wakila

Freezing temperatures across the nation provided more evidence that mass adoption of battery electric vehicles (BEVs) faces serious obstacles that will hinder sales and profitability of General Motors Company (NYSE:GM) and other BEV manufacturers.

Frigid weather combined with energy-sapping cabin heaters may reduce the range of BEVs up to 40%, depending on how the vehicle’s heating system is designed. Tow truck drivers in Chicago and elsewhere are reporting calls from stranded owners whose cars weren’t sufficiently charged to reach their destination.

Chill depresses range

As cold decreases range, the need to recharge more often has tied up and reduced accessibility to public chargers, which in any case are deemed insufficient in number and operability, notwithstanding the cold weather, to attract new owners.

Buick Wildcat EV prototype (General Motors)

Consumers are learning more about the drawbacks and disadvantages of BEVs, which has led many to resist the technology, a trend that retailers have noticed. In December, GM’s Buick division said 47% of its 2,000 or so U.S. dealer franchisees opted for buyouts from the automaker rather than invest the $200,000 in equipment and training required by GM to sell new Buick BEV models starting this year.

Between 180 to 200 smaller volume Cadillac dealers also opted to take a buyout from GM, according to the Detroit News, choosing not to take part in selling Cadillac's all-electric lineup coming by 2030.

GM, facing consumer pushback and battery manufacturing glitches, already has scrapped an earlier pledge to build 400,000 BEVs in North America through this year. Buick, which said its future BEVs will carry the Electra name, still aims at an all-BEV lineup by the end of this decade.

One of GM’s key initiatives, a “mainstream” BEV that fits into the budget of average as opposed to affluent consumers, has stumbled in the starting gate. As reported in the Wall Street Journal:

Buick dealer exit

“GM instructed Chevrolet dealers late last month (in late December) to stop selling the Blazer, while it sought to address certain software-quality issues that have frustrated buyers and auto reviewers alike. The company hasn’t given a time frame for when it might have a fix and continues to build them at its plant in Mexico, a spokesman said.”

Blazer debuted in the fall at a starting price of about $57,000 – still not inexpensive though more affordable than many other BEVs. But the model quickly was plagued by reviewer complaints of electronic features failing. The experience of Blazer owners and reviewers mirrors the experience with BEVs from rival manufacturers, as engineers struggle to perfect technologies such as high-end infotainment, charging and battery regulation.

Clearly, GM and other BEV makers attempting to transition from internal combustion engines are struggling to match the technology and market breakthroughs of Tesla, which has been building BEVs and its proprietary charging network for two decades. Surveys suggest that Tesla owners are generally satisfied with their vehicles, which doesn’t bode well for the future growth of BEVS from competing manufacturers.

GM’s battery difficulties almost certainly contributed to the decision of Honda Motor Co. (HMC) in October to drop out of a planned collaboration with GM designing and producing affordable BEVs. GM and Honda were mum about the specifics. Background discussions with industry officials at the CES exhibition in Las Vegas this month indicated that Honda engineers concluded that GM’s Ultium battery – the power source for the proposed joint model – proved too heavy and would result in an unprofitable Honda BEV.

