original post

Thesis

The Western Asset Global Corporate Defined Opportunity Fund (NYSE:GDO) is a fixed income closed end fund. As per its literature, the fund:

Provides a portfolio of U.S., foreign, and emerging market corporate fixed income securities, with a limited term structure that will liquidate on or about December 2, 2024. Seeks to provide current income and secondarily capital appreciation through investments in the global bond universe while maintaining an overall investment grade credit quality

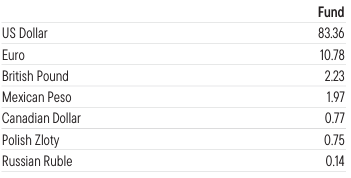

This fund is mostly an investment grade corporate one, with a global reach. The current collateral only includes around 11% of sovereign securities, and roughly 30% in junk bonds. While the vehicle does contain some local currency bonds, most of the holdings are dollar based, accounting for over 83% of the portfolio. This makes the CEF susceptible to dollar rates moves and credit spreads.

A very important aspect to note is that this CEF is a term fund, set to mature in December 2024. The collateral pool is not tenor matched, meaning it has very different maturity dates than the fund's termination date. This translates into equity holders in GDO taking significant market risk as the maturity date approaches. We believe the maturity date feature is defining for this name, and a holder should trade this fund accordingly.

From a macro stand-point we believe the fund is in luck – this year will be a recessionary one, while 2024 will see a recovery and Fed rate cuts. That should translate into a positive tail-wind for the CEF as it nears its maturity date. Holders in the name should therefore await the maturity date, while new money should only buy when a significant discount to NAV arises.

Analytics

- AUM: $0.19 billion

- Sharpe Ratio: -0.08 (3Y)

- Std. Deviation: 12 (3Y)

- Yield: 9.7%

- Premium/Discount to NAV: -3%

- Z-Stat: -0.13

- Leverage Ratio: 34%

- Composition: Fixed Income – Global Bonds

- Duration: 6.18 yrs

- Expense Ratio: 2.12%

Holdings

The fund is focused mostly on corporate credits, with only an 11% sovereign allocation:

Holdings (Fund Fact Sheet)

When parsing through the collateral we can find Mexican bonos, Panamanian USD bonds and Indonesian hard currency debentures as sovereign exposure.

While the CEF does undertake some local currency exposure, most of the purchased securities are USD denominated:

Currency Exposure (Fund Fact Sheet)

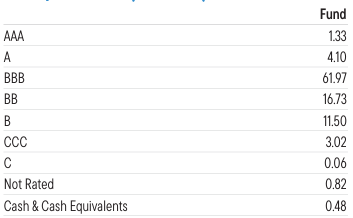

From a credit rating perspective this is an investment grade fund mostly, with a 35% junk limit for the name:

Ratings (Fund Fact Sheet)

We can see that currently the fund is around the 30% threshold for junk bonds.

No products found.

An important aspect to note is that the collateral is not term matched with the fund's maturity date. That will translate into equity holders in this CEF taking significant market risk as we close into the CEF's maturity date.

Performance

Since this CEF is a term fund, what matters most at this juncture is where we stand in the macro cycle and what the fund has done in the past:

Performance (Fund Fact Sheet)

We think the most pertinent year to look at is 2019, when the Fed started cutting rates. We believe we are going to see the central bank start cutting rates again in 2024, so we will have some sort of similar market action to a certain extent.

Timing is key here, since the more backdated the cuts are, the less likely the fund will realize a substantial gain from the duration boost. In any instance, we expect the fund to have a nice positive 2024, as the Fed cuts and credit spreads narrow.

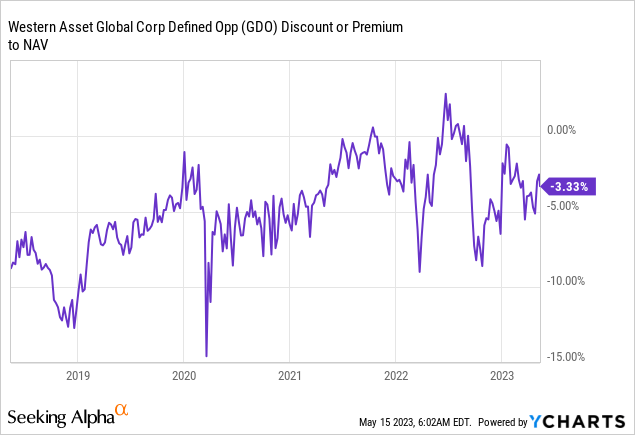

Premium / Discount to NAV

As a term fund, the discount to NAV is an item to be watched closely:

No products found.

The fund is currently trading with only a -3% discount to NAV, but we can observe a nice beta to the market here. During the October/November 2022 sell-off the discount widened substantially. Expect the same market action during the next wide sell-off.

Conclusion

GDO is a fixed income CEF. The fund focuses on global bonds, with an investment grade tilt. Only 11% of the holdings are sovereign, with the rest being composed of corporate bonds. While some of the collateral is denominated in a local currency, most of the fund is dollar based (over 83% of the holdings). What is defining for this CEF is its term structure, with the fund set to mature in December 2024. Its collateral pool is not maturity matched, meaning a shareholder will take increased market risk as we approach the fund's maturity date. GDO is lucky from a macro perspective, with the recession that we expect this year set to fade in 2024 as the Fed decreases rates. The best way to trade a fund like GDO is to wait for a substantial widening of the discount to NAV in order to enter. The discount will move to zero upon fund maturity. The CEF will also benefit next year from tail-winds in the form of lower Fed Funds (as implied by the SOFR forward curve) and a more benign credit spread environment. Holders in the name should therefore await the maturity date, while new money should only buy when a significant discount to NAV arises.