Investment Thesis

An increasing need for change in employee hiring processes and the emergence of remote work culture are drivers for freelance platforms growth. The global freelance platforms market size is expected to grow at a compound annual growth rate (CAGR) of 16.5% from 2024 to 2030, while the U.S. freelance platforms market size is projected to grow at a CAGR of 13.1% in the same period.

Upwork (NASDAQ:UPWK) is the market leader with about 31-32% market share in freelance platforms and has an economic moat based on two-sided network effects (from the two sides of the equation: freelancers and employers), albeit not a strong one. This year brought a more challenging environment, and after that I would expect a slightly lower than average growth (due to its bigger size), but that would still give close to 10% expected growth until 2030. Considering that Upwork only recently became profitable and that it has some inherent operational leverage, we could expect a higher EPS growth.

The stock price seems reasonable at $10.47, especially if we look through a Discounted Cash Flow (DCF) model. For extra income and a higher margin of safety, we could further look at a simple strategy involving options, like a Covered Call.

Business Analysis and Economic Moat

Upwork is a standard example of a two-sided marketplace: on one side, the freelancers in search for projects; on the other side, the employers, the companies. Upwork generates revenues from each side in several ways:

- From freelancers: service charges, membership charges, “connects” (virtual tokens required to apply for jobs, but also for “boosted profiles”, which bring more visibility). The highest membership plan for freelancers is called Freelancer Plus, containing a set of benefits (including extra connects), which can help them market their services more effectively.

- From employers: processing and administration fees, membership, service costs. The most complex solution for employers is Upwork Enterprise, offering, among others: access to top 1% experts, support along the way, integrated payroll solution, managed services.

This type of business develops an economic moat of type “network effects”, and more specifically in this case two-sided network effects: the more employers on the platform, the more freelancers will be attracted; the more freelancers on the platform, the more employers will be attracted.

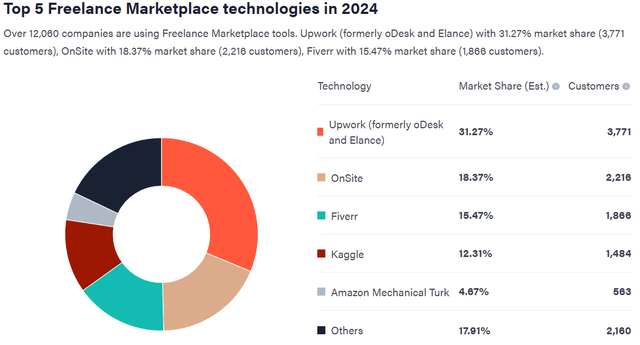

There are usually two-three winners, for example, why a freelancer looking for a very good contract go to the number five on the list? He wants to go to the best platform with the most opportunities. That can vary a little, of course, depending on some factors like geography. And Upwork is the top freelancing platform, with a market share of 31.3%, according to 6sense, and with top geographies United States and India:

Freelance marketplaces market share (6sense)

However, I think we can only speak about a weak (or narrow) economic moat for now, they still have much to prove, like strong Return on Invested Capital (ROIC), or a strong leadership position maintained for several years, in their way to a strong economic moat.

Another moat source could be a “data network effect”: the more clients on the platform, the more data they can collect; the more data, the better the services (for example, machine learning, trained on that data, can offer a best match for a job) they can offer to attract more clients. While they are only scratching the surface of AI for now, that can add up into the future.

Financial Analysis

The revenue guidance for the full year 2024 was lowered to $735m – $745m (up ~7.5% YoY), due to a challenging environment, as the CEO presented in their last earnings call:

This challenging environment showed through with softer top-of-funnel activity than expected in the second quarter. A leading indicator of this softness that we track internally is clients seeking work, which is a measure of the number of clients engaging in an action that leads to a new contract. In Q1, this number accelerated 11% quarter-over-quarter, while in Q2 this number decelerated 6% sequentially, with particular impact in May and June, along with the mix shift of active clients towards very small businesses. While we applaud the resiliency of smaller businesses outperforming other cohorts on our platform, small businesses’ historical characteristics of lower spend per contract and fewer contracts per client lead us to have more caution about performance expectations for the remainder of the year.

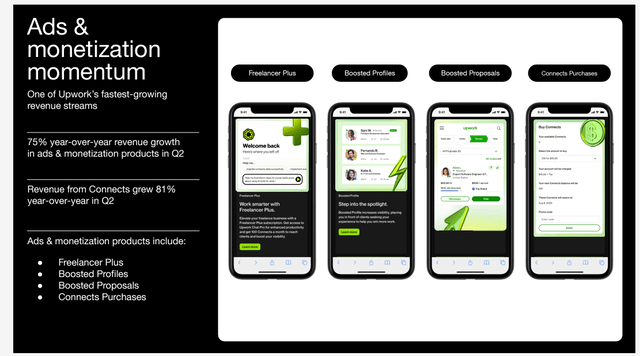

There are, however, some bright spots, especially the strong momentum in ads and monetization:

Investors presentation (Upwork)

In terms of profitability, they maintained the guidance for Adjusted EBITDA at $140m – $150m. This was helped by the decline of 22% in Sales and Marketing (25% margin) and management expects “to maintain a similar level of spend as a percentage of revenue for the remainder of the year”.

