The Rise in Popularity of Laddered Protection Strategies

Over the past few years, the US market has seen a rise in the popularity of Structured Outcome ETFs – primarily comprised of ETFs offering partial downside protection (e.g., 10% or 20% buffer) and more recently those offering 100% downside protection. In May 2024, Calamos Investments introduced the world’s first suite of ETFs designed to deliver 100% protection and upside participation (to a cap) over a one-year outcome period relative to the S&P 500, Nasdaq 100 or Russell 2000.

Today, the entire Structured Outcome ETF space encompasses more than $50b in assets. While investors can buy and sell a Structured ETF anytime the market is open, ETF issuers (like Calamos) often issue multiple “series” of the same protection level, typically on a monthly cadence, to give investors multiple opportunities to buy in near the beginning of an outcome period so they can achieve the stated protection level and cap rate.

The increasing popularity of these products has led to the development of a laddered approach to Structured Outcome ETFs, offering an even more turnkey approach seeking to mitigate risk and capture growth while maintaining flexibility, liquidity and tax efficiency. A laddered strategy enables single-ticker access to a full suite of ETFs and structurally involves:

- Staggering the multiple ETFs across different outcome periods (e.g., rolling 1-year).

- Offering the same underlying exposure across the bundled ETFs (e.g., S&P 500).

- Affording a high level of protection for each underlying fund.

The result is a continuously and highly hedged experience, with measurable upside participation along the way.

Today, nearly $8b (of the ~$50b in Structured Outcome ETF assets) are tied to laddered approaches. This swift demand has mainly stemmed from financial advisors increasingly implementing model portfolios and looking for a turnkey approach to allocate across multiple client accounts through a single ticker. Institutional clients looking for upside while preserving assets have also spurred additional demand.

Why a Laddered Approach Makes Sense

- Continuous Protection: By investing in multiple Structured Protection ETFs with different reset dates, investors can access some level of continuous downside protection. As each ETF reaches its reset date, a new one begins, providing an uninterrupted hedge. This is illustrated in the chart below.

- Smoother Return Experience: A laddered approach minimizes timing risks. If an investor buys a single Structured Protection ETF, the outcome is dependent on the market’s performance over that specific defined period. By laddering, investors reduce the risk of entering at an unfavorable point and can experience smoother returns with much less volatility over time, especially relative to stocks, bonds, and even other buffer strategies that offer less than 100% protection.

- Diversified Time Horizons: Markets are inherently unpredictable. A laddered approach spreads exposure across different market conditions, capturing periods of volatility or growth more effectively. This diversification of time horizons can lead to better long-term outcomes by capturing various phases of the market cycle.

- Turnkey Solution with Daily Liquidity: One of the key advantages of Structured Protection ETFs is that they can be bought and sold any day the market is open. This liquidity, combined with a laddered approach, offers flexibility to rebalance or adjust allocations based on market conditions while maintaining a hedged position.

- Tax Efficiency – Structured Protection ETFs maintain tax efficiency and anticipate distributing no capital gains from the ETF. Investors’ capital grows and compounds tax-deferred inside the ETF. At the end of each outcome period, the options inside each Structured Protection ETF simply roll into a new outcome period. The ETF will never “mature” or expire, which contrasts with most capital protected solutions in the market today, where returns are often treated as ordinary income upon a set expiration date.

Why Now?

In today’s environment, where market volatility and interest rate uncertainty are ever-present, a laddered strategy offers a compelling balance between risk and reward, especially for those looking to allocate “safe” money or for those nearing or in retirement. And for those looking for a way to hedge without completely forfeiting growth potential, a laddered approach to Structured Protection ETFs may be a straightforward solution.

Historical Performance of Laddered Protection Strategies

Below are several charts illustrating the recent performance of various laddered protection strategies. For ease of reference, each of the strategies below deliver laddered exposure to 12 one-year outcome periods (each starting at a different calendar month) relative to the S&P 500, but with varying degrees of protection.

