Introduction

Everyone has heard of Tesla (TSLA) CEO Elon Musk and the way he is changing the automobile industry. Entrepreneur Li Shufu is also well known as he is the force behind Zhejiang Geely Holding Group which controls many OEMs including Volvo Car Group (OTCPK:VLVOF)(OTCPK:VLVCY) and Geely Automobile (OTCPK:GELYY) (OTCPK:GELYF). Additionally, Li Shufu is known for his investments in Mercedes-Benz Group (OTCPK:MBGAF) and Aston Martin (OTCPK:AMGDF)(OTCPK:ARGGY) (OTCPK:AMLRF) (AML.L).

BYD (OTCPK:BYDDY) Founder, Chairman and CEO Wang Chuanfu is not well known outside of China but his contributions to the global automobile industry have been enormous. My thesis is that Wang Chuanfu and BYD are changing the world with respect to the automobile industry.

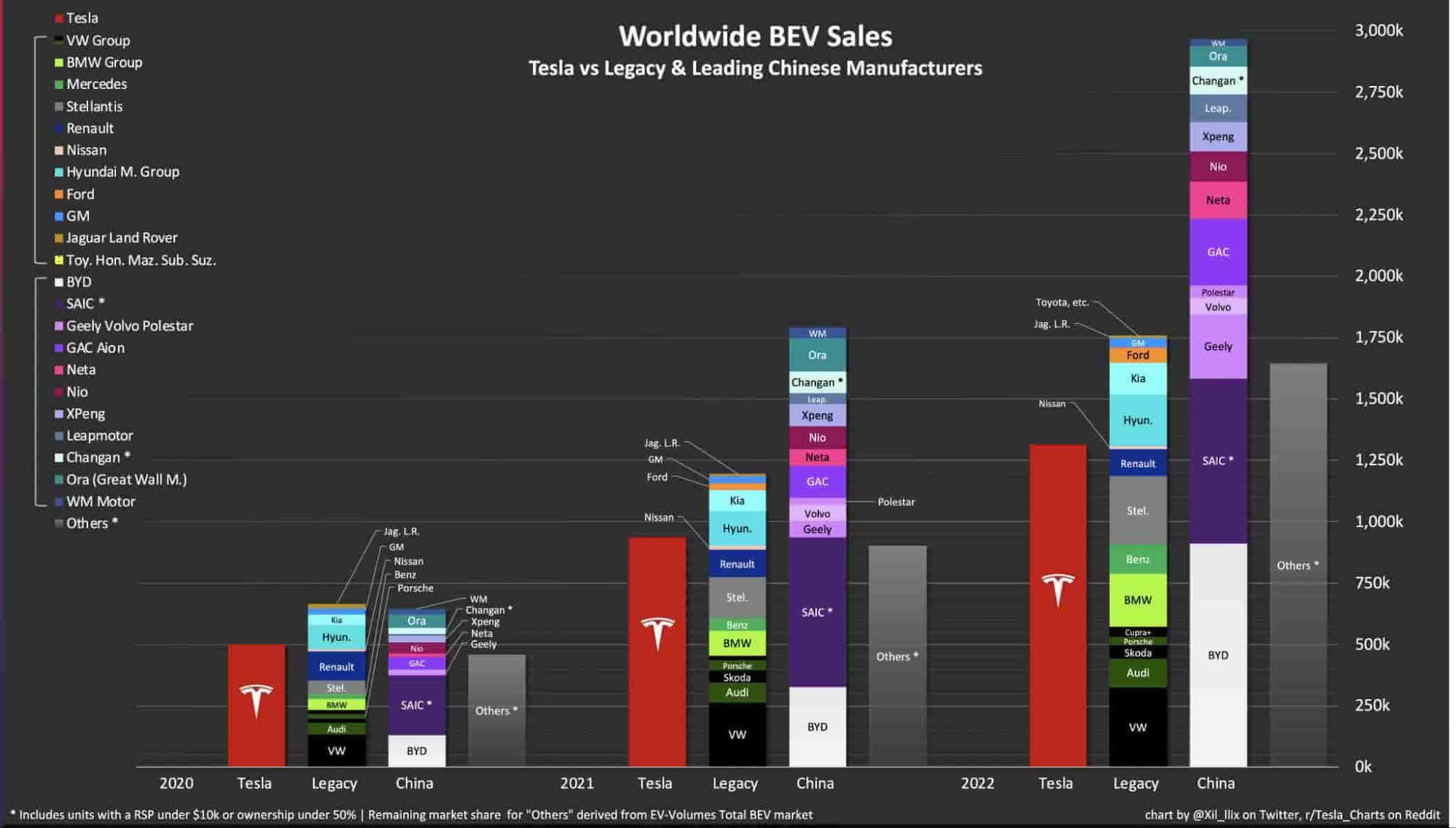

Per an updated graph from @Xil_llix, BYD in white below was second only to Tesla in terms of global battery electric vehicle (“BEV”) sales in 2022:

BYD BEVs (Graph from @Xil_llix)

At the time of this writing, RMB 100 is $14.37.

