Summary

- Pfizer remains a compelling bargain, supported by a strong dividend yield and undervalued financial metrics, despite post-pandemic headwinds.

- PFE’s acquisition of Metsera positions it for growth in the obesity market, though the deal will be dilutive to earnings through 2030.

- Recent FDA approval of the PADCEV/Keytruda combination and a robust oncology pipeline are expected to drive future revenue and margin expansion.

- I maintain a Strong Buy rating on PFE, confident that its cost-cutting, M&A strategy, and pipeline will offset patent cliff risks.

Introduction

Following my review of Novo Nordisk, I want to go through another great bargain in the pharmaceutical industry that I’ve covered extensively. With the Metsera deal going through and the company releasing its latest quarter, I want to see if Pfizer (PFE) is worth buying into at this particular juncture.

Though Pfizer needs no introduction, the company has been lagging behind since the COVID pandemic that initially pushed the company’s stock to its all-time high, but then the pharma giant failed to capitalize on its excess cash flows and the excess COVID investments were ill-fated considering the duration of the pandemic.

Current Dynamics

First, I’ll dive into the company’s most recent quarter, which was published earlier in November. Pfizer posted a double beat, which was certainly welcomed, with revenue coming in at $16.65B, down Y/Y by nearly 6%, though it is still a beat of $150MM. On the bottom line, there was a big surprise of 23 cents that pushed EPS to 87 cents. Strangely enough, this was thanks mainly to sales from its COVID vaccine developed in tandem with BioNTech. This has pushed Pfizer to reaffirm its full-year guidance to a range of between $61B and $64B, all the while the company increased and narrowed its EPS guidance to a range of between $3 and $3.15. Furthermore, the company has stated that they’re on their way to delivering $7.2B in cost savings by the end of 2027, thanks to their cost-cutting initiative, which will already deliver around $4.5B in net cost savings by the end of 2025. And though Pfizer is still facing vaccine headwinds, I believe that it was a relatively good quarter for the company.

There is also the Metsera question, which I stated in my latest analysis was one of the tailwinds assessed for the company. The initial deal had a total value of around $7.3B, though rival Novo Nordisk has pushed Pfizer to increase its bid for the company, which, in return, Novo withdrew from contention. The latest deal is set to reach around $10B, with around $7B to be paid upfront, which comes to around $65.6 per share in cash. The assets purchased will include MET-097i, which is a weekly and monthly injectable GLP-1 agonist that is currently undergoing Phase 3 development, and will directly push Pfizer into the lucrative obesity market. Pfizer is expecting the acquisition to be dilutive to earnings through 2030 as the company requires heavy investments to go through late-stage development and further commercialization.

More recently, the FDA approved the combination of an operative treatment for muscle-invasive bladder cancer, which is ineligible for cisplatin-based chemotherapy. It is quite significant as it is the first and only approved perioperative regimen that significantly improves survival rates. This was based on the Phase 3 trial that resulted in a 60% reduction in the risk of disease recurrence, progression, or death compared to surgery alone. On overall survival, this showed a 50% reduction in the risk of death compared to surgery alone. The combination of PADCEV and Keytruda will achieve multi-billion dollar peak annual sales, in my opinion, as PADCEV alone is already expected to contribute over $3B in annual peak sales.

Valuation

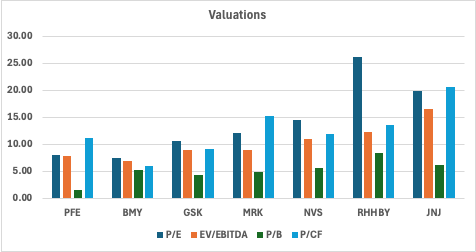

Pfizer is still clearly a bargain when looking at financials with its current P/E Non-GAAP of 8.03, with Bristol Myers Squibb only being lower in its peer group, with the same trend being seen with its EV/EBITDA of 7.91. Though this is mainly due to the market pricing in the worst-case scenario for Pfizer in terms of COVID revenue decline, as well as the incoming patent cliffs for Eliquis and Xtandi. Though I believe that the worst can be avoided, especially with the oncology franchise derived from the Seagen acquisition, as well as the non-COVID portfolio showing strong operational growth. And though Metsera will be dilutive in the coming years, its value could resemble Seagen’s as Pfizer could use it for growth in a new healthcare industry for the giant pharmaceutical company. The cost-cutting measures are also in full effect, with Pfizer generating $4B in FCF, the largest over the past 3 quarters, giving the company a large 7.1% FCF yield. This current valuation is the result of investors being overly pessimistic on Pfizer’s long-term prospects, in my opinion, which leaves an opportunity for bargain hunters. One of my main arguments about investing in Pfizer has always been, take the generous yield currently standing at 6.69% while waiting for the company to capitalize on its acquisitions.

