PM Images

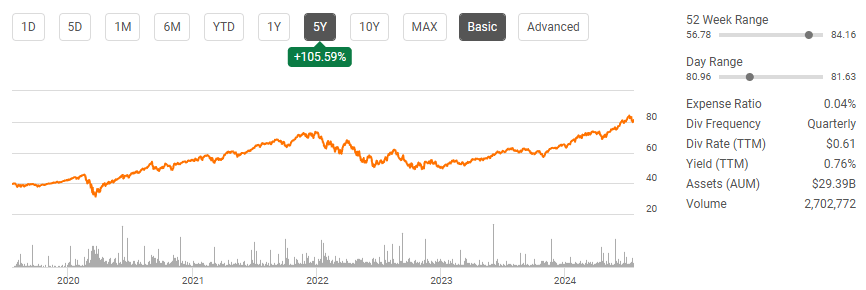

It’s earnings season, and the Magnificent Seven is front and center as Tesla (TSLA) and Alphabet (GOOGL) delivered their Q2 earnings after the bell on 7/23. This will be followed up by Meta Platforms (META), Apple (AAPL), Amazon (AMZN), and Microsoft (MSFT) next week. Nvidia Corporation (NVDA) will finish off earnings season at the end of August. While I am directly invested in all of the companies I have mentioned, excluding Microsoft (MSFT), I also have indirect exposure to many ETFs in which I am invested. The SPDR Portfolio S&P 500 Growth ETF (NYSEARCA:SPYG) is still my favorite large-cap growth ETF as it focuses on the largest growth companies in the S&P 500. I am invested in several index funds, and rather than trying to squeeze out additional growth by incorporating small or mid-cap funds, I have allocated capital toward SPYG. This provides me with a higher concentration into the largest growth companies in the United States, while consistently outperforming the S&P 500. Big tech has led the markets higher, and I believe that expansion in earnings is coming, which will allow this trend to continue. I am very bullish on SPYG as I believe it will continue to outperform the S&P 500, and provide investors with solid returns for years to come.

Seeking Alpha

Following up on my previous article about SPYG

I had previously discussed SPYG in an article I wrote in July of 2021 (can be read here) when the previous bull market in technology was occurring. I had discussed SPYG’s investment strategy, and why I was bullish on its forward potential. Since then, we experienced a risk-off environment where technology experienced a bear market, inflation skyrocketed, and the Fed took interest rates to the highest levels in 4 decades. As the economy grew stronger, the largest companies flourished in 2023 and 2024, which led to higher shares of SPYG. There have been some recent price target hikes on the S&P 500, and while SPYG isn’t a replacement for a standard S&P 500 index fund such as the SPDR S&P 500 Trust ETF (SPY), it’s my favorite large-cap growth fund to capitalize on potential future appreciation. I am following up with a new article as we head into the most anticipated period in earnings season. I believe that the Magnificent Seven will lead the market higher, and SPYG will continue to outperform traditional index funds over a long period of time.

Risks to investing in SPYG

While SPYG is an ETF with 232 holdings, there are still risks to investing in SPYG. There are risks with any investment, but they can vary from investment to investment. SPYG has a large concentration to technology as more than half of the portfolio is weighted toward this sector. If we experience a market rotation out of the tech sector, or if earnings disappoint expectations, the narrative around earnings expansion and AI leading the market higher could cool off. This could cause the markets to experience a significant retracement and potentially end the current bull market.

ETFs like SPYG would likely be hit harder than standard index funds as SPYG has more exposure to the largest companies in the market. While SPYG has less diversification than other ETFs, if we enter into a new market dynamic where value comes back into favor rather than growth stocks and big tech, SPYG is likely to underperform other investment vehicles that are more equally weighted or value focused. Investing in SPYG is a play on the current narrative, staying intact and expanding. While SPYG has outperformed the market, we could experience a period where boring companies take the reins, which would be negative for investors of SPYG.