On the other side, Research and Development reached a record 27% margin after a 21% jump year-over-year, but they expect “R&D to be higher in absolute dollars year-over-year but decline as a percentage of revenue throughout 2024”.

Their financial position is strong, with $497.7m in cash & equivalents and only $357m debt. This strong position helped them repurchase $100m in shares in 2024, counting for approximately 7% of the current market capitalization.

Fair Value

A relative valuation of Upwork vs. 5 years average is useless today because in 2020 – 2021 the stock was in a stratospheric bubble, fueled by COVID-19 work-from-home policies, so the multiples would be abnormally skewed to the upside.

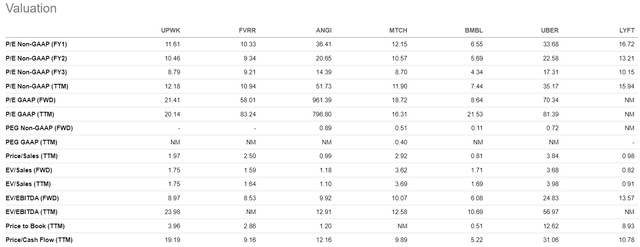

For a comparison against peers, I started with Fiverr (FVRR), their closest rival. Then, I also added other service marketplaces, from different areas:

Upwork peers comparison (Seeking Alpha)

We observe their metrics are remarkably close to the ones of their sibling Fiverr. Then, Match Group or Uber have higher multiples, which I consider partially normal because they are more mature businesses, with either higher profitability or higher growth. On the other side, Bumble has lower multiples, which is normal, being plagued by high debt and stagnant growth, while Lyft has lower EV/Sales, yet higher P/E due to a much lower profitability. Overall, it seems Upwork is fairly valued relative to peers, maybe slightly undervalued if we look at Match Group or Uber.

For an absolute valuation, I built a DCF model, with the following estimates for the next five years revenue and expenses:

| (millions) | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Reasoning |

| Revenues | 740.00 | 779.00 | 859.00 | 925.00 | 1,000.00 | Challenging environment ~1 year |

| Gross profit | 569.80 | 599.83 | 661.43 | 712.25 | 770.00 | 77% (more managed services) |

| R&D | 195.00 | 205.00 | 215.00 | 225.00 | 235.00 | Peak margin ‘24 for ML, Gen AI |

| S&M | 185.00 | 194.75 | 214.75 | 231.25 | 250.00 | Same 25% margin |

| G&A | 118.40 | 116.85 | 120.26 | 120.25 | 120.00 | Lower SBC & higher scale in time |

| D&A | 11.84 | 12.46 | 13.74 | 14.80 | 16.00 | Constant 1.6% |

| EBIT | 59.56 | 70.77 | 94.09 | 120.85 | 149.00 |

For Weighted Average Cost of Capital (WACC) I start at 10.5% (higher than average due to higher re-levered beta, a little offset by a narrow economic moat), and for Growth in Perpetuity at 3% (between US and global GDB growth), and then I am varying these two for a sensitivity analysis:

| Fair Value | WACC=9.5% | WACC=10% | WACC=10.5% | WACC=11% | WACC=11.5% |

| Growth=2% | 13.70 | 12.87 | 12.12 | 11.47 | 10.88 |

| Growth=2.5% | 14.48 | 13.54 | 12.71 | 11.97 | 11.32 |

| Growth=3% | 15.39 | 14.31 | 13.37 | 12.55 | 11.83 |

| Growth=3.5% | 16.43 | 15.20 | 14.13 | 13.21 | 12.40 |

| Growth=4% | 17.67 | 16.22 | 15.00 | 13.95 | 13.04 |

For a base case with WACC = 10.5% and growth in perpetuity of 3%, Fair Value is 13.37, a 28% upside from the current price of $10.47.

It seems the activist investor Engine Capital, who recently disclosed a 3.5% stake, has a relatively similar opinion about the undervaluation and argued that the company needs to repurchase more of its shares.

Strictly from a stock perspective, I think this might be an interesting entry level (perhaps for half a position, followed by another half at a lower price or after some signs of increased profitability and/or growth). However, I would sell when the price would be around Fair Value for about 30% profit, for me, it’s not worth it to keep it long term if the estimated CAGR will be rather modest at 10% or even lower.

