In the final two months of 2023, Lululemon (NASDAQ:LULU) surged more than 25%, from $393 to over $500. Before last week’s 4Q23 earnings release by the company, the stock was down 6% year to date but are now more than 20% below the late December 2023 peak. I believe the market is offering investors another opportunity to get into the stock with the post-earnings selloff an overreaction compared to the result and the outlook.

More specifically, the price action is less a reflection on the result/outlook than it is on the pre-Christmas surge by 25%. This felt unjustified at the time, and has been proven such now with the correction back to the ~$390 level.

To illustrate this, in this article I will provide a summary and analysis of the recently released 4Q/FY2023 financial result, discuss the outlook from the company and present my investment thesis as to why Lululemon remains a buy today.

Business Model

Lululemon is a designer, distributor, and retailer of premium athletic wear. The company has its genesis in women’s yoga apparel but has since expanded into other sports such as running, tennis, golf, and training, as well as a menswear line in the same categories. Lululemon has also recently launched a footwear range with a focus on both casual wear and running.

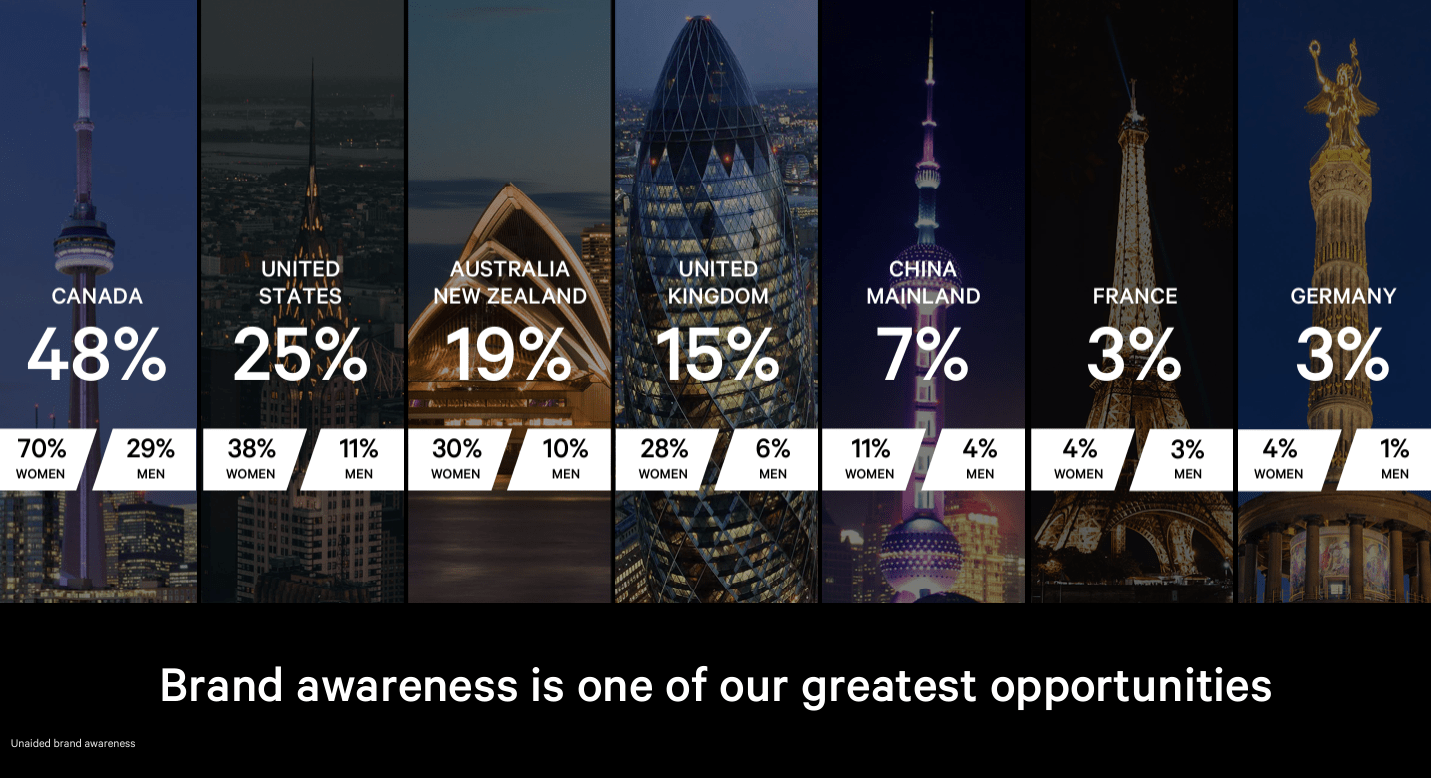

Lululemon appeals to its customers with high quality garments that are fit for purpose and are backed by continual innovation in raw materials and product construction. This focus on quality has allowed Lululemon to take market share for many years despite its premium pricing. And although Lululemon has many years of market share growth behind it, it is evident that there is still plenty more to come. It was nearly 2 years ago now, but at the last Lululemon analyst day