Last May, I turned bullish on MercadoLibre (NASDAQ:MELI) based on its growing scale, competitive advantages in key markets, the success of both its core and new products, and its international expansion plans. MELI stock is up around 20% since then. As attractive as that may sound, the S&P 500 has still beaten MELI stock since then, registering gains north of 23%.

Then there's Amazon.com, Inc. (AMZN), a company I have been bullish on for as long as I can remember. Amazon's e-commerce revenue growth has accelerated in recent quarters after a lackluster 2022 but remains below historical levels. As a diversified business, the company continues to perform well, with AWS and advertising services revenue growing at a stellar pace.

Comparing MercadoLibre with Amazon is not a straightforward process because of some notable differences in their business models. However, I thought this would be a good exercise to determine which e-commerce giant is poised to deliver better returns in the foreseeable future. As the findings of this analysis confirm, I believe MercadoLibre is the better investment option for growth investors.

MercadoLibre Has Several Growth Engines

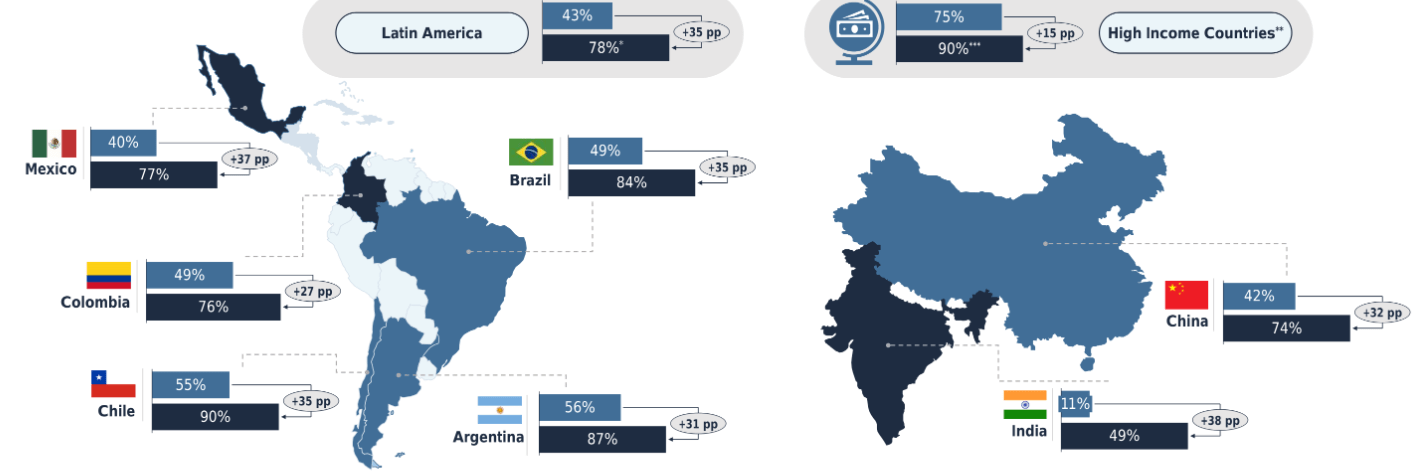

MercadoLibre's e-commerce leadership in Latin America is a perfect storm for growth. There are many reasons behind the growth of the e-commerce sector in this region, including a surge in Internet access, with millions of Latin Americans coming online for the first time in their lives. The addressable market opportunity for MELI is continuing to expand. According to data from Atlantico's Latin America Digital Transformation Report 2023, the Internet penetration rate in Latin America reached 78% last year, surpassing China.

Exhibit 1: Latin America's Internet penetration rate

Atlantico

MELI's three biggest markets – Brazil, Argentina, and Mexico – have made stellar progress in the last decade in expanding Internet access, which works well for the company's growth plans.

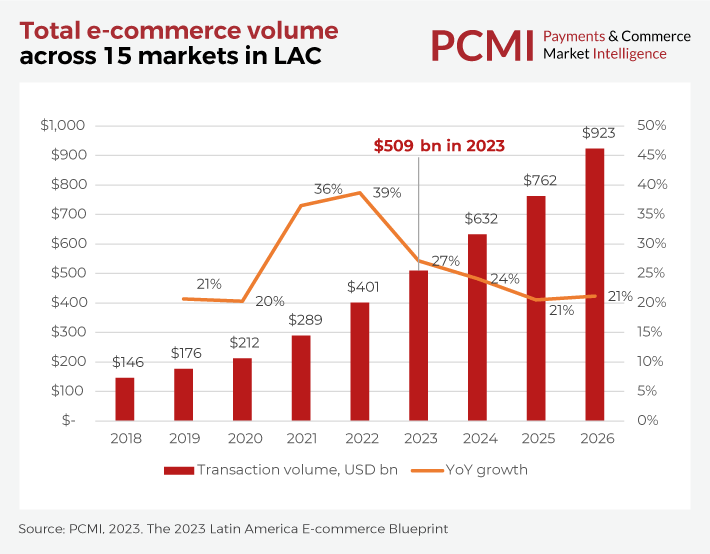

On the back of growing Internet penetration, the e-commerce sector in Latin America is expected to grow in leaps and bounds in the next few years. Payments and Commerce Market Intelligence projects the Latin American e-commerce market volume to grow 24% this year to $632 billion, followed by equally strong growth in the next couple of years as well.

