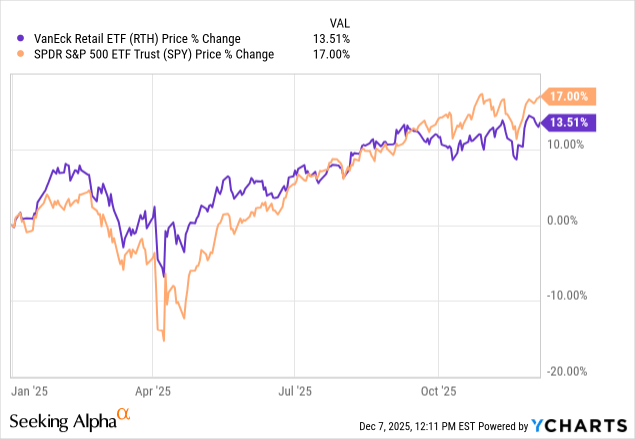

The retail sector continues to evolve fast and is shaped by shifting consumer behavior, rising e-commerce, and changing macroeconomic conditions. The VanEck Retail ETF (RTH) provides investors with convenient access to this segment, bundling together the largest U.S.-listed retailers into a single ticker. With top holdings like AMZN, WMT, and COST, the fund captures both traditional brick-and-mortar and online retail trends. The fund has been an underperformer compared to the S&P on a year-to-date basis, but will that outperformance continue? Let’s take a look at some aspects of the fund and come to a conclusion.

The Fund

RTH aims to provide exposure to companies operating in the consumer discretionary retailing sectors, seeking to replicate the performance of the MVIS US Listed Retail 25 Index by using the full replication technique. The benchmark:

MVIS US Listed Retail 25 Index (MVRTHTR) tracks the performance of the 25 largest and most liquid US exchange-listed companies in the retail industry. This is a modified market cap-weighted index, and only includes companies that generate at least 50% of their revenue from retail, such as retail distribution, wholesale, online retail, direct mail retail, multi-line retail, or specialty retail. “

This is a modified market cap-weighted index, and any single issuer is capped at a maximum of 20% of the fund’s assets. The size and liquidity requirements for constituents are also adequate, with market cap of firms at least $150M and three-month average daily trading volume of at least $1M USD.

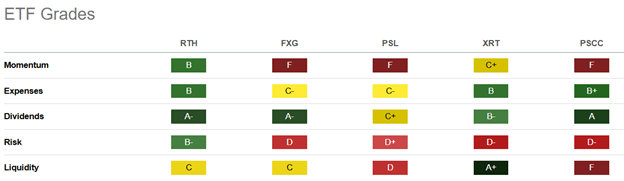

The expense ratio is somewhat higher compared to the broad passive ETFs, but it is still competitive as opposed to the median expense ratio of all ETFs, and it earns a B Seeking Alpha Expense grade when taking into account the relatively low bid-ask % spread of 0.07%. It is graded with a C liquidity score as per the Seeking Alpha grading system, with an AUM of $259M and an average daily dollar volume of $991k. Although liquidity is average, I think the fund can be considered liquid for any small retail investor.

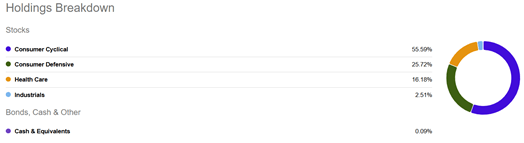

The sector allocation is mainly concentrated around the Consumer Cyclical sector with around 56%, and Consumer Defensive and Health Care come in second and third place with 26% and 16%, respectively.

Seeking Alpha

In terms of geographic allocation, the fund is U.S.-focused, with around 96% of the fund’s assets being American companies.

Compared to peers in the industry, RTH is generally better ranked than the peer funds, except for the liquidity grade, which we discussed earlier.

Seeking Alpha

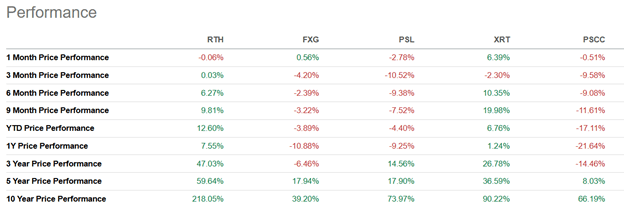

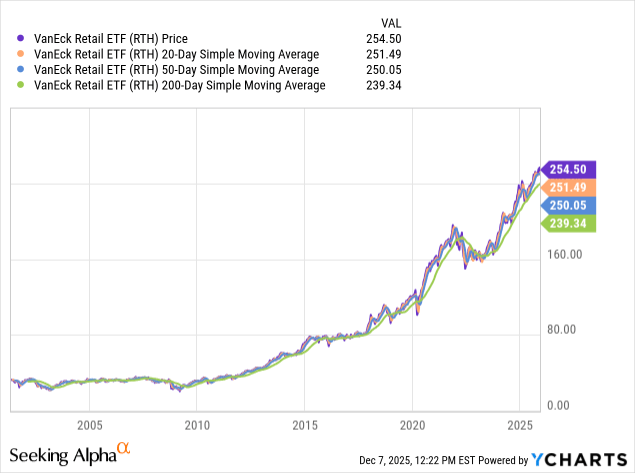

Also, what I think is a plus is that RTH has managed to outperform by quite a margin all of the other peer funds analyzed, showing strong performance on a 5- and 10-year basis.