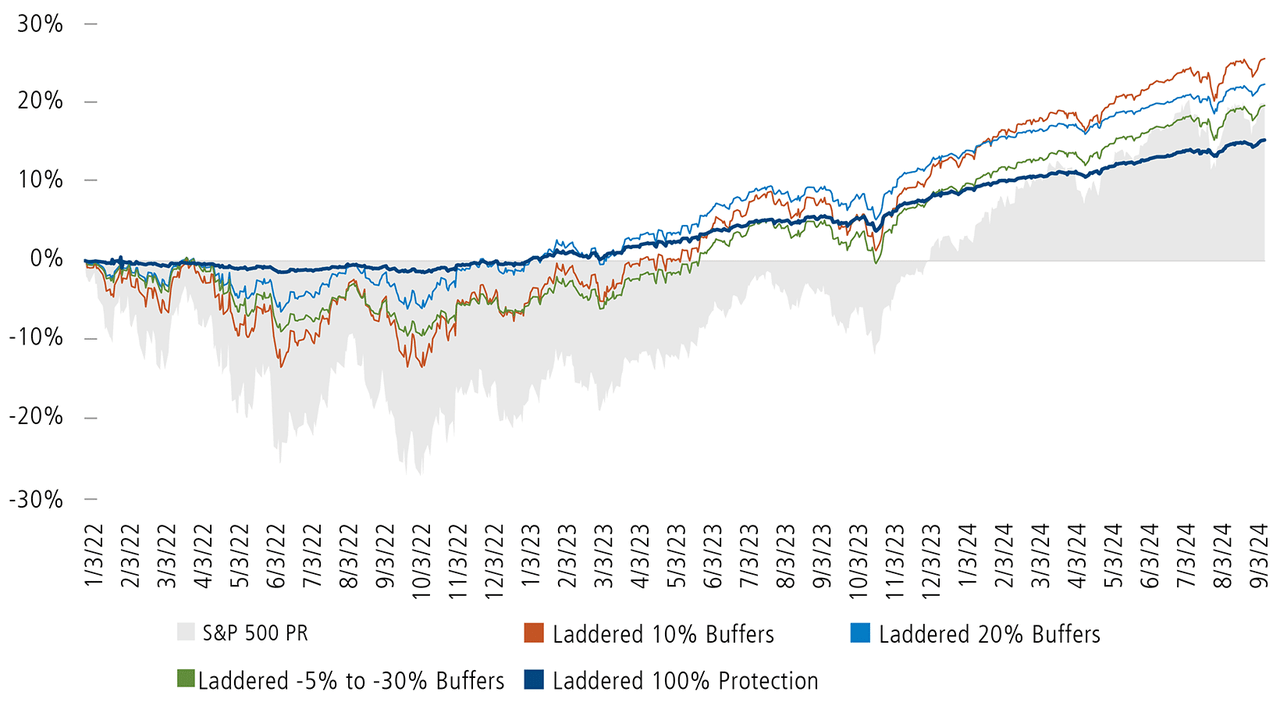

Exhibit A illustrates the recent performance of various laddered protection strategies, as represented by MerQube Buffer and Capital Protected Laddered Indices.

Exhibit A: Recent Performance of Laddered Protection Strategies

2022–2024 YTD

Source: Morningstar. Performance data quoted represents past performance, which is no guarantee of future results.

Key Takeaways:

- Through the period, all laddered strategies offered improved risk/reward relative to the S&P 500. The 100% Protection Laddered Index exhibited the best overall risk per unit of return of any laddered buffer strategy in the market, delivering a significantly hedged experience and strong upside potential.

- The protection level was largely maintained throughout the outcome period. For example, the 100% Protection Laddered Index maintained near 100% protection through the bear market of 2022, exhibiting only a 1.5% drawdown.

- The 100% Protection Laddered Index captured 91% of the S&P 500 return over the period, with 85% less volatility.

- The laddered protection indexes offer investors the potential to find the risk/reward level that suits their needs in a turnkey approach without “giving up” the intended hedge effectiveness of any individual portfolio outcome period. In fact, the diversification of cap rate and outcome period may provide an even smoother overall experience over time.

