The growth story in energy demand is real. It’s leading to innovative strategies from companies trying to secure reliable and sustainable energy sources. Traditional energy sources, particularly oil and gas, continue to play a vital role in this evolution. Natural gas, for example, remains a key component in meeting the rising energy demands of AI and data centers. The resources required—whether natural gas, solar, wind or nuclear— have a source feedstock or inputs of minerals and more to meet this power demand.

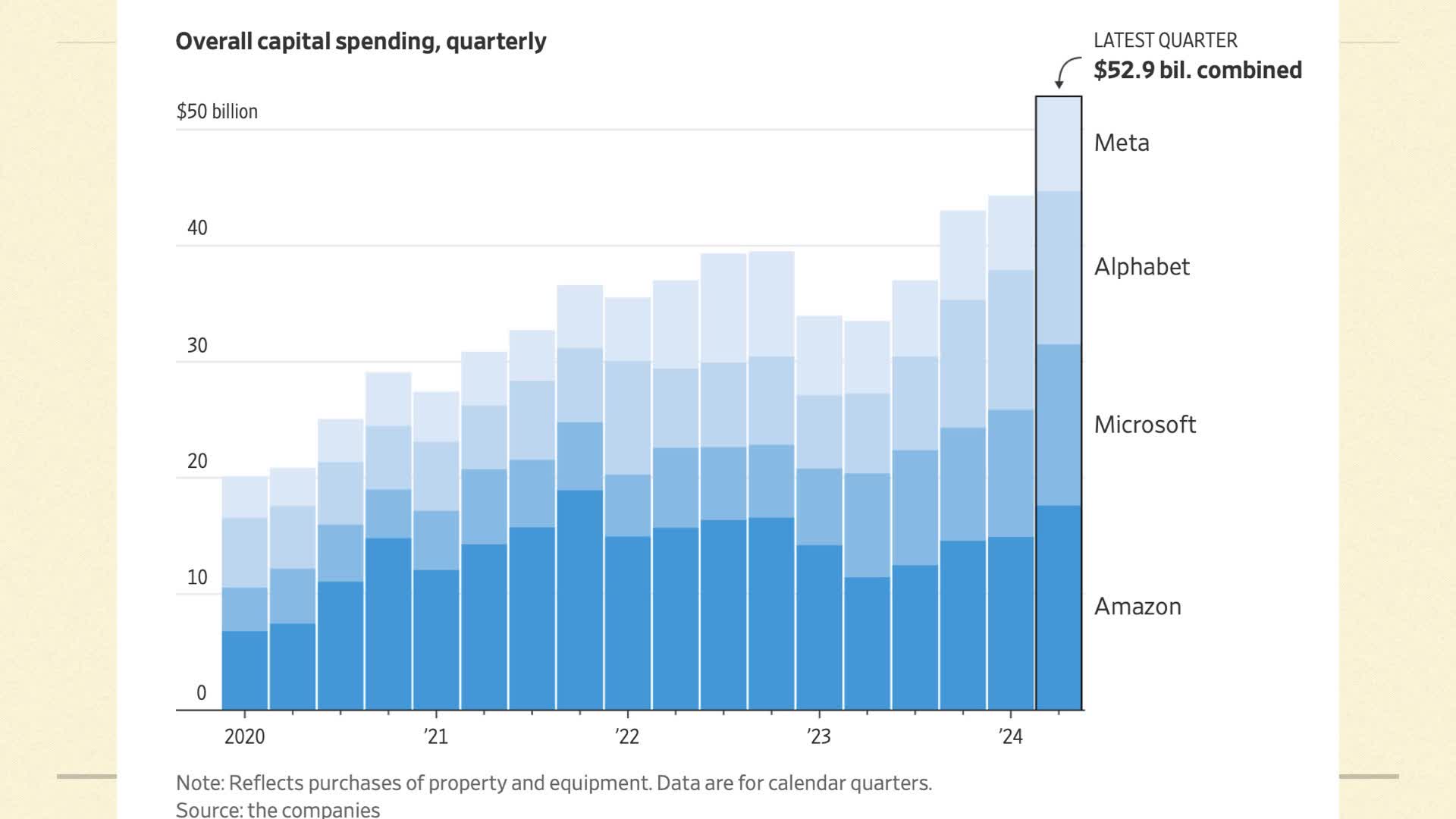

Big tech is pushing the growth of energy in the U.S. and elsewhere. The top four big tech firms — Meta (META), Alphabet (GOOG) (GOOGL), Microsoft (MSFT), and Amazon (AMZN) — spent nearly $100 billion of cap ex in the first half of 2024. This is largely for infrastructure investments connected to the cloud- and AI-data center development.

Mega Cap Capital Spending, 1H 2024 (WSJ)

