The Dutch chip-equipment manufacturing leader ASML (ASML) has rallied over 60% year-to-date, and now it is a more than $400 billion market-cap company. The market rewarded ASML due to consistent performance and solid top and bottom-line growth.

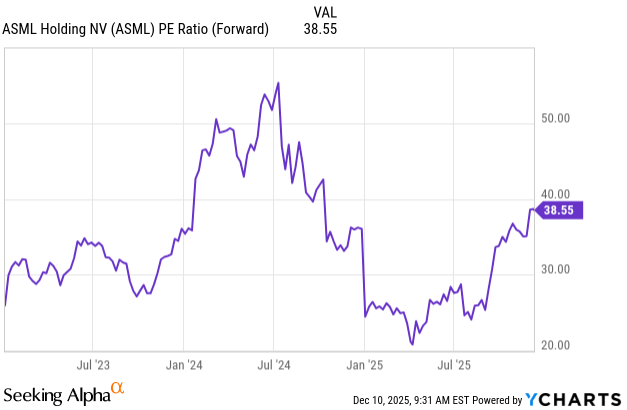

The semiconductor company now trades at 39x earnings multiple versus FY2025 EPS estimate, and roughly 37x versus FY2026 EPS forecast. This is not cheap. Compared to the FY2026 EPS estimate, it represents approximately a 54% premium versus peers at 24x, and nearly 61% versus the average company in the S&P500 at 23x earnings multiple. This seems to be too pricey to chase, and caps the upside in the short term.

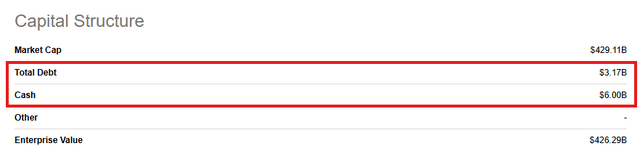

I think that ASML is an outstanding, high-quality business, but the market already knows it. The Dutch leader has a low-leveraged capital structure, delivers steady top and bottom, while maintaining above-market margins, but valuation already reflects that.

That is why I rate ASML a Hold. I think it may appreciate in the stock price, followed by bottom-line expansion, but I also wouldn’t be surprised if the stock slightly consolidates from these premium levels. I forecast a $1,176 price target over the next year, implying a 6% upside possibility, but unlikely to outperform the benchmark. It remains a solid business, but given its elevated multiple, it seems that the market already knows it.

Q3 2025: Miss On The Top-Line, But Beat On The Bottom-Line

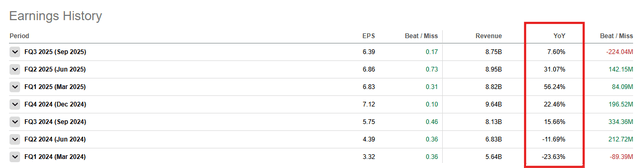

On October 15, the company delivered Q3 2025 results. This seemed to be a mixed quarterly performance, as although ASML posted a beat on the bottom-line result, the revenue result came in below analysts’ estimates. Nevertheless, the stock was up 3% on the earnings day.

ASML delivered $8.75 billion in revenue, highlighting a 7.60% growth over the past 12 months, but $224 million below what the market had anticipated. The bottom-line arrived at $6.39 in diluted EPS, an 11% on a year-over-year basis versus $5.75 in diluted EPS in the same quarter last year, and $0.17 above analysts’ estimates. I think the single-digit growth in revenue appears to be slightly concerning, and that contributes to my neutral stance. If top-line decelerates, and the trend continues in the future, the upside appears capped.

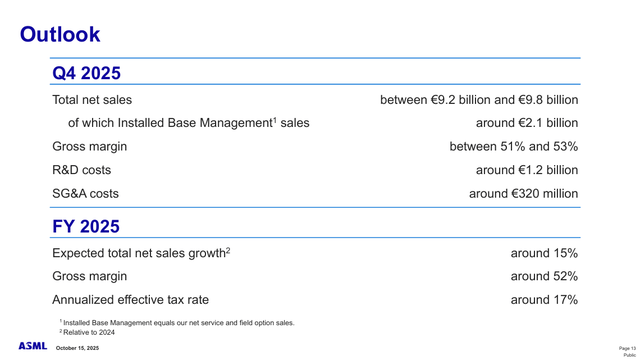

ASML: Q4 2025 Key Highlights (ASML Investor Relations)

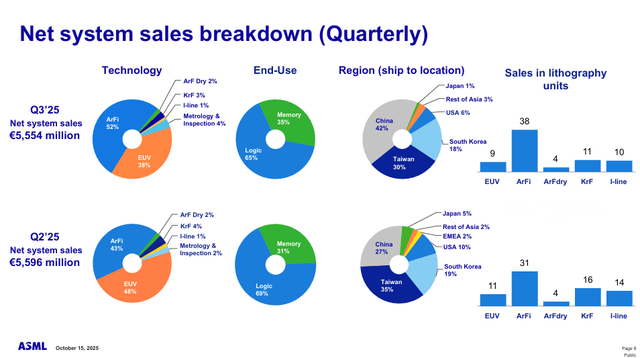

In the earnings presentation, management highlighted that ASML generated EUR5.6 billion in net system sales, accounting for 75% of the total revenue. The installed base management sales reached EUR2 billion. The top-line performance argues that ASML remains a well-diversified business across segments. The system sales are leading revenue performance, and it captured a split of 52% for ArF immersion revenue, while EUV lithography accounted for 38% of the total sales.