Valuation Metrics (Data from Seeking Alpha)

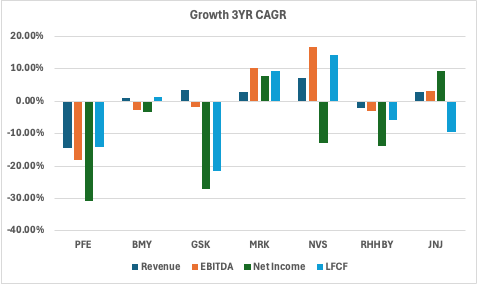

For growth, the main goal for the company is to capitalize on its oncology segment, mainly on the back of the PADCEV/Keytruda expansion as well as ADCs. Pfizer is expected to have eight or more blockbusters oncology medicines in its portfolio by 2030, which would put the pharmaceutical giant at the forefront of the potentially high-margin segment. Thus I expect Pfizer to fare better in the coming years and that’s why the company is buying up Metsera even if it is dilutive to earnings, as it plans on recreating its Seagen playbook in the weight-loss category. I will closely watch for the key readouts for its bispecific antibody Elrexfio and vepdegestrant to get a grasp on the potential of its oncology endeavor. Though there might be some pressure, mainly by 2027 due to the patent cliffs incoming, I believe Pfizer could pull it off, though the IRA impact on revenues is not helping, as it is set to already reach around $1B in 2025 alone.

Growth Metrics (Data from SA)

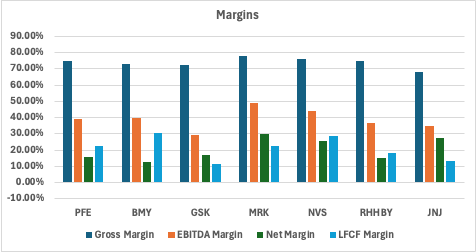

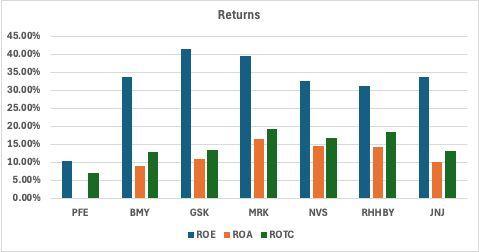

I’ve already stated that I believe Pfizer’s margins will improve as Oncology takes a larger share of the revenue mix. But right now, margins are already quite impressive, with gross coming in at 74.81%, higher than GSK or BMY, while FCF margin is standing at a healthy 16.5%. This should further be boosted in the immediate term with the cost-cutting initiatives that, in my opinion, are not yet priced into the stock. The outlook is grim with the patent losses, yet the current measure should help Pfizer maintain the same level of margins, and I see them increasing by 2028 onwards, despite the Metsera deal.

Margin Metrics (Seeking Alpha Data) Return Metrics (Data from SA)

Risks

The incoming patent cliff is the largest risk, with an estimated loss of upwards of $18B in annual revenue with Eliquis, Ibrance, and Xtandi all seeing expiration by 2027, which pushes Pfizer to take risks in order to offset the multi-billion dollar loss of revenues.

This all hinges on a strong pipeline and M&A execution, with, for example, the Metsera deal, which is now worth upwards of $10B, becoming a critical long-term growth bet that carries risk as the assets are still in trial phases. Any clinical failure would drastically set back Pfizer in its bid to offset revenue loss. The same could be said about Seagen, though it has been successful so far with the approved Padcev/Keytruda combination, Pfizer still needs to realize the full potential of ADCs.

Conclusion

Right now, I still believe that Pfizer is worth buying, as the road is clear for the Metsera deal that will help the company gain traction in another highly coveted healthcare segment. Pfizer is also operating and integrating successfully the Seagen pipeline, which leads me to believe that it will be able to further capitalize on it. There are still patent cliffs, but the current dividend yield offsets the associated risk for the moment. I keep my Strong Buy rating for Pfizer as I believe that healthcare is currently the best opportunity on the market.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.