The Federal Reserve’s decision to cut interest rates by 50 basis points marks a notable change in the fixed-income market. As the Fed moves away from its restrictive posture and shifts its focus from inflation control to mitigating the risks of a weakening labor market, fixed-income investors should look beyond the immediate market reaction and consider the broader implications of the Fed’s policies.

In this environment, credit selection becomes paramount for investors. As slowing economic growth begins to pressure corporate balance sheets, investors need to closely assess which segments of the credit risk spectrum – and which sectors and companies within those segments – present the most attractive alpha-generation opportunities.

Follow the Fed

Rather than fixating on the impact of any one Fed meeting, investors should consider how the Fed’s decision-making framework is changing — and what this new approach means for the economy. The Fed’s dual mandate focuses on inflation and employment, and for the past two years, inflation has been the main concern. But inflation has come down significantly — in the second quarter alone, it was at 1%, compared with the 8%–9% range two years ago. While inflation has cooled, the reason the Fed is making its move now is due to concerns that the labor market is less robust and potentially weakening.

The current landscape is already quite restrictive. Starting yields are near their highest point in 20 years, which means the Fed feels it no longer needs to keep applying the brakes on the economy. Yields were recently around 5.5%, and the neutral rate (i.e., the point at which the Fed is thought to be neither boosting nor slowing the economy) closer to 3%. This leaves the Fed plenty of room to maneuver as new information about unemployment and other economic slowdown indicators come into focus.

