First Trust Dynamic Europe Equity Income Fund (FDEU) is converting from a closed-end fund to an exchange-traded fund. The conversion will eliminate the discount to net asset value and remove the leverage ratio of the fund. The management fee of FDEU will need to be adjusted to be competitive with other ETFs. There are structural issues to be considered for the conversion, such as the reduction of the dividend yield, and timing of the unwind of assets to pay down the outstanding leverage.

Thesis

First Trust Dynamic Europe Equity Income Fund (NYSE:FDEU) is an equity closed-end fund. The vehicle seeks a high level of current income, with capital appreciation as a secondary goal. The fund will invest at least 80% of its collateral in European equities. Currently, the CEF is focused on large capitalization stocks, which make up most of the fund portfolio. FDEU is best thought of as a structural instrument to extract a high dividend yield from European equities.

FDEU is one of the rare cases of CEFs converting themselves into a new structure, namely an ETF. This action was approved by the board of trustees for the fund, and has unique implications for the current shareholders.

A retail investor needs to fully understand the current state of affairs given the corporate action, the implications, and next steps for the fund.

FDEU Conversion from a CEF to an ETF

What is interesting about this fund is its conversion from a closed-end fund to an exchange-traded fund. We cover both structures here at Binary Tree Analytics, and FDEU represents a perfect study case on financial structures.

A retail investor needs to understand the pros and cons of each structure and make a decision on what suits best their needs. CEFs are independent, segregated companies that issue shares only once (unless there are rights offerings subsequently), while ETFs are exchange-traded funds that create units continuously. This massive structural difference generates premiums/discounts for CEFs, while ETFs generally have no premiums/discounts since their creation mechanism allows fund managers to close any arbitrage gap.

To that end, we can see certain CEFs trade at astounding premiums – such as the Gabelli Utility Trust (GUT) which is a defensive utilities CEF trading at a 124% premium to NAV, or CEFs that trade at large discounts – such as BlackRock ESG Capital Allocation (ECAT) which is currently trading at a -12% discount and has seen activist fund Saba purchasing shares.

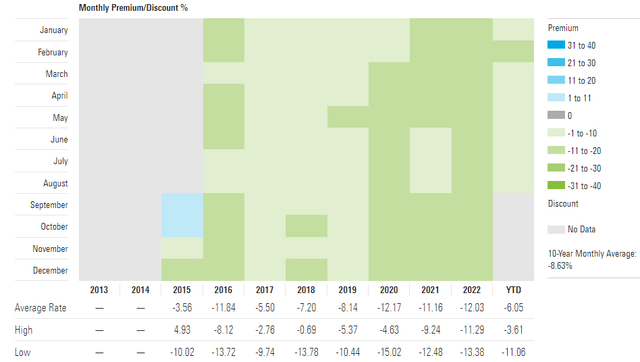

FDEU used to be a CEF that was unloved by the market, trading for long periods of time at steep discounts to NAV:

We can see that on average, in the past four years, the CEF was trading at discounts to NAV exceeding -8%.

The CEF had an interesting contingent conversion feature in its fund documents, a feature which was triggered by the fund management in March 2023:

WHEATON, Ill.–(BUSINESS WIRE)–First Trust Advisors L.P. (“FTA”) announced today that the Board of Trustees of First Trust Dynamic Europe Equity Income Fund, a closed-end fund managed by FTA, approved the reorganization of FDEU into a to be-created exchange-traded fund (“ETF”), that will be traded on the NYSE Arca and will be an actively managed ETF managed by FTA and sub-advised by Janus Henderson Investors, FDEU's current sub-advisor.

Under the terms of the proposed transaction, which is expected to be tax‑free, the assets of FDEU would be transferred to, and the liabilities of FDEU would be assumed by, the new ETF, and shareholders of FDEU would receive shares of the new ETF with a value equal to the aggregate net asset value of the FDEU shares held by them. It is currently expected that the transaction will be consummated during 2023, subject to requisite shareholder approval of FDEU and satisfaction of applicable regulatory requirements and approvals and customary closing conditions.

There are several interesting points to note here:

- firstly, the old CEF company will be shut down, with the assets and liabilities moved.

- The move will happen via new share issuance and the conversion will happen at NAV for NAV.

