Silver – The third spike

Silver (SLV) (XAGUSD:CUR) is currently in a major parabolic spike, with the price around $60/oz.

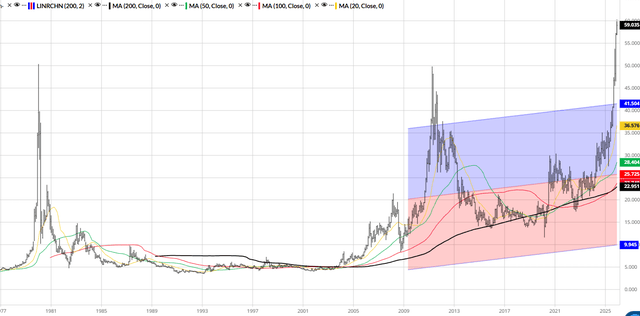

Based on the chart below, this is the third major spike in the price of Silver since the 1970s, and based on the chart, it will not end well. Just like in the previous two episodes, silver is likely to collapse to below $20/oz.

Thus, Short Silver is possibly one of top trades for 2026. However, the only problem is to figure out where the top is, as the current spike could continue.

As I will explain, the current spike in silver is very similar to the GameStop short squeeze because it’s driven by the retail investors. However, GameStop (GME) is a company with earnings, a balance sheet, and a valuation ratio, and thus, we can measure fundamentals. Silver is a commodity, and there is no PE ratio to track the deviation from fundamentals.

In my playbook, Silver is trading based on a certain macro theme, and it will rise for as long as that theme holds, after which it will likely collapse. The challenge here is to pinpoint what exactly is driving the price of Silver – what’s the theme, and how long will it last?

It’s a Fed bubble

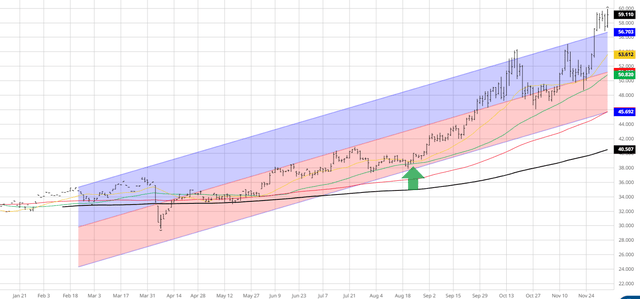

In my playbook, Silver has been driven primarily by the Fed. Notice on the chart below the green arrow pointing higher. At that point, Silver was trading at $40, and it was late August.

The Fed was at the Jackson Hole Symposium on August 21st, when the Chair Powell surprised the market and signaled the beginning of the policy normalization, or a series of interest rate cuts to bring the Federal Funds rate to the neutral level.

After the Fed’s Jackson Hole dovish turn, many speculative bubbles started to inflate, and one of those was Silver, which has increased by 50% since then – that was the parabolic move.

However, the Fed is about to signal the end of normalization policy at the December FOMC meeting. I expect that the Fed will signal that the normalization policy will extend over the next two years with one cut in each year, which practically means a long pause after the December cut and practically the end of interest rate cutting cycle.

Thus, the market will likely interpret this as a hawkish cut, and the Fed bubbles are likely to start to deflate, including the Silver bubble.

Other factors

Silver has been in a major short squeeze driven by the retail investors, similar to what happened with GameStop. Here is an example of social media campaign to trigger the Silver Squeeze 2.0.

X

I remember for a long time, many have been trying to cause Silver short squeeze. There was always a rumor that major “bullion banks” are trying to manipulate the price of Silver by shorting the paper market, or shorting Silver futures.

The “plan” was that Silver investors should buy Silver futures and ask for physical delivery at expiration. Exchanges would not be able to deliver Silver because they don’t have sufficient Silver inventory – at that point the price of Silver would spike and force “bullion banks” to cover their short positions.

