With stocks continuing to surge in 2025 (up just over 17% year-to-date), following a 23% rise in 2024 (excluding dividends), 2026 could be another bumper year. In the macroeconomic environment, there are several trends that I see continuing to play out over the coming year. I do feel that the market is heading into “bubble” territory, but I think we are closer to 1926 than 1929 and closer to 1997 than 2000 in this regard. What I mean is, I think the key drivers of growth over the past 2 years – mainly big tech and AI-connected firms – will sustain for the time being. I do see a decent-sized correction of some kind coming, but I feel it is more likely to arrive in 2027 or 2028 than in 2026. There is more room to run, principally because of two reasons:

- Earnings results from the major players have continued to sustain investor confidence in the benefits of AI in terms of creating efficiencies, generating strong returns on investment, and thus driving growth.

- The peak of market euphoria has yet to arrive in the present market cycle, given so many analysts are already sounding the alarm of inflated stocks. It is often only when caution is thrown to the wind, so to speak, that we reach the scary euphoria that tends to lead inexorably to mass selling.

I suspect we’ll see a market rotation into some different sectors, and I would highlight healthcare (including the highest quality biotech), renewable energy (including associated utilities) and industrials to outperform the market. Consumer staples and financials should also perform well, but I’ll keep my analysis to the first group as other analysts are better able to comment on the latter.

I would expect an end-of-2026 S&P 500 target price of around 7600, continuing its current upward trend.

In this analysis, I’ll explain my reasoning but commence with some caveats – mainly to address my own discomfort with making general market predictions – and then follow-up by highlighting what macroeconomic factors I am focusing on in my analysis. I’ll detail why I feel those sectors mentioned above will outperform the market in 2026 before accounting for several short- and long-term risks to the market generally.

Some Caveats

It can be a lot of fun to make predictions about how the general market will perform in any given year, much like it is fun to speculate who might win the World Cup in the summer. However, personally, I do not approach the stock market from the perspective of a gambler, as I see flaws in the logic of doing so and, in any event – and this is where the stock market is so much harder to predict than sports – there are any number of unanticipated events or developments that could impact market performance.

As such, I do not privilege any broader market insights as a primary determinant of my own investing decisions for buying, selling, or holding a stock. They are secondary considerations at best, as I focus my analysis on individual stocks set in their broader context. The analogy of rising tides lifting many boats is countered by the idea that the “tide” in question seems to be controlled by a small number of “boats.” I take an inverse approach: the stocks determine the index performance; not the other way round.

I tend to follow 2 maxims (personal beliefs or rules of conduct) in this regard. This requires in me a great deal of humility, which I tend to believe is the most beautiful of character traits in human beings and one of the two most important traits necessary for successful stock market investing (the other being patience). I know my “best guess” could be proved wrong at any point, and I actively seek out competing viewpoints to learn and improve as an investor and analyst.

The First Maxim

I do not have – and will never have – enough information to be able to determine, with any real confidence, the three main factors determining successful market predictions:

- The direction the general market will move. It can move up, down, or sideways.

- The sectors/industries that will outperform. There are 11 sectors to choose from and dozens of industries (sub-sectors) that often move independently of their parent sector.

- The timing for when the movement will take hold. We could be correct about the first two but if we are late or too impatient to wait for our thesis to play out, we will miss out on gains.

Taken together, there are simply too many factors that could weigh on stocks in a given period of time, and most will be unpredictable a year in advance. Looking beyond the Covid shock from 2020 and just consider the last two years, where we had the following developments impact stock prices. Ask yourself for each of these: did you know this would occur; did you predict how the market would react; were you correct about which sectors would be impacted; and did you get the timing right?

- New U.S. president.

- New tariffs introduced, but then delayed, paused, renegotiated, and walked back in many instances.

- Growing fears about stagflation.

- Conflict with Federal Reserve over interest rate cuts.

- Massive AI and data center spending spree by big tech.

- 43-day government shutdown and resultant black-out period of published economic data/information.

- Ongoing US-China trade tensions, which focused on, among other things, the global control of rare earths, impacting precious metals pricing.

- Japan carry trade.

- Bitcoin’s performance and meme stocks.

- Ongoing conflict in Ukraine and escalating conflict in Israel/Gaza.

At the time, two years ago – let’s be honest – the only thing truly predictable was how unpredictable the next two years was likely to be. The wise person who said that was proven correct, as they always will be. Of course, it is often very unexciting to say “I don’t know” – and it certainly doesn’t make for good headlines – but it’s correct to take this position. We should always be wary of the person who says with supreme confidence: I know what will happen. In this regard, I tend to follow the sage advice from Peter Lynch:

“If you spend more than 13 minutes analyzing economic and market forecasts, you’ve wasted 10 minutes.”

