Natural resources, believe it or not, matter a lot more than code. They are the foundation of many key industries. They are what run the world. And there is a real opportunity to outperform by investing in those companies focused on them. If you agree, and are seeking an alternative to Tech-driven AI hype and momentum, then you may want to consider the SPDR® S&P Global Natural Resources ETF (NYSEARCA:GNR).

This ETF provides investors with exposure to a vital sector of the global economy. GNR includes stocks from the S&P Global Natural Resources Index, which tracks the performance of 90 large- and mid-cap publicly traded companies that explore, produce, and distribute natural resources and commodities. GNR ETF provides diversified exposure to three critically important sub‑sectors of the natural resource complex – agriculture, energy, and metals and mining.

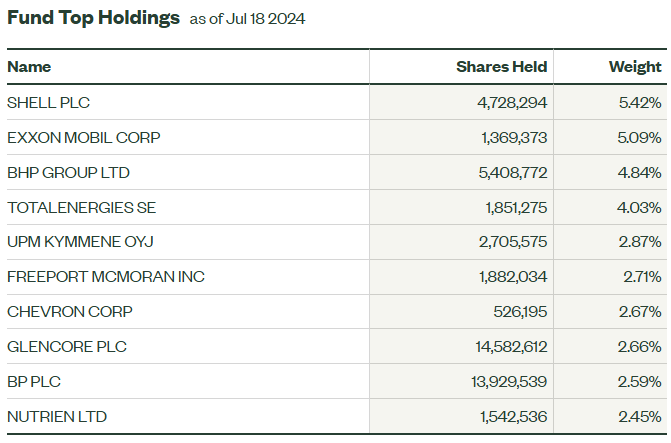

A Look At The Holdings

When we look at the holdings, we find that Energy shows up at the top of the list with the largest position, Shell, making up 5.42% of the fund. This is fairly well diversified overall.

What do these companies do? Shell plc (SHEL) is a multinational oil and gas company with operations across the world. Exxon Mobil Corp. (XOM) is a multinational, vertically integrated oil and gas company, working in the upstream domain of exploration and the downstream domain of refining and selling petrol, diesel, and other products in global markets. BHP Group Ltd. (BHP) is a global-diversified natural resources company providing extractive services to manufacture and process metals and minerals including copper, iron ore, and coal. It is part of the metals and mining sector. TotalEnergies SE (TTE) is a French multinational energy company. And UPM-Kymmene Oyj (OTCPK:UPMKF) is a multinational under the agriculture sub-sector. This Finnish forestry and biomaterials company manufactures pulp, paper, and biofuels.

These are industry giants, and buying the fund gives easy and fast exposure to them.

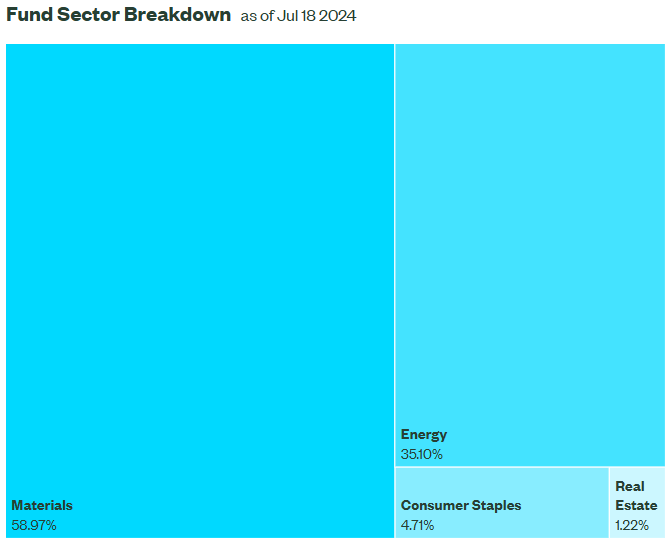

Sector Breakdown And Geography

The portfolio of the GNR ETF is well-balanced between three main sectors, which account for the most important domains of the global economy. The Materials sector makes up the largest allocation (no surprise) followed by Energy.

Good broad diversification, and I like that Energy isn’t the largest weighting here, despite most people automatically thinking about oil when they think about the natural resources sector.