Exhibit 2: E-commerce transaction volume growth in Latin America

PCMI

MercadoLibre, as the leading e-commerce player in Brazil and many of its key target markets, is well positioned to benefit from this expected growth. One of the core strengths of the company is its established presence in fast-growing e-commerce markets.

Amazon, on the other hand, primarily operates in mature e-commerce markets. The United States is still the largest market for the company by far, followed by Germany, the United Kingdom, and Japan. As a diversified business with many fast-growing products/services in its portfolio, Amazon's strategy of focusing on more mature e-commerce markets makes a lot of sense.

Exhibit 3: Amazon net sales by country

Statista

All of Amazon's key markets are projected to grow this year, albeit at a slower pace compared to Latin America.

| Country | Projected e-commerce growth in 2024 | Source |

| The United States | 10.5% | Statista |

| Germany | 7% | EcommerceDB |

| United Kingdom | 8% | Statista |

| Japan | 9% | Statista |

Although growth in all of these regions will be noteworthy this year, Latin America stands out with the e-commerce market expected to grow more than 20% this year. Therefore, based on a growth perspective, I believe investors should find MercadoLibre better positioned than Amazon to deliver explosive growth.

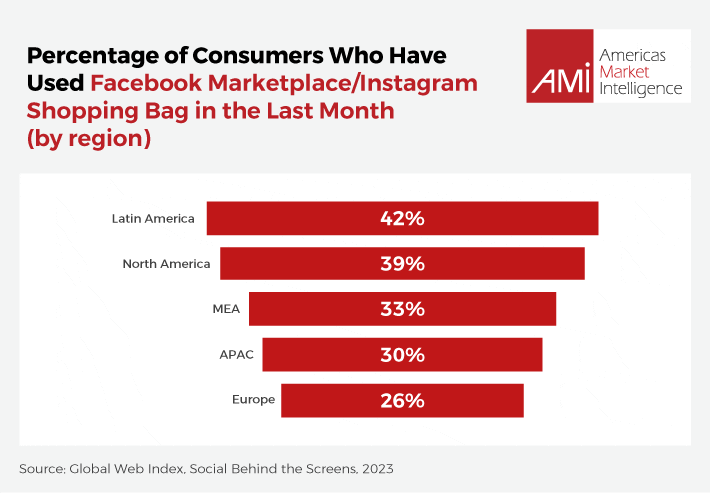

The rise of social commerce is another factor that would help MercadoLibre grow in the coming years. Deloitte expects social commerce to be worth a staggering $2 trillion by 2025, growing at a CAGR of 18% from now. Industry statistics suggest Latin America will be the hottest place on Earth for social commerce in the next few years, which tilts the odds in favor of MercadoLibre. According to data from Americas Market Intelligence, Latin America was the leading region for social commerce in 2023 based on the percentage of consumers who used Facebook and Instagram shopping features.

Exhibit 4: Percentage of consumers who have used Facebook Marketplace and Instagram Shopping

Americas Market Intelligence

Compared to Amazon, I believe MercadoLibre is well positioned to make the most of the growing popularity of social commerce in the next decade, with Latin America proving to be a driver of this market segment.

Mercado Pago, MELI's Fintech arm, will be another growth machine for the company in the next decade. Originally conceived as a secure payment solution for the e-commerce platform, it has evolved into a powerful financial ecosystem that extends beyond online shopping. Latin America is home to millions of unbanked individuals. Mercado Pago offers several financial products such as digital wallets, QR code payments, digital banking solutions, insurance products, investment products, and credit products.

In the fourth quarter, Mercado Pago surpassed 50 million active users for the first time and also reported market share gains alongside TPV growth. In addition, the credit portfolio grew 33% YoY. The increase in net interest margin after losses from 39% to 39.8% suggests Mercado Pago is growing its profitability.

Market Data Forecast, a research firm, expects the Latin American Fintech market to grow at a CAGR of 26% through 2029 to $51.9 billion. According to the research firm, several factors will drive this growth, including higher Internet penetration and favorable policy decisions.

- INTERCHANGEABLE GRILL and GRIDDLE PLATES: From...

- 500°F MAX HEAT: Reach temperatures of up to...

- EDGE TO EDGE COOKING: No hot spots. No cold spots....

- SMOKELESS GRILL: The perforated mesh lid...

