The Schwab U.S. TIPS ETF (SCHP) is a straightforward way to own Treasury Inflation-Protected Securities at a very low cost. It holds a full-curve portfolio, so its results can look very different from those of short-term TIPS ETFs and traditional Treasury funds. While inflation adjustments matter over time, SCHP’s shorter-term price moves come from changes in real interest rates, not the monthly inflation print.

First, What are TIPS?

Treasury Inflation-Protected Securities or “TIPS” are government bonds. When inflation rises, they increase in value and pay more interest.

- The principal (what the bond was issued for) adjusts based on the Consumer Price Index. So when inflation goes up, so does the value of the bond.

- Because interest is calculated as a percentage of that principal, those payments also increase. TIPS pay out interest every six months until they mature, the same as Treasury notes and bonds.

Example: a $1,000 TIPS bond with a 1% coupon. If inflation is 3%, the principal will go to ~$1,030. Interest payments would then be calculated on that higher amount.

If inflation is negative, the value may drop. But investors are guaranteed to get back their original investment if held to maturity.

Schwab U.S. TIPS ETF: Its Structure and Strategy

SCHP tracks the Bloomberg U.S. Treasury Inflation-Linked Bond Index (Series-L). This is the most common benchmark for the TIPS market. The Bloomberg index includes all publicly issued fixed-rate TIPS with 1+ years to maturity and $500M+ in outstanding face value. The index is updated monthly and weighted by market value.

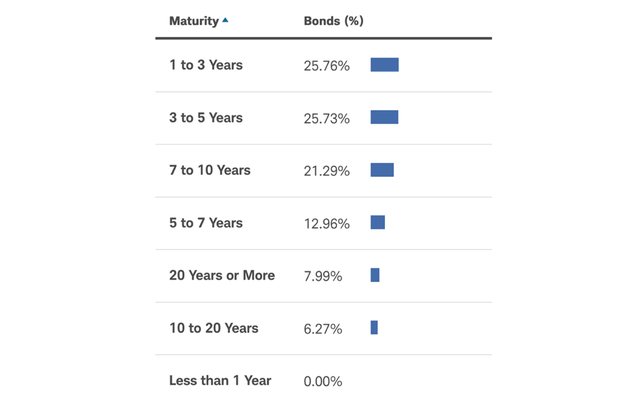

SCHP currently holds 49 bonds spread across the full maturity curve, from short-term to 20+ years.

Schwab Website

The weighted average maturity is ~7.2 years with an effective duration of ~6.5 years.

This is similar to intermediate Treasury funds like iShares’ (IEF) or Schwab’s (SCHR).

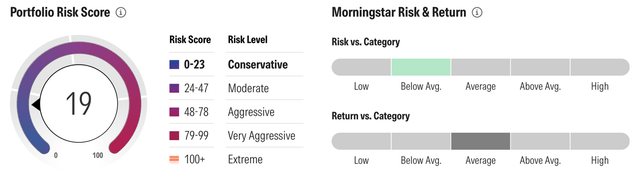

100% of SCHP’s holdings have AA-equivalent credit ratings. The default risk is next to zero because TIPS are backed by the U.S. government. Morningstar classifies the ETF as “conservative” and “below-average risk” compared to its category.

Morningstar Website for SCHP

SCHP’s mandate requires that at least 90% of assets are invested in the index. The rest can go to newly issued bonds, government securities, or cash equivalents. The fund’s turnover is around 24% per year, consistent with the index’s monthly changes and steady issuance of new TIPS.

The current 30-day SEC yield for SCHP is 4.74%. The average yield to maturity is 3.89%.

Where the Schwab U.S. Tips ETF Might Fit in Portfolios

An ETF like SCHP generally serves three purposes. The first I’ve touched on: it’s a bond option that adjusts with the cost of living. When inflation rises, both the principal and interest payments increase.

Second, it can be used tactically when the investor thinks inflation is headed higher than the bond market has priced in. Historically when that’s happened, TIPS prices held up better than traditional Treasuries with similar duration. Why? Because the market quickly reprices securities based on inflation expectations.

Third, SCHP can help diversify. TIPS respond mainly to changes in inflation-adjusted interest rates, not credit stress or the equity market. They have low correlation with stocks. Adding SCHP can steady returns of a portfolio that’s heavily weighted toward equities or credit-sensitive bonds.

SCHP is best held in tax-advantaged accounts. With individual TIPS, the inflation adjustment to principal creates “phantom income” because it’s taxable even though no cash is received. SCHP distributes the adjustment as cash, and those payments are taxed as ordinary income in regular brokerage accounts. Holding SCHP in an IRA or 401(k) avoids this.

Performance Expectations for SCHP

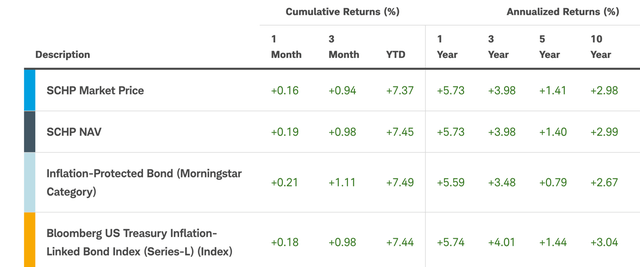

Historically, SCHP has closely tracked the benchmark. It has also slightly outperformed its category peers:

Schwab Website for SCHP

Annualized total returns were ~3% over the past decade but have been notably higher since late 2022. This tracks with the broader TIPS market’s recovery as inflation cooled from post-pandemic highs.

Long-term performance for SCHP and other TIPS funds stems from: (1) the real yield at purchase; (2) the rate of inflation over the holding period; (3) changes in real interest rates. Of these, movements in real rates are the main risk for TIPS investors.

