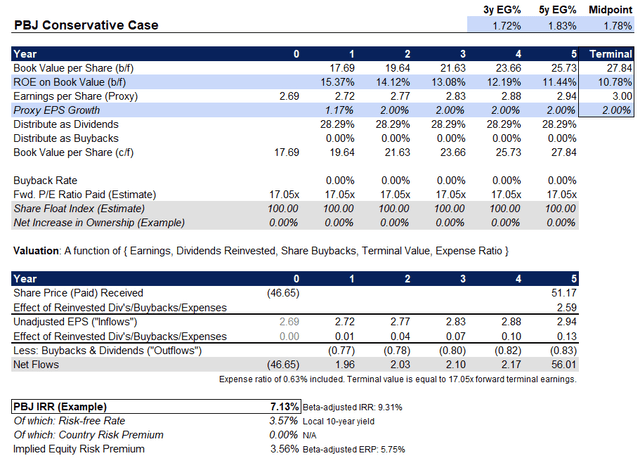

I think that the forward price/earnings multiple could potentially offer some opportunity for expansion. Nevertheless, we will hold this constant for now. Assuming no share buybacks but a roughly constant 28% dividend distribution rate, my model implies a forward IRR of 7.13%, but this is based on a 2% earnings growth rate from year 2 onward, i.e., probably zero “real” earnings growth (inflation-adjusted). This is in stark contrast to the massive 12-13% earnings growth rate suggested by Morningstar.

- ➤【 HIGH-PERFORMANCE CAR JUMP STARTER...

- ➤【 SMART CORDLESS INFLATOR WITH LCD SCREEN 】...

- ➤【 ESCORT YOUR SAFETY 】Thanks to the...

- ➤【 ALL-IN-ONE JUMP STARTER 】Say goodbye to...

- ➤【 WHAT YOU GET & WARRANTY 】YabeAuto YA70...

- 【UNIVERSAL FIT KIT】- The kit contains 23 types...

- 【TOP QUALITY】- These car retainer clips are...

- 【PREFECT FOR WHAT YOU NEED】 - Up to 680 pieces...

- 【BONUS ACCESSORIES】- We provide different size...

- 【WIDE APPLICATION】- Professional push clips...

- Powerful Car Jumper Starter - The Scatach 011 jump...

- Advanced Safety Features - Easy to opearte, and...

- Portable Design - This portable car battery...

- Respond to Emergencies - Portable power bank with...

- What will you Get ? - Scatach 011 Car Starter...

- 【What You Get】1*Tactical Molle Seat Back...

- 【Military Molle System - Lots Of...

- 【Durable and Long Lasting】 MOLLE seat back...

- 【Tactical Seat Covers Universal】 The size of...

- 【Guarantee】If you're not 100% satisfied with...

PBJ's portfolio is mature, and also subject to the vagaries of the commodity markets. It is not too surprising to see meagre earnings growth over the next year of 1.17% (implied by Invesco's financial data). However, I don't necessarily want to assume that the portfolio will bounce significantly as suggested by Morningstar estimates. My conservative estimates imply an underlying return on equity that drops from over 15% to about 10%. If on the other hand I allow some bounce in earnings from year 2 (+8% in year 2, 5% in year 3, before settling back down to 2% by year 5 and the terminal year) the implied IRR moves up to 9.23%.

In this IRR range of 7.13-9.23%, we have an underlying beta-adjusted equity risk premium of 5.75% to 9.13%. This is high, but it does take into account the low fund beta (the fund's beta is approximately 0.62x). Using historical Original Postowersh.-dynamic-food---beverage-historical-data" rel="noreferrer noopener" target="_blank">price data I calculated annualized volatility for PBJ of circa 15% (less more recently, but 15% over longer time frames; alternatively you could say 10-15%). So, in volatility-adjusted terms, I would argue that PBJ currently offers a very “average” return profile.

Nevertheless, if one is more risk averse, PBJ will probably beat inflation and preserve one's purchasing power. If inflation were to hold at 5%, for instance, my calculations above (in the conservative case) would suddenly look even more conservative with negative real earnings growth rates of -3% from year 2 onward. In spite of this, an IRR of 7% or more should still be achievable, which would should preserve the purchasing power of one's invested dollars (with a net 2% real return per annum, above inflation).

As mentioned earlier, I also think the earnings multiple is probably on the low side. However, slower-growth, mature funds tend not to see significant expansions in earnings multiples since they are usually rewarded higher equity risk premia by investors. So, while the earnings multiple might hit 18x or more in the long run, I would not want to count on this. Nevertheless, it is worth mentioning, as it could for example slap another 1% on the annual IRR in my conservative case.