Growing BEV sales

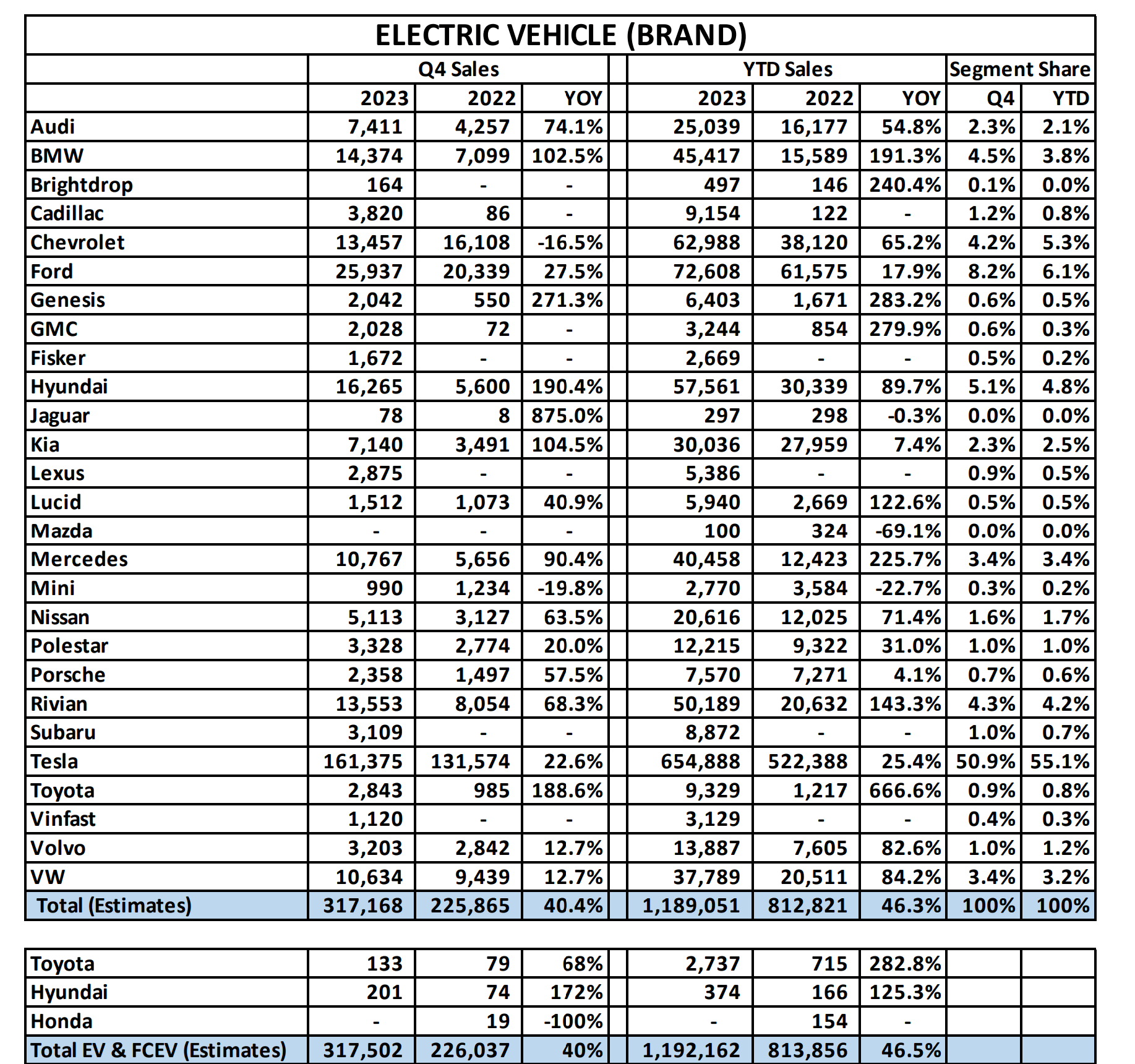

In the aggregate, BEV sales are growing. Last year, Cox Automotive estimated that 1.2 million were sold in the U.S., comprising 7.6% of the new-vehicle market and up from 5.9% in 2022. A deeper look at the numbers reveals a slowdown in the fourth quarter compared to the first three quarters of the year. Part of the annual growth can be attributed to more models entering the market and greater availability of colors and option packages.

- Sturdy and Durable: This OROPY wall mounted...

- Sleek Industrial Design: With its simple...

- Optimized Space Utilization: Expand your storage...

- Convenience at Your Fingertips: Hang your daily...

- Versatile Functionality: This multi-functional...

- 【Industrial Clothing Rack】 The clothing racks...

- 【Sturdy & Durable】 Our clothes racks are made...

- 【Height Adjustable】 The height of the lower...

- 【Multifunction Closet Rack】 Wall clothes rack...

- 【Multi-Scene Use】 Dimension: 115” W x87.5”...

- 【Safer Size/Style】: Whole sconces are UL...

- 【Outstanding Details】: Our high-quality black...

- 【NOTE】: Our bar lighting wall sconce include...

- 【Wide Application】: Vintage wall light...

- 【Tips】: As the tube bulb is a bit special, it...

Tesla held a commanding 53% of the U.S. EV market at the end of the 2023 while GM’s share amounted to only a 7% share among its Chevrolet, Cadillac, GMC and Buick brands.

2023 BEV sales in U.S. (Kelley Blue Book)

Faced with the grim reality of a BEV future that may well take longer than a decade or two to reach mainstream buyers, and a stock price that had sunk to $26 and change in early November, GM announced a $10 billion accelerated stock buyback and plans to assuage higher labor costs from its latest UAW contract. Significantly, GM said it would partially fund the share buyback with capital previously allocated for development of battery-powered vehicles. (Capital also will be conserved by cutbacks at Cruise, GM’s affiliate for development of self-driving tech.)

Since the buyback announcement, GM shares are up about 29%, propelled by $6.8 billion of stock bought back in early December, the balance to be purchased by the end of 2024. The company also said it intends to raise its cash dividend by 33% starting this month.

Data by YCharts

The share price collapse and buyback presented a golden opportunity for Mary Barra, GM CEO, to remind shareholders that the automaker – still the No. 1 player in the U.S. – maintains a substantial and growing internal combustion business that should yield growing profit for years to come – assuming it isn’t prematurely replaced with products that the car buying public doesn’t want or need.

Hybrids ahead?

A tantalizing question is whether GM will take the next and obvious remedial step to its emphatic, precipitous and misguided rush to create battery-powered vehicles. Like its top rival, Toyota Motor Corp. (TM), GM ought to roll out advanced gas-electric hybrid versions of all its models, which will save fuel and demonstrate to the U.S. that it’s serious about moving toward a carbon-free future. GM’s BEV development and investment should roughly align with consumer uptake of such models.

Barra also could help matters by explaining and lobbying – like Toyota chairman Akio Toyoda has done – that the path to a low-carbon or even carbon neutral future encompasses many technologies and will take more time than the most avid environmentalists are demanding.

For the moment, I advocate a Hold on GM shares until such time as the automaker demonstrates a more realistic strategy for the introduction of gas-electric hybrids, BEVs and other emission-free technologies such as hydrogen fuel cells.