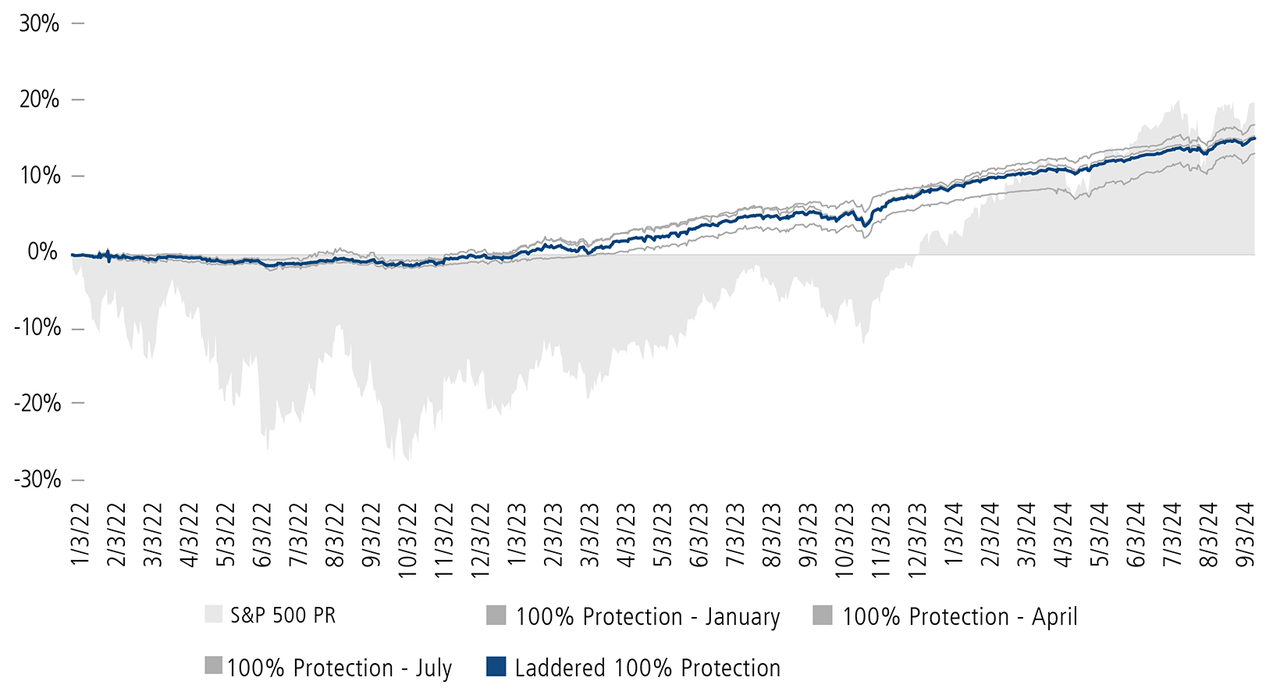

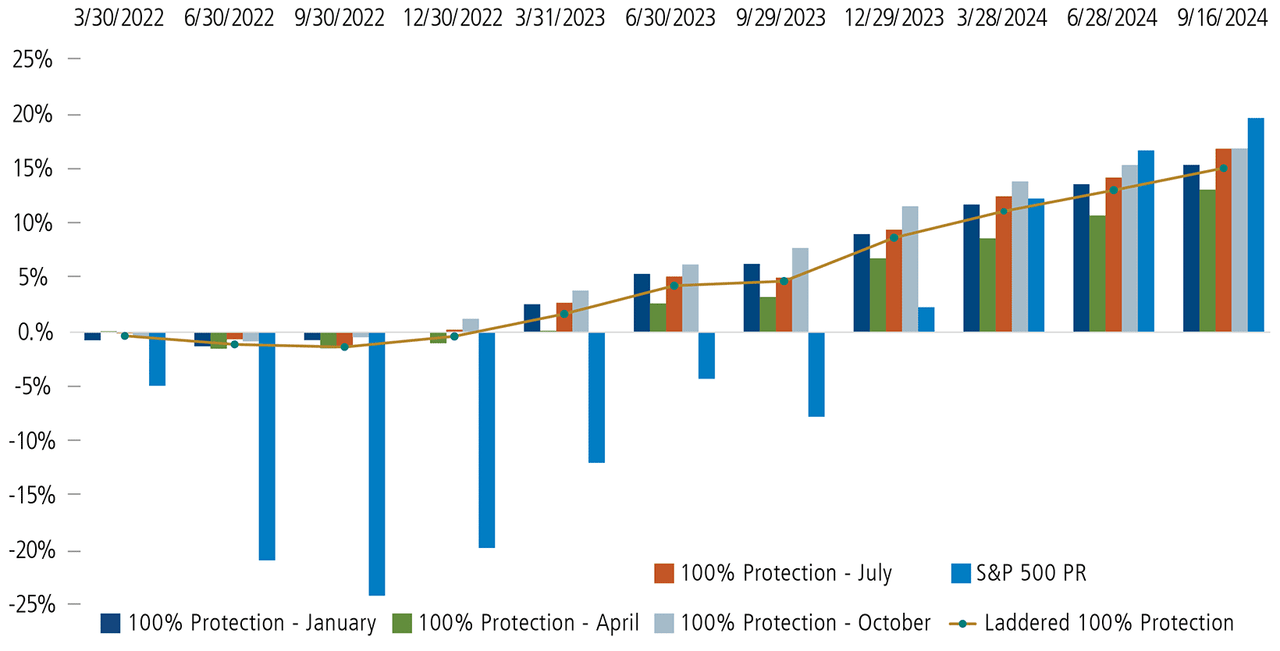

Exhibits B and C illustrate the performance of the Laddered 100% Protection Index relative to four of the individual 100% Protection Series underlying funds: January, April, July and October. Exhibit B illustrates the performance over the same timeframe as Exhibit A, while Exhibit C dives into the protective power of the laddered approach and potential benefits of outcome period diversification by illustrating the cumulative performance of each index in quarterly intervals.

Exhibit B: Recent Performance of Laddered 100% Protection vs. Individual Series

2022–2024 YTD

Source: Morningstar. Performance data quoted represents past performance, which is no guarantee of future results.

Exhibit C: Performance of Individual and Laddered 100% Protection Indexes

Cumulative return snapshots at each quarterillustrates the protective power of outcome period diversification

Source: Morningstar. Performance data quoted represents past performance, which is no guarantee of future results.

Key Takeaways:

- The laddered approach delivered remarkably similar performance over the illustrated period, providing nearly 100% protection during the down market in 2022 and strong upside capture relative to the individual 100% Protection Indexes.

- The laddered 100% protection index demonstrated its ability to protect nearly 100% of the capital during market drawdowns. For example, on 12/30/22 the 100% Protection – January Index concluded its outcome period and was down 0%. The intraperiod performance of the other monthly indexes ranged from -1.01% (April index) to +1.25% (October series). The Laddered 100% Protection Index was down -0.38% over this same period. In other words, over this January-to-January 2022 outcome period, the Laddered Index protected nearly 100% of the downside (99.62%).

- On the upswing, the Laddered Index demonstrated its ability to keep pace with the individual monthly indexes, achieving approximately the average return of the underlying individual indexes.

