Summary

- I rate Siemens Energy a Strong Buy due to its clear margin expansion, a strong backlog order book and attractive valuation.

- Core segments are driving consistent, profitable growth while the wind division risks are now contained.

- 2025 performance beat expectations across all KPIs and management raised guidance for 2026 and 2028 targeting that profit margins will doublr to 14%.

Investment Thesis

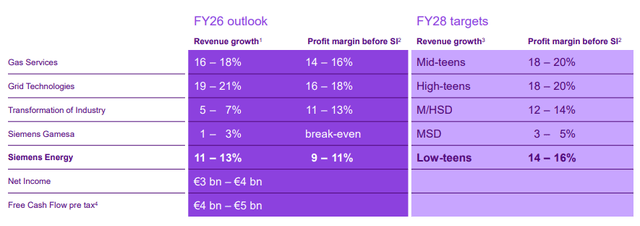

I am giving Siemens Energy AG (OTCPK:SMNEY) a Strong Buy. And this is because, in my view, the company is a rare all rounder that is positioned to lead the global energy transition, and do so profitably. Siemens Energy has solidified a foundation of growth especially after a record €138 billion order backlog. And, it is now entering an acceleration phase of margin expansion. In 2025, revenue jumped 15% with profit margins up by 500 bps y/y. Management upgraded both near term and mid term targets as shown in the figure below. In 2026 the management has guided between 11% and 13% revenue growth and between 9% and 11% profit margin. On the other side, the company aims for growth between 14% and 16% margins. This is more than 2x the current margins within 3 years. And in other words, Siemens Energy is turning scale into earnings.

Siemens Investor Day Nove 2025

What I mean is that, this is not a pie in the sky kind of promise. It is grounded in hard evidence. For example, the backlog quality has improved obviously because of better pricing and less legacy drag. The company has also just delivered at the top of its 2025 guidance KPIs. It is also important to mention that Free Cash Flows [FCFs] are quite robust, supported by a growing high margin service business and disciplined project execution. In simple words Siemens Energy looks poised to convert the world’s urgent power infrastructure needs into shareholder returns.

And from where I stand, I see a thesis with three pillars. First, a broad-based revenue growth engine firing on multiple cylinders such as gas turbines, grid upgrades, industrial solutions and wind turbines. Secondly, clear margin expansion is visible thanks to better project pricing, cost out programs and a rising service mix. And lastly, I believe Siemens Energy has an attractive valuation compared to its immediate peers especially after factoring in the growth, which I will discuss in detail in the valuation section. I believe the stock has more room to continue climbing despite rising over 200% in 2025. And this is why I am rating Siemens Energy a strong Buy.

Business Overview

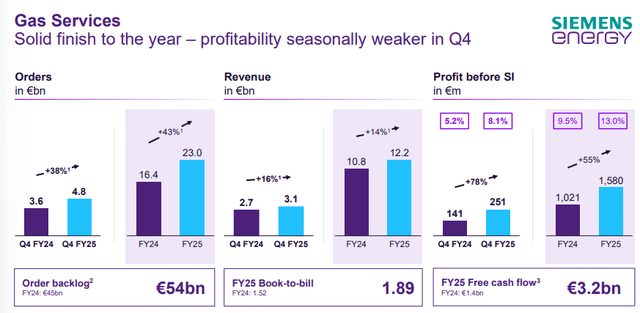

Siemens Energy is a global energy technology leader with 4 business segments that span the electricity value chain. First is Gas services [GS] which builds gas turbines and gas fired power plants. These are the big machines keeping the lights on from the US to the Middle East. And this is Siemens Energy’s cash cow and backbone. For instance, in 2025 GS delivered €1.6 billion profit at a 13% margin.

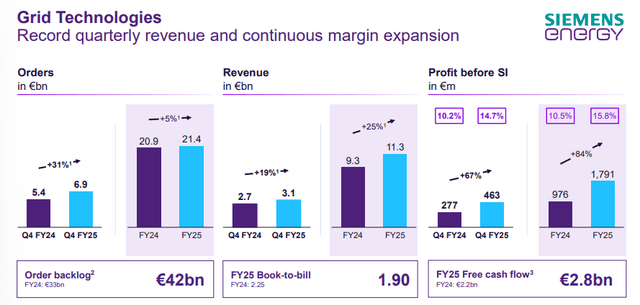

Secondly, there is Grid Technologies [GT] which provides transmission systems, high voltage equipment and power grid stabilization solutions. If Gas services is the muscle, then Grid is the connective tissue of the electric age. And it is in high demand. In 2025, orders hit an all time high and backlog reached €42 billion. GT’s revenue grew by 19% with profitability surging as high as 14.7% in Q4 2025.

