The WisdomTree U.S. High Dividend Fund ETF (DHS) is a passively managed exchange-traded fund designed to track high-dividend-yielding companies in the domestic market. The fund was designed to be complementary to a large-cap value strategy given its prioritization of large-cap dividend paying stocks. The strategy currently has a distribution rate of $3.22/share, yielding 3.18% on a trailing twelve-month basis, presenting investors an appealing portfolio for equity income in an ETF wrapper.

About WisdomTree U.S. High Dividend Fund ETF

DHS was launched by WisdomTree Funds on June 16, 2006 on the NYSE Arca Exchange. The strategy was primarily designed to track the WisdomTree High Dividend Index, a subindex of the WisdomTree Dividend Index. The Index selects and weights stocks based on their dividend yield, focusing entirely on companies domiciled in the US. Companies must have a minimum market capitalization of $100mm and must have an average daily trading volume of $100k for inclusion. The Index is rebalanced and reconstituted annually to reflect forward dividend projections and their proportional balance amongst constituents.

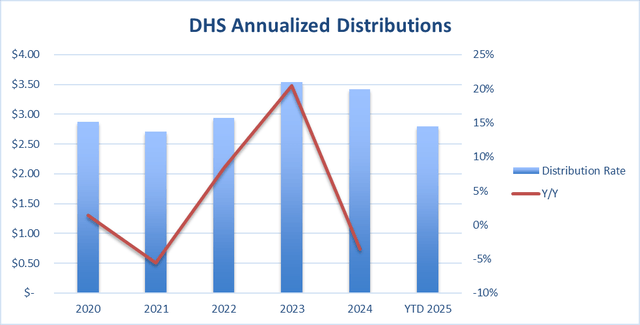

DHS pays out distributions on a monthly basis and currently has an annualized rate of $3.22/share yielding 3.18% on a trailing twelve-month basis. Distributions can vary widely from month-to-month, let alone year-to-year depending on the constituents’ price appreciation and relative distribution yield. Given that the fund is weighted based on distribution yield, the total distribution rate will likely expand and contract from year-to-year to reflect the underlying yield rather than rate.

Seeking Alpha

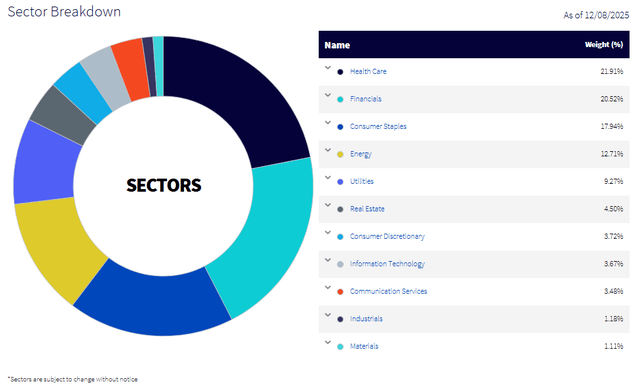

DHS is broadly diversified across 363 individual holdings with the top 10 holdings making up 42.39% of net assets. In contrast, the bottom 10 holdings account for roughly 0.013% of the total portfolio weight, suggesting that the portfolio is relatively top-heavy in terms of asset allocation.

DHS is largely weighted in the health care sector at roughly 22%, financials at 20.52%, and consumer staples at nearly 18%. Top holdings within the strategy include Johnson & Johnson (JNJ) at 6.66%, AbbVie (ABBV) at 5.27%, and Philip Morris International (PM) at 5.11%.

Corporate Filings

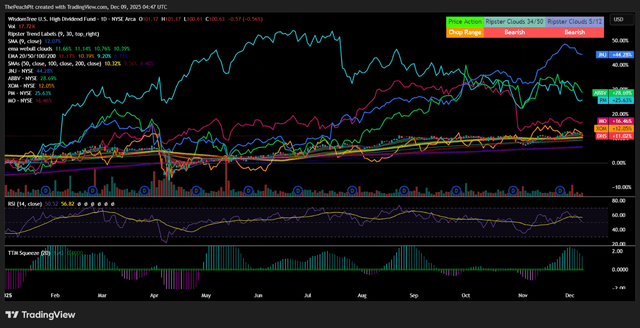

Year-to-date, DHS has modestly outperformed the S&P 500 Value Index (SVX), beating the Index by roughly 0.36%.

TradingView

Taking into consideration the fund’s top constituents, top holdings outperformed DHS on a total return basis with many of these holdings maintaining a distribution above the ETF.

TradingView

At a high level, DHS could be an appealing investment strategy for investors seeking to diversify their portfolios out of the technology sector given that the sector is underweight at 3.67% whereas the S&P 500 has a sector weight of 27.23%. This can be exceptionally appealing for investors following the run-up in the technology sector in recent years with the AI theme driving the market for two years running. Though I’m not suggesting that the AI theme has been exhausted, I believe that sector rotation may be necessary to hedge risk if the AI theme were to face disruption or slowdown.

Given that DHS prioritizes large-cap stocks, the ETF could potentially be utilized to replace a respective large-cap core ETF or be used as a complementary position given the sector weightings. For example, the Schwab US Broad Market ETF (SCHB) is largely weighted in technology stocks, though to a lesser extent when compared to the S&P 500 (SPY) or the S&P 500 Value (IVE).

One of the benefits of DHS is that the portfolio rotates based on dividend yield rather than sector rotation. This may mean that the portfolio protects its distribution by rebalancing and weighting holdings more heavily towards higher yielding stocks rather than targeting sectors for growth. The biggest headwind as part of this strategy is that the strategy may prioritize yield over growth, potentially impacting investors’ total returns while favoring income.

That being said, rather than chasing yield, the portfolio also takes a fundamental approach to valuing risk associated with the company and durability of the dividend. This can be critical for balancing risk and yield, potentially offering investors more moderate risk with respect to large-cap indices. For example, the average price/earnings ratio in DHS is 17.14x, substantially lower than SVX which has an average P/E of 23.10x. In addition to this, the portfolio has a beta of 0.88x with respect to SVX, potentially suggesting lower volatility risk with respect to the broader market, offering investors a more sustainable portfolio strategy.

Investor Suitability

DHS can be best utilized as a long-term core position for dividend income and value. I believe investors can best utilize DHS by building a portfolio around the ETF, adding satellite positions to capture growth in sectors of interest that may be underrepresented in DHS such as industrials or technology. DHS can also be utilized as a placeholder for unutilized excess cash in an equity portfolio, capturing dividend income rather than remaining idle in money market funds.

Risks Related to DHS

DHS aims to allocate funds into high dividend-yielding US companies, potentially exposing investors to certain risks that must be considered prior to making an investment decision.

Risks are largely centered around investor suitability. Though DHS will capture capital appreciation and growth to a certain extent, underweighting growth sectors like technology may lead to lower growth with respect to peer core equity strategies. DHS’s rebalancing approach may result in overweighting stocks that may have historically underperformed in order to achieve a higher relative dividend yield, potentially adding certain risks to security selection depending on the quality of the company.

Final Thoughts

DHS can be an appealing core dividend income strategy for investors seeking current income or long-term dividend growth. The strategy can be best utilized as a core equity holding as part of a diversified strategy, providing investors with greater exposure to sectors that may be less represented in large-cap indices and core strategies. I am recommending DHS with a Buy rating as a core equity income holding.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.