While the world loves to focus on the Tech sector and digitization, it’s the Industrials sector which drives meaningful economic growth. Companies in this sector are critical to infrastructure globally, making their performance a big driver of what comes next. Sadly though, momentum in the space has stalled in recent months, and could either be pausing for another run higher, or going through a topping formation. If you think this is more a pause that refreshes, and want to get exposure to the sector, then you may want to consider the Industrial Select Sector SPDR Fund (NYSEARCA:XLI).

This is a sector exchange-traded fund tracking the Industrial Select Sector Index. The fund offers targeted sector exposure to some of the larger industrial players which drive the world forward. Companies in the fund range from aerospace and defense to industrial conglomerates to transportation infrastructure to materials-processing, machinery, manufacturers of durable goods, logistics and commercial facilities management, among others.

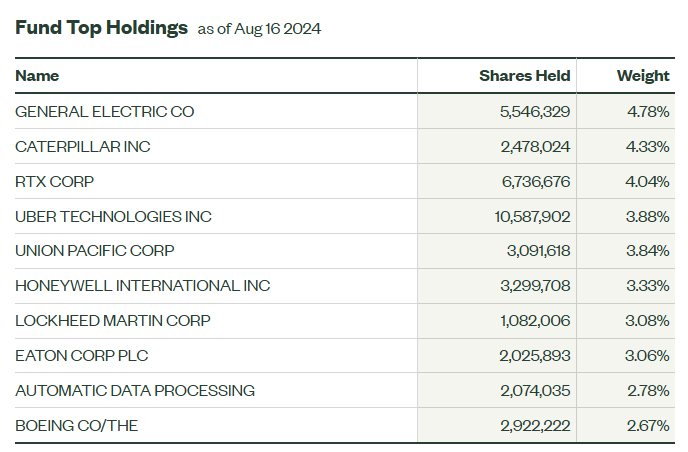

A Look At The Holdings

If you want to know what XLI is all about, look no farther than its top holdings. These companies are giants in terms of their important to economic growth and the way we live our lives. No position exceeds 4.78% of the fund, with overall a fairly spread out mix of companies at the top.

ssga.com

What do these companies do? General Electric has been a leader in American industrial business for more than 100 years, operating in four main segments: aviation, power and water, renewable energy, and healthcare. Caterpillar Inc. is the maker of much of the world’s heavy machinery and construction equipment. Uber Technologies is best known for its ride-sharing business. Union Pacific Corporation is an American railroad network. And Honeywell International Inc. produces everything from parts for planes to building hand dryers and face masks.

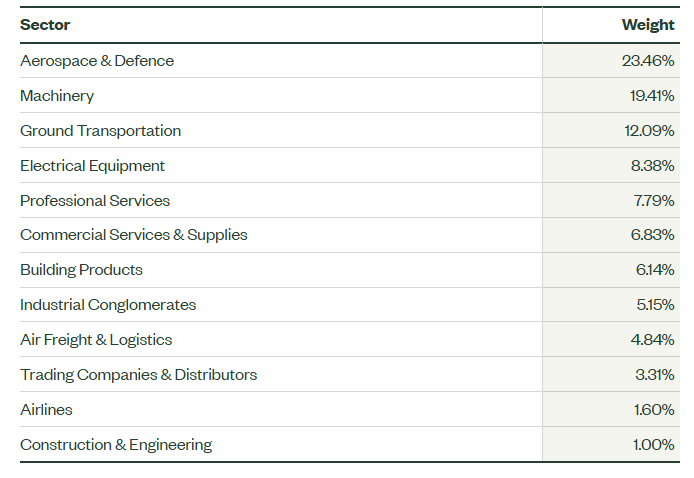

Sector Composition

When we dig deeper, we find the sector has a nice range of sub-industries.

ssga.com

Aerospace and Defense is the largest allocation and covers companies whose business primarily revolves around the design, manufacture, and maintenance of aircraft, spacecraft, and defense systems. It reflects the leading edge of technology and national security. Machinery comes in 2nd, and includes companies that range from espresso-machine manufacturers to construction equipment and industrial machinery manufacturers. And none of this matters unless there is Ground Transportation ranked 3rd. This includes the behemoths that run the nation’s railroads, the heavy-haul trucking companies that carry the freight, and their logistics consultants.

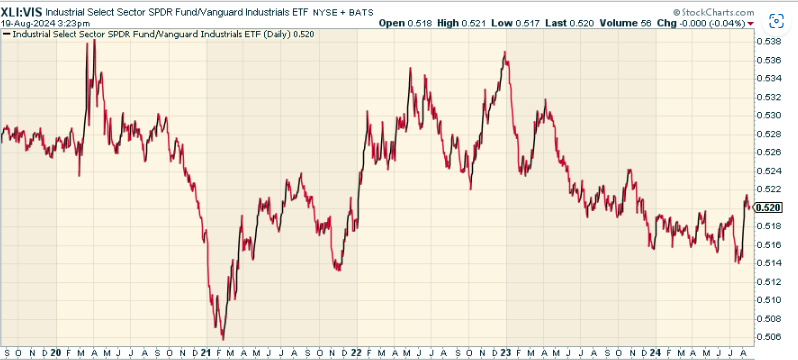

Comparison

Although XLI stands out as a focused sector ETF in the industrial space, it is certainly not unique. One fund worth comparing this against is the Vanguard Industrials ETF (VIS). This ETF tracks the MSCI US Investable Market Industrials 25/50 Index. When we look at the price ratio of XLI to VIS, we find that the two have been in a wide range, but it’s not clear which has the bigger performance advantage over the other. In other words, both get the job done in terms of broad tracking.

stockcharts.com

Pros and Cons

On the plus side? It’s targeted. When you buy XLI, you are investing strategically in an industry that is innovative and plays a crucial role in the real economy. XLI’s portfolio holds the most dynamic companies across industries that are driving economic growth. These industries include aerospace and defense, vehicles and parts, machinery, transportation, construction and agricultural equipment, and all other industrial manufacturing companies. Investing in XLI means owning shares in industry leaders, the top dogs of their respective sectors with solid track records, dominance and growth potential.

Still, it is this sector focus and exposure that brings risk to XLI. The industrial sector is well-known for its significant cyclical nature – it is typically associated with the wider economic cycles, experiencing ups and downs along them. When the economy slows down or falls into recession, demand for many industrial companies’ products and services likely will, too. Moreover, there is the risk that disruptive technologies might overtake industrial companies or change consumer tastes towards new usage patterns of such companies’ goods and services. Consequently, the ongoing profitability and market position of such companies might become at risk. Given the holding of traditional industrial companies within XLI, this might adversely affect the overall fund performance.

Conclusion

For those investors who want to make a bet on a pickup in real economic growth, XLI as an industrial play makes sense. I think the sector can certainly have years of outperformance ahead, though I, personally, might want to wait a bit before making a concentrated bet, given my own personal views on economic slowdown risks. Still – if you’re looking to get away from Tech, this fund can help.

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Get 50% off for a limited time by visiting https://seekingalpha.com/affiliate_link/leadlag50percentoff.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.