Back in January, I penned an article on the ProShares Inflation Expectations ETF (NYSEARCA:RINF) suggesting that declining inflation was transitory and we may be in for a prolonged period of high inflation. The recent advanced GDP report for Q1/2023 that was released on April 27th confirmed some of my fears.

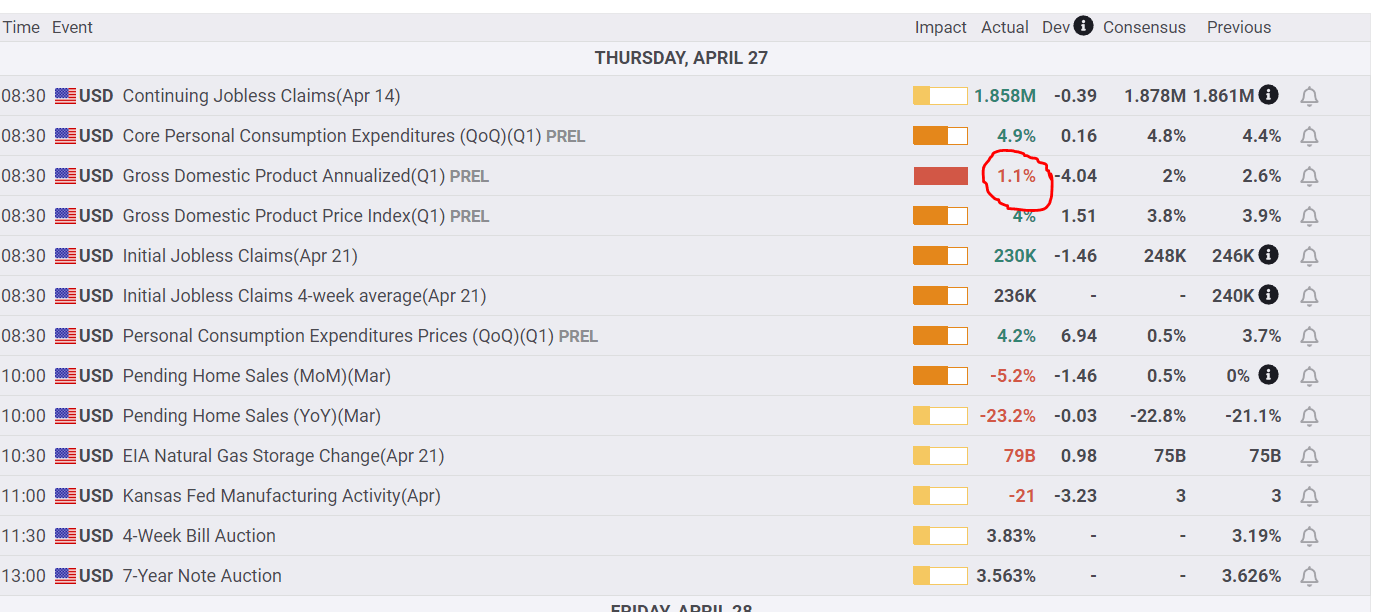

First, the headline GDP figure of 1.1% annualized was far below consensus estimates of 2.0% and Q4/2022's figure of 2.6% (Figure 1).

Figure 1 – Q1/2023 GDP was lower than expected (fxstreet.com)