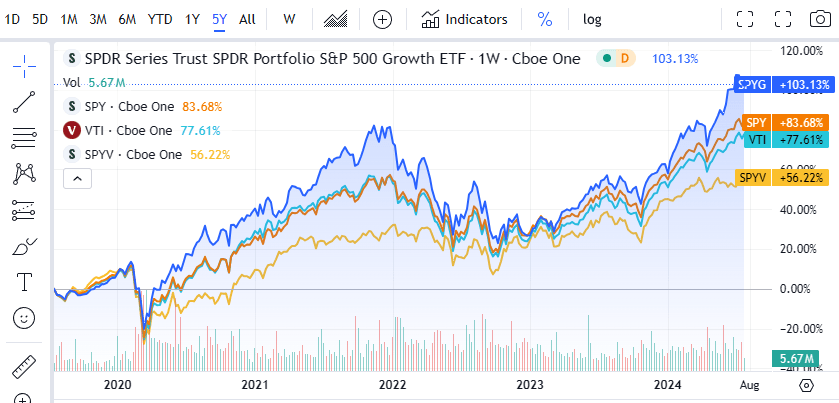

SPYG continues to outperform many other popular ETFs

Seeking Alpha

When I look at SPYG compared to SPY, the Vanguard Total Stock Market Index Fund ETF Shares (VTI), and the SPDR Portfolio S&P 500 Value ETF (SPYV), the results speak for themselves. This takes into consideration an S&P 500 and total market index fund while also tracking how SPYG is performing against a value index. Over the past 5-years, the baseline is 77.61% – 83.68%, depending on if you prefer an S&P 500 index fund or a total market fund. Personally, I prefer an S&P 500 index fund because I am not as interested in small or mid-cap companies. Value has underperformed the market, returning 56.22% over a 5-year period. SPYG on the other hand has appreciated by 103.13% and provided investors with an additional 19.45% in appreciation over a standard S&P 500 index fund.

As we can see in the chart, SPYG can be more volatile than the peer group. In 2022, SPYG had a steeper decline than its peers when the markets corrected, and the risk-on environment disappeared. Once the bottom was established, SPYG maintained a lead in appreciation, and the gap widened as time progressed. If I look back over the past decade, SPY has appreciated by 188.48% while SPYG has increased by 253.43%. Value hasn’t done nearly as well, considering SPYV is up 108.77% over the past decade. Without getting ultra-concentrated into an ETF such as the Invesco QQQ ETF (QQQ), SPYG has been a strong ETF to gain exposure to the leading growth companies in the S&P 500 while riding the technology wave higher. I believe that SPYG will continue to benefit from strong earnings and market expansion going forward, which is why this remains a large holding in my overall portfolio.

Why I am bullish on SPYG going forward

Citigroup (C) has forecasted that there is a strong potential that companies will beat the Q2 estimates for earnings due to productivity gains in the labor market. Strategists at Citi believe there could be a $3 upside in earnings, which would create a strong earnings season for the largest companies in the market. UBS just raised their S&P 500 target for 2024 to 5,900 and took their June 2025 target to 6,100. Barclays also increased their 2024 target to 5,600 and believes the selloffs are contained compared to how the broad market is performing. Goldman Sachs (GS) also increased their price target on the S&P 500 to 5,600. As more upgrades hit the street, they should drive increased volume as investors continue to get excited about long-term prospects from the market.