in April 2022, one of my key takeaways was the unprompted brand awareness of the brand across the world. In its home market of Canada it is unsurprisingly high at 48% (70% for women), but even in the United States, its largest market, it is only 25% (and 38% for women).

2022 LULU Analyst Day

The international expansion is a core component of the growth profile of the company, and while markets like Australia & New Zealand, the UK, and Europe remain important, expansion through China presents a large opportunity. Brand awareness at the time of the event was a meaningful 7% (11% for women), but all of these numbers suggest there is plenty of headroom to grow sales through increasing brand awareness in their target markets.

Lululemon keeps the vast majority of marketing and distribution in-house, selling their wares via company-owned stores and via the Lululemon website. In Q4, Digital represented 52% of sales. The company-owned stores and Other segment was not given, but in 2022 it was 45% and 9% respectively so given the increase in digital, we can assume it would be lower this year. The growth in digital has been a key enabler of recent success, and it directly benefits from new stores, as this lifts the brand presence in every new market they enter.

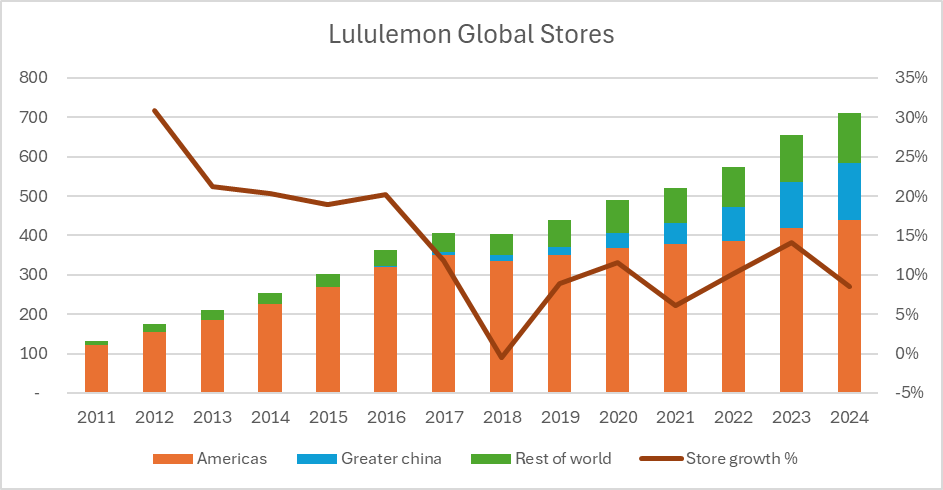

More importantly, Lululemon are changing how they report their segments, now presenting it on a geographic basis. This more closely aligns reporting to the growth drivers of the company, which is the store roll out. Lululemon has a strong history of growing via opening new stores. The combination of this with an increasing brand profile can be very powerful. As you can see in the following chart, store count continues to grow at a robust level, growing 9% to 711 stores in 2024.

