In my thesis on Tesla (NASDAQ:TSLA) last week, I updated my long-term outlook for the company, including a 5-year price target of approximately $1,050. Since then, Tesla’s Q2 earnings results have been reported.

Here is a brief summary of the results:

Total revenue: $25.5B, exceeding the analyst expectations of $24.8B.

Earnings per share: $0.52, falling short of the analyst expectations of $0.62.

Here are two highlights from the earnings call, which I have identified:

…the biggest differentiator for Tesla is autonomy… …while others are pursuing different parts of the AI robotic stack, we are pursuing all of them. – CEO Elon Musk, Q2 2024 Earnings Call

…we’ve begun the journey towards the next phase for the company with the building blocks being placed. It will take some time, but will be a rewarding experience for everyone involved. – CFO Vaibhav Taneja, Q2 2024 Earnings Call

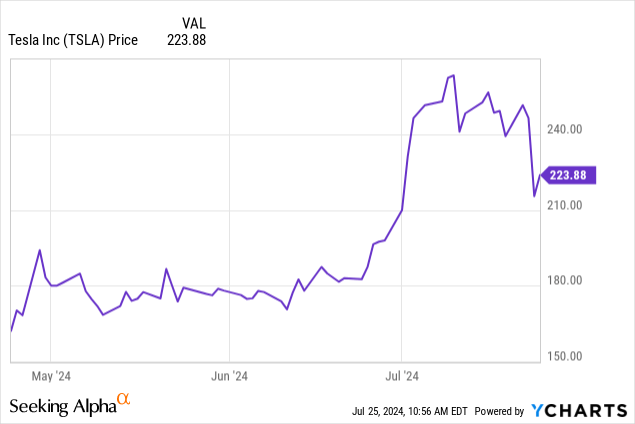

In my opinion, Q2 results were disappointing for short-term Tesla investors; for long-term investors, it arguably ironically opened more of an opportunity, as the shares dropped 13.25% post-results. The reason I say this is that my long-term thesis on Tesla is related to its moat in autonomy primarily, and in this analysis, I will review what management revealed in Q2 earnings is in store for long-term TSLA shareholders.

Data by YCharts

Earnings Call Analysis

FSD Licensing

First of all, I have mentioned in my previous analyses on Tesla that FSD licensing could be part of the moat that Tesla develops, but analyst Alex Potter was quite strong in the earnings call, in my opinion, in raising a question on the constraints that this FSD licensing strategy could face in the near term, as well as elucidating the fact that this potentially might not be one of the most lucrative elements of TSLA, at least for now. That being said, in terms of long-term benefits, I think Tesla’s moat in FSD will be hinged on its AI software; while this is difficult to implement in third-party automobiles in the near future, I think Tesla has the capability of developing this to be third-party adaptable, as well as OEMs developing cars in the future that suit and fit Tesla’s AI. However, Musk also stated third parties would have to adopt Tesla’s FSD software on a large-scale to make it worthwhile to them; otherwise, they could just build the cars themselves and add them to the Tesla network. So, I think this FSD software licensing will come at a premium to OEMs, and it will be very difficult to compete with Tesla’s cheaper models.

…There are a few major OEMs that have expressed interest in licensing Tesla full self-driving. And I suspect there will be more over time… …given the speed at which, the auto industry moves, it would be several years before you would see this in volume… …the kind of deals that are obviously relevant are only if, some OEM is willing to do this in a million cars a year or something significant. – CEO Elon Musk, Q2 2024 Earnings Call

Optimus

Furthermore, in the earnings call, Musk was very bullish about Optimus, which is arguably an area of Tesla I have not given enough consideration. I think it is very compelling to see the CEO of what is commonly known now as a car company, which for insiders is an AI company, state that its long-term future is likely to be in humanoid robots. This is a bold statement, but it is one that I think could work out for Tesla as part of its evolution into an autonomous company rather than an advanced clean-energy car company.

…Optimus is already performing tasks in our factory… …in 2026 we’ll be providing Optimus robots to outside customers… …as I’ve said a few times, I think the long-term value of Optimus will exceed that of everything else that Tesla [does] combined… …just simply consider the usefulness utility of a humanoid robot that can do pretty much anything you ask of it. I think everyone on earth is going to want one. There’s 8 billion people on earth, so it’s 8 billion right there. Then you’ve got, all of the industrial uses, which is probably at least as much, if not way more. So I suspect that the long-term demand for general purpose humanoid robots is in excess of 20 billion units. And Tesla… …has the most advanced humanoid robot in the world, and is also very good at manufacturing, which these other companies are not. And we’ve got a lot of experience — with the most experienced with the world leaders in real world AI. – CEO Elon Musk, Q2 2024 Earnings Call

There is a wide range of use cases for humanoid robots, and one case study that comes to my attention is in agriculture. In this field, the adoption of autonomous robots is expected to take 5-10 years because it will likely take some time and gradual adoption before these technologies are utilized at scale. In my opinion, the first industries and companies to begin to utilize these technologies will see very strong financial results and have a great competitive advantage. It is likely that Tesla will develop a significant moat in the market for humanoid robots based on scale and AI with Optimus, so it is another reason to be bullish about TSLA for the long term.