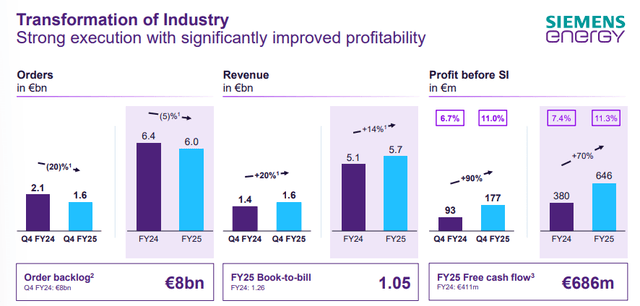

Then there is transformation of Industry [TI] which covers industrial electrification and decarbonization solutions. This is everything from electric boilers and hydrogen electrolyzes to compressors and small scaler power. TI is smaller in size compared to GS and GT having yielded revenue worth €6 billion. This was a growth of 20% in Q4.

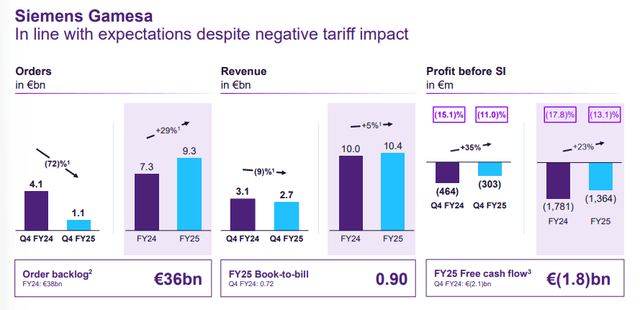

And lastly, there is Siemens Gamesa Renewable Energy [Wind]. This is the wind turbine division. If I was to be honest, this segment has been the problem child. Siemens Energy had to take full control of Gamesa in 2023 amid quality issues and big losses in onshore wind. But the good news is the worst seems over because in Q4 2025, Gamesa’s revenue decline was expected due to a planned pullback in loss-making onshore projects. However, offshore wind sales actually rose significantly. And this is a sign of healthier business mix.

Growth Drivers

I am rating Siemens Energy a strong buy because they are at an inflection where external catalysts and internal readiness meet. The world is in the early innings of a massive energy infrastructure build out and Siemens Energy is sitting in the front seat to supply the needed tech. One of the major growth drivers is the electrification and decarbonization super cycle. From EV charging networks to replacing coal plants, the push to electrify everything has been accelerating globally. Global electricity demand is projected to double by 2040. This means that every additional Megawatt of renewable generation requires grid investments. And every coal plant retirement opens opportunity for efficient gas turbines as reliable backup. And Siemens Energy hits both notes as mentioned by the CEO, Christian Bruch as they cant wait for Germany’s auction of new plants to begin

…and I cannot wait really until they finally pull the trigger to do the auctions…

…but we would be more than willing to fight for it, and we will try to secure a fair share out of these different projects….

Second we have data centers, AI and the digital grid. Here is a 21st century driver that nobody saw coming at this scale: Hyperscale data centers. The likes of Amazon.com, Inc. (AMZN), Alphabet, Inc. (GOOG) and Meta Platforms, Inc. (META) are building huge AI farms and are power hungry beasts. They not only require vast electricity supply but also ultra reliable grid connections. In 2026 this trend hit like a thunderbolt in the US. Surging data center build led Siemens Energy’s orders to explode. They sold 194 gas turbines in 2025 which is nearly 2x of 2024 volume. The AI revolution and Cloud adoption are only growing, so this is likely a multi year demand stream.

Third is grid modernization and small modular Reactors [SMRs]. The electric grid in many developed countries is old and creaky. Governments and utilities worldwide are investing money into grid upgrades, HVDC interconnectors and grid hardening against weather and cyber threats. Siemens Energy’s Grid Tech segment is one of the only few global providers of HVDC systems used for long distance power transmission. They have a record HVDC order backlog after big wins linking regions in Europe and Asia. Grid tech is expected to grow between 19% to 21% in 2026 as per management guidance. And this is the fastest in all the segments. SMNEY is also not missing out on the nuclear resurgence. The company has partnered with Rolls-Royce Holdings plc (OTCPK:RYCEY) on smaller modular reactors. These are essentially factory built mini nuclear plants that could roll out by 2030s. And while this is beyond the 2028 horizon, it is notable that Siemens Energy will supply instrumentation, electrical systems and perhaps turbines to these SMRs. This means that if SMRs take off as credible decarbonization tool, then Siemens Energy could have a new growth leg.