LULU Company Reports

On the conference call, CFO Meghan Frank noted they expect to open 35-40 net new stores in the 2025 fiscal year (ending January 2025), only 5-10 of which will be in the Americas region. The speaks to the underpenetrated nature of the company, not only in terms of brand awareness, but also brand presence.

If Lululemon can successfully continue to open new stores and supplement this with an increased brand profile, this will underpin revenue and earnings growth for many years to come.

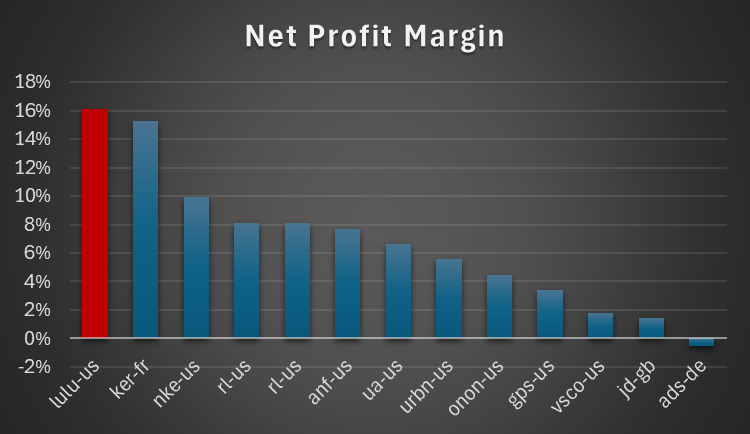

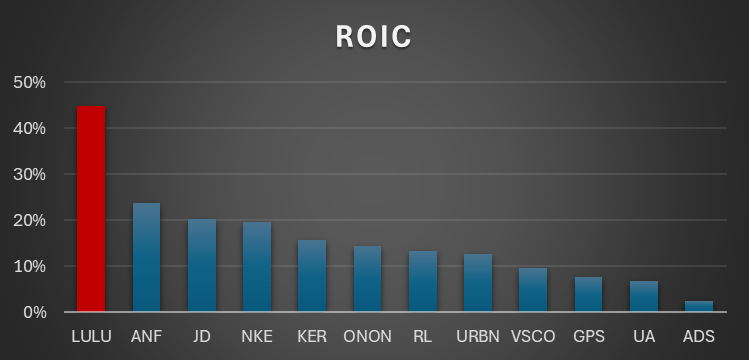

Historical Returns profile

Lululemon has an industry leading return profile with net margins of 16% and return on invested capital of 44%. These are both significantly ahead of most peers in the retail or luxury apparel industries and is shown on the charts below:

FactSet

FactSet

With a return profile like this and a growth outlook such as Lululemon’s (which I’ll get to soon), one could reasonably expect Lululemon to trade on a premium multiple. But let’s not put the cart before the horse. I’ll discuss valuation after we look at the recent earnings.

Lululemon 4Q and fiscal 2024 earnings review

Lululemon provided a strong quarter, reporting better margins while achieving revenue expectations (as per FactSet).

For the quarter, sales increased 15.6% on the year-ago period (4Q23), while operating income grew 31.6% as the prior period had some goodwill write-offs relating to the Mirror acquisition. Growth was 16.3% on an adjusted basis, which is a clearer picture of the year’s business performance. Importantly, Adjusted EPS grew 20% year over year for Q4 to $5.29, which also adjusts for the impairments and write-offs in 4Q23.

| 4Q23 | Consensus | beat/miss | |

| Sales | $3,205m | $3,195m | In line |

| Gross profit (margin) | $1,903m (59.4%) | $1,875m | 1.5% beat |

| Operating Income (margin) | $913.9m (28.5%) | $894.7m | 2.1% beat |

| Net income (margin) | $669.5m (20.9%) | $630.8m | 6.1% beat |

The fiscal year result was broadly in line with consensus expectations with revenue and gross profit in line, and slight beats at the operating and net income lines.

Sales increased 16%, adjusted gross profit increased 20%, showing good margin improvement over the period.