Quantifying demand

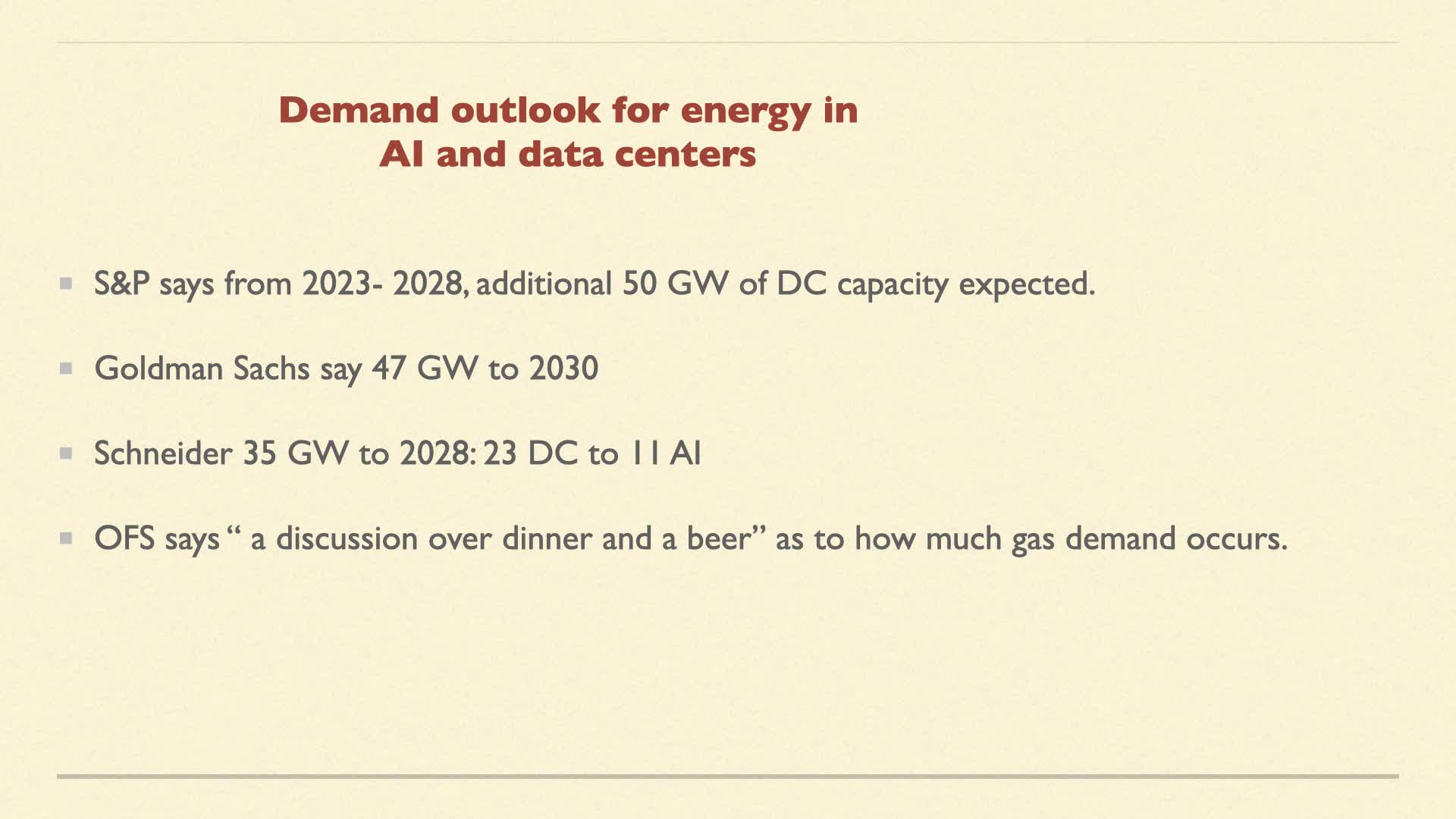

The exact demand for energy for data centers and AI-related infrastructure is unclear, with projections ranging from 35 to 50 gigawatts of additional data center capacity by 2028 or 2030. The Paris-based IEA is attempting to quantify the demand for power generation and will convene a conference in December of this year. According to their calculations, electrification globally was expected to grow 4% lead by: China (6.5%), India (8%) and the U.S. (3%) in 2024. It’s partly economic growth, excess heat and thus A/C demand, and increased electrification owing to development. They suggest a stocktaking of the power generation demand surrounding digitalization. The Texas grid was called out as an example, with top-level thoughts discussed in many of my earlier posts.

