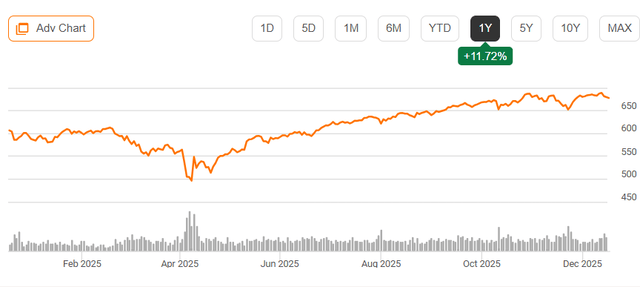

With December fast approaching an end, now is the time of year when analysts put forth their 2026 predictions. 2025 was another strong year for markets, with the S&P 500 (SP500) up 12%. That said, the economic cycle is aging, earnings growth targets are ambitious, and fears of an AI bubble loom. While I believe extreme pessimism is not warranted, I would caution against potential excesses and view 2026 as a year when investors should seek prudence and carefully manage risk.

I expect modest economic growth in 2026

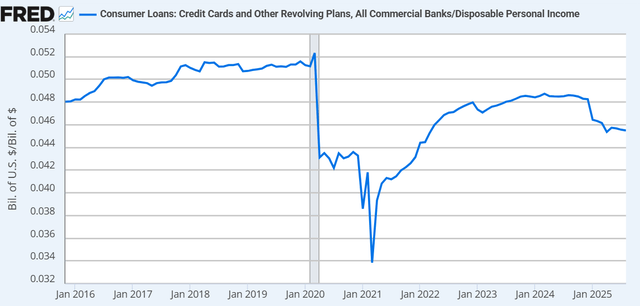

Beginning with the macro, I am cautiously optimistic about the outlook for next year. Of all industries, I follow the banking sector most closely, and consumer credit trends have been fairly encouraging. Even at the lower end of the spectrum, consumer credit quality is stabilizing after years of normalization. Consumer balance sheets are in a healthy position. Households have accumulated significant home equity, and stock prices are high. Credit card debt as a share of income is also below pre-COVID levels.

St. Louis Federal Reserve

Consumers have a capacity to spend from a balance sheet perspective. I also expect consumer incomes to improve in Q1 2026 as there is a tax refund windfall from the 2025 tax bill. That bill cut taxes in multiple ways (no taxes on tips, overtime, a larger SALT deduction, enhanced child tax credit, etc.), but there was no change in withholding (which is not really feasible midyear). Accordingly, consumer incomes received no benefit in 2025 from these measures. Instead, we should see refunds be larger than normal next year—likely by at least $25 billion in my view.

I believe we may see this support further credit improvement and a boost in spending, which should help support economic activity next year. That said, after years of inflation, consumers are clearly fatigued, and I remain cautious on very discretionary categories, like travel. I also expect spending to disproportionately come from asset-rich, higher-income households as the “K-shaped” economy continues.

On fixed investment (ex-AI, which I will discuss separately), I see the outlook as muted. I remain cautious on the prospect for meaningful “reshoring.” While tariffs should increase reshoring activity, companies react to permanent policies. If it takes three years to build a factory, that company wants to be certain tariffs will still be in place after three years to justify the investment. With tariffs facing legal challenges, being just executive orders, and being politically controversial, they may not survive into the next administration. I fear this freezes business decision-making to an extent.