So, the lack of a complete picture and the inherent complexity of the global economic, political, social, cultural and environmental/climatic landscapes mean we are, to use an analogy, essentially placing bets on what a complete puzzle will look like but with only a handful of the pieces. It is guesswork. Moreover, the puzzle keeps changing just to make things even more challenging for us.

The Second Maxim

It is far easier to predict the performance of a given company or stock than an entire market or index. This can be backed up with simple logic.

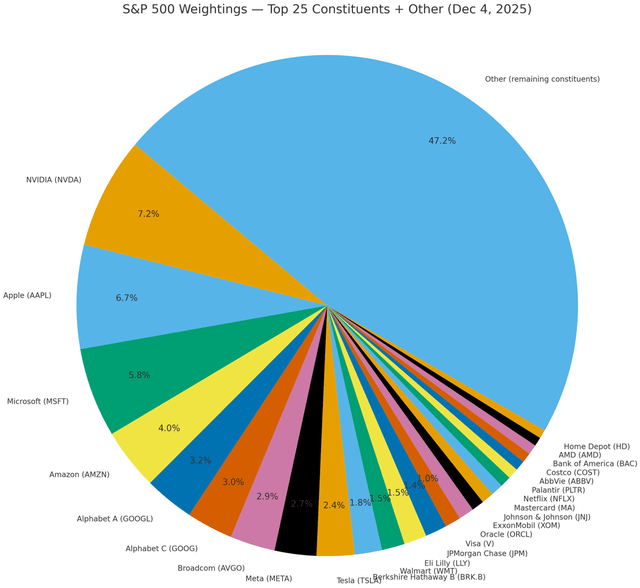

The S&P 500 (SP500, SPY) is currently dominated by 6 companies that represent nearly 30% of the entire index, and a further 14 represent the other 20% that comprise half of the index (the top 20). It would not be too much of a stretch to say that the performance of these top 20 stocks is what truly drives the index or general market, as they are broad and diversified enough to have a major impact on the smaller companies behind them. So, to be correct about the general performance of the index, you would have to be correct about the majority of these 20 stocks. Therefore, while we all know how difficult it is to determine how just one company/stock will perform in a given year, and how much information we need to have confidence in our assessment, now multiply that level of difficulty by 20 to assess how difficult it is to predict the general market with any confidence.

In short, not only is market performance invariably driven by a host of unpredictable factors beyond our own expectations, but also we do not have nearly enough information to determine how these factors will impact a large collection of companies across several dozens of different industries.

So, in making buy, sell or hold decisions on stocks, what I look for are patterns across many different companies and use these to determine what groups/types of companies are most likely to diverge from the rest of the market through their outperformance. My assessment today is based on my own confidence in company specific growth expectations and undervaluation metrics. The broader macro environment will play a role in situations where companies are highly leveraged or in a particular stage of growth that is highly sensitive to things like interest rates. Where do I see value? What types of companies am I buying going into 2026? Let’s look at the macro picture first before answering this question.

The Macroeconomic Picture

The main macro trends that I am focusing on are the following:

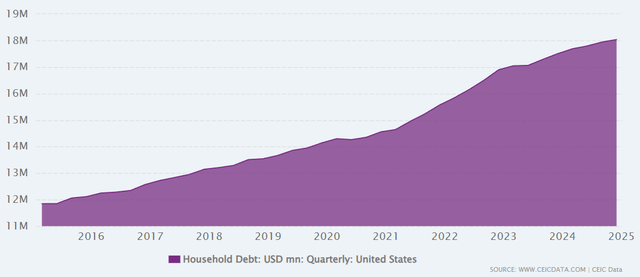

- Personal debt/credit: up. U.S. household debt is continuing to rise. While this might not be good for consumers in the long-run, it is certainly helping to buoy consumer spending, which is helping companies generate profit and sustain hiring. Only when the chickens come home to roost will the rising consumer debt become a problem on a structural level, and I do not necessarily see a catalyst for that happening just yet. Rising debt also helps banks and financial stocks as much of their revenue is tied to consumer lending and interest payments.