There were some small one-off items in the period, related to the Lululemon Studio business, which is being written down. In fiscal 2023, LULU took a $442.7m impairment charge against the assets and goodwill that arose from the acquisition of Mirror in 2020. Lululemon Studio was the replacement to the Mirror business, which replaced the hardware+membership business model with a lower priced content only membership. The reason was simply that, no longer confined to their own four walls, people are back outside and at the gym exercising and large, expensive equipment is significantly more difficult to justify in that normalised world.

In September 2023, Lululemon evolved this model again, announcing a 5-year partnership with Peloton. Under the agreement, Peloton will provide the content for the Lululemon Studio membership, while Lululemon will be the primary athletic apparel partner of Peloton. The result of this was a further post-tax $72.1m impairment for the Lululemon Studio business. I have presented both statutory and adjusted figures below.

| FY23 | Consensus | beat/miss | |

| Sales | $9,619m | $9,609m | In line |

| Gross profit (margin) | $5,609m (58.3%) | $5,587m | In line |

| Operating Income (margin) | $2,133m (22.2%) | $2,165m | 1.5% miss |

| Adjusted Operating Income | $2,231m (23.2%) | $2,209m | 1.0% beat |

| Net income (margin) | $1,550m (16.1%) | $1,536m | 0.9% beat |

| Adjusted net income (margin) | $1,622m (16.9%) | $1,586m | 2.3% beat |

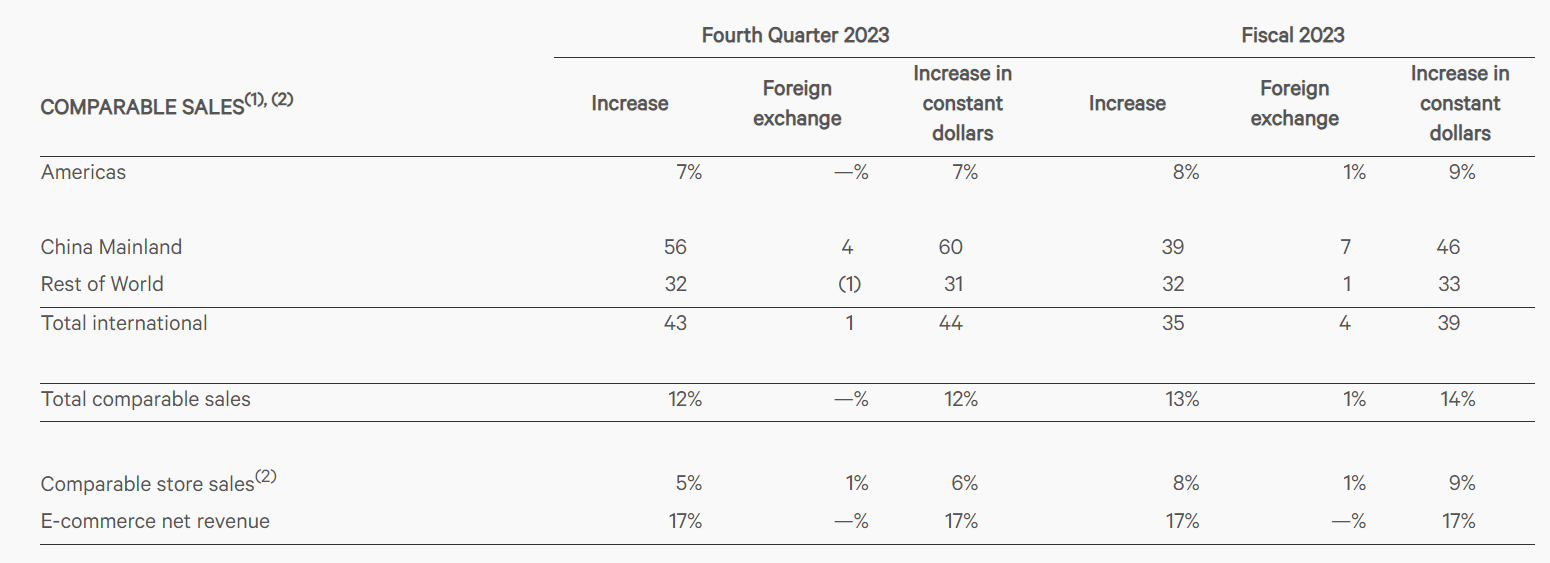

In addition to the new stores, comparable sales were a material contributor to growth. In fiscal 2023 comparable sales increased by 14% in constant dollars. Comparable measures the like-for-like sales growth of stores (and ecommerce) that have been open for longer than 12 months. It gives a slightly different picture to Group sales growth because it only shows sales growth on the basis as if no new stores were opened during the period.