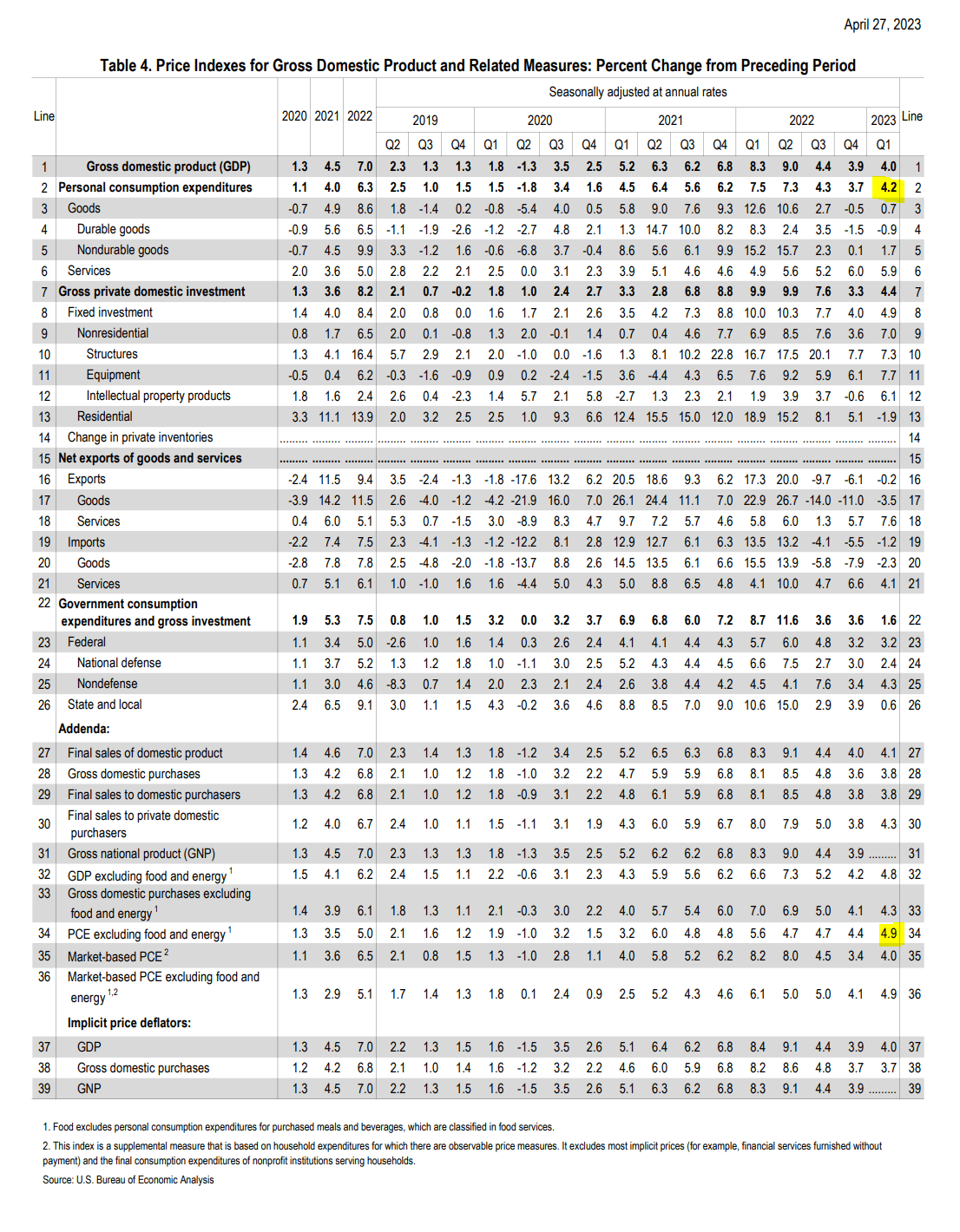

More importantly, looking at the details with respect to inflation, we can see that the price index for personal consumption expenditures (“PCE”) accelerated from Q4/2022's 3.7% to 4.2% in Q1/2023. Worryingly, PCE excluding volatile food and energy prices jumped to 4.9% from 4.4%, completely going against the Federal Reserve's narrative of improving inflation readings (Figure 2).

Figure 2 – GDP Price Index shows stubborn inflation (BEA.gov)

Taking a step back, the overall economic picture appears to be morphing into a case of ‘stagflation', characterized by slow to negative economic growth and stubbornly high inflation. So far the only difference in the current stagflationary episode compared to classic examples is unemployment, which has remained near all-time lows at 3.5%.