Valuation

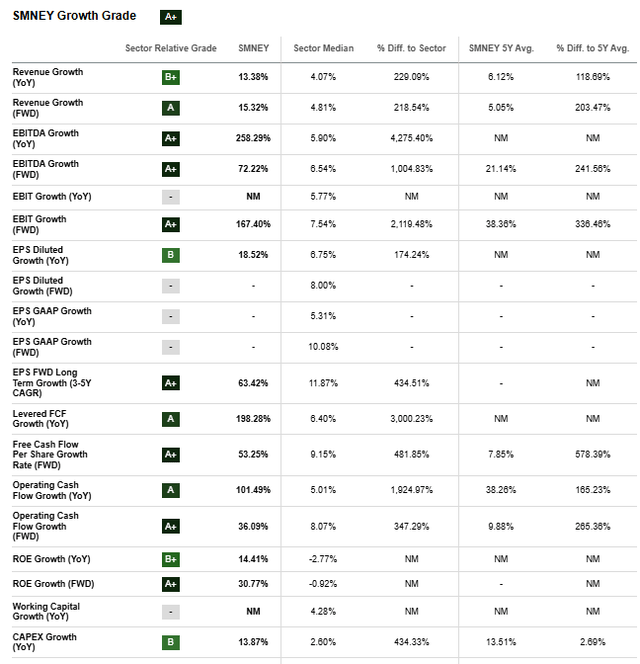

First I note that SMNEY scores an excellent A+ growth grade as shown below. Specifically, I note that the FWD Revenue growth of Siemens Energy stands at 15.32% while the sector median stands at 4.81%, implying an outperformance to the sector.

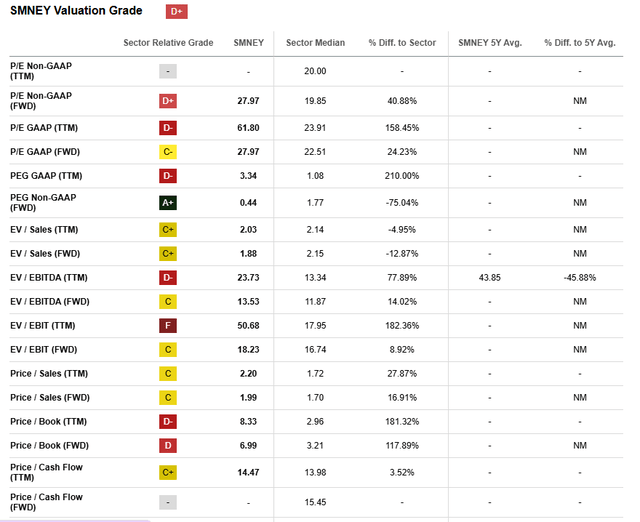

When I look at the valuation numbers, while the company scores a D+ valuation grade, the FWD Non-GAAP PEG stands at A+. Siemens Energy AG has the PEG ratio at 0.44x while the sector median stands at 1.77x as shown below. And this implies that the stock is trading at a 75% discount relative to the sector.

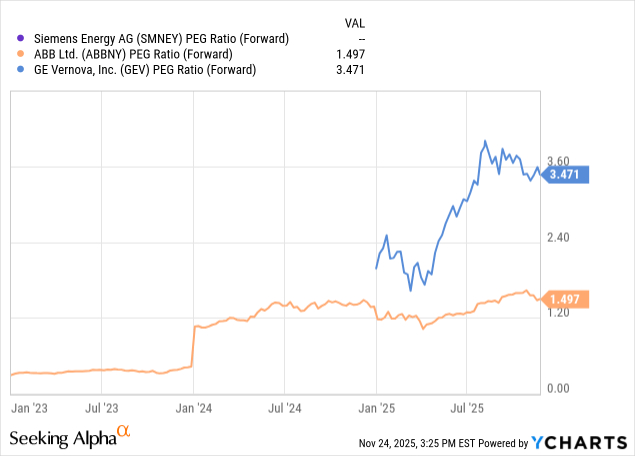

Siemens Energy has its FWD V/EBITDA at 13.53x while the sector median stands at 11.87x which shows a slight premium to the sector. This is similar to its FWD GAAP P/E ratio which stands at 27.97x while the sector median stands at 22.51x. When I look at some of the peers such as ABB Ltd (OTCPK:ABBNY) and GE Vernova Inc. (GEV) I note that Siemens Energy has a lower FWD PEG ratio compared to ABB and GE Vernova at 1.497x and 3.471x respectively.

I would say that Siemens Energy is valued similar to a normal industrial company but delivering compound growth more akin to a tech orientated company in the shorter. And this is thanks to the heavy backlog conversion to profit. And as a result, this mismatch is the opportunity. And I believe if management even hits the low end of its 2028 targets, that would be €7 billion EBITDA.

Siemen’s Key Risks

The biggest risk I see for Siemens Energy is the Siemens Gamesa Wind Turnaround risk which I mentioned before that it is the problem child. The biggest risk is that the wind turbine division might continue to struggle or throw in new surprises. Blade design issues, warranty claims or simply high than expected losses in onshore wind could drag on the group’s profits. There is also a possibility that fixing the onshore business takes longer or costs more than planned especially if new turbine models encounter glitches in the field.

Final Thoughts

At the end of the day, Siemens Energy has navigated through fire (especially the Siemens Gamesa Wind ) and came out the other side with momentum. I also see a management team that is intentional on delivering on its promises as noted by the CEO:

…we have achieved the top end and partly overachieved our upgraded targets. Fiscal year 2025 has been a year with strong performance…

And with growth accelerating, margins set to double and secular tailwinds at its back I believe Siemens is in the early stages of a multi year run. And this is why I am rating the company a strong Buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.