I’m a fan of international investing at this point in the cycle and diversification away from large-cap Tech, which does hugely dominate investor portfolios today. I’m also a big fan of a return to dividend investing, particularly because it does look like the Fed is done hiking rates (which means less competition for dividend-paying companies to deal with). If you’re in the same camp, you may want to consider the iShares International Select Dividend ETF (BATS:IDV). This exchange-traded fund offers high-quality exposure to a host of developed market equities with a strong distribution. The current 30-Day SEC Yield stands at 5.9%, which is quite attractive for an equity play that largely hasn’t gone as manic as, say, the S&P 500 or Nasdaq in the past year.

IDV is passively managed and aims to mirror the performance of the Dow Jones EPAC Select Dividend Index. This benchmark consists of high-dividend equities issued from developed markets outside of the US and targets those companies which have a history of paying out consistently higher yields. The fund has been around since 2007, has total assets of over $4 billion, and an expense ratio of 0.51 percent.

A Closer Look at the Holdings

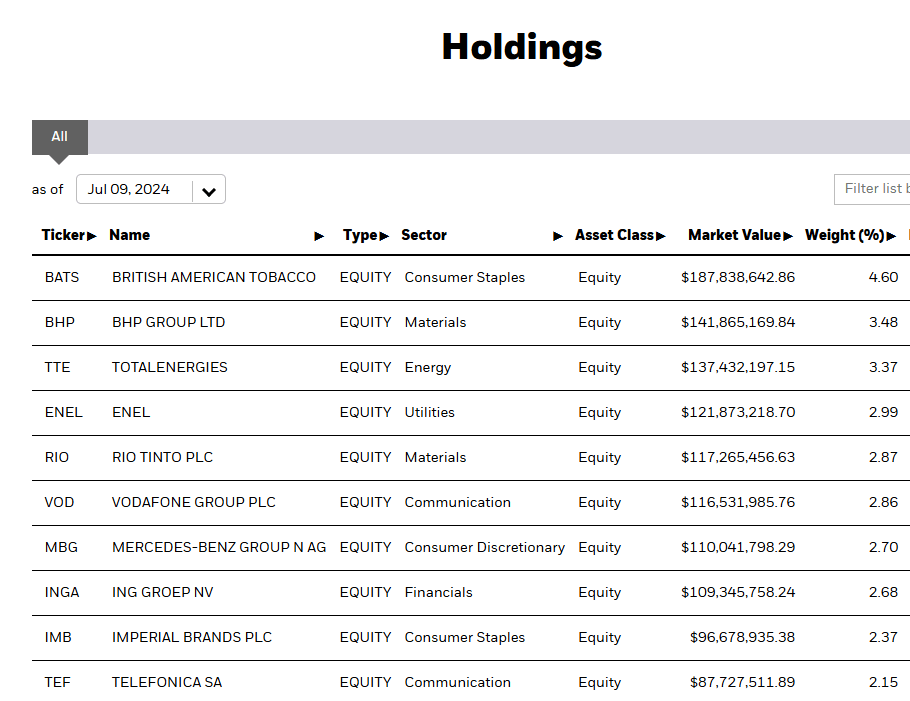

The fund has 102 holdings presently, with no position making up more than 4.6% of the portfolio. It’s fairly well dispersed, which I think is a positive in terms of overall diversification in a world where a select number of stocks are dominating US large-cap momentum.

iShares.com

What do these companies do? British American Tobacco (BTI) is a multinational tobacco company based in the United Kingdom. It has operations in more than 200 countries. BHP Group Limited (BHP), on the other hand, has nothing to do with this. It’s a global resources company primarily engaged in the exploration, production, and marketing of iron ore, copper, and coal. TotalEnergies (TTE)? It’s a French multinational integrated oil and gas company that operates in more than 130 countries and is involved in every aspect of the industry, from exploration to the production, purchase, storage, transport, refining, and distribution of petroleum. Mercedes-Benz Group (OTCPK:MBGAF) manufactures luxurious cars, vans, trucks, buses and provides other transportation-related technology and services. And ING Groep (ING) is a Dutch multinational banking and financial services corporation that operates in over 40 countries.

Quite the mix!

Sector Composition and Geographic Diversification

IDV’s sector allocation is very well-diversified with a tilt to Financials (31.44%), Utilities (16.23%), Communication (11.59%), and Materials (9.79%). I like the heavy allocation to Financial and Utilities (not just dividend plays, but also style-wise more on the value end of the spectrum). There is essentially zero Tech exposure, which is a positive if you’re, well, bearish on Tech.