What About Other Inflation Reports?

Was I cherry picking the GDP report to show inflation is high and reaccelerating? Unfortunately, that is not the case. Over the past few weeks, we have seen multiple inflation reports coming in hotter than expected.

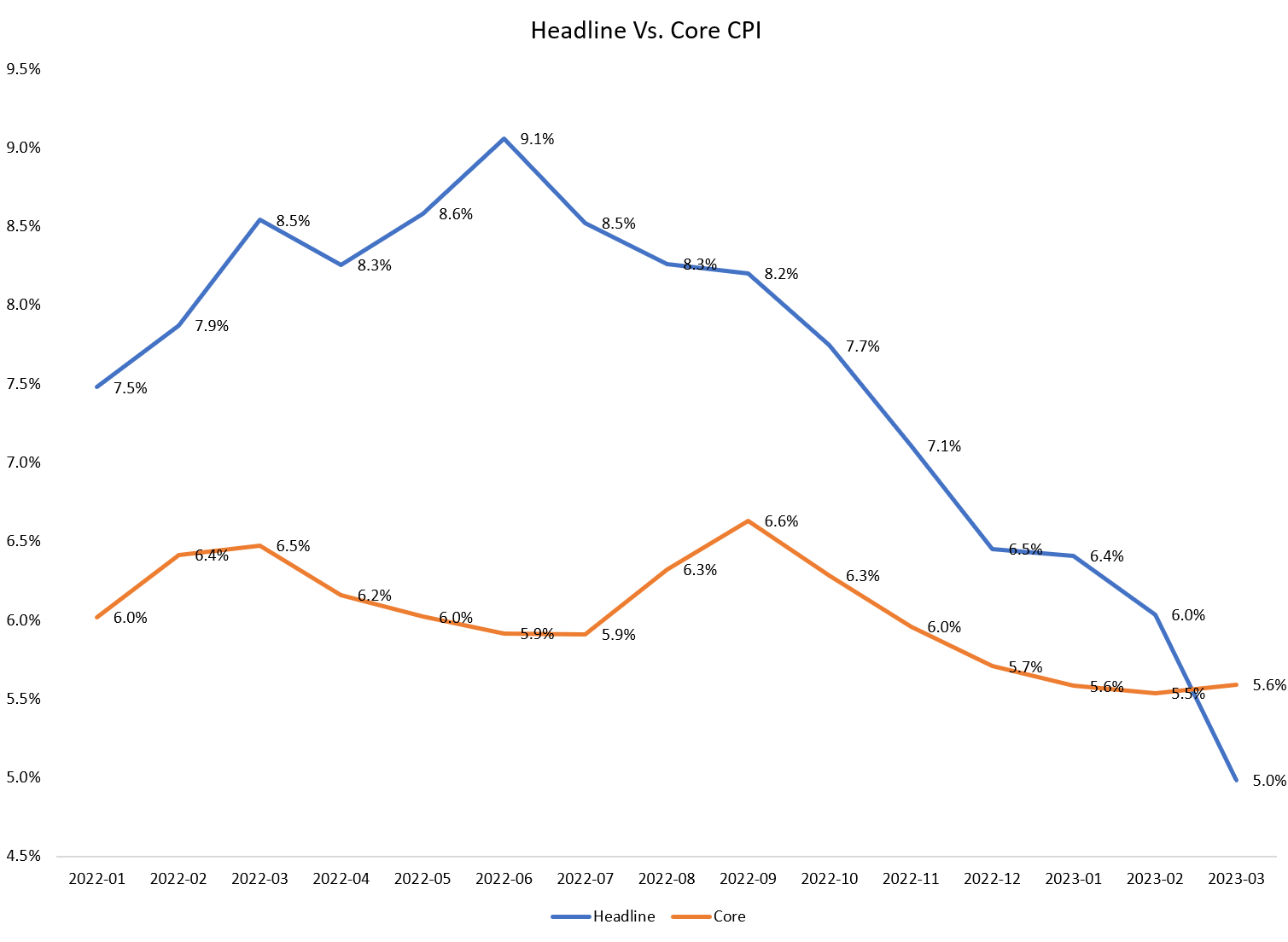

For example, although the March CPI report showed headline inflation slowed to 5.0% YoY from 6.0% in February, the important core CPI edged higher to 5.6% YoY (Figure 3).