Batteries

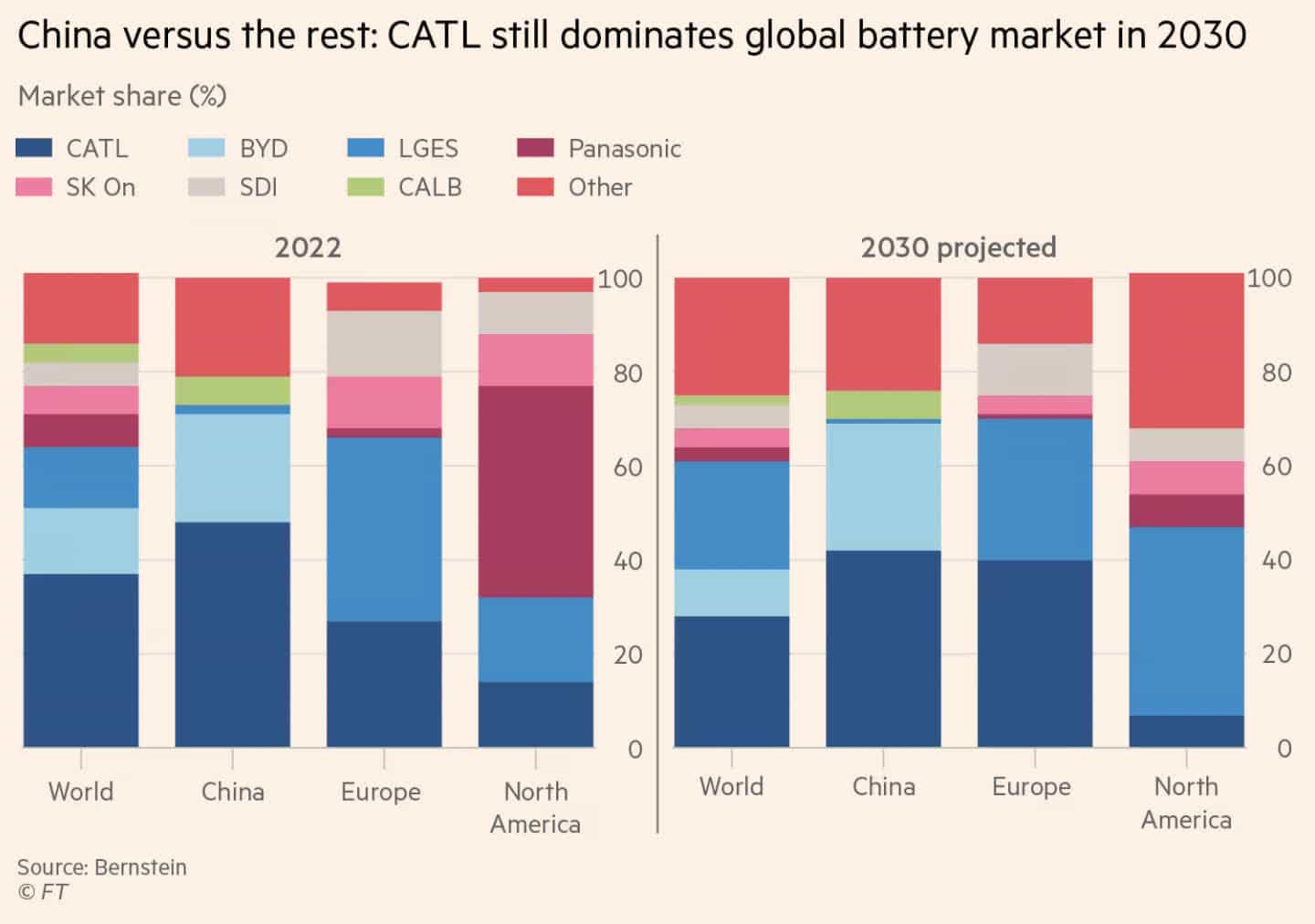

Having degrees in chemistry and materials science, Wang Chuanfu has specialized in batteries for many years. Per CarNewsChina.com, he registered BYD as a manufacturer of rechargeable batteries in February 1995. In addition to making their own batteries, BYD also supplies batteries to other BEV makers like Tesla. An April 3rd article from the Financial Times shows BYD as one of the world's biggest global battery suppliers:

BYD batteries (Financial Times)

A November 9th Forbes article explains how BYD provides a cobalt-free alternative to traditional BEV batteries:

One combination of technology and strategy success at BYD has been the development of what it calls a blade battery, a cobalt-free alternative to other rechargeable lithium-ion batteries that are said to be safer and more stable. BYD not only installs the batteries in its own cars; it sells them to other automakers, reportedly including Tesla.

Vertical Integration

The same Forbes article above explains how BYD has a system where they do many things themselves:

Behind its pole position is a portfolio of innovative tech, says Wang: “[BYD] has mastered the core technologies of the whole industrial chain of new energy vehicles, such as batteries, motors and electronic controls.” That list also includes semiconductors – BYD's chipmaking arm, BYD Semiconductor, specializes in making the chips used in EVs, which has allowed the firm to get around shortages that disrupted sales of other EV makers.

