In a world where everything from businesses to governments is operated by complex networks of technology, data, and devices, the foundations of the global “world of bits” could be held together by a single connection too weak to withstand malicious attacks. The strongest systems fail because of a single vulnerability. These vulnerabilities can’t be fully eliminated, but they can be strengthened through cybersecurity. Protecting trade secrets and customer data, avoiding reputational damage and supply chain interruptions, all contribute to the urgent need for cybersecurity solutions that protect organizations at the cutting edge.

This megatrend is real, and that’s why the WisdomTree Cybersecurity Fund ETF (NASDAQ:WCBR) is worth considering as a thoughtfully structured exchange-traded fund, or ETF, that provides investors with focused access to growing cybersecurity demand. The fund seeks to track the WisdomTree Team8 Cybersecurity Index, which invests in cybersecurity companies with above-average revenue growth and direct exposure to a comprehensive set of cybersecurity development themes. Team8 is a leading global venture group made up predominantly by elite teams of cybersecurity, data, artificial intelligence, and fintech leaders.

A Look At The Holdings

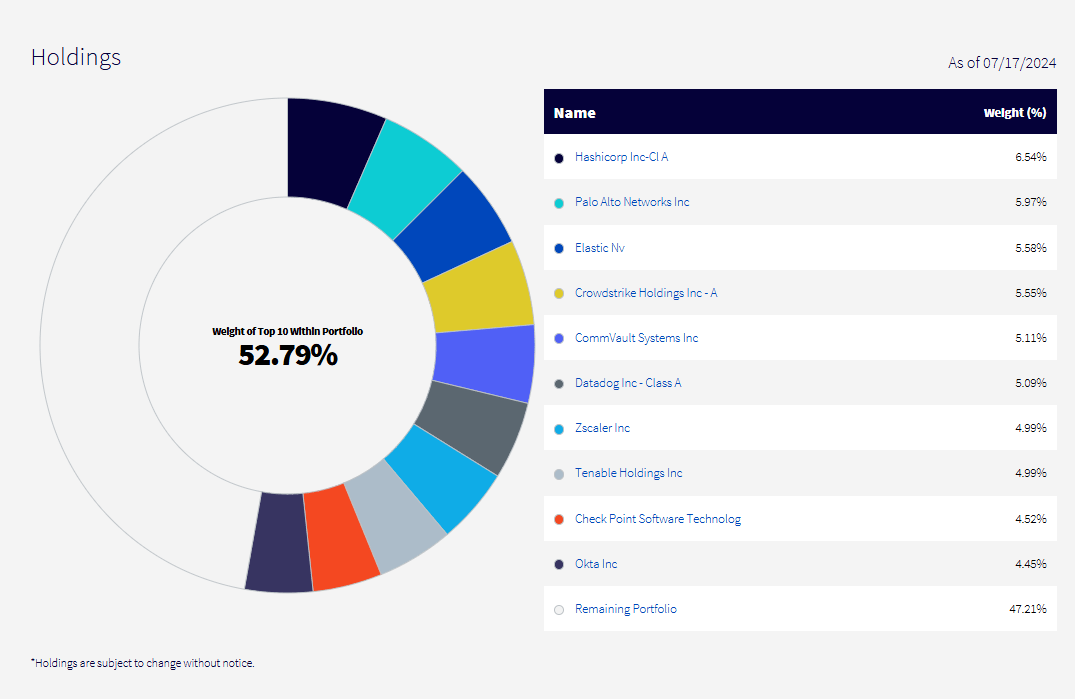

Because this is a narrowly focused fund, it should come as no surprise that over half the portfolio is in the top 10, with the largest position making up 6.54%.

What are these companies? HashiCorp, Inc. (HCP) specializes in antivirus protection and software, addressing all the hacking, cyberwar, and ransomware routes it can find. Palo Alto Networks (PANW) is an industry leader in cybersecurity. Elastic N.V. (ESTC) is a data analytics powerhouse. Datadog provides a leading-edge monitoring and security platform serving cloud applications. And Tenable Holdings, Inc. (TENB) is a security software developer.