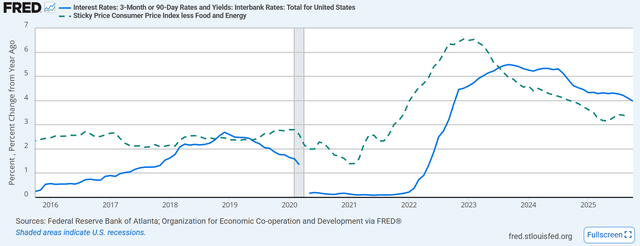

- Interest rates: down. Interest rates are trending downward, and this is good for businesses that are leveraged, helping to decrease their interest payments and reduce the cost of investing in growth. So long as inflation continues to trend downward this will be bullish for stocks. The Consumer Price Index (less food and energy) is 3.4% presently, which is still higher than what the Federal Reserve want but probably not high enough for them to actually raise interest rates in my view.

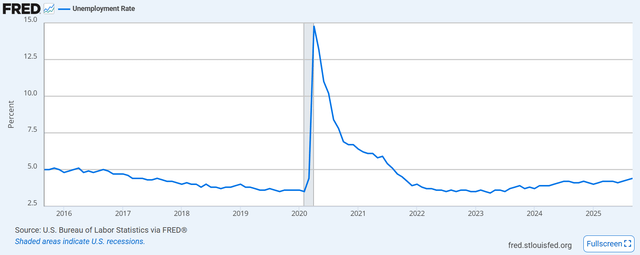

- Unemployment – up. The U.S. unemployment rate is trending upward since 2023, but is still low by historical standards. Only if this were to continue rising above, say 6%, that the stagflation fears sparked earlier in the year might resurface. Moreover, rising inflation is often seen as a catalyst to reduce interest rates and spur growth. The Federal Reserve has this option up their sleeve. If interest rates were below 1% and unemployment was rising, we’d be in trouble as the Federal Reserve would have fewer levers to pull.

- Consumer spending: up. While various news sources reported that U.S. consumer spending slowed in September – increasing just 0.3% – U.S. consumers spent a record combined $14.6 billion in recent Black Friday and Cyber Monday sales, up 27% from 2024 according to Shopify. So, while higher prices are hurting consumers, their appetite for consumption itself seems strong. I would expect this to moderate at some point, but we are still very much in the post-Covid “revenge spending” phase that mirrors the Roaring 20s when people in many countries like the U.S., Canada, and many European nations were recovering from the First World War by splurging. We all know how that came to an end, but I don’t think we’re there yet, a century later and under different macroeconomic circumstances.

Areas of Outperformance

In my view, the AI-enabled tech boom is still underway and as long as the major drivers of this growth – big tech alongside semiconductor firms like Advanced Micro Devices (AMD) and companies like Oracle (ORCL) and Palantir (PLTR) – continue to boast strong growth as they by and large did in Q3, this trend should continue.

It will also likely pull along those industries or sectors that will underpin this growth. Huge infrastructural build-outs are ramping up as data centers are being constructed and brought online, and energy needs increase. Beyond some of the more obvious beneficiaries, I expect companies exposed to renewable energy to perform well, a key driver being the global push to move beyond reliance on fossil fuels. Beneficiaries going into 2026 would include utilities like NextEra Energy (NEE), alongside more profitable renewables (and especially solar) pure plays like First Solar (FSLR) and Nextracker (NXT) that have shown decent growth despite souring sentiment in the renewables space generally.

Renewables must play an increasing role in the energy mix going forward given the energy price inflation being discussed so widely, alongside battery tech, and though some of the companies in this space have been volatile, there is quality in there and, collectively, they provide the solutions that are needed to satisfy the increasing demand for cheaper and more efficient power generation. I would expect the Invesco Solar ETF (TAN) to perform well, and I note it has risen a whopping 83% since its bottom in April 2025.

Alongside the renewables energy sector, several lesser-known names in industrials seem cheap by historical standards, like Cintas (CTAS), Copart (CPRT) and Watsco (WSO), yet offer solid profitability and generate enormous FCF. These are “boring stocks,” not tied to the AI boom so have not participated in the recent rally, but are bound to bounce back as investors seek safer investments in profitable industries.

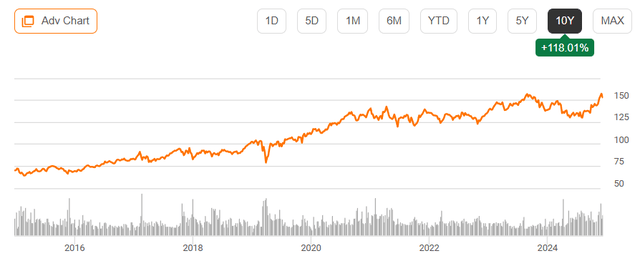

The industrials index fund (XLI) has shown decent 10-year growth (11.3% CAGR) but has only risen 9% in 2025. One of the strongest stocks in the index is Uber Technologies (UBER) – really a technology company – which I suspect will continue into 2026 as they expand operations.

