Overshadowing the third quarter report is the weather. A polar vortex event promises some very cold temperatures for at least another week (and maybe two weeks) in December. For a company like Bonterra Energy (OTCPK:BNEFF), the weather is providing a lot of badly needed good news for a company that still has considerable natural gas production. It is also providing a respite (however temporary) from all the worries marked by threats of trade wars and tariffs. North America is also adding a fair amount of export capacity that should tighten natural gas supplies as well. All of this could help the company reset the balance sheet at a time when such a reset would provide some liquidity to continue to shop for premium acreage.

Trading

Before going any further, it needs to be stated that the founder and major shareholder is George Fink, who is now Chairman Emeritus. In a situation like this maybe half the shares are available for trading at any given time. This will affect volume and liquidity for this small company.

Because of the volume and liquidity situation, it is best to be patient and use limit orders. Liquidity may be better if your brokers allow purchases and sales in Canada. But with any small company, this one in particular, there has got to be some patience, or you can pay a lot more for shares than you need to.

Last Article

This was yet another natural gas producer that was looking for a more profitable production mix, which would also enable the company to thrive under a wide variety of scenarios. The last article covered at least part of the transition. More acreage acquired was covered in earlier articles.

As a result of these moves, the company now needs less capital to either sustain or grow production. But because the wells are larger, there can be considerable production variance by quarter when those larger wells experience that first-year decline.

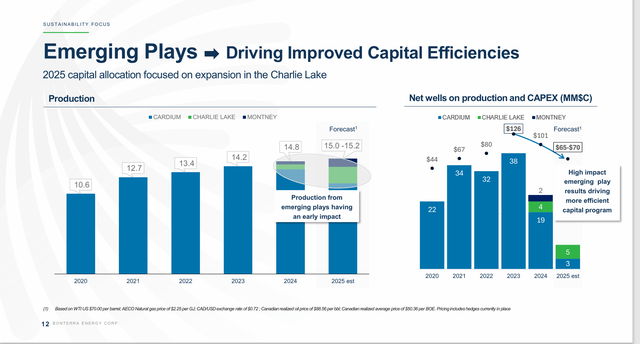

Bonterra Energy Production Trend And Wells Trend (Bonterra Energy Corporate Presentation November 2025)

What has been happening as a result is summarized above. Production has grown with fewer wells brought online and, of course, lower capital costs. This is yet another way to build free cash flow faster than the company growth rate. It is also lowering the company breakeven point because the later wells obviously have a much lower breakeven point than existing production had.

That said, production has been declining all year because the few wells brought online were brought online early in the fiscal year. For wells with significant natural gas production, the exposure to the strong natural gas prices that exist during the heating season likely raises the return on investment a percentage point or two. So, it makes sense to not bring wells online in the summer.

Now, as some of this acreage produces a greater percentage of liquids production, that consideration may not apply in the future to at least some wells drilled.

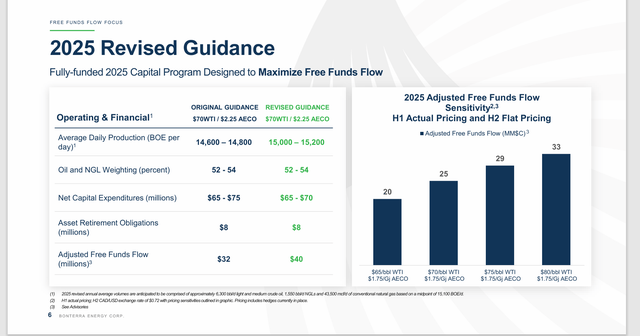

Revised Guidance

The revised guidance was looking more and more optimistic from a pricing viewpoint because it used WTI $70 as the price of oil. But what is happening now is that the natural gas price of C$2.25 may turn out to be far too conservative if that polar vortex causes a lot of natural gas to be used due to some abnormally cold temperatures.

Bonterra Energy Revised Fiscal Year 2025 Guidance (Bonterra Energy Corporate Presentation November 2025)

Keep in mind that this is a Canadian producer that reports using Canadian dollars unless noted. WTI is a United States dollar denominated price for oil.