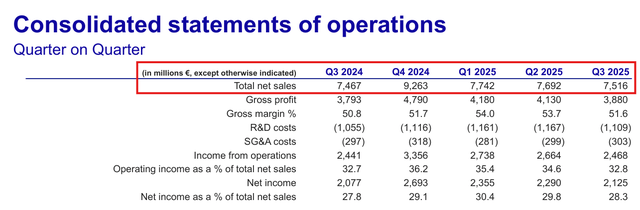

I would also like to emphasize that AMSL heavily benefited from favorable FX. The slide below highlights that on a EUR basis, the top-line performance has increased by half a percent. If no favorable FX tailwind, the company’s top-line has stagnated, and it argues for my consolidation narrative.

ASML: Q3 2025 Consolidated Statement Of Operations (ASML Investor Relations)

In terms of end-use, it accounts for 35% memory and 65% logic, making it less dependent on sole end-use. China has meaningfully contributed to the top-line performance, as shipments have surged from 27% of total deliveries to 42% on a quarter-over-quarter basis. Japan, EMEA, the US, and Taiwan contracted in terms of the percentage of total contribution. Investors should monitor, as high dependency on China could lead to a discounted earnings multiple because of elevated concentration risk.

It has also indicated that ASML achieved 51.6% in gross margin, while operating margin arrived at 32.8%. The net income accounted for 28.3% of total sales. I think these profitability metrics imply an above-market performance, arguing for an elevated valuation. For instance, in terms of the net income margin (TTM) of approximately 29%, ASML operates at roughly 5.8x outperformance versus peers at 5%. If the Dutch leader can sustain premiums, I wouldn’t be surprised if ASML traded at a substantial premium further.

ASML: Q3 2025 Shareholder-Friendly Capital Allocation Approach (ASML Investor Relations)

Furthermore, the semiconductor company is also exposed to meaningful tailwinds related to broader market growth. For instance, the global lithography market was valued at $28 billion in 2024 and is anticipated to reach $55 billion by 2032. This represents a 9% CAGR, and if the company can sustain a leading position in the space, it appears to be well-positioned to benefit from the broader market expansion.

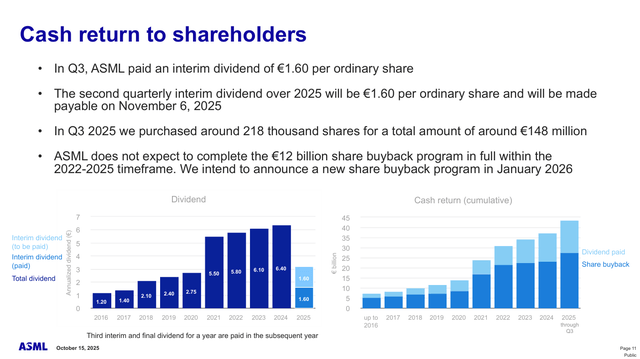

In Q3 2025, ASML has also indicated that it continues a shareholder-friendly capital approach. Besides the quarterly dividend, it has repurchased roughly 218,000 shares, resulting in about EUR148 million. Furthermore, the company anticipates the announcement of a new share buyback program in January 2026. If it includes a significant amount authorized for a share repurchase program, this may heavily support bottom-line growth over the following years.

ASML: Q3 2025 Consolidated Statements Of Operations (ASML Investor Relations)

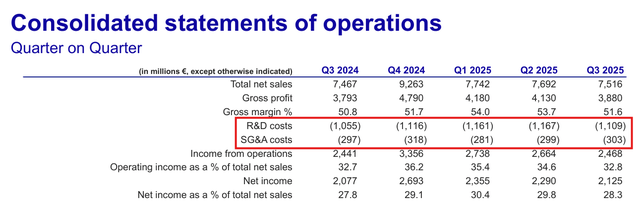

On the upside, ASML presents a business and margin stability due to well-managed costs. Both R&D and SG&A costs remained roughly flat over the past year. However, due to top-line stagnation in EUR, investors should monitor whether costs don’t pick up from here. If that happens, margins may contract, and investors may not be willing to pay a premium for the ASML stock.

To conclude, this was a mixed performance, and due to a favorable FX rate, the company’s top and bottom-line growth appeared greater than it actually was. However, management guides for a strong finish to FY2025. It remains well-positioned to deliver double-digit top-line growth, but if we exclude FX, I think the result would signal high-single-digit performance. It will be interesting to see how it plays out, but at the current price tag, it seems to be difficult to justify premium expansion; thus, supporting my Hold stance.

ASML: Q4 2025 Outlook (ASML Investor Relations)

ASML Appears Expensive, And Too Pricey To Chase

ASML currently trades at a forward P/E of about 39. Although the chart below highlights this is a business-typical valuation, given its recent performance, I argue the stock is expensive and may be due for consolidation.