Elsewhere, the healthcare sector has underperformed the market but several names continue to boast strong earnings, trading at historically low valuations. I would include Zoetis (ZTS), Davita (DVA), Novo Nordisk (NVO), Progyny (PGNY) and Align Technology (ALGN) as examples. Most of these are companies I have covered before, which I believe remain good value. The healthcare ETF (XLV) has shown a strong 10-year trend and will, in my view, bounce back from a weaker 2025 (just 6% growth). This process has already started to develop, with shares in the ETF edging closer to all-time highs reached in September 2024 after a healthy rebound in the last few months.

Eli Lilly (LLY), Johnson & Johnson (JNJ) and AbbVie (ABBV) continue to show strength as leaders in the general healthcare and pharmaceuticals space, where sustained product demand and a flight-to-safety could push these non-cyclical stocks still higher in 2026.

Risks

I see several short-term risks to the market. The US Supreme Court is set to rule on whether President Trump’s tariffs are unlawful, which has already brought lawsuits from Costco (COST) among others. Also, unemployment could continue to rise, and the consumer could weaken further. Alongside these more transparent (and not unexpected) impacts are those as yet unknown. We cannot account for these, but we can protect our portfolios by investing in companies that show strong fundamentals. If anything, it is this gradual shift to value/quality that I foresee happening in 2026. While the general market will hum along nicely, I do suspect more and more investors will rotate out of the speculative stocks that brought enormous gains this year and instead focus on those with more durable moats and long-term earnings trends.

If we don’t see this and instead watch AI-based stocks continue their seemingly inexorable rise, we may speculate further on the bubble bursting. At this point, there is still time for earnings to “catch up” to the projections without a major correction happening, but I would expect money to stay in the market and be diverted to the other areas I outlined above.

I also see one major long-term risk, which is the impact of Trump’s policies on hiring overseas labor. News broke in October of a $100,000 fee for new H-1B visas. The aim, it seemed, was to stop abuses and protect American workers from losing out to educated overseas laborers by making it more expensive to hire externally. However, I believe this – when added to the tariffs and other protectionist policies – could cause American leadership in areas like technology to deteriorate. Over recent decades, U.S. growth industries have been built off the back of both foreign investment and overseas labor, where American (often multinational) corporations have been able to attract the best talent globally. Indeed, a recent study estimated that 46.2% of fortune 500 companies were founded by immigrants or their children, representing $8.6 trillion in revenue during the 2024 fiscal year. These companies were also responsible for employing over 15.4 million people worldwide.

Nvidia’s Jensen Huang (born in Taiwan), AMD’s Lisa Su (Taiwan), Tesla’s Elon Musk (South Africa), Microsoft’s Satya Nadella (India), and Alphabet/Google’s Sundar Pichia (India) are just a handful of examples of how some of the most successful American businesses have benefitted from foreign-born leadership. It is not a stretch to say that if American companies reduce salary/benefit packages to compensate for these higher visa costs, talent might go elsewhere, and the longstanding belief of a U.S. company as “the place to be” for those born overseas could lose its shine.

To foster American-born talent at the expense of an educated workforce from overseas merely reduces the talent pool or disincentivizes international recruitment by American companies. The long-term risk is that this could make American companies not only less competitive in the talent market, but also thereby weaken them relative to their overseas competitors who suddenly become more attractive as places to move and work. This risk is not necessarily something that may be witnessed in 2026 but cracks could begin appearing as the policy rolls out and companies begin to shift their hiring procedures in its wake.

Conclusion

While big-tech will likely continue driving a lot of the growth in the U.S. economy in 2026, I would expect a mild rotation into some of the more beaten-down sectors like healthcare, industrials, renewables and utilities as a flight to safety begins. While I have no intention of making any major adjustments to my own portfolio based on this “best guess,” these are the areas into which I have been buying stocks in anticipation of improving sentiment. Fundamentally, there are still several areas of strength in the market, but opportunity cost dynamics have fueled the AI/tech rally rather than significantly weakening fundamentals in these other areas. While rating the general market a Buy and assigning a 7600 price target for the S&P 500 index, I expect this pendulum to begin swinging back in 2026. Of course, we should be prepared for anything.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.