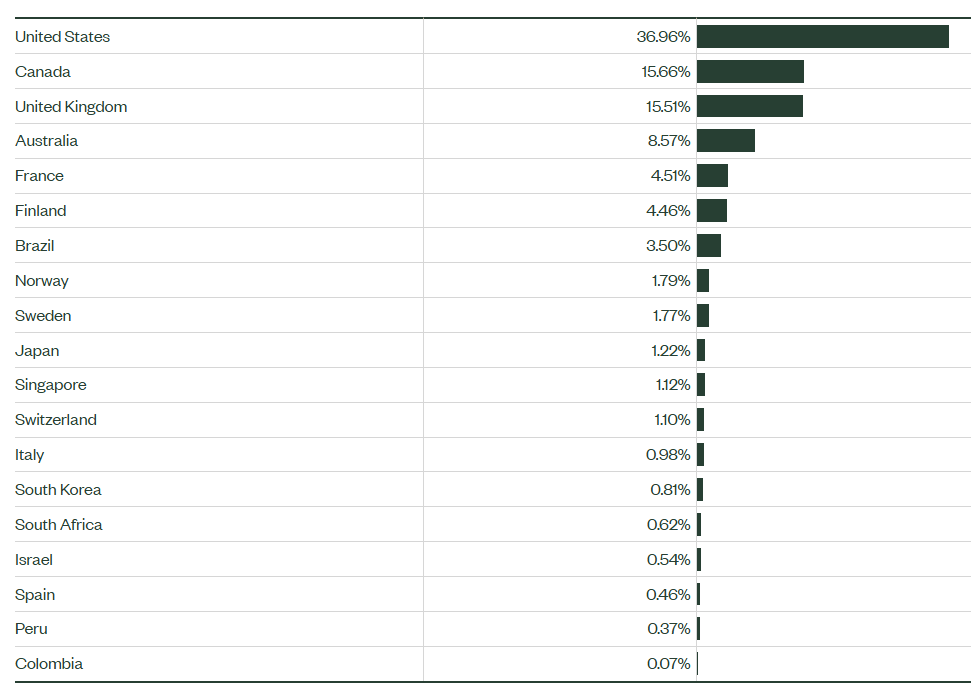

In addition, keep in mind this fund is geographically diverse. The US takes the lead at roughly 37% of the fund, but exposure goes from Canada to the UK to Australia to Colombia. I like international investing here and think it’s a net positive for the fund overall.

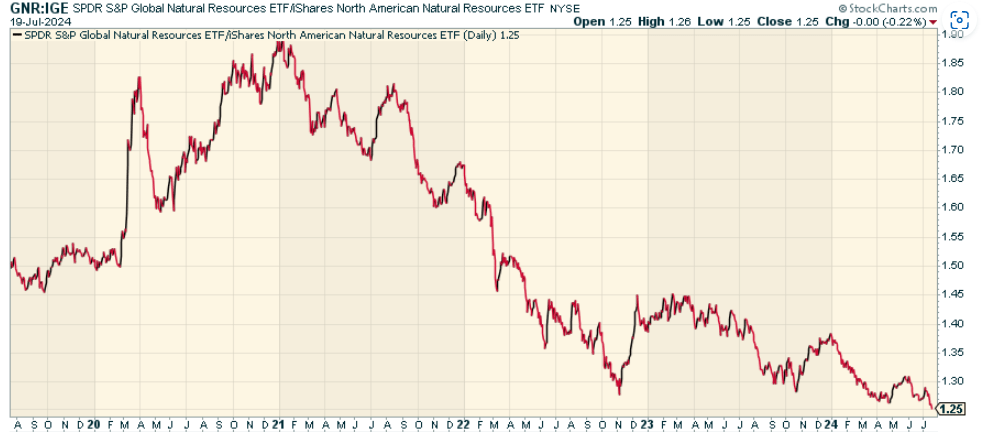

Peer Comparison

One fund worth comparing GNR to is the iShares North American Natural Resources ETF (IGE). This ETF also offers natural resources exposure. When we look at the price ratio of GNR to IGE, we find that GNR has underperformed in the last several years after leading into 2021. The reason? Much more energy exposure in IGE, and its North American focus, has helped from a momentum and outperformance perspective. I would still choose GNR over IGE though as I suspect Materials outperform, alongside international.

Pros And Cons

On the positive side is the space the fund is playing in. Global natural resources include gold, silver, copper, coal, oil, timber, and water. These are critical components of the world economy and unloved from an investment perspective. As global growth potentially re-asserts with China being a driver of that economically, all these areas should perform quite well.

On the other hand, the disadvantage of this investment vehicle is that it is highly sensitive to cyclical activity. If we enter a broad-based recession, international diversification and valuations should help, but this fund could get disproportionately hit as demand is pulled back. That isn’t my base case, but is something to consider from a risk perspective overall. Keep in mind also that the international exposure, while a positive in my view, does introduce with it currency risk as these stocks are unhedged to forex movements.

Conclusion

I like the SPDR® S&P Global Natural Resources ETF. It allows for access to a dynamic and vitally important part of the global economy: the natural resources sector, through a diversified portfolio of companies spanning agriculture, energy, and metals and mining from across the world. I think it’s worth considering and would much favor this than anything Tech-focused now.

Get 50% Off The Lead-Lag Report

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.