- The conversion will need to be approved by the FDEU CEF shareholders in order to move forward (only the CEF board of trustees has approved the conversion so far).

What happens if the conversion goes through?

1. Firstly the discount to NAV will disappear

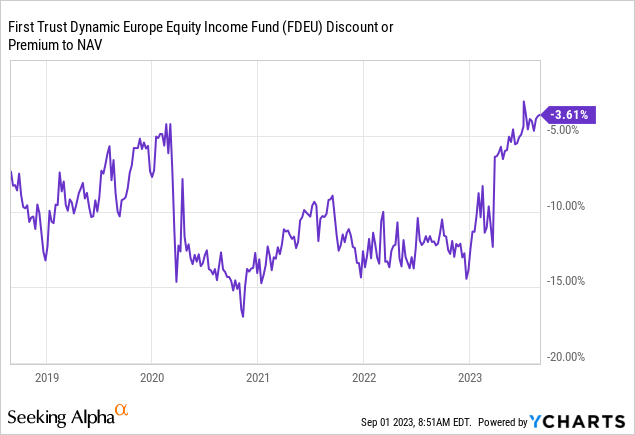

The market has already priced in a successful conversion, with the discount to NAV narrowing dramatically after the board of trustees votes came out:

We can see the CEF trading at a rough -12% discount to NAV prior to the vote, a discount which has narrowed significantly to only -3.6%.

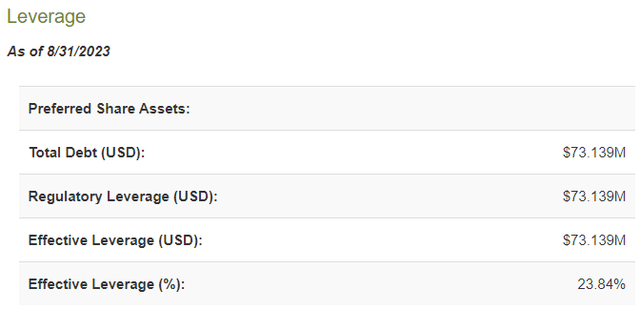

2. The leverage ratio will go to 0%

The CEF currently has a 24% leverage ratio, meaning it borrows capital against its securities to magnify returns. ETFs cannot have outright leverage like a CEF, thus this will need to go to 0%. That translates into assets being sold and debt being repaid:

The CEF does not have any preferred shares outstanding, thus the leverage is obtained via TRS facilities with providers, facilities which will be unwound.

Timing on the unwind here is critical. A leverage unwind entails asset sales. If the market suddenly enters a prolonged risk-off period, the fund will crystalize permanent capital losses via any sales. There are risks here around market conditions when the leverage is removed.

3. The management fee will need to be amended

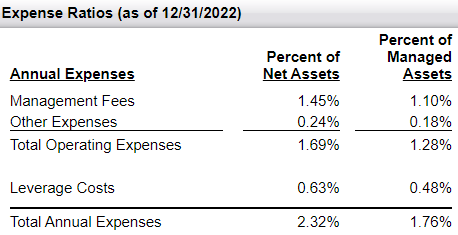

Many large asset managers like CEFs because they generate very hefty fees. In FDEU's case the total non-leverage fees amount to 1.28% of managed assets:

- New Store Stock

- Rivan, Maria (Author)

- English (Publication Language)

- 208 Pages - 04/14/2020 (Publication Date) -...

- Elevate Your Vision : An Enhanced Vision Board...

- Experience a new level of quality with our...

- Our vision board kit for women offers hand-picked,...

- Whether it’s a gift vision board for teens,...

- At Lamare, our mission is to help women plan and...

- National Geographic Special - 2017-1-20 SIP...

- English (Publication Language)

- 128 Pages - 01/20/2017 (Publication Date) -...