Figure 3 – Core CPI inflation reaccelerated (BLS.gov)

In fact, if we look at the CPI inflation data series, we can see that while headline inflation has indeed slowed down due to base effects (i.e. we are lapping the surge in energy prices due to Russia's invasion of Ukraine last spring), core CPI inflation has remained essentially unchanged over the past year between 5.5 to 6.5% (Figure 4).

Figure 4 – Headline vs. Core CPI (Author created with data from BLS)

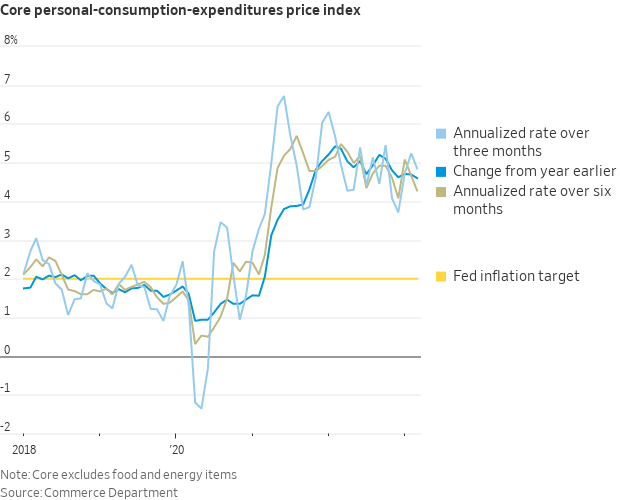

Similarly, the latest Core Personal Consumption Expenditures (“PCE”, the Fed's favourite inflation measure) report released on April 28th showed that Core PCE increased at a 4.6% YoY rate in March, above expectations of 4.5% (Figure 5).

Figure 5 – Core PCE above expectations (fxstreet.com)

Monthly gains in both January and February PCE were revised up. According to WSJ reporter Nick Timiraos, the core PCE has increased at an annualized 4.9% rate in the previous 3 months, 4.2% annualized in the previous 6 months, and 4.6% annualized over the previous 12 months (Figure 6). This is far above the Fed's 2% target.

Figure 6 – Core PCE stubbornly high (WSJ)

How Will Higher Inflation Impact RINF?

Again, for those not familiar, the RINF ETF gives investors duration hedged exposure to 30Yr TIPS bonds, i.e. it provides direct exposure to 30Yr inflation expectations (I covered the mechanics of this ETF in my initiation article here).