SCMP also talks about vertical integration, saying BYD manufactures 90% of its own car parts.

Valuation

Capital allocation is a key valuation consideration. Wang Chuanfu is hesitant to invest significant amounts of capital in self-driving efforts, both at the camera and the LiDAR levels. Elon Musk happily invests in self-driving efforts at the camera level but not the LiDAR level. Li Shufu, on the other hand, invests readily both at the camera and the LiDAR levels. An April 5th JIEMIAN article shows Wang Chuanfu's pessimism in this area as he says unmanned driving is nonsense. He sees advanced assisted driving as the way forward and he believes others are coming around to his view:

Wang Chuanfu believes that autonomous driving is a vain thing that is coerced by capital, and it is all deception, and advanced assisted driving is the future development direction. Unmanned driving is nonsense, it is essentially an advanced configuration for assisted driving “In the beginning, it was coerced by capital, so no one pointed out its shortcomings. Some manufacturers kept bragging about how much autonomous driving they would realize in a year. It's gradually returning to rationality.”

I believe both Wang Chuanfu and Elon Musk are preserving capital for shareholders by avoiding LiDAR investments at this time. While I agree with Wang Chuanfu about robotaxis being many years away, I don't think Tesla is making poor investment decisions with their iterative self-driving approach at the camera level.