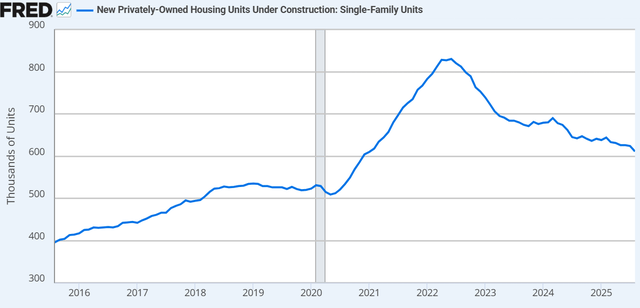

I am also particularly cautious about residential construction activity. Fed rate cuts have increased optimism about a recovery in the housing market. This was also the case 12 months ago, and I fear 2026 may prove equally disappointing. The number of homes under construction continues to fall, and I expect this to continue for at least nine months. Markets in the South are struggling with elevated supply, and apartment demand is also muted. We are likely to see housing continue to detract from growth, albeit at a lessening pace. I expect home prices to fall modestly (0%-3%).

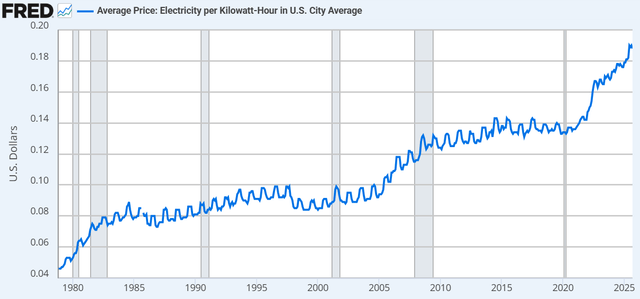

St. Louis Federal Reserve

Overall, I expect U.S. economic growth of ~1.5%-2.25% with ~1.5% consumption growth, a slightly narrower trade deficit, flattish investment ex-AI, and a ~0.5%+ boost from AI data center activity. As companies continue to pass through tariff-related costs and electricity prices face ongoing upward pressure, I expect inflation to run 2%-2.5%. I am currently anticipating two Fed rate cuts over the next 12 months, and I expect the 10-year treasury yield to remain around 4%, +/- 25bps.

Solid earnings growth is priced into markets

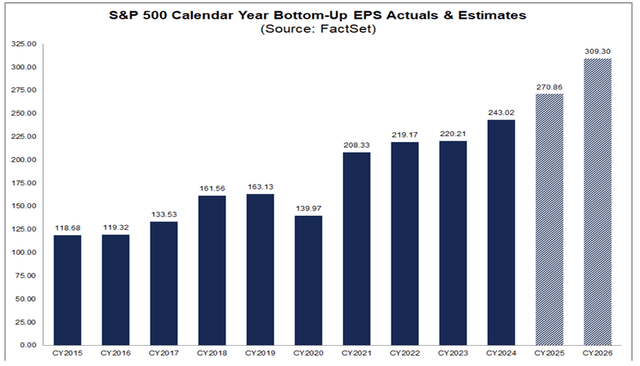

The next question is what this macro outlook suggests for corporate earnings. As you can see below, consensus is currently for meaningful earnings growth next year. The S&P 500 should increase earnings by about 11% in 2025, and analysts currently expect a similar pace of growth next year, based on an aggregation from FactSet. I am currently expecting about ~4%-4.5% nominal growth, though currency may also be a ~1% tailwind to earnings growth. In this environment, 11% earnings growth is dependent on margin expansion.

Now, excluding the technology sector, earnings growth is expected to be closer to 8%, speaking to how dependent the market is on technology delivering. Still, 8% ex-technology growth is ambitious. I am also cautious that tariffs may have a delayed impact on margins, as companies have worked through pre-tariff inventory. I view 5%-7% ex-technology earnings growth as a more reasonable base case. Even assuming tech delivers as hoped, I view ~$304 as a better EPS base case for the S&P 500. This still is up 9% from 2025 levels.