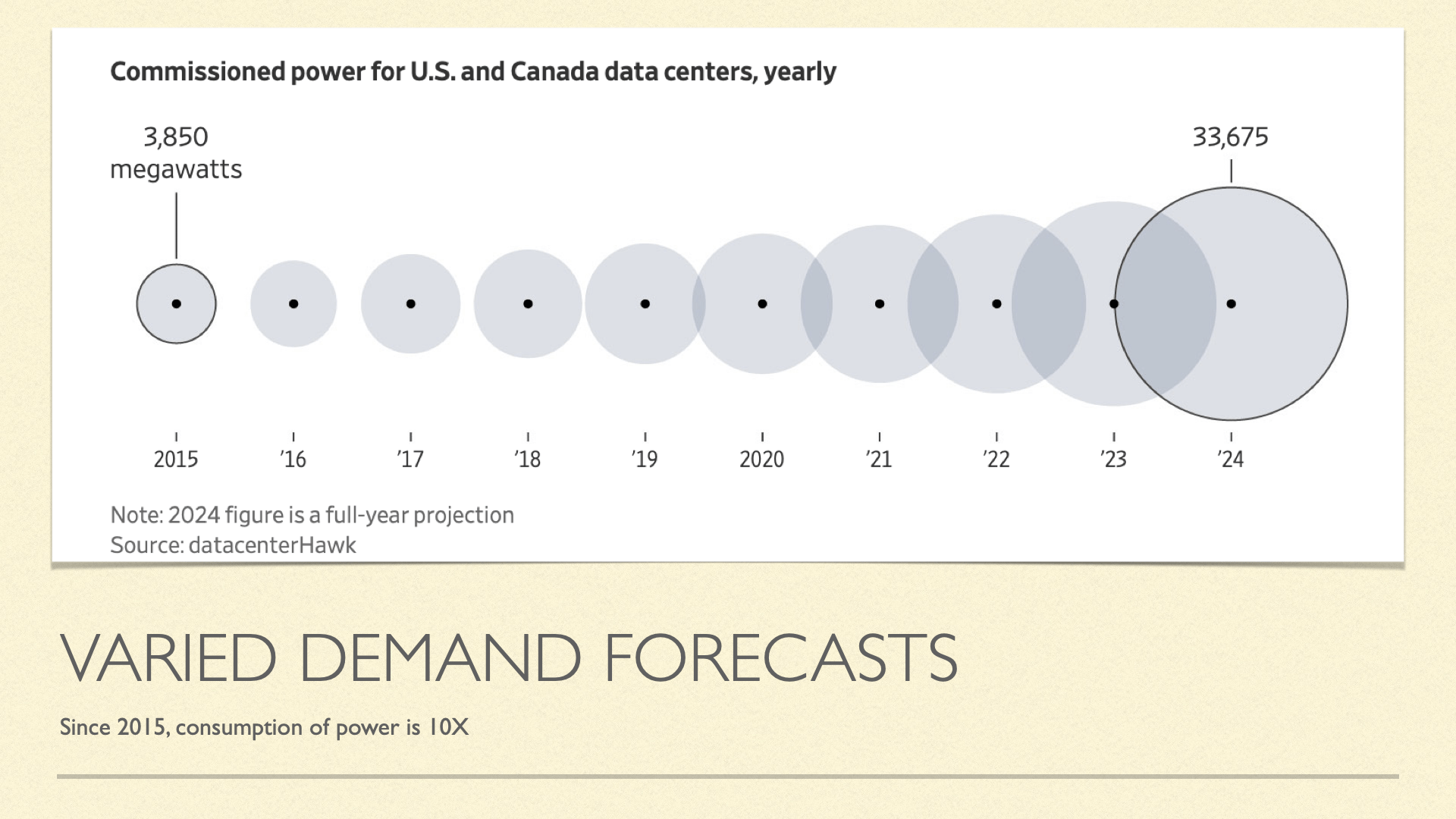

Varied forecasts of data center power demand (Author and see slide)