Definitions

Real yield: yield on a bond after accounting for inflation

Real interest rate: interest rate adjusted for inflation

Example

Real yields rose sharply as the Fed tightened policy in 2022. Despite elevated inflation, higher real rates led to double-digit declines across the TIPS category. SCHP’s worst quarter during that period was a loss of about 6% (in Q2 2022).

Summary of How SCHP Performs in Different Market Environments

When inflation runs hotter than expected: SCHP is at its best here. As discussed, both the principal and interest payments on TIPS adjust upward with CPI. Treasuries, by contrast, suffer as their fixed payments lose value when prices rise.

When the Fed is hiking: Performance during tightening cycles is based more on changes in real interest rates than inflation. The 2022 example illustrates that real yields rose but SCHP’s price (NAV) still declined despite elevated inflation.

When the Fed is cutting: Easing cycles have been good for SCHP and its peers. The 2007-2008 period is a clear example: TIPS performed well when the Fed cut aggressively but inflation stayed elevated.

During a slowdown or in mild inflation: SCHP can lag traditional Treasury funds since falling nominal yields favor fixed-rate bonds. That said, TIPS have a built-in floor: the bonds won’t repay less than their original principal at maturity. This offers protection in severe disinflationary periods.

Comparison of SCHP and Its Closest Peers

For this discussion we’ll limit the comparison to ETFs, where there are a handful of large, low-cost options. SCHP’s closest peers fall into two groups:

Full-Curve Peers

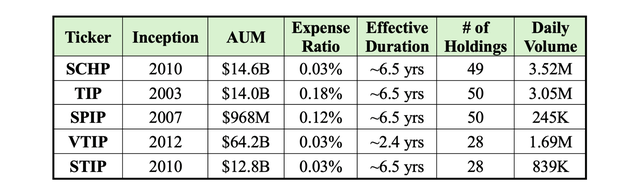

iShares TIPS Bond ETF (TIP): Tracks the same Bloomberg index as SCHP, so any portfolio differences are minimal. The main difference is cost: TIP charges 0.18% vs. 0.03% for SCHP. Over a decade, that compounds to a ~2.3% return gap. But since 2015, SCHP has only outperformed TIP by about 1.5%. TIP actually won at the portfolio level but its higher fee more than offset that advantage.

SPDR Portfolio TIPS ETF (SPIP): Also covers the full TIPS curve but tracks a slightly different Bloomberg index. This ETF is much smaller than both SCHP and TIP. It too has underperformed SCHP, likely due to its higher expense ratio (0.13%). SPIP is also far less liquid.

Short-Duration Peers

Vanguard Short-Term Inflation-Protected Securities ETF (VTIP): Only holds TIPS with maturities under five years, resulting in a shorter duration of about 2.4 years. It’s the largest in the category by far and matches the 0.03% expense ratio of SCHP.

iShares 0–5 Year TIPS Bond ETF (STIP): Nearly identical to VTIP in structure but pays distributions monthly instead of quarterly. Though it’s about a fourth the size, STIP is the more liquid of the two short-terms. iShares also matches Vanguard’s and Schwab’s expense ratio.

Side-by-side comparison:

Data sourced from Seeking Alpha

Pros and Cons of Short Vs. Long

Short-duration TIPS funds should modestly outperform in periods of rapid rate hikes because of their lower price sensitivity. Full-curve funds like SCHP and TIP offer more upside when real yields fall or when inflation is high for an extended period.

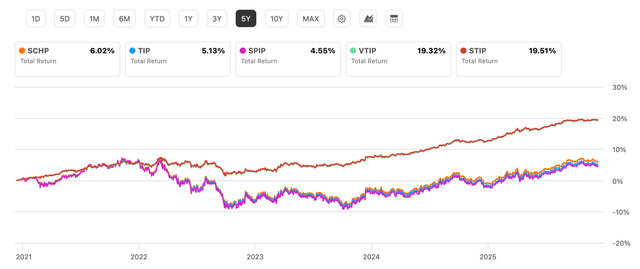

The charts below illustrate this. Short-term TIPS had a significant advantage in the recent rate-hiking period:

Seeking Alpha

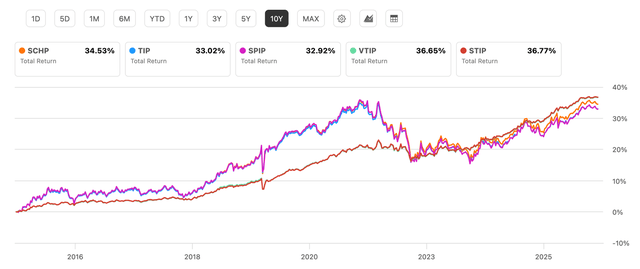

While performance converges over a longer horizon:

Seeking Alpha

Summary

The Schwab U.S. TIPS ETF offers total exposure to the Treasury Inflation-Protected Securities market. It does so at a very low cost. The portfolio spans the full maturity curve resulting in moderate interest rate sensitivity. The ETF’s returns are tied to inflation adjustments and changes in real interest rates. Investors use SCHP for long-term inflation protection, tactical inflation hedging, or portfolio diversification.

This article answers these five main questions about SCHP:

1. How do Treasury Inflation-Protected Securities work?

2. How is the Schwab U.S. TIPS ETF constructed?

3. How can SCHP function within a diversified portfolio?

4. How does SCHP behave in different market environments?

5. How does SCHP compare to peers such as TIP, SPIP, VTIP, and STIP?

Editor’s note: This article is intended to provide a general overview of the ETF for educational purposes only and, unlike other articles on Seeking Alpha, does not offer an investment opinion about the ETF

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.