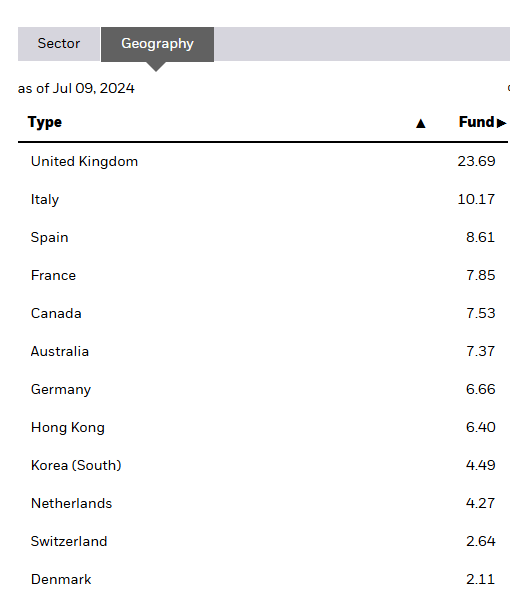

Geographically, the fund’s top holdings span many developed markets, led by the United Kingdom, Italy, Spain, and France. Since the fund is well-diversified across these countries, it limits country-specific risk while enabling investors to leverage the growth of economies simultaneously.

iShares.com

Peer Comparison

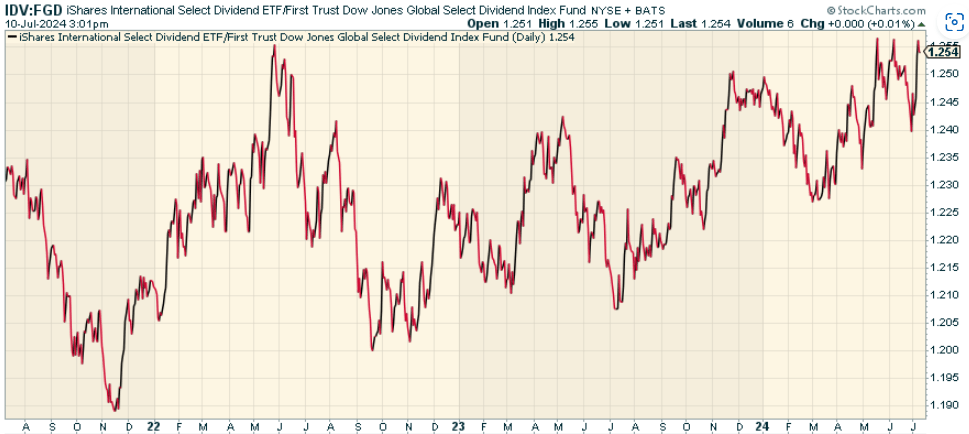

One fund worth comparing against is the First Trust Dow Jones Global Select Dividend Index Fund (FGD). This fund screens for current dividend, a 5-year average payout ratio of less than or equal to 60%, and ranks by yield (currently at the same 5.9% as IDV). When we look at a price ratio of IDV to FGD, we find that IGV has been outperforming nicely over the past 3 years with comparable yield.

StockCharts.com

Pros and Cons

On the plus side, IDV has a number of benefits. One of its main attractions is, of course, access to a selection of well-known large international companies with a successful history of paying steady dividends. Not only can your passive income stream be increased this way, overall portfolio volatility likely would be lowered blending this against other equity funds given that dividend stocks tend to not be as volatile overall. In addition, IDV’s international diversification across multiple industries and geographies can create a hedge against concentration risk, making the fund less sensitive to localized economic or geopolitical events.

But the risks of investing in IDV can include the broader risks associated with international investing – greater currency volatility and political and regulatory differences that can potentially lead to poor performance. Moreover, while IDV’s focus on dividend-paying equities results in a dependable income stream, it also means that the fund might struggle to beat the broader index in the long term, as companies that prioritize dividend payouts typically reinvest a lower proportion of their earnings back into the business and miss out on opportunities for potentially superior long-term growth.

Conclusion

I like this fund. IDV is worth considering if you’re looking for international diversification and an additional dividend stream. With its balanced sector allocation, geographic diversification, and emphasis on large, well-established companies, IDV is a great way for income-oriented investors to supplement their US-based investment portfolios.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.