The exposure to natural gas is fairly significant at roughly half the production. So, this could get interesting. La Niñas are known for weak polar vortexes that can leak cold air south. So, what is happening now is very much an expectation of La Niña (but by no means guaranteed). These cold air leaks are what give La Niñas their cold reputation. Without these leaks (that happen for various reasons), La Niñas are actually warm.

But nothing helps like revising natural gas production upward, as shown above right in time for unusually cold weather that can push natural gas prices sky high.

Debt

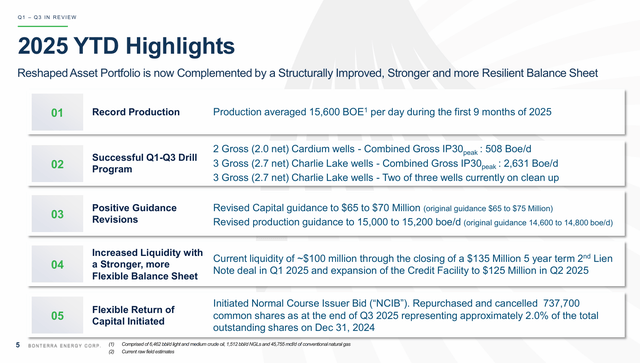

A big issue here was the refinance of debt before lower commodity prices would have increased the challenge. This wiped out all the debt that was coming due within the next two years. Now the company has some breathing room and some liquidity.

Bonterra Energy YTD Accomplishments (Bonterra Energy Corporate Presentation November 2025)

Note that the new notes take the debt out of the hands of banks (which happens to be a lot more typical of small companies anywhere) and puts them into bonds or notes. This tends to be a much more flexible arrangement.

Banks are notorious for worrying about loans at the bottom of the business cycle or when a recession hits. Too much debt with a bank can destabilize a company. This is likely the reason that some of the bank debt went into the notes that were issued as well.

The reason for the stock repurchase plan is not only that the stock is seen as cheap, but also that such a plan is seen as more flexible than paying a dividend. Right now, the weak commodity prices have been raising the debt ratio.

We saw before how management was increasing free cash flow. But now a polar vortex event could well strengthen natural gas prices that would send the debt ratio back down while providing a fair amount of extra cash to retire some debt. Waiting to see how the fourth quarter turns out is a very conservative way to operate. It is also smart because the weather is notoriously low visibility. But the stock buyback plan provides shareholder returns until management feels secure enough to begin a dividend.

Summary

Events that are largely outside of management’s control are threatening to overwhelm or dominate the company’s prospects for some time to come. The company has had decent cash flow all year, and the debt ratio is still below 1.5. But now a polar vortex may make the fourth quarter the most significant quarter for the company in some time. Even if the company pays nothing on its debt, that debt ratio may well come down when the fourth quarter becomes part of the calculation.

In the meantime, the company is migrating to a more profitable production mix that includes liquids. That has led to a lower capital budget combined with a buildup of free cash flow.

The whole process makes this a continuing speculative strong buy idea. If you go back to my older articles, you will see that this company relied upon an income model for too long. That nearly cost the company dearly. The turnaround from that situation is now well underway. This is going to be a different company going forward than the one that paid a consistent dividend in the past.

Fiscal year 2020 put the final nail in the coffin for upstream companies that tried to pay a dividend “no matter what”. Much of the industry is now moving to a base dividend combined with stock repurchases so that the dividend paid is more defensible. But that means that share buybacks begin first.

Risks

The weather is very low visibility going forward, and it is also fast moving. There is a long way for this La Niña winter to go. But right now, it sure is off to a good start for natural gas producers. Let us hope it keeps going this way.

Any turnaround like this one can be unsuccessful in the future for any number of unforeseen reasons. This turnaround story actually looks like it will get a short-term boost from the weather. But that can quickly change to become a setback.

So far, the debt levels have held steady. Cash burn appears about to reverse in a big way. Time will tell if that happens and if it is sustained as management has planned.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.