ASML: Forward P/E (YCharts)

On a forward PEG (non-GAAP) of 2.19, ASML appears to be trading at 26% premium versus the sector median of 1.74. It remains insignificant, and may argue for uptrend continuation in the stock price, if top and bottom-line growth meaningfully resume.

On a forward EV/Sales and Price/Sales ratios of 11.28 and 11.36, respectively, ASML appears to be trading at 3x overvaluation at the midpoint versus peers at 3.49 and 3.55. Valuation metrics imply that the market anticipates a meaningful top-line growth, and I don’t think that high-single-digit performance, if we exclude FX, justifies a premium multiple. In addition to this, ASML remains heavily dependent on AI-driven tailwinds, and if sentiment dramatically shifts, top-line could correct, too, alongside earnings multiple.

ASML: Capital Structure (Seeking Alpha)

The Dutch semiconductor manufacturing company has a low-leveraged capital structure, arguing for a bullish continuation. Although the company has $3.17 billion in total obligations, it also has $6 billion in cash. The capital structure reveals ASML could pay its debt with ease, and remains well-positioned to operate in both high and low interest rate environments. To this, following the company’s reference to the expected share repurchase program in FY2026, this supports a shareholder-friendly capital allocation approach, indicating strong liquidity and low leverage.

Over the past 12 months, ASML delivered a 23% revenue growth, but it’s important to emphasize a few things. To begin with, the company’s performance remains volatile, with one quarter posting an 11% top-line decline, which is then followed by 16% growth on a year-over-year basis. Moreover, the recent performance highlighted a slowdown in revenue growth, and investors should monitor whether this is a more structural issue. Also, long-term investors should consider FX headwind if the EURUSD pair experiences a shift in the trend.

ASML: Earnings History (Seeking Alpha)

ASML operates at premium margins, and that partially supports a premium multiple. The gross profit margin (TTM) of 53% indicates an 8% increase versus the sector median of 49%. The EBIDTA margin (TTM) of 38% highlights a 3.5x outperformance versus peers at 11%. If the semiconductor leading can sustain such margins further, this would support a bullish outlook.

The Dutch leader remains a strong company that has a solid market position and experiences momentum in demand. However, it trades at a substantial premium, which argues that the market may have already priced in the company’s future growth. If results arrive weaker-than-anticipated, the downside is not protected. I remain cautious, especially due to recent performance, which would indicate a flat yearly performance, if not the FX tailwind.

Wall Street anticipates $30.15 in diluted EPS for FY2026, and this represents a 5% growth on a year-over-year basis. I agree with the estimate, as I think the company may be due for consolidation. I also think that ASML may mirror bottom-line performance; thus, if we apply approximately the current earnings multiple of 39x to the FY2026 EPS estimate of $30.15, we arrive at my price target of $1,176. It will be interesting to monitor whether the forecast plays out.

Main Risks And Concerns

ASML is tied to risks and concerns that could weigh on the stock price performance in the short term.

The company is heavily dependent on AI-powered demand. If sentiment dramatically shifts, or IT spending slows down, or the heavy Capex investments do not translate into meaningful top and bottom line growth, the AI-related names may correct. If that happens, ASML is likely to follow the trend, too.

Based on the recent quarterly performance, if we exclude a favorable FX rate, it seems that the company’s top-line result was flat on a year-over-year basis. Although this could be a temporary hiccup, which is expected to pick up in the following quarter, it may also highlight a more structural issue. If the trend persists, this could significantly weigh on the company’s performance and result in a correction.

The recent quarterly performance has also indicated revenue concentration risk in China. It has accounted for 42% of total shipments in the region, and if geopolitical friction emerges between the EU and China, the company’s future may be clouded. In addition to this, there has been a shift in geographic trend on a quarter-over-quarter basis, with declining performance in the US, Japan, and the rest of Asia. If this isn’t also a temporary hiccup, I think investors may not be willing to pay a premium for the company’s stock.

On the other hand, if none of the above risks and concerns materialize, I think ASML remains a solid player in the space, whose stock price may appreciate in accordance with its bottom-line growth.

ASML Is A Hold

Although I think ASML is a high-quality company that remains well-positioned to drive the AI-powered wave, its valuation appears to be too expensive to chase. If we exclude the FX tailwind, it may seem that it experiences a slowdown in top-line performance, and if this is a feature of a more structural issue, it may correct from premium levels.

Furthermore, based on the recent quarterly performance, it seems that the company has a revenue concentration risk and a high dependency on demand in China. If the AI-powered demand declines or sentiment around AI shifts, the company’s performance may erode, and investors may not be willing to pay a premium for the company’s stock. This presents a mixed picture, and I don’t think it is well-positioned to outperform the benchmark in the short term.

Thus, I rate ASML a Hold with a $1,176 price target over the next year. This presents a 6% upside possibility. 38 Wall Street analysts imply a $1,062 price target over the next year, signaling a 4% downside potential. This is definitely a possibility, and it will be interesting to see how it will play out for the Dutch company.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.