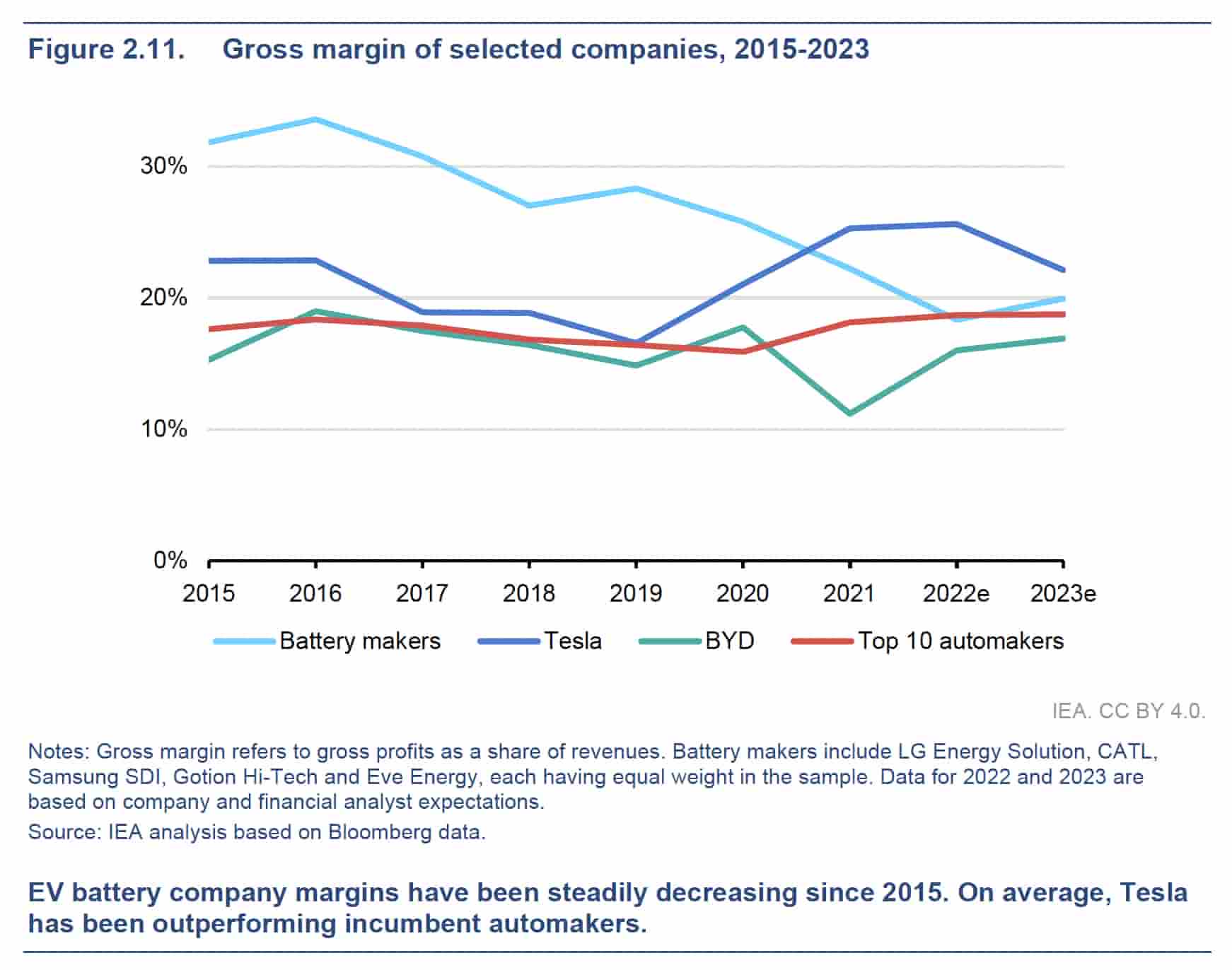

The IEA Global EV Outlook 2023 shows BYD and Tesla challenging the notion that BEVs can't be made profitably:

- Sturdy and Durable: This OROPY wall mounted...

- Sleek Industrial Design: With its simple...

- Optimized Space Utilization: Expand your storage...

- Convenience at Your Fingertips: Hang your daily...

- Versatile Functionality: This multi-functional...

- 【Industrial Clothing Rack】 The clothing racks...

- 【Sturdy & Durable】 Our clothes racks are made...

- 【Height Adjustable】 The height of the lower...

- 【Multifunction Closet Rack】 Wall clothes rack...

- 【Multi-Scene Use】 Dimension: 115” L x87.5”...

- 【Safer Size/Style】: Whole sconces are UL...

- 【Outstanding Details】: Our high-quality black...

- 【NOTE】: Our bar lighting wall sconce include...

- 【Wide Application】: Vintage wall light...

- 【Tips】: As the tube bulb is a bit special, it...

BYD gross margin (IEA Global EV Outlook 2023)

Automobiles and related products now account for more than 3/4ths of the overall revenue at BYD and they had a tremendous year despite the fact that 2022 was a year of stasis for China as the GDP only grew 3%.