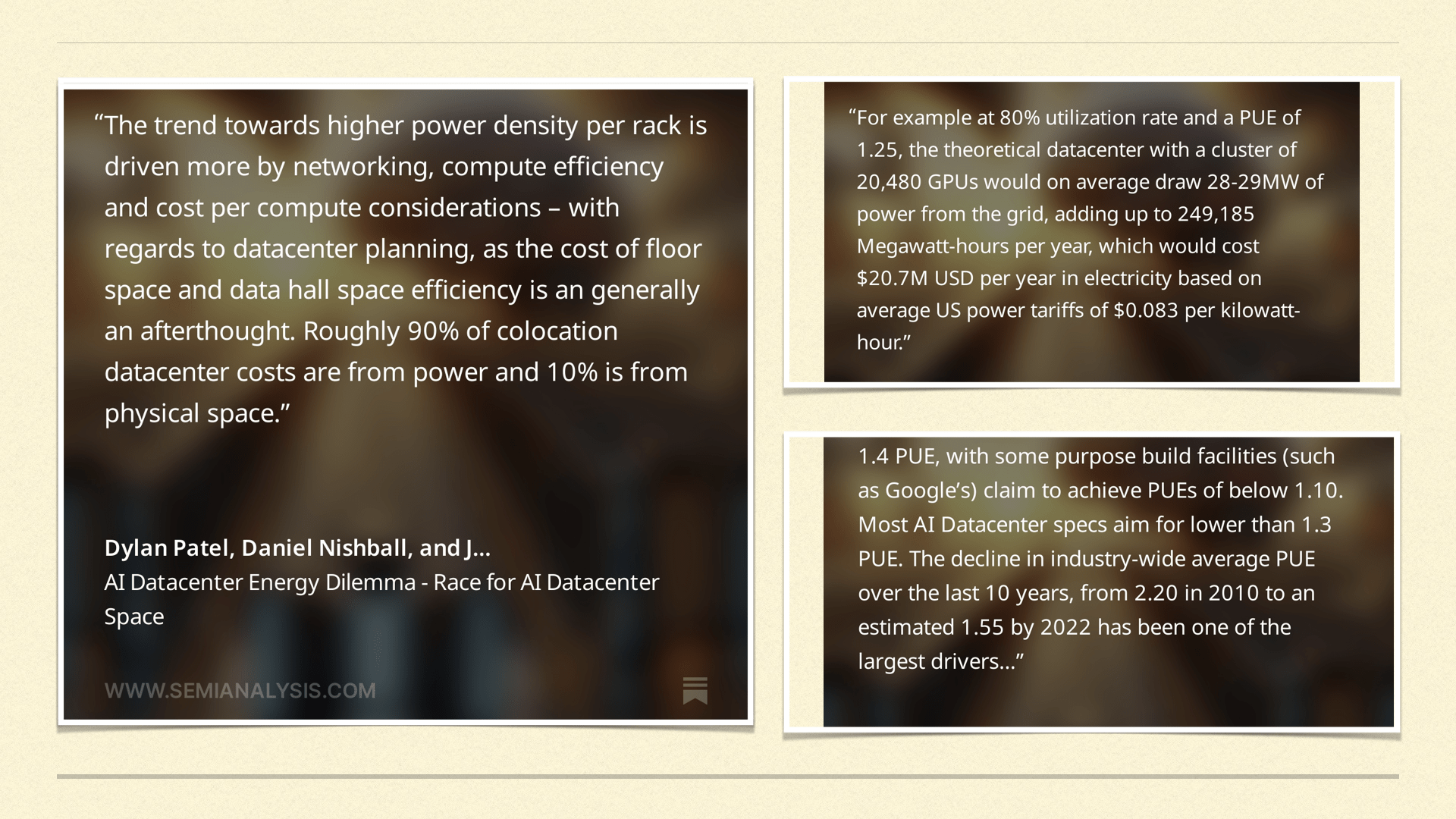

In digging through research, three things stand out:

1) 90% of data center costs are for power.

2) Data centers spend on power is significant.

3) Data centers (and their servers) are becoming more efficient.

But, the demand for energy of the basic CPU to an AI-GPU is 10x based on the latest information of Semianalysis. (This is constantly changing at the margins too.)

How Much Power: CPUs and GPUs (Semianalysis)

