Summary

- Japan’s potential rate hike is a pivotal global risk, with the yen strengthening and JGB yields at multi-year highs.

- Japanese institutions may shift capital from US Treasuries to domestic bonds, pressuring US yields and equity valuations.

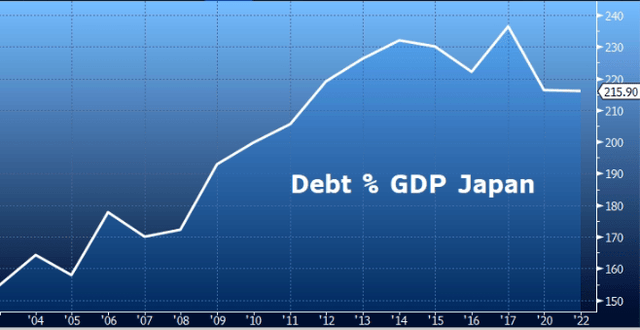

- Japan’s debt-to-GDP exceeds 215%, with expansionary fiscal policy and inflation above target driving market uncertainty.

- The December 19th BOJ meeting is a critical catalyst, as a rate hike is now the baseline scenario.

If Japan Has a Cold, the Rest of the World Goes Into Quarantine

Today I’d like to talk to you about the “Japan case” and why it could ruin Christmas for everyone.

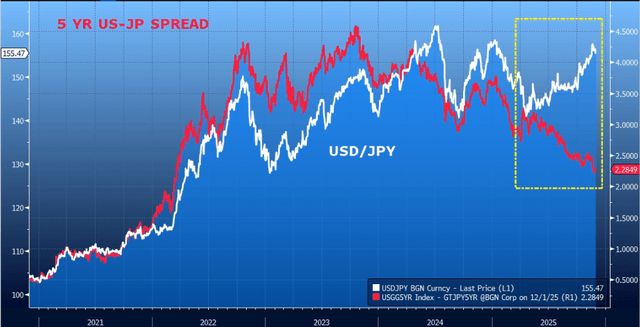

Generally, the USD/JPY exchange rate is aligned with changes in the US-Japan interest rate differential. As a result, if US interest rates increase more than Japanese ones, the yen loses value, and thus the dollar gains. Once the interest rate difference becomes smaller, the yen gets stronger again. Pretty logical, isn’t it?

The following chart shows precisely this movement over the years and how the two lines (interest rate differential and USD/JPY exchange rate) have moved together for almost the entire 2021-2024 period.

Recently, however, something has been changing, and this is highlighted in the final section of the chart, circled in red. The US-Japan interest rate spread is rising again, so in theory, USD/JPY should continue to rise, as we mentioned earlier. Yet, the opposite is happening: the yen is strengthening while the spread widens. In practice, the market is no longer mechanically tracking the interest rate differential but is starting to price in another variable: the possibility that the Bank of Japan will change monetary policy much sooner than expected.

All this seems to have been amplified by recent statements from the Bank of Japan governor, who highlighted the possibility of a rate hike in December this year during his meeting on December 19, just before Christmas. The market reacted impulsively and positioned Japanese interest rate futures with a roughly 80% probability of a 25 basis point rate hike.

Goldman Sachs disagrees and, in a note I received by email this morning, states that Ueda had used similar tones in the past, especially ahead of wage negotiations, and ultimately postponed the rate hike. The bank expects the first rate hike to take place in January. Whether that’s December or January, the risk is on the table, and that’s a given. If the BoJ decides to raise rates at its next meeting, it could trigger a wave of forced carry trade liquidations and subsequent violent sell-offs in various assets, including cryptocurrencies (the cryptocurrency market may already have sensed something, as violent sell-offs increasingly occur on weekends, without any news or clear trigger).

Before we delve deeper, I’ll tell you right away that this signal sends us two messages:

- Capital flight

- Market distrust

Japan’s High-Pressure Experiment With 230% Debt

To better understand the concepts we’ll discuss in this article, I believe it’s necessary to briefly discuss the macroeconomic and political context facing Japan recently.

With a debt-to-GDP ratio of 215%, the country remains the highest overall. Added to this is the political stance of new Prime Minister Takaichi, who has shown no sign of pursuing an austerity program, which is exacerbating the situation. The new prime minister, in my opinion, looks to be more “aggressive“, focused on expansion and growth. This is significant because it typically leads to increased issuance of Japanese government bonds to finance broader spending programs, and therefore the Bank of Japan will have to intervene in some way (we’ll soon find out how) to maintain stability.

Currently, Japan’s inflation is above the 2% target, with rice prices (a key crop in the country) having doubled compared to a year ago (+100%) and the cost of living having become the truly decisive and divisive factor in the recent elections. In this case, Takaichi has opted for the most financially dangerous but politically expedient path: a new mega-budget, which entails increasing debt, greater public spending, and, consequently, the need for the Bank of Japan to stabilize the situation.

Inflation isn’t the only reason the BoJ governor put a potential rate hike on the table. There are other domestic dynamics that Japan hasn’t seen in twenty years. Ueda emphasized that the BoJ is “paying particular attention to the prospects for wage increases” ahead of next year’s shunto, where the country’s largest union will demand increases above 5% for the third consecutive year. This is a country that has experienced twenty years of wage stagnation, and this appears to be a structural, not a cyclical, sign.