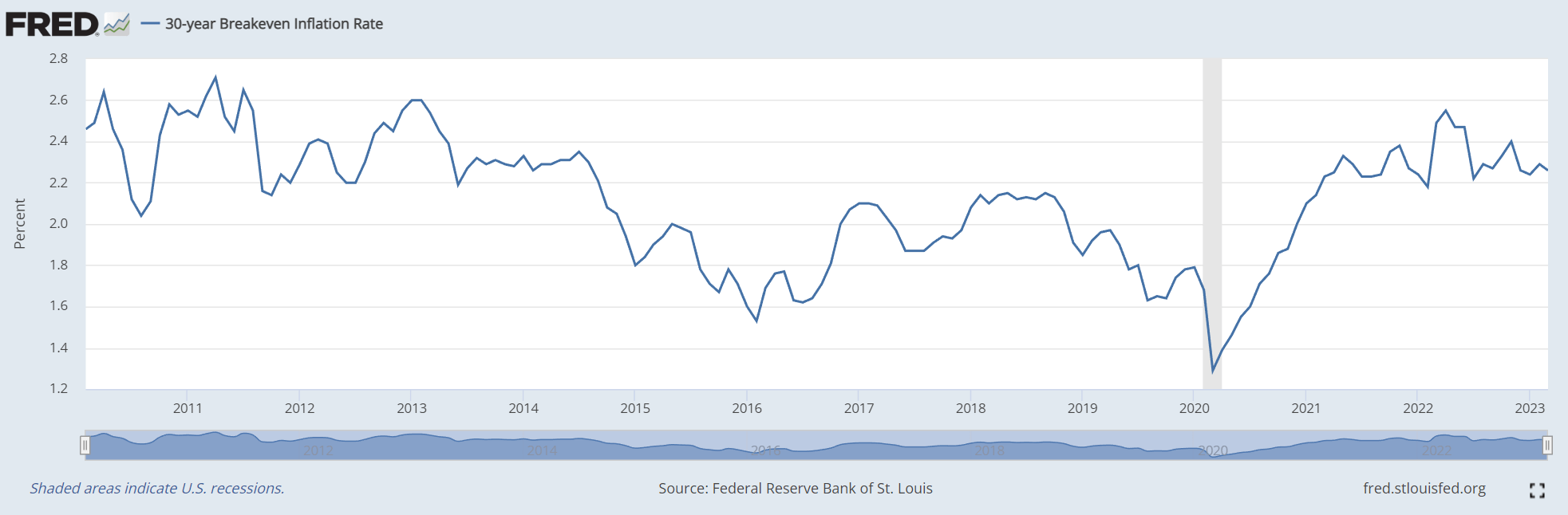

So far, 30-Yr inflation expectations remain very well anchored at only 2.26% (Figure 7). However, we are also seeing inflation expectations rising at shorter-term horizons, with 1Yr inflation expectations at 4.6% and 3Yr at 2.8%.

Figure 7 – 30Yr inflation expectations well anchored (St. Louis Fed)