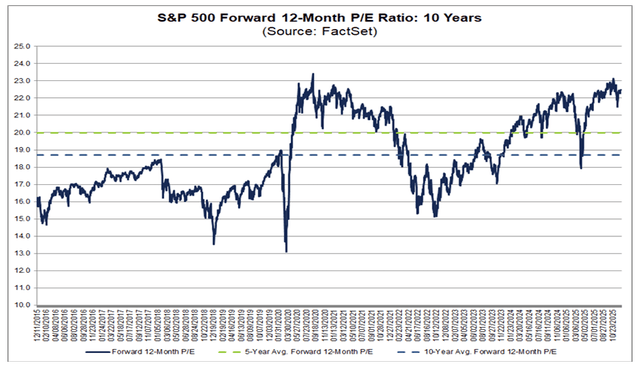

While earnings growth is expected to be robust, it is difficult to argue that stocks are cheap. The market is trading at ~22.5x forward earnings, which is above both its five- and 10-year averages. We only saw the market trade at a higher forward multiple during the COVID pandemic. Of course, during recessions, markets tend to have higher multiples as near-term earnings are depressed. To be near a peak multiple while also at record earnings is less typical. Now, elevated valuations can persist for longer than anticipated, and as such, I generally avoid sell recommendations based solely on this, but it clearly should be a source of caution for investors.

Markets are concentrated

This gets to the “X factor” for the market: AI sentiment. As you can see below, the top 9 components of the S&P 500 are all large technology firms. Together, these stocks account for ~37% of the market. Looking through my records, I have covered over 220 companies in 2025, but together, their value may be less than this handful of companies. I could be right that a company like Jackson (JXN) has 30+% upside, but from a broader market perspective, even a 0.3% drop in these companies would fully offset it.

Investopedia

It may be uncomfortable, but the reality is that how these large technology companies perform in 2025 will largely determine how the market performs in 2026. Frankly, I have been encouraged by the market’s ability over the past three months to digest some volatility here. We have seen Oracle (ORCL) fall sharply and NVIDIA (NVDA) pull back 10% from its high, but the market remains near a 52-week high thanks to rotation. Other sectors like financials (XLF) have pushed to 52-week highs to offset this weakness. This rotation helps to reduce AI sentiment risk in the market.

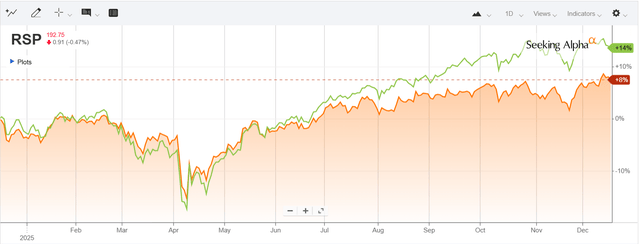

As such, I am more comfortable that the market can maintain near current levels even in a 5%-10% correction in large tech, so long as earnings growth continues elsewhere. That said, breaking out to new highs will likely require participation from big tech. After all, this is a top-heavy market. As you can see below, the S&P 500 (SPY) has outperformed the equal-weighted S&P 500 (RSP) by about 6% this year. As an investor who tends to focus on value over high-growth stocks and sees many interesting opportunities among companies with sub-$100 billion market caps, I am more comfortable with RSP exposure than SPY exposure over the next year, as I believe there is upside in many non-tech stocks and am wary of AI optimism.