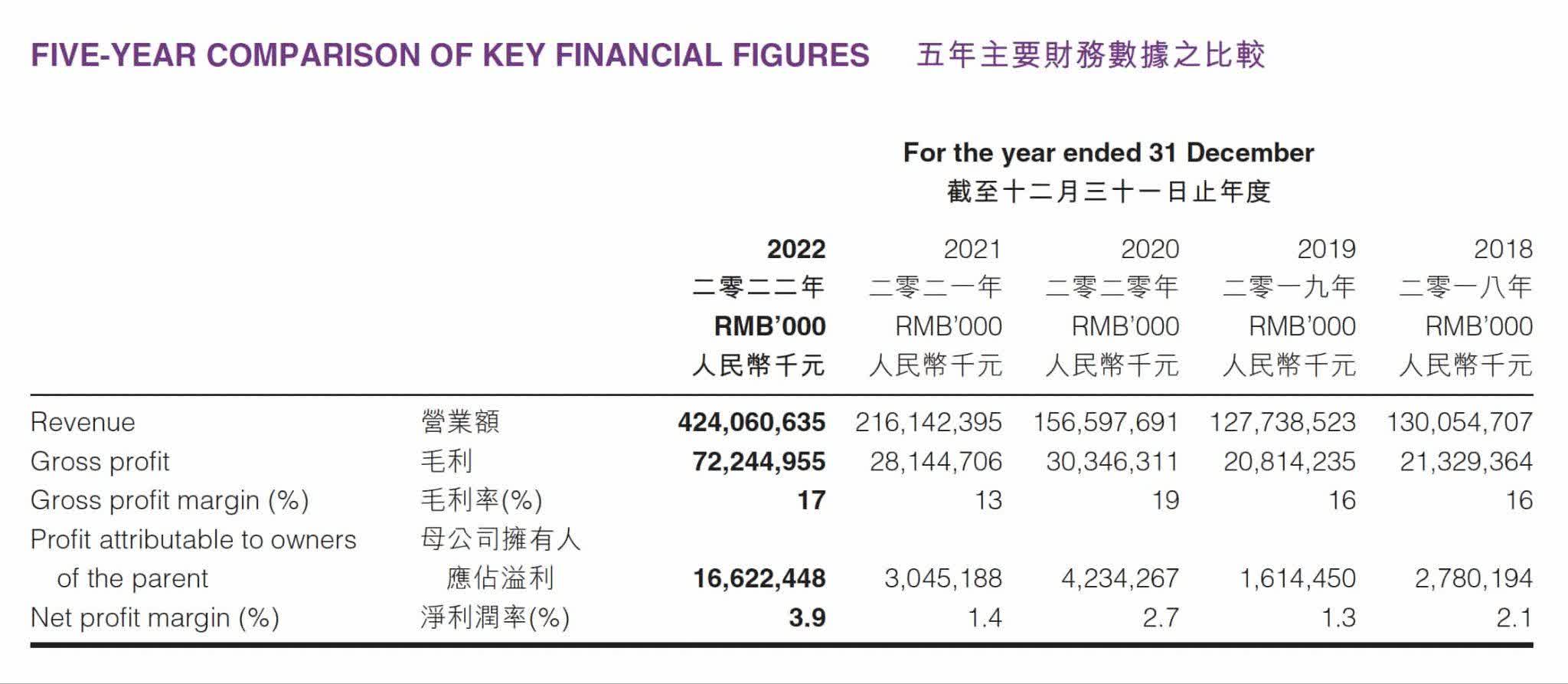

BYD's 2022 annual report shows that in 4 years, net profit climbed from RMB 2,780 million in 2018 to RMB 16,622 million in 2022 for a CAGR of more than 56%. During the same time, gross profit climbed from RMB 21,329 million to RMB 72,245 million for a CAGR of nearly 36% and revenue climbed from RMB 130,055 million to RMB 424,061 million for a CAGR of more than 34%. The gross profit margin has been in double digits the entire time:

BYD financials (2022 annual report)

Seeing as BYD is investing for growth with income statement expense lines, I like to look at gross profit as opposed to net profit. 2022 gross profit was RMB 72,245 million which is about $10.4 billion and it is growing rapidly. I think BYD could be worth up to 8 to 10 times this amount or $83 to $104 billion. The 2022 annual report shows 1,813,142,855 A shares plus 1,098,000,000 H shares for 2,911,142,855 total shares. 2 BYDDY ADRs represent 1 regular share so the market cap is a little under $90 billion based on the May 12th BYDDY ADR price of $61.42. I think the stock might be reasonably valued but I can't say it's a buy so long as Berkshire Hathaway (BRK.A) (BRK.B) continues to sell it.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.