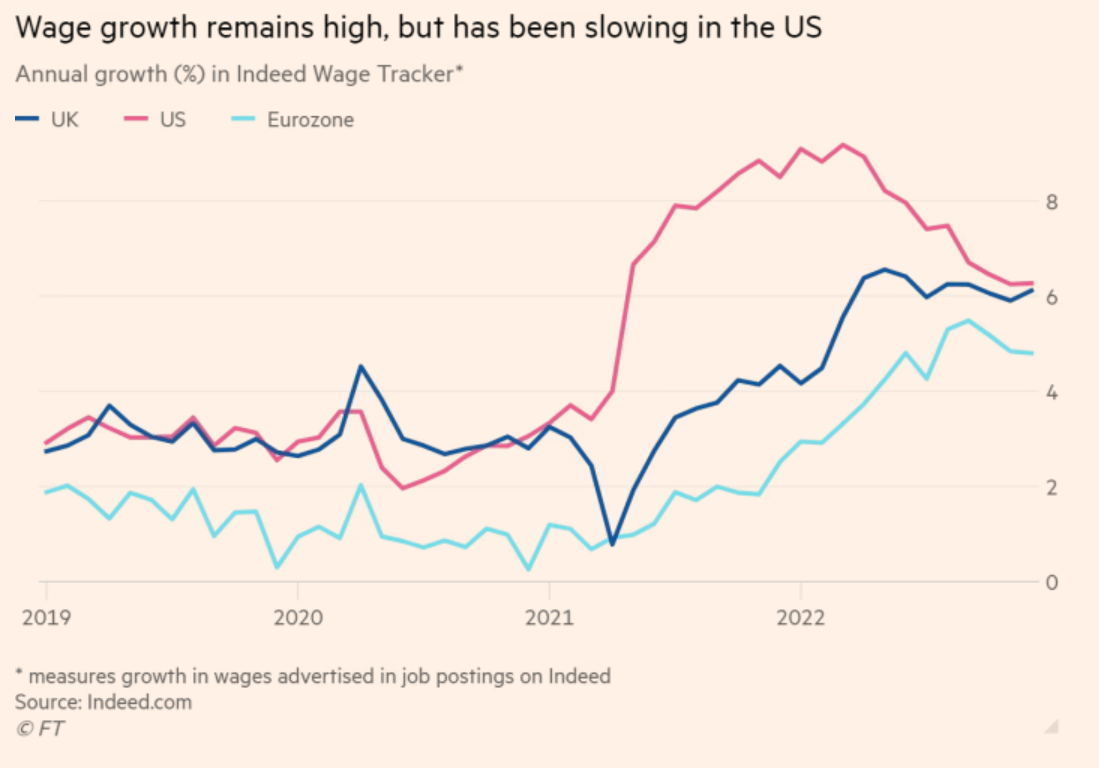

I believe the longer core inflation stays elevated, the more upwards pressure there is on long-term inflation expectations. According to survey data from Indeed Wage Tracker, wage growth remains at levels far above inflation. While this is good news for workers, it also incentivizes companies to raise prices in response, creating a dreaded ‘wage-price' spiral (Figure 8).

Figure 8 – Wage growth far above levels consistent with 2% inflation (FT)

- New Store Stock

- Rivan, Maria (Author)

- English (Publication Language)

- 208 Pages - 04/14/2020 (Publication Date) -...

- Elevate Your Vision : An Enhanced Vision Board...

- Experience a new level of quality with our...

- Our vision board kit for women offers hand-picked,...

- Whether it’s a gift vision board for teens,...

- At Lamare, our mission is to help women plan and...

- National Geographic Special - 2017-1-20 SIP...

- English (Publication Language)

- 128 Pages - 01/20/2017 (Publication Date) -...

Inflation May Be Structural

As I detailed in my prior article, macro forces are at play that may cause inflation to be structurally entrenched for years to come. In the short-term, as we lap the price spikes from the Russia/Ukraine war, energy prices will once again be additive to headline inflation in the coming months (Figure 9).

Figure 9 – Gasoline prices will soon lap price spikes from 2022 (St. Louis Fed)

Moreover, increasingly bipolar geopolitics threatens to lengthen supply chains and increase friction to companies' cost structures. For example, the Biden administration is actively trying to impede the export of advanced semiconductor manufacturing technologies and equipment to China, not just from the U.S. but also from allied countries.

Putting aside the geopolitical reasons behind these curbs, the economic impact is likely going to be increased costs for consumers and businesses as companies must build additional factories outside of China and suffer reduced convenience benefits from China's manufacturing hubs.

Furthermore, China's joining of the WTO in the early 2000s paid enormous dis-inflationary dividends as literally a billion low-cost workers were added to the labour pool. However, as China's population ages over the coming years, this demographic dividend will reverse (Figure 10).

Figure 10 – Chinese working age population peaked and set to decline (population.un.org)

Risks To RINF

The short-term downside risk to my structural inflation call is that it increasingly appears a recession will occur in the next few quarters. Even the Fed's staff economists are projecting “a mild recession starting later this year, with a recovery over the subsequent two years,” as we recently learned from the Fed's FOMC Minutes.

