The iShares 0-5 Year High Yield Corporate Bond ETF (NYSEARCA:SHYG) is a risky proposition while financiers are threatened and refinancing conditions are worsened for higher risk borrowers. High yield markets were subject to disarray as the train of rate hikes started, and it could happen again on greater bank fears and actual bank collapses, as well as the ‘divide premium' that could be placed on US debt if systematic political disintegration becomes a definite problem for the US coffers. In general, high yield markets are high yield not only because of credit risk of the borrowers, but greater sensitivity to the financing markets that keep the system alive that maintains the solvency of those borrowers.

SHYG Breakdown

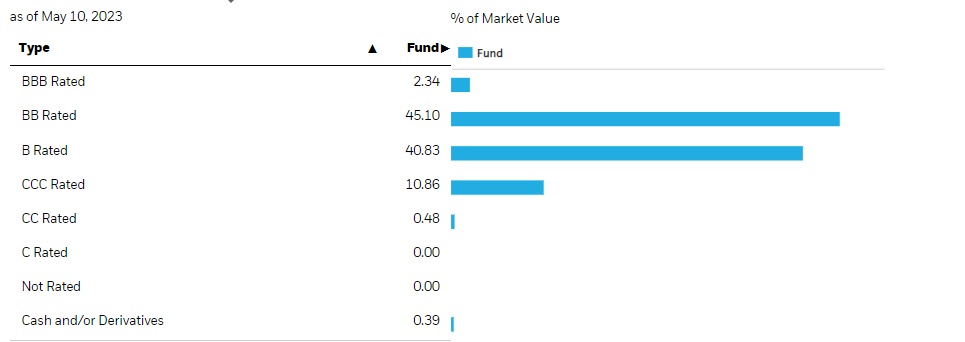

SHYG has a YTM consistent with a high-yield portfolio at 8.27%, and the credit risk definitely deserves those sorts of figures, clustering around junk-rated in distribution.

Credit Ratings (iShares.com)

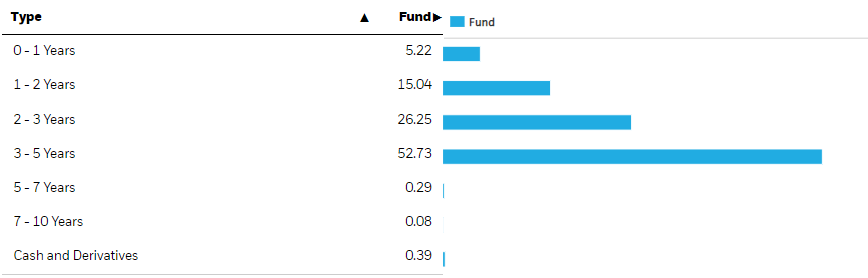

Maturities (iShares.com)

Exposures are primarily in the consumer discretionary business, mainly automotive. ETF expense ratios are low at 0.3% and duration is middling among the ETFs we've looked at of 2.39 years. 2-3 year maturities on the yield curve currently yield between 3.6%-3.9%, meaning the risk premium is over 4% for these junk bonds, which seems about right in terms of historical risk premia, but possibly a bit low.

Performance of SHYG shows that the high yield category is priced at levels consistent with the ongoing issues that have been plaguing the high-yield market. Indigestion in secondary markets, and the consequent low rates of issuance in high yield bonds in the primary markets.

No products found.

Data by YCharts

Problems

There are a couple of ways we have more issues in high yield:

- The debt ceiling impasse persists to the point where markets start applying a ‘divide' premium' on US Treasuries, with the sanctity of the Treasury now subject to risk from political divisiveness, which is likely a secular problem. This would be such a silly reason for the US to create a rate premium on its essential and privileged financing instrument of the Treasury. Any further issues of rate hiking, even if not from the persistent Fed rate hiking train, would not be good for the stability of the high yield markets.

- There could be another wave of banking troubles in regional banking around commercial real estate, specifically offices. Were this to come to pass it would compound issues in the functioning of the financing environment, and generally create risk premia where large institutions may not always be willing to offer debt to the thousands of corporations about to hit a maturity wall in high yield. Issues that impact the environment that helps keep high yield debtors solvent and refinanced are not a good thing for the high yield instruments. These issues are less of a catalyst to draw down the SHYG further, but more to keep it from recovering in price.

Bottom Line

The category is not the safest, and there are pretty likely ways in which SHYG could perform worse than it already is. While it has some duration, it's not a lot, so a rate pivot isn't the biggest catalyst, especially with the likely tenor of a rate pivot according to the yield curve, offering only a couple of percent in upside that may actually already be priced in.

While there is a decently high YTM, relative to credit risk premium for the level of risk of the portfolio, it may actually be too low. It's harder to make a judgment here, but credit default swaps incur more than a 5% cost to compensate for sovereign credit risks at the same average level as SHYG. The YTM offers a smaller risk premium than that, so its value is also in question.

Overall, we just don't see any reason to take a leap here, there doesn't seem to be any edge.

No products found.

Thanks to our global coverage we've ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it's for you.

Three High-Yield ETF Options