Furthermore, Ueda said that there are “signs of solidity in wages” and that corporate profits-which are what finance the increases-remain robust despite the US tariffs. Also, external uncertainties have been reduced as a result of the better trade relations with the United States, and the governor warned that the recent weakness of the yen could accelerate inflation and affect the way companies set prices and wages.

All these factors taken together would push the BOJ toward a gradual normalization of interest rates.

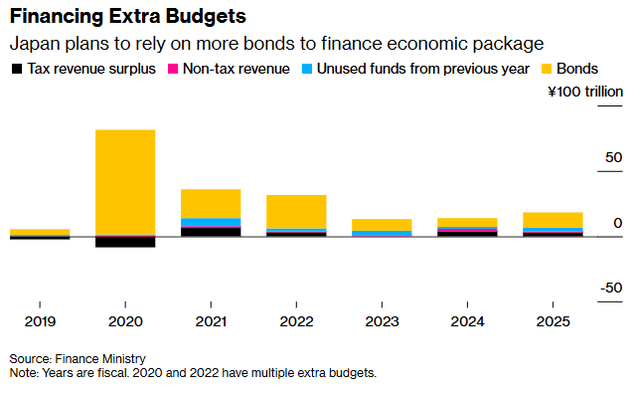

For these reasons, Prime Minister Takaichi approved a new mega-budget ($117 billion), which means more government spending, more transfers, and more fiscal stimulus.

It’s a popular strategy in a context of rising living costs, but from a financial perspective, it’s also the choice that puts the most pressure on the BOJ because it means a higher deficit, more issuance, more JGB supply, and thus a greater need for the central bank to prevent the yield curve from spiraling out of control.

The markets have already figured out how to position themselves, as we can see from the following chart, where the 10-year yield is surpassing levels not seen in the last twenty years, while the 20-, 30-, and 40-year yields are rising to 3-3.5%.

In this analysis, I won’t discuss politics, much less Japanese politics. I don’t believe I’m qualified to judge or offer economic policy advice for a country I only know from afar, but in economic terms, I can say that if the new prime minister’s plan works, the country will win the silent war against deflation (after who knows how long). Otherwise, it will force the entire world to simultaneously reevaluate interest rate risk (I’ll explain why later). We will get some answers to all this on December 19th, during the Bank of Japan meeting, where a rate hike is now priced in as a baseline scenario.

From Japan to Treasuries

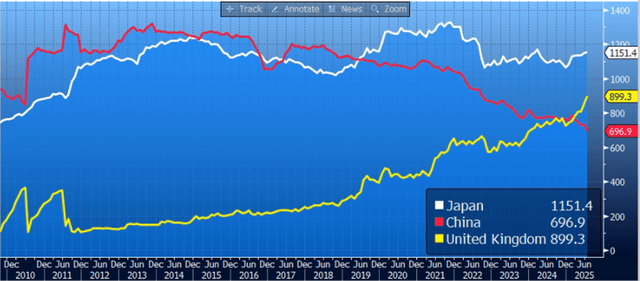

The largest holder of US debt after the Fed is Japan. That’s why, over the years, Japanese investors (from banks to insurance companies to pension funds) have been buying foreign assets. As the following chart shows, approximately $1.151 trillion of the assets invested abroad were invested in US Treasuries.

But really, why? Local returns have been close to zero until very recently, so the logical move for investors was:

If Japanese Government Bonds (JGBs) gave 0-0.3% and U.S. Treasuries 3-4%, investors’ automatic choice was:

- Borrow in yen at zero cost

- Buy dollars

- Buy Treasuries

- Collect the spread

It was a simple, almost trivial mechanism. But as long as Japanese interest rates were at zero, everything was fine. Now, however, the cost of that debt is rising, and if yen financing is no longer “free,” investors must close their positions, which means selling what they had purchased and converting everything back into yen.

If this happens, it means the Japanese are selling Treasuries, thus pushing up US government bond yields. If the 10-year Treasury yield approaches 4.5-5%, the S&P cannot be expected to remain stable at 20-25 times earnings. The cost of capital increases, and multiples decrease. It’s simple math.

As a result, a minor increase in Japanese rates can lead to this money, which was going out, coming back again. The day of December 19th is in danger of being the most overlooked macroeconomic event of the year.

What Happens Now

Personally, I see three possible scenarios.

Scenario 1: The BoJ actually raises rates on December 19th

I assign this scenario the highest probability of occurrence and also the worst magnitude. I say this not so much because 25 basis points will change the world, but because they occur during the week of least liquidity in the market (the end of the year), making everything more fragile. High-duration assets (I’m talking about growth stocks in general, including semiconductors, artificial intelligence, cloud computing, etc.) will obviously suffer the consequences, as they are valued based on the cost of capital. Valuations will be squeezed. Just simple math. Also, in this particular situation, hedge funds and CTAs will have to unwind their leveraged positions, therefore resulting in a snowball effect of more forced selling and steep drops.

Scenario 2: The BoJ doesn’t raise rates but remains aggressive

In my view, this is the least undervalued but most likely alternative. The BOJ could state that it will consider a regime change in 2026. Essentially, this is what GS is currently advocating, namely a rate hike in January rather than December. In that case, the risk would not be eliminated, and the strong pressure on carry trade positions would persist. It sounds like “peace,” but it isn’t.

Scenario 3: The BoJ doesn’t raise rates and returns to an accommodative stance

This is the only scenario that offers some respite, but honestly, I think it’s unlikely to materialize. In any case, if this scenario were to materialize, we would see two or three days of relief and some technical rebounds.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.