Europe is an epicenter of ramped-up defense spending. Many countries in the region are also NATO members pledging to increase the percentages of GDP allocated to national security in significant fashion in the coming years.

Some European nations promise to get 5% of GDP directed to defense spending. That could be a sign the newly minted WisdomTree Europe Defense Fund (WDEF) is an example of a rookie ETF that’s at the right place at the right time.

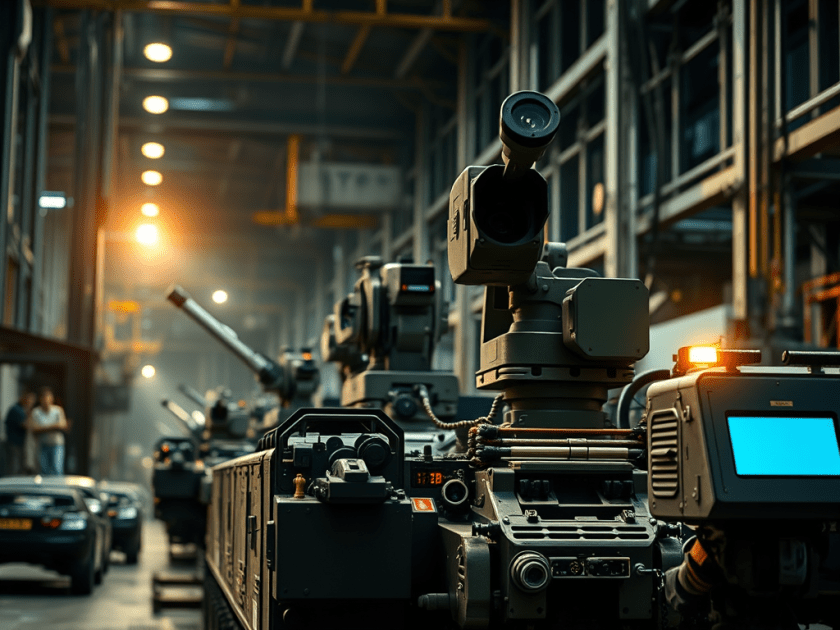

That’s a valid assertion not only because WDEF addresses a theme — European defense expenditures — with long-term tailwinds. The ETF also taps into that theme with exposure to the right holdings. Rheinmetall, HENSOLDT and RENK stand as prime examples. Germany-based Rheinmetall is WDEF’s second-largest holding. Overall, that trio represents about 18% of the ETF’s portfolio on an aggregate basis.

WDEF Has the Right Ingredients

Looking at Rheinmetall, which accounts for over 10% of the WDEF roster, that stock could be key contributor to the ETF’s long-term prospects.

“Europe has learned the hard way that a military without shells is like a car without fuel. That’s why Rheinmetall isn’t just building one factory,” noted WisdomTree. “To de-risk bottlenecks in explosives and logistics, it is investing more than €1 billion in a joint venture in Bulgaria to localize gunpowder and shell production, with a parallel ammunition project underway in Romania. These moves mean Europe’s stockpiles don’t depend on a single link in the chain or on suppliers thousands of kilometers away.”

Another interesting element regarding WDEF is that it’s not an old guard aerospace and defense ETF. Yes, the ETF holds many stocks hailing from the industrial sector, as expected. However, it also has plenty of defense tech leanings. Take the case of HENSOLDT.

“Taken together, HENSOLDT is Europe’s sensor spine. A radar stack that spans ground, air and sea. Common designs that simplify sustainment. Passive detection and counter-drone radars that match the drone era. And electronic warfare tools that evolve at the speed of software. If Rheinmetall is Europe’s arsenal, HENSOLDT is its situational awareness, the eyes that make resilience possible,” added WisdomTree.

Renewed Focus

Bottom line: Defense spending is a renewed focus in Europe, but adequately capitalizing on that theme can be difficult for single stock investors in the U.S. WDEF eliminates that burden.

This article was prepared as part of WisdomTree’s general paid sponsorship of VettaFi | ETF Trends. This specific content within and any opinions expressed therein belong solely to VettaFi and do not reflect the opinion or analysis of WisdomTree, its employees, or its affiliates. Content published on VettaFi | ETF Trends is provided for educational purposes only and should not be considered investment or tax advice. For investment or tax advice, please consult a financial professional.

WisdomTree is an independent company, unaffiliated with VettaFi | ETF Trends. WisdomTree has not been involved with the preparation of the content supplied by VettaFi | ETF Trends. It does not guarantee, or assume any responsibility for its content.

For more news, information, and analysis, visit the Modern Alpha Content Hub.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.