This idea of widespread adoption of autonomous humanoid robots is integral to the long-term thesis held by many big tech companies at the moment and shared by investment professionals like myself and Cathie Wood of ARK Invest. The reason to allocate to big tech companies is, in my opinion, hinged on the thesis that these autonomous technologies are likely to drive significant deflationary effects in the economy through radically higher levels of production and cheaper costs of manufacturing possibilities.

Autonomous Network & Investment Case Analysis

Tesla is positioned and is consolidating itself as one of the integral linchpins in this autonomous technology network, and so I think, despite the concerns with the valuation, one is very mistaken if they consider Tesla as just a car company. As a result of the economies of scale and pricing strategies that Tesla is likely to be able to command due to its moat in autonomous networks and robot provision, I think it is quite likely that the valuation for Tesla expand significantly. Musk mentioned in Q2 that he thinks ARK Invest’s $5T+ market cap prediction for TSLA is achievable, and furthermore, he envisions this could become much higher with Optimus deployed at scale commercially and internally. This is very exciting, and it arguably places Tesla central to a profound economic revolution that could be sparked by autonomous technology. In other words, this narrative, grounded in moats, economies of scale, and AI infrastructure, is very real and very investable. What I think a lot of the short sellers and a lot of the traditional value investors have missed is the macroeconomic value creation Tesla may be fundamental to over the long term. However, it is key that TSLA investors remember that it could be a very long term, and I think holding Tesla for 10+ years is the only strategy that makes sense if investing in the stock for autonomy growth and expanding market sentiment as a result of this because I truly see Tesla as positioning itself to be enduringly committed to this goal. Selling for short-term stock price movements would likely miss out on the untimeable exponential growth possible from this stock based on autonomy over the next few decades.

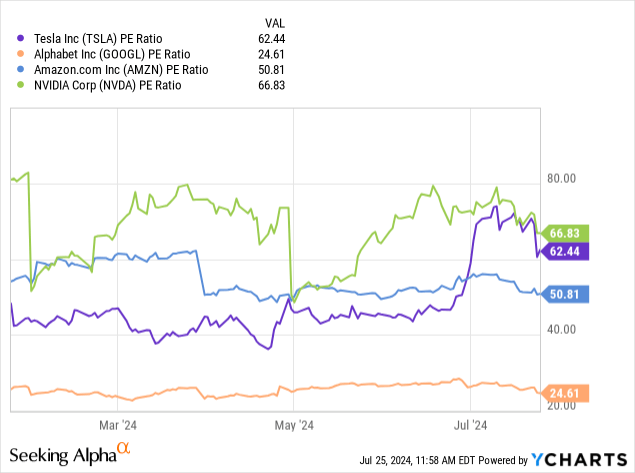

Like Alphabet (GOOGL) (GOOG), Amazon (AMZN), Nvidia (NVDA), and others, TSLA is unlikely to stop expanding over the long term as a result of the extraordinary benefits this Western technology infrastructure could have on global economics. Unlike Nvidia, Tesla has had an extended period recently of deflated valuation compared to previous highs, so I think it has presented an excellent buying opportunity. On the other hand, NVDA is at its limit in terms of valuation, so I would see it as potentially quite shrewd to take capital from NVDA and put it into TSLA for now. Once Nvidia’s valuation is more reasonable again, which I think could be around 2026/2027, Nvidia would arguably become a Strong Buy again.

Robotaxis

In terms of the robotaxi network, Musk and the Tesla team spoke quite openly about this in the Q2 earnings call, and one area that stood out to me is that Tesla’s FSD is programmed to be able to be deployed anywhere, even on a planet that no car has ever driven on—given the way Tesla’s FSD is trained, it can drive based on spatial awareness and with similar cues to humans. This is much more advanced than Waymo’s model, which requires pre-structured mapping of an environment to guide its sensor-based approach. Travis Axelrod, Tesla’s Head of IR, also outlined how this could give faster regulatory approval across states. However, this is one area that Tesla is going to have to work patiently on to convince the regulators that Tesla’s FSD is ready to be deployed fully autonomously. From the data, it is becoming very evident that autonomous transport is going to be much safer than human-operated transport.

…in terms of regulatory approval, the vehicles are governed by FMVSS in U.S., which is the same across all 50 states. The road rules are the same across all 50 states. So creating a generalized solution gives us the best opportunity to deploy in all 50 states, reasonably. – Head of IR, Travis Axelrod, Q2 2024 Earnings Call

Furthermore, Musk gave a very insightful analogy that Tesla’s autonomous network would work like Airbnb (ABNB) but for cars. I think this is a clever way to view the future autonomous vehicle market for Tesla in the medium term to long term. However, I also think that as it scales its operations, it is likely to find itself more involved in fleet development, and I think the very long-term future of Tesla is likely to be mainly autonomous vehicles that are not co-owned with customers but fully owned by Tesla. I think this will happen as the economies of scale and pricing advantages of autonomous vehicles deter vehicle ownership and potentially create a majority of the public who do not own a car but opt for autonomous taxis, particularly in cities.