- FAMILY SIZED CAPACITY: The 14’’ grill and...

- Generous Capacity: 7-quart slow cooker that...

- Cooking Flexibility: High or low slow cooking...

- Convenient: Set it and forget it feature enables...

- Minimal Clean-Up: One-pot cooking reduces dishes;...

- Versatile: Removable stoneware insert can be used...

The expected growth of MercadoLibre's Fintech business in Latin America is another reason why I find the company more attractive compared to Amazon. Amazon also offers Fintech products such as Amazon Pay and merchant solutions, but I find MELI's customer-focused approach in the Fintech sector more appealing. Adding to my optimism is the company's strong presence in Latin America, a Fintech market that's poised to grow exponentially through 2030.

MercadoLibre's investments in its logistics network will prove to be another growth machine in the future. The company is investing in building warehouses and distribution centers in key markets to reduce delivery times, similar to how Amazon with its FBA program has done in the past few years.

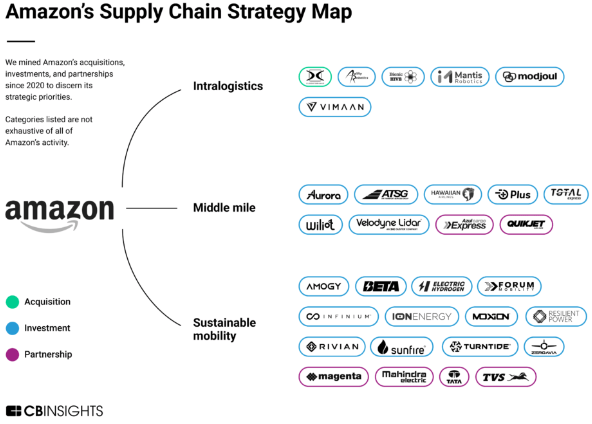

With the success of FBA, Amazon aggressively invested in building warehouses across the world to optimize delivery times further. The company's massive success today comes down to its ability to offer same-day or next-day delivery on most products, which has fueled the growth of Amazon Prime.

Exhibit 5: Amazon's investments in logistics

CB Insights

Today, Amazon is reaping the rewards of its aggressive logistics investments. MercadoLibre, on the other hand, is still in the early stages of building a robust logistics network, which leaves room for more meaningful expansions in profitability and customer growth in the next few years. As a growth investor, I prefer siding with MELI today compared to Amazon because of this reason.

Valuation Comparison

MELI has beaten AMZN in the stock market in the last five years. If you look at the stock price performance more closely, you will see that the divergence between the two stocks occurred in mid 2022. This coincides with the recovery of the Latin American economy from COVID-induced growth challenges.

Exhibit 6: MELI and AMZN stock price return

Seeking Alpha

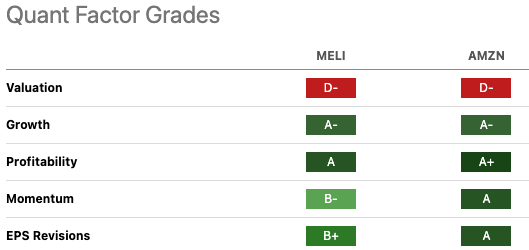

MELI's strong performance in the last five years has resulted in stretched valuation multiples. The same is true for Amazon as well. A quick look at Seeking Alpha's quant factor grades reveals both companies have similar valuation grades.

Exhibit 7: Seeking Alpha quant factor grades

- 【Easier to Move】You can use these appliances...

- 【Save Space and Protect Countertops】The small...

- 【Strong Adhesive】The counter slider for...

- 【Easy to Use】28pcs 22mm/0.87in kitchen...

- 【Wide Application】The coffee slider for...

- ✔Update Dishwasher: This dishwasher cover in...

- ✔Size: This Magnet Sticker Dishwasher Covers...

- ✔Material: This dishwasher cover is made of Our...

- ✔Easy to Install and Remove: Dishwasher Magnet...

- ✔Widely applicable: This magnets are easy to...

Seeking Alpha

That said, I find MELI attractive at a forward P/E of 47 compared to Amazon at a forward P/E of 42 because of the long runway for growth enjoyed by MercadoLibre's core e-commerce business. MercadoLibre's revenue has grown at a 58% CAGR in the last five years compared to 20% for Amazon, and MELI is expected to book 23% revenue growth in Fiscal 2024 compared to Amazon's 12%.

The findings in the previous segments also suggest MercadoLibre is the better option for growth investors.

Takeaway

Aided by favorable macroeconomic developments, first-mover advantages in key target markets, and exposure to a few growing end markets, MercadoLibre is well-positioned to grow in the next five years. Although I'm not bearish on the prospects for Amazon, I believe MercadoLibre is a better bet for growth investors today as there is more visibility into its prospects. I'm reiterating my buy rating for MELI.