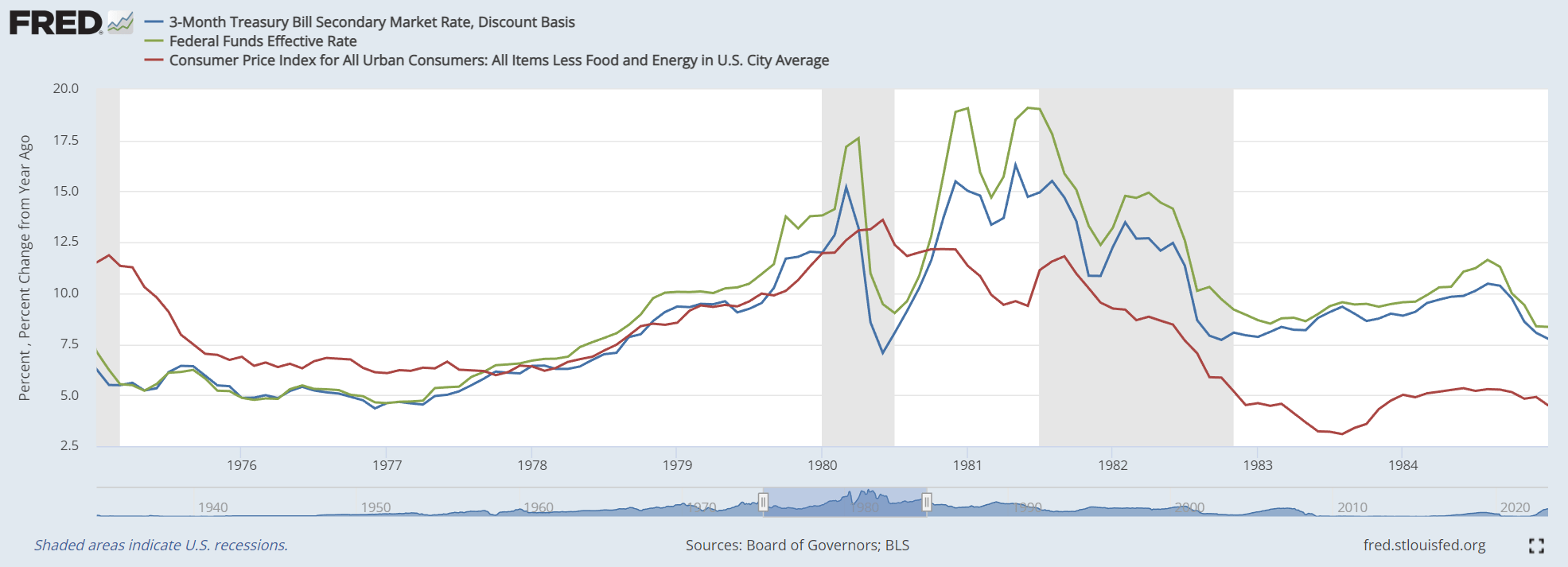

So while inflation may be a long-term structural call, we could actually see a dip in inflation expectations during a recession. However, if traders are correct in their view that the Fed will rapidly cut interest rates later this year to stimulate the economy (Figure 11), then we could see a resurgence of inflation similar to early 1980s.

Figure 11 – Traders expect the Fed to cut rates rapidly in 2023 (CME)

In 1980, the Fed cut interest rates despite high inflation in response to a developing recession. However, as the Fed cut interest rates, inflation rebounded strongly. This ultimately required the Fed to raise interest rates even higher in 1981 and caused the 1982 ‘double dip' recession (Figure 12).

Figure 12 – Fed rate cuts in 1980 caused resurgence of inflation in 1981. Could history repeat? (St. Louis Fed)

- Amazon Kindle Edition

- Baldacci, David (Author)

- English (Publication Language)

- 487 Pages - 04/16/2024 (Publication Date) - Grand...

- Amazon Kindle Edition

- Hannah, Kristin (Author)

- English (Publication Language)

- 472 Pages - 02/06/2024 (Publication Date) - St....

- Amazon Kindle Edition

- Elston, Ashley (Author)

- English (Publication Language)

- 348 Pages - 01/02/2024 (Publication Date) - Pamela...

Conclusion

I believe the macro fundamentals are aligned for structurally higher inflation that will eventually feed through to long-term inflation expectations. One way to benefit from higher long-term inflation expectations is through the RINF ETF, which makes a direct bet on 30Yr duration hedge TIPs bonds.