Seeking Alpha

In summary, the fund is designed to replicate an index that has adequate liquidity and size requirements, constituent positioning is highly concentrated with the top 10 companies making up a large bulk of the fund, the expenses connected to the fund are relatively better than peer funds, and the fund is better positioned in all categories ranked by Seeking Alpha compared to the peer funds.

The Consumer Remains Strong

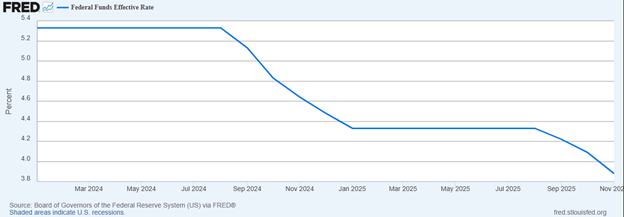

The strength of the American consumer is a major catalyst for the performance of the ETF, and naturally we will concentrate on this part. Retail sales have been climbing for four straight months now, with the latest data showing a slight slowdown from previous months, with September retail sales rising 0.2% month-over-month. The consumer has seen an uptick in disposable income with the Fed easing cycle underway, with the federal funds rate now in the vicinity of 3.75% to 4%, with the Fed’s latest cut of 25 bps in October.

Board of Governors of the Federal Reserve System via FRED

I expect this to continue to be a major headwind for the strength of the consumer and therefore the companies in the ETF, as the Fed is expected to ease rates by around 100 bps until the end of 2026.

The case for an ongoing strong consumer is also supported by the data for the current US holiday season, as shoppers spent around $14.25 billion on Cyber Monday and around $44.2 billion over the Thanksgiving weekend, both records. According to the Adobe Analytics report, spending rose 7.7% for the entire Cyber Week, above expectations. The report highlights the ongoing trend of the endurance of ecommerce, and Adobe expects the full holiday season to be around $253.4 billion in sales, rising 5.3% on an annual basis. This, in my opinion, presents another catalyst for the retail sector.

In addition to that, consumer credit and specifically revolving credit show a stable trend the last couple of months, with the latest figures for October showing that revolving credit (primarily including credit cards) increased at an annual seasonally adjusted rate of 4.9%. At the same time, delinquency rates on consumer loans and on credit card loans have hit a plateau and have been decelerating the last few quarters. This means that consumers are still managing their credit levels, reducing the risk for a broader cutback in consumption.

Valuation

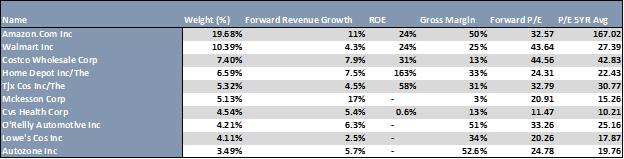

From a valuation perspective, the fund has a P/E ratio of 29.24x, trading at a slight premium compared to the market’s 28.95x.

Seeking Alpha, Author Compiled

The top 10 companies collectively represent around 70% of the fund assets and are characterized by generally high gross margins and trade at a higher P/E compared to their average. Top constituents are Amazon.com, Inc. (AMZN), Walmart Inc. (WMT), and Costco Wholesale Corp. (COST).

The chart shows a positive trajectory, with the current price above the 20, 50, and 200 DMA lines.

Cooling Labor Market and Tariff Impact

Of course the risks are the other side of the coin to my thesis; tariff impacts, according to a report from the OECD, are yet to make an impact on the global economy and therefore inflation. Higher inflation leads to higher rates for a longer period than previously thought and discussed in this analysis. Another risk is the impact of tariffs on headcount and employment on a large scale, as some respondents are answering in the ISM November Survey: the tariff environment is starting to make permanent changes, such as headcount reduction and additional offshore manufacturing. A large part of respondents are issuing cautionary tone statements connected to the trade uncertainties and the impact of the government shutdown. Furthermore, we can clearly see that the current labor market is weakening, and ADP employment data has been choppy at best.

Conclusion

RTH presents an adequate opportunity for gaining exposure to the retail sector, benefitting from a mix of traditional retail companies and ecommerce behemoths that are expected to shape the future of shopping. Compared to peer funds, the fund is generally better positioned in all aspects presented by the Seeking Alpha grade score and largely outperforming peers on a longer time scale. I believe the performance of the ETF will be heavily tied to the strength of the consumer, while uplifted valuations make the sector vulnerable to disappointing future data. Concluding, taking everything into account, I would currently give the fund a ‘Hold’ rating and wait for better entry levels.

.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.