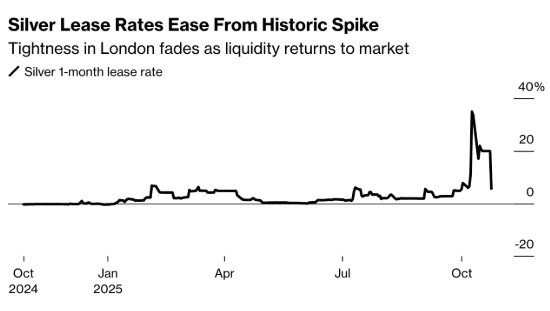

It looks like that’s exactly what happened recently. The inventory shortage first appeared in London when Silver lease rates spiked to nearly 40% in October, as the price below shows. Subsequently, Silver lease rates fell to 5.6% on Monday, October 27th, after some Silver inventory had been shipped to London from other exchanges.

Bloomberg

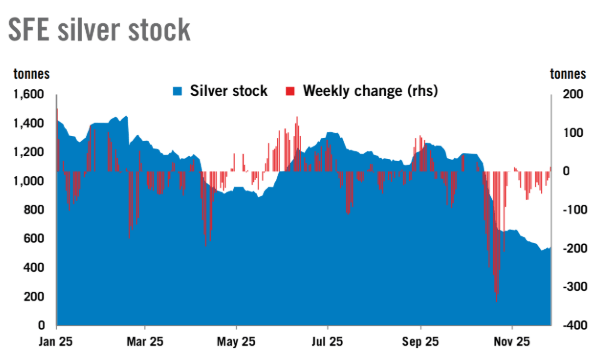

However, now the Shanghai exchange is experiencing a silver inventory shortage. The Silver shortage in Shanghai suggests that the short squeeze is not finished.

Obviously, as long as Silver futures investors demand physical delivery, the Silver squeeze could continue.

Bloomberg

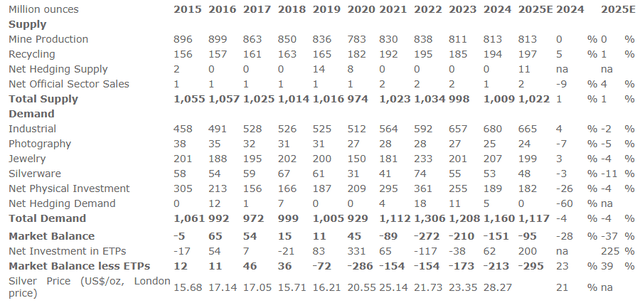

The Silver supply-demand deficit

Silver has been in a supply-demand deficit since 2020. The industrial demand for silver has been increasing due to EV vehicles and general electrification, while supply has been limited due to mine production issues.

In fact, as for any other commodity, the silver price fundamentals are a function of supply and demand.

However, Silver has been in deficit for 5 years, but the price just recently turned parabolic. Thus, even as fundamentals remain positive, I view the recent parabolic move in Silver primarily due to the Fed’s August dovish turn, which triggered the speculative fever and a massive Short Squeeze.

Implications

Silver is in a major parabolic spike, and it is very likely that the price collapse is coming, just like in the previous two spikes. Thus, Silver is a candidate for a Short position. In fact, the Fed’s December meeting could trigger the bust.

However, the risks are substantial.

- The short squeeze in Silver could continue for as long as investors in Silver futures continue to demand physical delivery upon contract expiration. There is no way of predicting when this will end.

- The momentum in Silver is very strong, and technically Silver is a buy, which is likely to attract trend followers and add to the short squeeze dynamics.

- Finally, Silver could be broadly trading based on the currency debasement theme. Yes, the Fed could make a hawkish turn at the December FOMC meeting, but the Fed will also get the new Trump-appointed Chair in May, whose name will be announced shortly. Thus, the currency debasement trade will likely be active in 2026 and could continue to support the price of Silver and Gold (GLD).

Thus, as tempting as it is to enter the Silver Short trade, the risks are substantial, and we don’t want to be the ones squeezed. However, I would still recommend taking profit on Silver ETF (SLV), but this Sell recommendation is still not a recommendation to Short yet. It’s on my watchlist as a Short candidate for now.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.