14% is a very impressive growth number, but it is made even more impressive because the contribution of the international segment (including China and RoW), increased comparable sales by 39% (in constant dollar terms).

- Sturdy and Durable: This OROPY wall mounted...

- Sleek Industrial Design: With its simple...

- Optimized Space Utilization: Expand your storage...

- Convenience at Your Fingertips: Hang your daily...

- Versatile Functionality: This multi-functional...

- 【Industrial Clothing Rack】 The clothing racks...

- 【Sturdy & Durable】 Our clothes racks are made...

- 【Height Adjustable】 The height of the lower...

- 【Multifunction Closet Rack】 Wall clothes rack...

- 【Multi-Scene Use】 Dimension: 115” L x87.5”...

- 【Safer Size/Style】: Whole sconces are UL...

- 【Outstanding Details】: Our high-quality black...

- 【NOTE】: Our bar lighting wall sconce include...

- 【Wide Application】: Vintage wall light...

- 【Tips】: As the tube bulb is a bit special, it...

LULU 4Q earnings press release

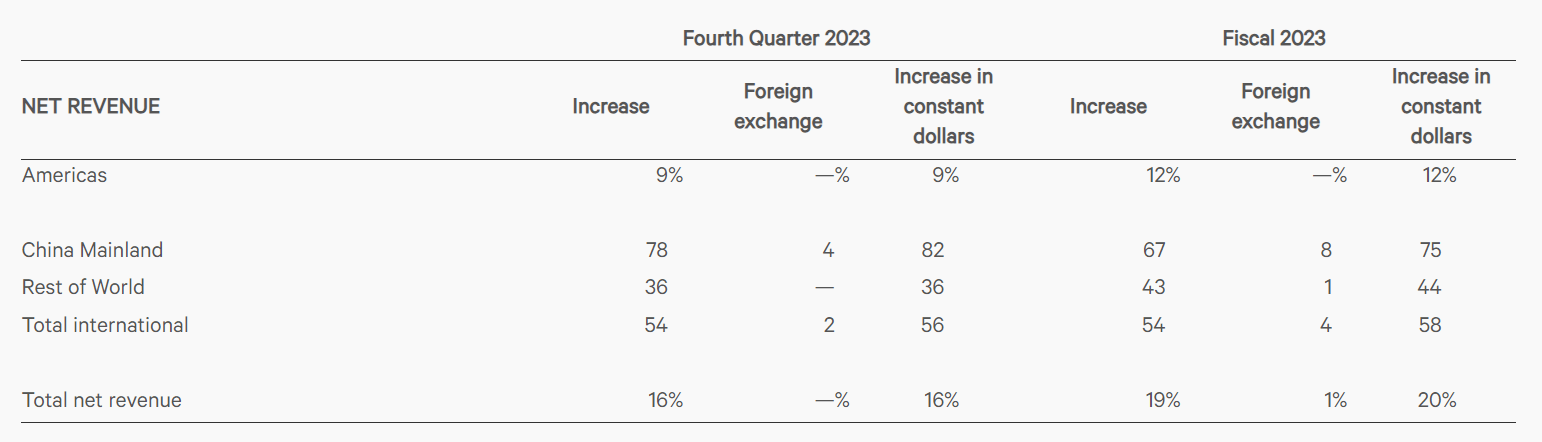

On a total sales basis, China was a standout, growing revenues at 75% for the year while the rest of world segment grew 44% (both in constant dollars). This is impressive and highlights the opportunity LULU has in growing in international markets through new store openings the maturing of recently opened and existing stores. Growth in Americas was still a robust 9%, and as the biggest component of the company’s revenues, this remains a very important part of the story.