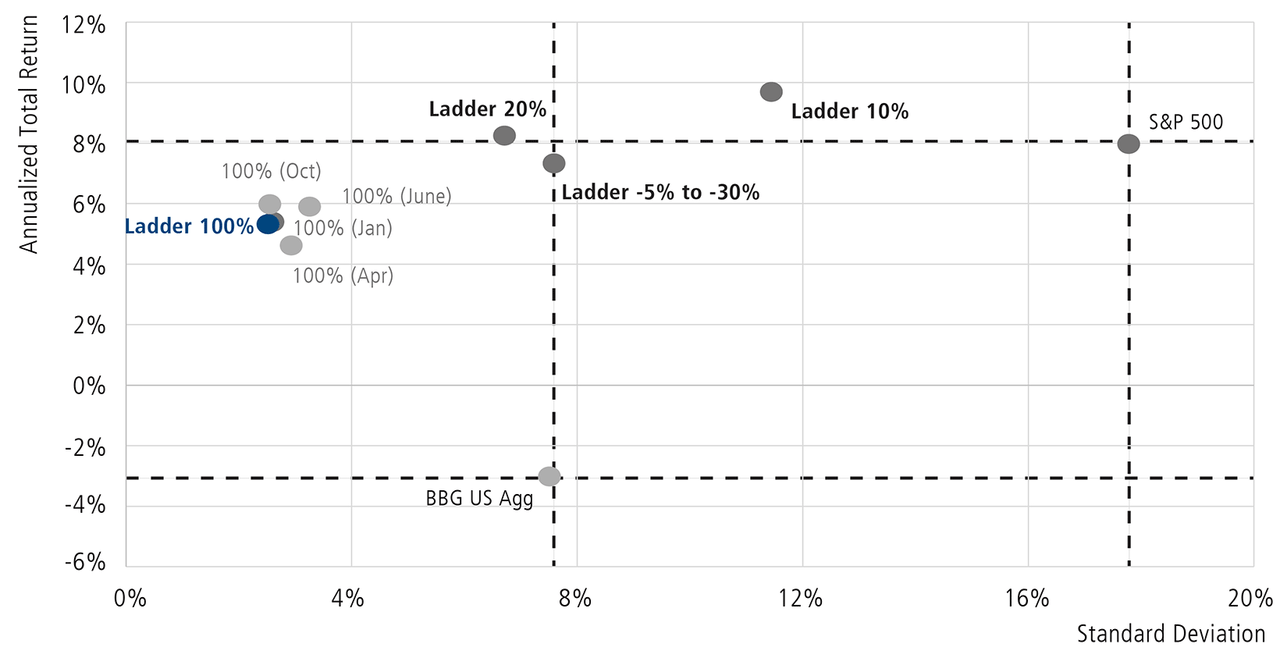

Risk versus Reward

Exhibit D illustrates the 3-year risk and reward of each aforementioned laddered protection (or buffer) index, along with the individual 100% protection indexes. And for comparative purposes, the S&P 500 and Barclays US Aggregate Bond Index are overlaid as well.

Exhibit D: 3-Year Historical Risk vs. Reward

Source: Morningstar. Performance data quoted represents past performance, which is no guarantee of future results.

Where Do Laddered Strategies Fit in a Portfolio?

Laddered structured outcome strategies are becoming increasingly popular as a turnkey portfolio solution. Below are a few portfolio application ideas, both as an equity or fixed-income replacement.

- As an equity hedge: Many financial advisors are using laddered strategies to de-risk equity portfolios in an effort to put on a continuous hedge without sacrificing all of the upside potential.

Example: Client A desires to preserve recent gains and reduce equity risk through year-end. To accomplish this, the advisor may move 50% of the client’s equity exposure to a laddered 100% protection strategy, thereby achieving approximately 50% less downside risk going forward, while still allowing for measurable upside participation along the way. And because the client has reduced their downside risk by approximately 50%, the client’s equity portfolio has the potential to achieve additional upside beyond the blended cap rate of the laddered strategy.

- As a fixed income replacement: Trillions of dollars in assets sit in short-term debt instruments. Structured Protection strategies allow investors to obtain similar or better downside risk management (see risk/reward chart above) than bonds, with meaningfully better upside potential. This is especially true on an after-tax basis. To date, most capital protected instruments have an expiration date, at which point gains are treated as ordinary income from a tax perspective. When executed inside the ETF wrapper, a structured protection strategy may grow and compound tax deferred. Tax is only paid upon sale of the security, which would be treated as a long-term capital gain if held for longer than one year. Over time this tax “alpha” can far outweigh the after-tax yield from a bond or CD.

Example: Client B is nearing retirement and looking to outpace inflation over time while avoiding much of the drawdowns typically associated with the stock market. Rather than relying on the fixed-income markets for risk management and income (which are inversely correlated to inflation), the advisor decides to use laddered 100% protection to achieve Client B’s goals. The client can now outpace inflation over time via exposure to the stock market and maintains strong downside risk management. And if rates rise, the advisor knows the average upside cap rate will also rise, allowing the investor to participate in greater upside opportunity at precisely the right time. Regarding income, the advisor and client develop a plan to take systematic withdrawals from the portfolio’s capital gains, likely at tax rates that are more advantageous than ordinary income rates.

- To manage balance sheet assets: Many financial professionals operate large balance sheets on behalf of institutions, and desire upside participation but, as a matter of policy, are unable to accept significant balance sheet risk. To that end, institutions are using laddered strategies (particularly the 100% protection strategy) to access equity-linked upside growth potential, but without taking on outsized balance sheet risk. And the added flexibility and liquidity allow easy access to the institution’s capital should the need arise.

As more investors discover the merits of investing in the equity market with built-in protection, we believe the laddered approach will continue to gain traction as an innovative and effective solution that allows for a significantly hedged experience while retaining upside potential in a flexible, liquid and tax-efficient framework.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.