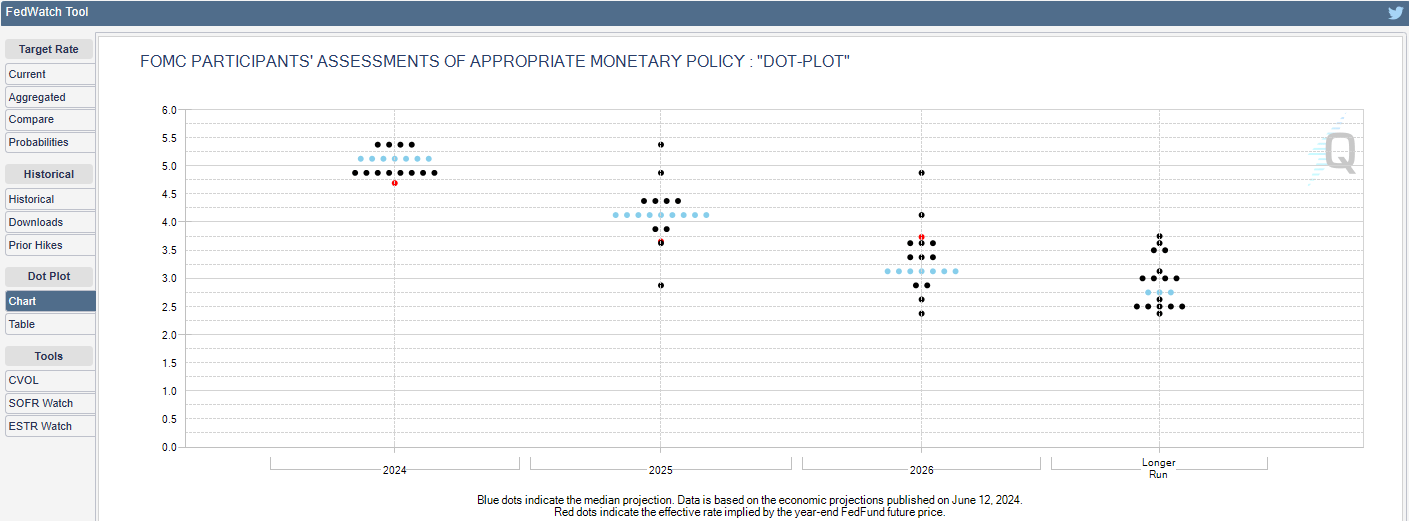

CPI data came in at the lowest level over the past year with a print of 3%, while Core CPI came in at 3.3%. CME Group is projecting that at the September FOMC meeting there is only a 3.9% chance that rates remain unchanged and the largest probability is that a pivot of 25 bps will occur. Looking at the Fed Dot Plot, the consensus is that rates will reach 3.1% in 2026, then continue lower as time goes on. This should lead to growth in the economy for several reasons. A lower rate environment should calm the fears about a regional banking crisis as debt that REITs are carrying will be able to be refinanced at more friendly rates. This should allow the banking sector to avoid a situation where defaults on loans rise, and they are stuck with unwanted assets and forced to take losses. As rates decline the lending market will become less restrictive, and businesses will be more likely to borrow for expansion. As expansion occurs, we should see a lot of the capital spent flow up to the largest companies as more goods and services will be needed from cloud infrastructure to computers. Companies are also likely to increase their advertising spend, which will be good for AMZN, META, and GOOGL. In a scenario where the Fed signals all clear with a pivot and the strong possibility of expansion when that occurs, it should lead to SPYG climbing higher as the largest companies beat earnings and raise guidance.

CME Group

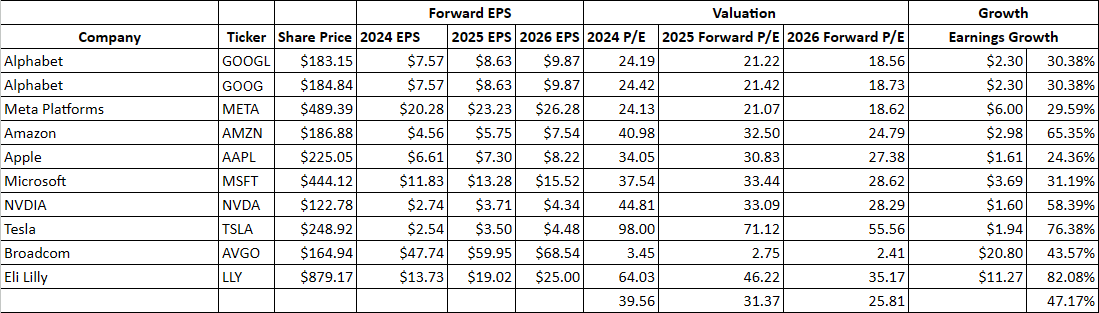

When I look at the earnings expectations from SPYG’s largest holdings, the growth seems to remain strong through 2026. SPYG’s top-10 holdings represent 59.54% of the funds assets. The combination of the top-10 holdings are trading at 39.51 times 2024 earnings. Over the next 2 years, these companies on average are expected to grow earnings by 47.17%, placing the forward 2026 P/E of these companies at 25.78. I would argue that paying 25.78 times 2026 earnings for these companies as a collective with 47.17% earnings growth over the next 2 years isn’t expensive.

There is also a possibility that these companies can beat expectations in a softer macro environment that experiences additional growth. Overall, I think that these companies are going to lead the market higher, and from now through 2026, there are another 10 earnings seasons from which the market can gain tailwinds. When I look at SPYG, almost 60% of the fund is represented by the 10 largest growth companies in the S&P, and I get very bullish on SPYG as there could be a lot of upside waiting to be unlocked.

Steven Fiorillo, Seeking Alpha

Conclusion

SPYG is my favorite large-cap growth ETF. While I have a large position in standard S&P index funds, I have a strong allocation to SPYG as I believe technology will continue to outperform for years to come. This allows me to benefit from diversification across the largest companies in the S&P 500 while focusing on growth rather than venturing into the world of small caps. I am very bullish on the Magnificent Seven and believe that the macroeconomic setup will work out in their favor over the next several years. SPYG has a long-term track record of outperforming value, and traditional index funds, and I believe that this will continue. I plan on adding to SPYG over the next year as I believe there is more upside potential to benefit from.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.