LULU 4Q earnings press release

Similarly, the women’s category remains critical to the success of the company and contributed with a strong 13% sales growth.

Power of Three x2

Lululemon distilled their medium term targets in a strategy called “Power of Three x2”, which was unveiled at the April 2022 Analyst Day. The plan aims to double revenue to $12.6bn by fiscal 2026, which is a CAGR of 15% over 5 years from fiscal 2021. Two years on, the company is well ahead of schedule with LULU having already compounded sales at 24.0% over the 2 years since this was announced and only needing to grow revenue at 9.4% for the next two years to achieve their goal. Indeed, the company’s guidance for the 2024 fiscal year is already ahead of this requirement, which forecasts sales at 11-12% for the year.

Key to the success of this growth program is mens and digital, which are both expected to double over the four years, while international is expected to quadruple. The rates discussed above certainly imply this is within reach. However, the strategy also noted that these would be achieved “while continuing to grow core areas”, meaning the expectation of womens to contribute low double digit compound growth rates without specifying anything more specific.

To achieve these growth rates, Lululemon has been and will continue to rely on continued product innovation, guest experiences at their stores and online, market expansion deeper into existing as well as new territories. It is the strategy that has been working and there is no reason to believe it will cease to be effective in the future.

Risks

I have discussed the great opportunity Lululemon has in front of it, but it is not without risk.

Firstly, LULU operates in the highly competitive apparel (and now footwear) market at the premium end. If there is any material economic weakness that impacts consumer spending, it is not difficult to envision consumers opting for a lower priced product. CEO Calvin McDonald actually flagged this in his opening comment on the call, saying they are navigating a slower start to the year due to a soft consumer. If this persists, the guided target may in doubt.

The second risk actually stems from one of the company's greatest opportunities: China. There is a lot of expectation on a China store roll out driving a significant portion of the future growth of the company. While still off a small base, the growth in recent periods demonstrates this. But it introduces some regional and geopolitical risk to the investment thesis. Personally, while I would love to be educated on the matter, I must admit that don’t have a great handle on Chinese consumer tastes and preferences. My rudimentary understanding is that the Chinese often love Western brands, and brands such as Nike (NKE) have done well there in the past. But I also understand there can be a strong preference for buying Chinese products over Western products, and sometimes this directive comes from those in power. If Lululemon, or Western brands in general, fall victim so changing preferences in this manner, it would harm the growth prospects and the stock would experience a material de-rating.

Valuation

Although I acknowledge that the recent sell off back below $400 only wiped out stock gains back to November 2023, it still appears to be an overreaction. Seeking Alpha consensus has LULU doing $10.8bn revenue in 2024 (period ending Jan 2025) and EPS of $14.20, which is the top end of the guidance range of $14.00-$14.20 per share.

After rising to above 40x 1-year forward earnings late last year, LULU is now trading at 27x, which is close to the bottom of the range it has traded at over the last 10 years. If LULU returns to even a 32x P/E (which is still below the 10-year average), its guided earnings would put it on a price of $454.40. That said, we are in a different interest rate environment today so the P/E history does not exactly provide a meaningful comparison.