Diverging outcomes in a shifting economy

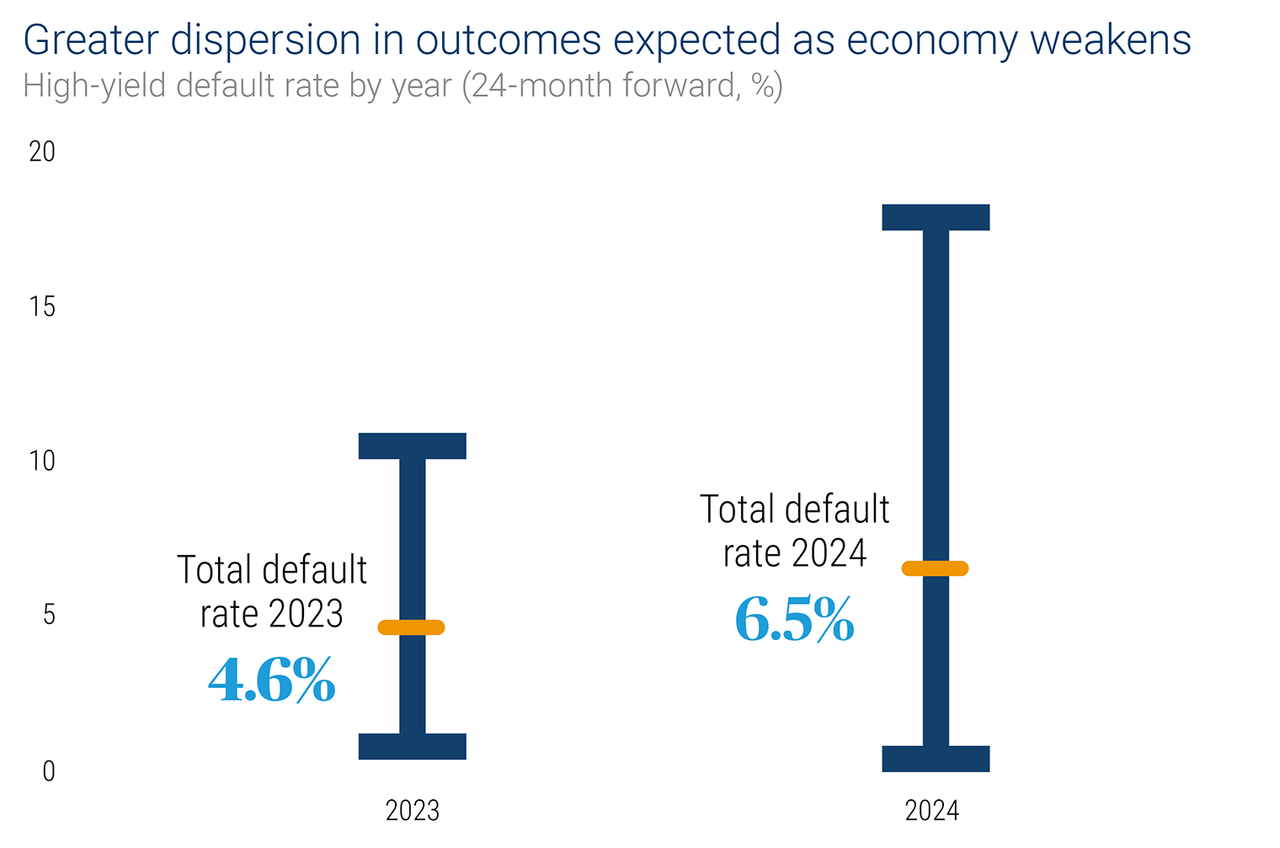

What does the rate cut mean for fixed-income investing? On one hand, a rate cut acts like a rising tide that lifts all boats, providing an immediate boost to bond prices. On the other hand, the risk of a weakening economy will likely produce a wider range of outcomes in some areas of fixed income. This dispersion can be observed in credit spreads — the additional yield that a bond offers over comparable Treasuries.

Source: Columbia Threadneedle Investments, as of September 2024. Industries included: Automotive, banking, basic industry, capital goods, consumer goods, energy, financial services, health care, insurance, leisure, media, real estate, retail services, technology and electronics, telecommunications, transportation and utilities.

In recent months, the most liquid, highest-quality investment-grade corporate bonds have become relatively “expensive.” In other words, they’re not offering much additional yield to compensate investors for the incremental risk these bonds present relative to Treasuries. Because of concerns about the economy, fixed-income investors have been willing to pay more for bonds issued by corporations with solid fundamentals. Investment-grade issuers have, for the most part, managed their liquidity well, kept leverage low and maintained attractive profit margins in the post-pandemic environment, which has led to historically low credit spreads.

However, in the context of a softening economy, we anticipate 2025 will be characterized by greater variability in economic outcomes, default rates, and the fundamental performance of industries and individual companies. This trend is already becoming apparent. For example, the telecom and media sectors could face heightened default risks due to structural pressures, while within consumer credit, default and delinquency rates are expanding beyond just the lowest-income borrowers to a broader range of consumers.

Election implications for fixed-income markets

Looking ahead to the upcoming election, several potential scenarios could affect fixed-income markets. The primary concern is not necessarily whether the presidency shifts between parties, but whether one party gains control of the House, Senate and presidency. A single-party sweep could create heightened uncertainty, potentially leading to larger deficits through increased spending or reduced taxes. For fixed-income markets, the concern is more about upside surprises to deficits, which could lead to an increased supply of government bonds and push long-term yields higher.

A different kind of global monetary cycle

This global rate-cutting cycle contrasts sharply with the rate-hiking cycle of 2022. At that time, the Fed led the way, with other central banks following suit. Now, the trend has reversed; the shift began with global central banks outside the U.S. — including the European Central Bank, the Bank of England, and others in Europe and Canada — cutting rates in response to slowing economic activity. This early movement by global central banks has created momentum and broader support for the narrative of lower interest rates to combat slowing growth.

Bottom line

We are at a turning point in the fixed-income market. The Fed’s recent rate cut and shift to a more accommodative stance signal a new phase for fixed income. As central banks lower rates, reinvestment risk rises for those holding cash or short-term instruments, prompting investors to look for higher returns elsewhere. The success of the “T-bill and chill” trade may soon fade as high-quality fixed-income assets become more appealing.

Given the potential for further broad-based economic softening and subsequent demand destruction, a disciplined approach with a strong emphasis on research is essential. With broad fixed-income assets receiving a bump from falling rates, the opportunity for outperformance lies in robust credit selection — identifying companies capable of navigating these challenges—those that can adjust their balance sheets and manage cash flows effectively — while avoiding those likely to struggle.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.