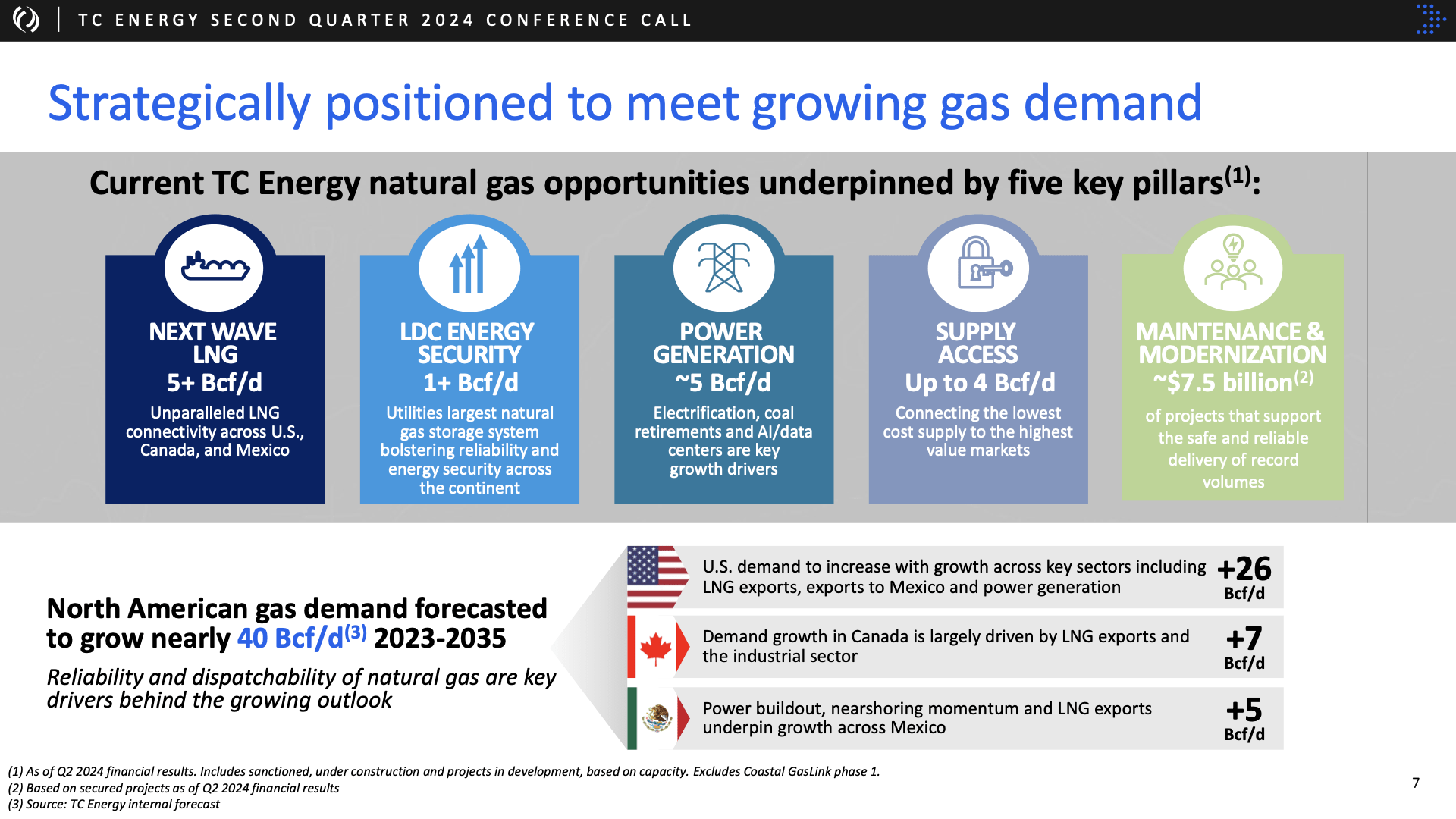

The Canadian-based TC Energy (formerly Transcanada) (TRP) estimated the gas demand going forward. Notably, they calculated 40 bcf/d over 2023-2035. Of that amount, roughly 26 bcf/d is the US market, with LNG exports, exports to Mexico and power generation underlying the demand. They attribute 5 bcf/d to data centers and some electrification plus coal retirements. This is considerable growth in an approximate 110 bcf/d market.

Quantifying gas demand (TC Energy presentation, Aug 2024)

In the field

Oil and gas remain central to the global energy landscape for both advanced economies and developing world economies. The good news: Companies are becoming more efficient. As a depletable resource, aside from new field developments in say Guyana, companies like Exxon Mobil (XOM) and Chevron (CVX) are investing in enhanced oil recovery techniques to improve efficiency and prolong the life of existing resources, alongside sustainable fuels’ plays.

BP’s (BP) recent announcement of partnering with Palantir (PLTR) is an interesting new AI development. The details offered merge an existing relationship between the two firms, seeking to further enhance operational efficiency. They plan to use LLMs (large language models or generative AI) for this. (See early days AI, LLM work here on Seeking Alpha.)

Importantly, in 10 years, data center power demand grew 10 times in absolute terms. Goldman Sachs notes that data center-AI demand increases U.S. power generation by about 1% of their 2.4% increase of U.S. power demand from 2022-2030.

Data center power gen growth (WSJ)