Sector Composition and Global Weighting

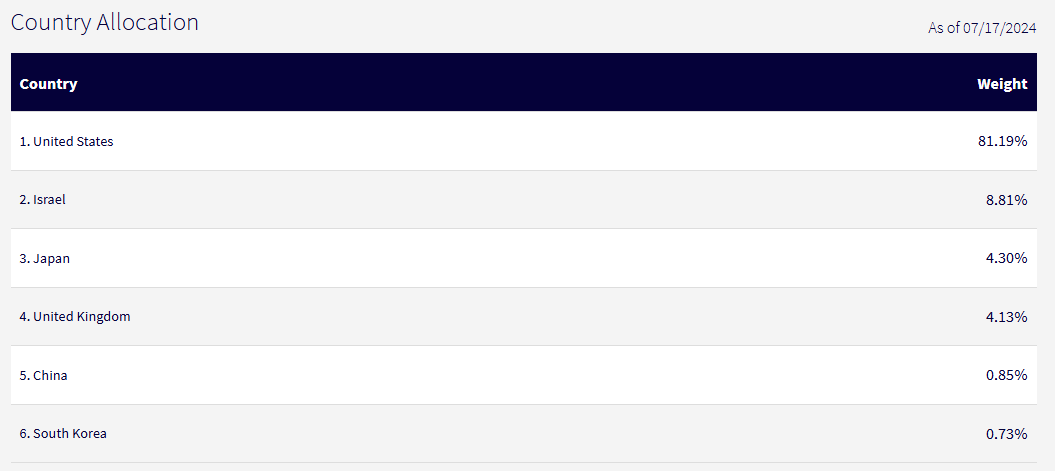

No surprises here, this is a Tech fund. All companies are classified in the sector. What is perhaps more important is the country allocation. This does have global exposure. Yes, the US is the dominant country, but some of these stocks are based out of Israel, Japan, the UK, and China.

Personally, I like international exposure, even if it’s just a bit, as is the case with WCBR.

Peer Comparison

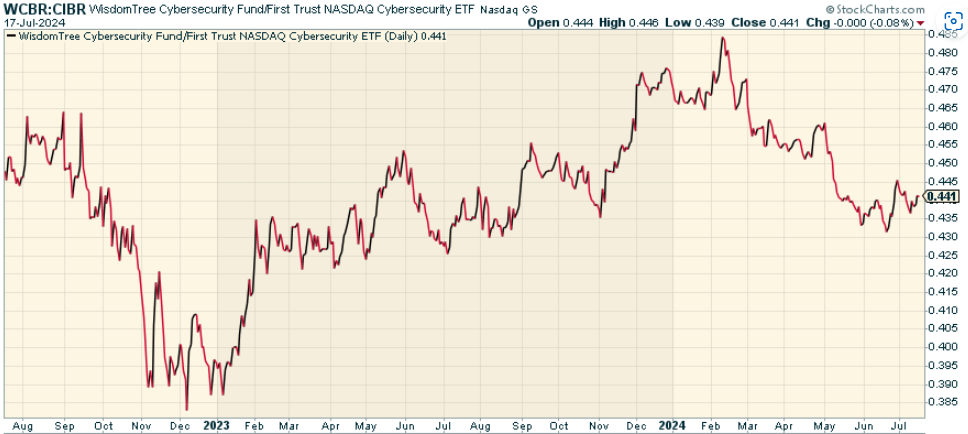

One fund worth comparing this against is the First Trust NASDAQ Cybersecurity ETF (CIBR). Both are attempting to provide exposure to the space. CIBR has slightly more holdings than WCBR, but overall the portfolios are similar. When we look at the price ratio of the two, overall performance on a relative basis is largely the same over the last 2 years. I am not sure if there is any clear differentiation from that alone.

Pros and Cons

On the positive side, the relentless pace of technological change and deepening digitalization of the global economy creates a massive demand for strong cybersecurity solutions. As attack vectors multiply, businesses in all industries are forced to enhance their digital defenses, and the cybersecurity sector gets a sizable boost as a result. WCBR’s focus on high-growth, high-margin names thus makes it a play on this megatrend. The partnership with the world’s leading cybersecurity specialist, Team8, gives it a further edge; by virtue of its proprietary data and in-depth understanding of consumer and industry trends, Team8 is in a prime position to spot fresh trends and startups that could be the next wave of transformation in the sector.

But that narrow focus on a high-growth sector comes with risks of its own. Investors could ultimately face a triple whammy of technology obsolescence, intense competition, and potential regulatory changes. Moreover, nearly all companies in the cybersecurity industry are reliant to a large degree on intellectual property, making them vulnerable to cyberattacks that could harm their key profit generators. In addition, its sector concentration – i.e., heavy investment in a single industry – in cybersecurity could cause significant volatility.

Conclusion

In an age where data is king, and everyone is connected, the need for robust cybersecurity defenses is something that we can no longer avoid. The WisdomTree Cybersecurity Fund offers investors concentrated exposure to the key beneficiaries of perhaps the most important megatrend of our modern age. I like the fund and think it’s a good long-term allocation.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.