I am cautious about AI sentiment

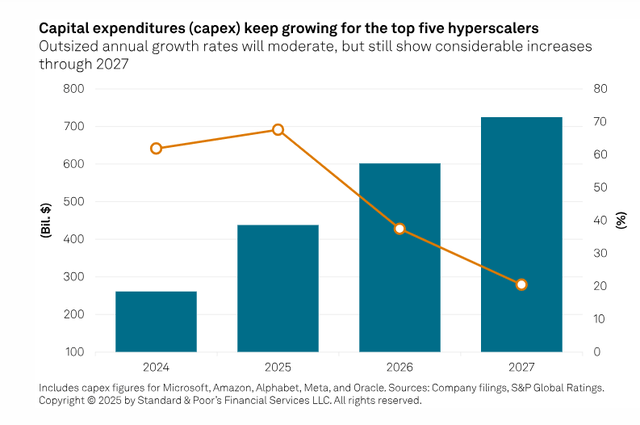

Now, no discussion of the market outlook is complete without a view on AI-related stocks. I fully admit that I do not know what AI revenue or businesses will be like in 5-10 years. This is such a frontier technology that I really am not sure anyone knows, and I suspect there will be impacts (both good and bad) that few see coming. What I do know is that we are still more in the investment than the revenue-generating phase of the AI cycle. Now, to be clear, suppliers like NVIDIA clearly generate revenue from this investment cycle, but the end producers of AI, Meta, Amazon, Microsoft, OpenAI, etc., are likely to spend more money building out the data centers and infrastructure than in collecting revenue in 2026. As you can see below, their cap-ex plans have exploded.

S&P Global

Now, this is not intended to be a criticism of AI. Every business and technology, including the great ones, has an investment cycle before a revenue cycle. We needed to build out the internet before companies could earn money from it. A car company needs to invest to build a factory before it can actually sell cars. AI is not a mature technology by any means, and we are still in the investment cycle and probably will be through 2027, at least. While revenue use cases are clearly growing, I suspect even most AI bulls would expect the impact on the economy to be substantially greater in 2029 than it will be in 2026.

While I see nothing negative about this, again, it is a natural part of a technology’s lifecycle, my concern is that this makes the share price performance of these stocks more closely tied to sentiment than near-term fundamentals. With the industry likely to spend over $2 trillion on cap-ex from 2024-2029, the revenue opportunity needs to be massive to justify this spending. When valuations are over 30x earnings in many stocks, even tweaking growth estimates from 25% to 23% can cause outsized share price reactions because the future is so uncertain.

I also am concerned about whether the supply side of the economy can meet this spending demand. We have seen news that Oracle may be delaying data center delivery dates. There is a finite number of construction crews, utility capacity, HVAC supply, etc. While the demand may be there, there is a risk that it takes a bit longer to deliver all of these projects, or that, in a bid to be first, project inflation increases. While total data center spending may meet all projections, if it takes a bit longer, this could be a negative for sentiment.

Finally, it is important to consider the fact that for years, stocks have been buoyed by a technicality: buybacks. In a sense, stocks have been a shrinking asset class thanks to buybacks, and large tech firms, rich in free cash flow, have led the way. Now, these same firms are spending much of their free cash flow on growth projects. This may be very wise long-term capital allocation, but with companies likely to slow buybacks and issue debt, that can be a headwind for EPS growth rates and share price performance.

With a 6,400 price target, I see risks skewed to the downside

With all of that said, now is the time for the moment of truth, my S&P 500 price target. As of this writing, we currently sit at around 6,800. Given my view that non-tech earnings are poised for mid-to-upper single-digit growth and the U.S. economy will grow modestly, I view a bear market as unlikely. That said, much of the optimism in technology appears priced in and is susceptible to a sentiment reset on any supply-side challenge or financing cost indigestion. I believe this is likely to limit upside, and as we saw in 2022, it can cause downdrafts (though interest rates are less of a pressure).

With about $304 of forward earnings and likely ~$315-320, I am setting a 6,400 price target on the S&P 500 by the end of 2026, or about 20x forward earnings. This implies a 6% downside and would basically return the market to where it was in August. Overall, I just see a risk that with a strong few years, we may see the market take a pause, especially as midterm elections loom (the last two midterm cycles, 2018 and 2022, saw meaningful volatility).

In the spirit of making a recommendation, on the S&P 500, I am going with a “Sell.” Investors can earn nearly 4% in cash, so a -6% return in stocks is relatively uncompelling, and I would not be opposed to investors taking some risk off the table. That said, I do not see enough downside to go outright short; rather, I see now as a time for prudent profit taking and risk rebalancing. In this weaker market, I would expect the RSP to outperform the SPY, and as always, there are many single-name opportunities. I view the insurance sector as having undue pessimism, for example, but at the top-down, overall market level, I see risks tilted to the downside.

option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.