You just literally open the Tesla app and summon a car and resend a car to pick you up and take you somewhere… …you can think of the giant fleet of Tesla vehicles as like a giant sort of Airbnb equivalent fleet, Airbnb on wheels… ….this would all be a Tesla network. And there’s an important clause we’ve put in, in every Tesla purchase, which is that the Tesla vehicles can only be used in the Tesla fleet. They cannot be used by a third-party for autonomy… …The entire Tesla fleet basically becomes active. This is obviously maybe there’s some number of people who don’t want their car to earn money, but I think most people will. It’s instant scale. – CEO Elon Musk, Q2 2024 Earnings Call

Risk & Valuation Analysis

In my analysis last week on Tesla, I outlined that I have a 2029 price target of $1,050. I retain this view following earnings, as not much has changed about my thesis. However, over the longer term, I think I have underestimated the effect Optimus could have on Tesla’s valuation expansion and fundamental growth, especially as it gets implemented in industrial use cases at scale around the world. However, this is not likely to happen in the near term or even in the medium term, so I think we are looking at a potentially volatile road to $1,050 per share and then a protracted and also volatile period beyond that when robotaxis starts to become deployed at scale, and then Optimus begins to be sold more readily. However, adoption may not be as fast as Musk wants, and the notion that everyone would want an Optimus (8B people, as noted by Musk) is likely an exaggeration. Given that a significant portion of the global population still does not have access to dishwashers, it could be 50+ years before that entire personal-use market is even close to fully tapped for Optimus, if ever. In my opinion, Musk underrepresented the industrial use cases for Optimus in the Q2 earnings call. I think Tesla would benefit from a heavier emphasis on industrial use cases, including Optimus model iterations to support autonomous operations in different industries. I think this could be a big market, but the road to adoption, usability, and deployment at scale is likely to be costly, so Tesla will need to focus again on efficiency internally and continue to focus on moat consolidation to make the economies of scale pay for the development costs. I think this is likely to create market skepticism over periods, and the earnings miss experienced in Q2 this time is likely to be a recurring theme as Tesla repositions itself operationally. One has to have a full understanding of Tesla’s operational direction to be an investor, and even then, it is worth remembering that Tesla is a high-risk investment because of the valuation and the dependency the company has on Musk’s vision and direction. I wonder whether the firm would be able to manage if Musk was not at the helm.

Tesla and Nvidia have roughly equal valuations based on the PE ratio at the moment, but the big difference is that the fundamental estimates on Wall Street show an increase for TSLA over 5 years from current contractions and a decrease for NVDA over 5 years from current highs. Therefore, based on the effect this is likely to have on investor sentiment surrounding the stocks, I think there is much more of a reason to be bullish about TSLA in the short term to medium term than NVDA. Regardless of this, the valuation for Tesla is still very high, and this means that any unexpected earnings contractions as a result of operational shifts and investments from the company could induce periods of significant downside volatility. This is a primary reason why I reiterate that TSLA works as a high-growth investment but arguably not at a large allocation in an effort to mitigate risk.

Data by YCharts

In Q2, Tesla missed its earnings estimates because it faced potential demand issues, indicated by an inventory build up—its global inventory rose by about 5,000 vehicles, bringing the total to approximately 150,000 units. Additionally, the company faced production and delivery issues for the new Model 3 at its Fremont factory and experienced supply chain issues at Gigafactory Berlin. Furthermore, the company experienced subpar sales in Europe and only modest production increases in China. Most of these reasons for the miss I am not too concerned about, as I view them as short term, except the note on weaker demand. This is something that I do not see as unlikely for Tesla to continue to face in the near term as inflationary pressures force reductions in demand, but also, as I mentioned above, in the medium term to long term, the cost benefits of its robotaxi initiatives will become more actualized, and demand for Tesla’s legacy vehicles is likely to wane. This opens up the need for management to allocate capital effectively during the transition to keep revenues stable amid changes in demand. Management will also need to prepare for large growth that could accrue in robotaxis by ensuring it is investing adequately in advance in elements such as an autonomous fleet to meet demand.

Conclusion

The Telsa Q2 earnings call was revealing, and Tesla’s management outlined many details of the company’s forward-looking operational strategy. The earnings results missed analyst estimates and we should expect more of this in the short term, in my opinion, but long-term Tesla bulls should not be deterred by short-term gyrations in the stock price based on earnings reports. Instead, holding TSLA for the long-term growth that could accrue through its autonomous network, which includes Optimus and robotaxis at scale, is the foundation of my thesis. In my opinion, the reduction in price following the earnings results opens up more of a long-term buying opportunity. While this long-term thesis could take 10+ years to truly play out, this length of a holding period, based on the potential for operational excellence and moat consolidation, is what I look for as an investor. Hence, after management’s sentiments in Q2 earnings, I reiterate my Buy rating for TSLA.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.