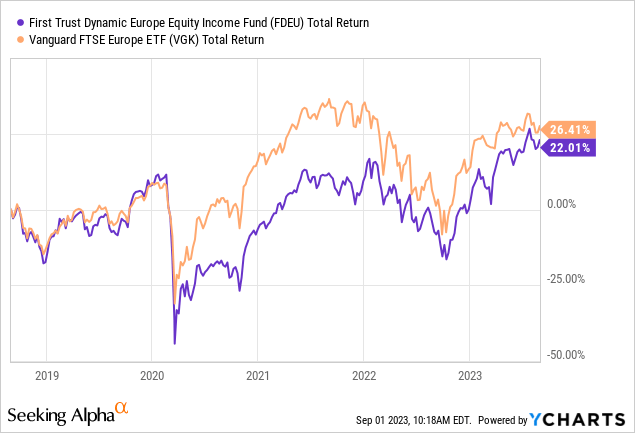

ETFs charge much lower fee levels, with the main competitor here, the Vanguard European Stock Index Fund ETF (VGK) charging only 0.11%. When FDEU converts, it will need to adjust its fees to be competitive. Hats off to the board of trustees in terms of doing right by shareholders and voting for a corporate action which has substantially narrowed the discount to NAV, but the fund itself has not done that stellar in the past five years:

FDEU has always lagged VGK, and the performance of the CEF in 2023 has been very much driven by the 10% ‘bump' from the narrowing of the discount to NAV. The portfolio management team will not be able to justify fees which would be 10x of what VGK charges with their current performance.

4. Disappearance of the High Dividend Yield

The CEF is currently paying a 6.4% dividend yield because of its leverage utilization and CEF structure. CEFs can utilize return of capital features to support high dividends, even when the underlying holdings do not perform as expected. ETFs, given their structure, cannot do that.

Once the conversion occurs, the fund will only be able to pass to shareholders what it makes, and that is a rough 3.4% dividend yield. That is almost a halving of what the fund currently pays.

There is more downside than upside for shareholders at this stage

Current FDEU shareholders have 2 risk factors affecting them presently:

- Structural risk factors (CEF to ETF conversion).

- European equities risk factors (underlying equities returns driven by the market).

On the structural front there is significantly more downside than upside at this stage. The only upside that can currently be realized is the disappearance of the -3% discount to NAV. The fund will not move to a premium. Conversely, if something goes wrong with the conversion and FDEU remains a CEF, do expect the discount to move back down to -10% (we assign a low probability to the CEF not converting, but it is still a risk).

Furthermore, if the fund manager is slow in implementing a new fee structure, shareholders will be stuck in a vehicle that has enormous fees when compared to a simple vanilla instrument like VGK.

From an equities risk factor standpoint, we have seen a very benign 2023 which has seen increased ‘soft landing' discussions, despite a plethora of overhanging risk factors. When eliminating the narrowing of the discount, FDEU is up roughly +10% for the year from a total return perspective. With a seasonally rough September ahead of us, a prudent investor is best served to be conservative here.

Conclusion

FDEU is a European equities CEF. The fund board of trustees voted for the CEF to be converted into an ETF, subject to shareholder approval. Once all the approvals are obtained, the old company will be wound down, with the assets and liabilities transferred to a new one. The conversion will happen at NAV for NAV.

- Amazon Kindle Edition

- Baldacci, David (Author)

- English (Publication Language)

- 487 Pages - 04/16/2024 (Publication Date) - Grand...

- Amazon Kindle Edition

- Hannah, Kristin (Author)

- English (Publication Language)

- 472 Pages - 02/06/2024 (Publication Date) - St....

- Amazon Kindle Edition

- Elston, Ashley (Author)

- English (Publication Language)

- 348 Pages - 01/02/2024 (Publication Date) - Pamela...

Given the structural differences between a CEF and an ETF, FDEU will need to eliminate its current 24% leverage ratio by selling assets and repaying debt. That is going to be a tricky move, and a market risk-off event can see permanent NAV impairment via loss crystallization.

The market is anticipating a successful conversion, with the ‘meat on the bones' now almost gone – we have seen FDEU move from a discount to NAV exceeding -12% to only -3% now. There is only a slim 3% upside here at the moment from a structural standpoint. As a CEF shareholder you also need to keep in mind that the large 6.4% dividend yield will disappear, with our estimation of the new portfolio yield at only 3.4%.

At this stage there is more downside than upside to shareholders in FDEU, including the successful vote, conversion, leverage unwind/asset sales and management fee amendment. We feel current shareholders are best served by Selling here and waiting out the conversion process, while institutional investors mandated to have European equity exposure in the interim can have a look at VGK.