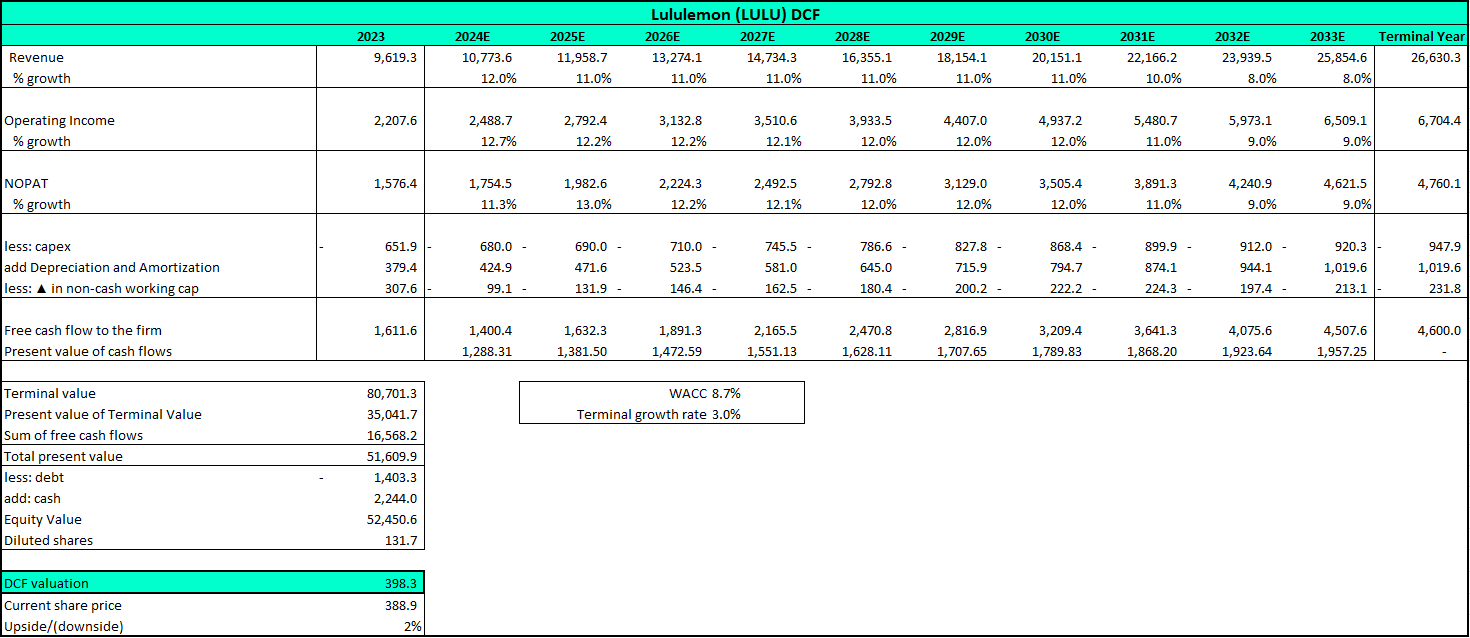

I prefer to use a discounted cash flow to value Lululemon, as the company has strong cash flow generating ability and, as discussed, the growth in these cash flows will be what drives the valuation of the business.

My assumptions are as follows:

- 10.4% revenue CAGR for 10 years. Very slight free cash flow margin expansion to 10.8%. This is based on management's guidance of 11-12% for fiscal 2024, and would represent a base case with upside, since the revenue CAGR over the last 10 years has been 20% and the only year that has been below 11% was the pandemic-interrupted 2020. But I have also intentionally kept the assumption to the low end as the law of large numbers will make it increasingly difficult to achieve the same growth numbers the company has had in the past.

- WACC of 8.7%, derived from a risk free rate of 4%, a market risk premium of 4.6%, and a beta of 1.03.

- Terminal growth rate of 3%. Once Lululemon achieves steady-state maturity, their brand strength, which will of course have much higher recognition by then, should allow them to increase prices at least in line with inflation.

Author analysis using FactSet data

These inputs produce a DCF valuation of $398.30 and backs up my assertion in the opening paragraphs that the share price got ahead of itself in late 2023. The Q4 result has recalibrated the market to reality and is now trading, by my estimate, slightly below its fair value.

As I say in most of my articles, I prefer to buy high quality stocks and pay a reasonable price for them and I think Lululemon comfortably fits into that category. LULU has proven to be a compounding machine in its history to date and there is plenty of opportunity for it to continue on its trajectory.