When and How to Sell Options for Extra Income

A simple strategy for extra income and for increasing the margin of safety is the Covered Call, so selling 1 Call option for 100 shares. In a previous article about Elastic (ESTC), I presented how I like to sell Call options when interest rates are high, usually close to At-The-Money (ATM) and with a duration of about six months for volatile stocks.

Considering that in this case the stock is about 28% undervalued, I would choose an Out-Of-The-Money (OTM) Call, and the most appropriate strike for my Fair Value ($13.37) seems to be 12.5. We could sell 1 UPWK 12.5 Call expiring April 17, 2025, for about $100, which will bring the cost down to 1047 (100 shares) – 100 = $947. So, the extra income (only brought by the Call option, considering no price appreciation) would be 100 / 947 = 10.5%, or about 22% annualized.

However, for stocks with this volatility I would look for at least 25-30% annualized extra income, so that 22% seems a little low. There are several choices (for simplicity, I exclude the choices that imply buying another option instead of buying shares, although these are even more efficient, so I will focus only on the combination of buying shares and selling Call options):

- Just wait until the stock price is around $12.50, and only then sell the Call option. We could buy all the 100 shares now, or 50 shares now and 50 shares either at a lower price, or when selling the Call option. The Call will be ATM, and the premium would be considerably higher, but the problem is that we don’t know when (if) this will happen, so we could lose the opportunity to sell one (or more) OTM Calls in the meantime.

- Keep some extra shares for a possible stock price increase; for example, sell 1 OTM Call option for each 125 shares. In this way, the extra income would be a little lower (considering no stock price appreciation), the margin of safety a little lower, but the return on stock price appreciation would be higher.

- A better variant of the last one would be to sell the Call closer to ATM (strike price 10), that would give us a lower break-even price and higher extra income considering no price appreciation. Indeed, the profit would be lower if the price moves up towards the fair value of $13.37, but the extra 25 shares are valuable in this scenario.

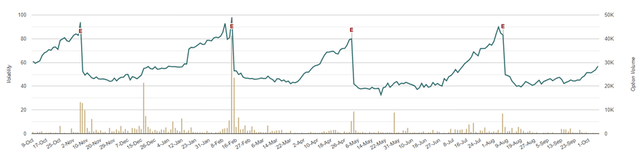

- Wait for the next earnings report (November 7, 2024) and sell the Call option exactly before the report (1-2 days before) because the implied volatility is higher close to the earnings report, and the Call option premium would increase due to this higher volatility, even with the same underlying price. We can see from this chart a noticeably clear pattern of increasing implied volatility for Upwork before each earnings report last 12 months (there is the IV30 presented in this chart, so 30 days expiration date, the six months expiration has a milder slope, but still the same pattern):

Upwork Implied Volatility (marketchameleon)

Risks

Any freelance marketplace platform would be naturally negatively impacted by a recessionary environment with an increase in unemployment. This would affect fair value and likely the stock price, even if only short-term.

Then, my fair value estimate is based on some margin assumptions starting from management comments and extrapolating for the next five years:

- For S&M, I assume the same 25% margin (a significant improvement in the last year) for the next five years

- For R&D, I assume a peak margin of ~27% this year (especially due to high AI spending), followed by an increase in absolute dollars, but a decline in margin towards about 23%.

- For G&A, I assume 1 bps margin decrease every year for the next five years, due to higher scale and lower SBC (stock-based compensations)

If any of these assumptions failed to materialize (they might choose to increase R&D or S&M to keep competition away), the fair value (and likely stock price) would be affected.

Takeaway

Upwork is the top freelancing platform, with a market share of 31-32%. It has an economic moat based especially on two-sided network effects: the more employers on the platform, the more freelancers will be attracted; the more freelancers on the platform, the more employers will be attracted. However, they still have to prove that moat is a strong one especially by maintaining a high ROIC for several years.

A challenging environment this year triggered a lowered revenue guidance. However, they kept the Adjusted EBITDA guidance, especially due to reduced S&M expenses. They have strong financials, with cash position higher than total debt helping them to repurchase shares.

Compared to its closest rival, Fiverr, Upwork has about the same market multiples, but it seems a little undervalued if we extend the comparison to other service marketplaces, like Match Group. A DCF model gives a base Fair Value of $13.37, for a WACC = 10.5% and growth in perpetuity of 3%, meaning a 28% upside from the current price of $10.47.

Selling an OTM Call (12.5 strike price), about 6 months to expiration, would bring a lower breakeven price and extra income of about 22% annualized (considering no price appreciation). However, I usually target at least 25-30% extra income (strictly from selling a Call option), and for that we have several choices: sell the Call 1-2 days before the next earnings report when the higher implied volatility will boost the option premium; sell the Call only when (if) the stock price would reach about $12.5; keep some extra shares for a possible stock price increase and sell an ATM Call (for example, sell 1 UPWK 10 Call for 125 shares).

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.