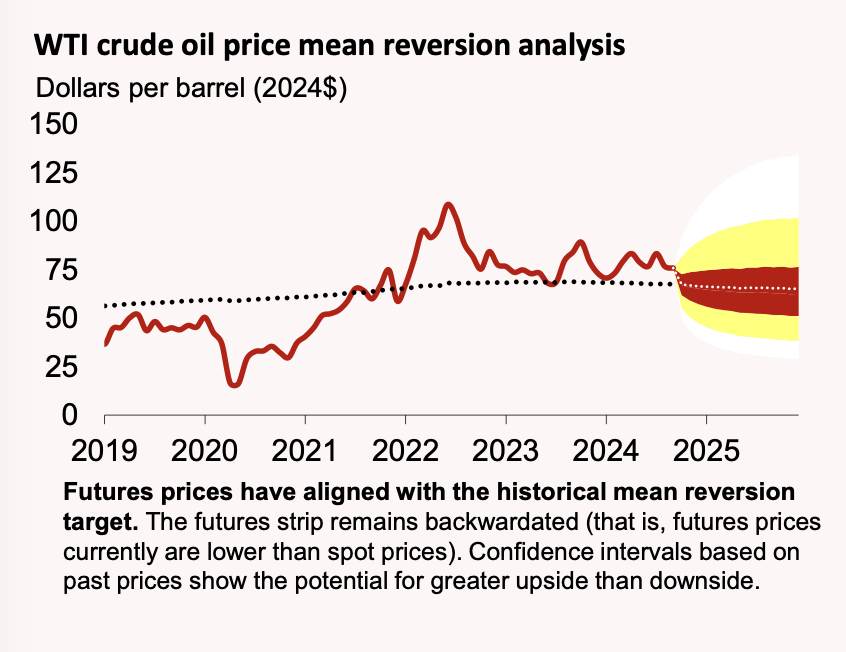

In considering oil and gas fundamentals, a recent TXOGA report suggests that oil markets are tight, to which I concur. Both oil and gas prices are most likely to land toward the upside, based on macroeconomic factors and supply/demand fundamentals.

The chief economist Foreman writes:

Oil market fundamentals tightened further, yet prices continued to fall. West Texas Intermediate (WTI) crude oil dropped by nearly $6 per barrel week-over-week (w/w) to under $68 per barrel as of September 6, despite OPEC+ delaying supply increases by at least two months. Notably, U.S. crude oil inventories fell by 7.6 million barrels w/w as of Aug. 30, placing this change in the top 5% of all weekly inventory shifts on record since 1982, according to the Energy Information Administration (EIA). U.S. crude oil inventories have cumulatively dropped by 42.4 million barrels (9.2%) over the past 11 weeks, reaching the bottom of the five-year range.

Oil prices, WTI, Sept 2024 (TXOGA)

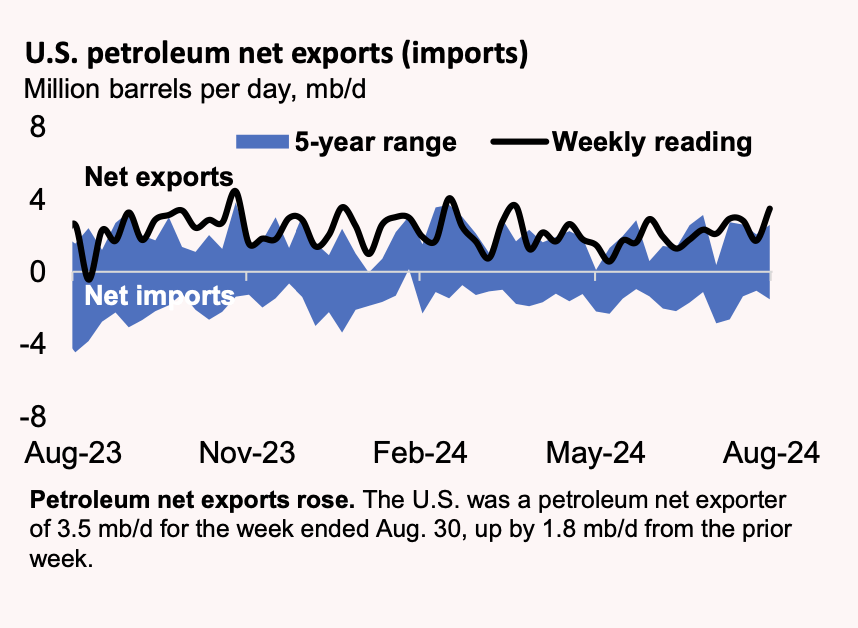

Petroleum exports depict strength. As noted in a recent podcast and video (pinned in comments and below), Texas is an industrial state, both using considerable energy and producing it, plus exporting.

US Petroleum Exports (TXOGA, Aug 2024)

The integration of AI and energy is just beginning. Nobody has a real fix on the energy requirements. We’re all at the base of a hill looking up. As companies explore the potential of AI in optimizing their business operations and strategies and in conjunction with energy production and consumption, this evolution may happen in fits and starts. It will take time to fully realize the benefits of these investments, and likely non-linearly. Meanwhile, energy firms in oil and gas and power will need to adapt and innovate to help shape these outcomes. Investors will have to dig deeper to find the hidden jewels.

Video of extended investment discussion:

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.