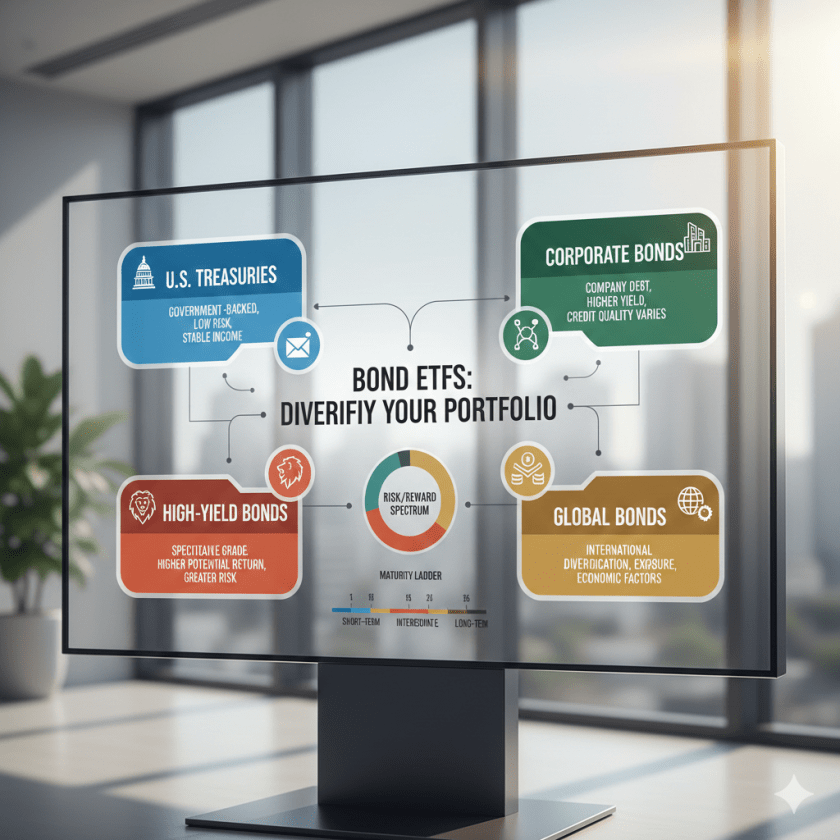

Bond ETFs have re-emerged as powerful income generators in 2025 because interest rates have stabilised at higher levels than the previous decade. Compared with savings accounts or term deposits, bond ETFs offer stronger yield potential, liquidity, global diversification, and the ability to tailor risk levels to individual investment goals.

This guide explores the best bond ETFs for income in 2025, covering U.S. Treasuries, global bonds, corporate bonds, high yield, and inflation-protected categories. ETF examples are included to help investors understand what each category typically looks like.

Why Bond ETFs Are Attractive in 2025

Several market factors make bond ETFs particularly compelling:

- Higher yields: Elevated interest rates increase income distributions.

- Lower volatility: Bonds provide portfolio stability during equity downturns.

- Diversification: Exposure spread across hundreds of issuers.

- Better liquidity: ETFs trade like stocks, unlike individual bonds.

1. U.S. Treasury Bond ETFs

U.S. Treasuries are considered the safest global fixed-income assets. They offer reliable income and act as strong hedges during risk-off periods. The examples below show how different durations affect risk and yield.

Short-Term Treasury ETFs (Lowest volatility)

- SHV – iShares Short Treasury Bond ETF

- SGOV – iShares 0–3 Month Treasury Bond ETF

- SCHO – Schwab Short-Term U.S. Treasury ETF

Intermediate-Term Treasury ETFs (Balanced yield and risk)

- IEF – iShares 7–10 Year Treasury Bond ETF

- VGIT – Vanguard Intermediate-Term Treasury ETF

Long-Term Treasury ETFs (Higher yield, more rate-sensitive)

- TLT – iShares 20+ Year Treasury Bond ETF

- VGLT – Vanguard Long-Term Treasury ETF

2. Investment-Grade Corporate Bond ETFs

Investment-grade bond ETFs provide higher yields than government bonds while maintaining high credit quality. These are suitable for investors seeking predictable income without excessive risk.

Examples of top investment-grade ETFs

- LQD – iShares Investment Grade Corporate Bond ETF

- VCIT – Vanguard Intermediate-Term Corporate Bond ETF

- IGIB – iShares Intermediate-Term Corporate Bond ETF

- VCSH – Vanguard Short-Term Corporate Bond ETF

3. High-Yield Bond ETFs

High-yield (or “junk bond”) ETFs offer significantly higher income but come with increased credit risk. These ETFs are typically used as small satellite allocations for income enhancement.

Popular high-yield ETFs

- HYG – iShares iBoxx $ High Yield Corporate Bond ETF

- JNK – SPDR Bloomberg High Yield Bond ETF

- USHY – iShares Broad USD High Yield Corporate Bond ETF

4. Global Bond ETFs

Global bond ETFs provide exposure to international issuers, reducing dependence on a single economy or interest-rate cycle. Many funds balance developed and emerging-market bonds to improve diversification.

Global aggregate examples

- BNDX – Vanguard Total International Bond ETF (hedged)

- AGGG – iShares Core Global Aggregate Bond UCITS ETF

- IGLO – iShares Global Government Bond UCITS ETF

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.