Investment Thesis

I reiterate my buy recommendation on assets that track the main American indices. This article is part of a weekly series where I bring insights about investments. I confess that it is difficult not to be optimistic about American stocks when analyzing trading data, labor market signals, and predictions for politics in 2026.

Encouraging Market Data

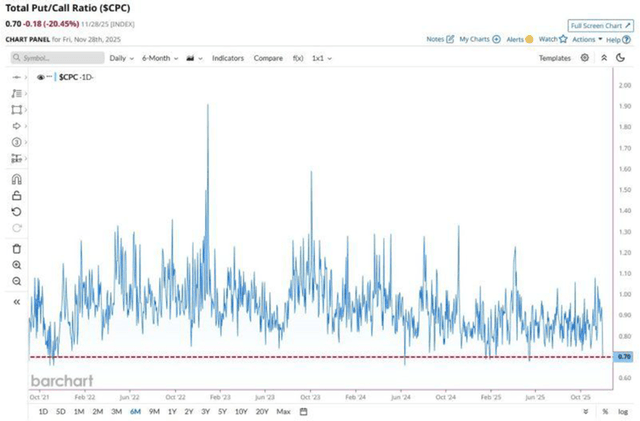

The first data is the Put/Call Ratio, which reached 0.7x. This mark is very important, as it is the lowest level in the last 4 years and indicates that there are many more calls than puts in the market. This means that the investor is very optimistic about further increases in the American market.

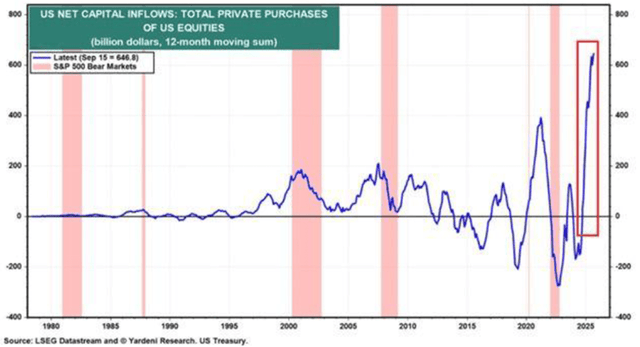

Another fact that draws attention is the massive purchases by foreign investors. They purchased $646 billion in the last 12 months ending in September. It is simply double what was reported at the beginning of the year.

Net Capital Inflow in US (LSEG)

In other words, in this first round of graphs, we can see that the American stock market remains very strong. We must remember that a great justification for these returns are the expectations with AI, so let’s continue our study.

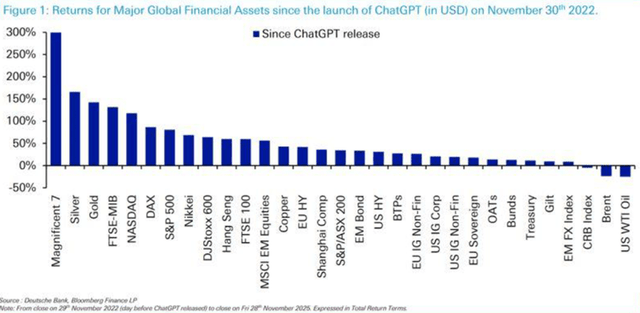

Winners and losers after the launch of ChatGPT

Last week marked another anniversary of the launch of the big actor of AI, which was launched in 2022. I bring a graph that shows the assets that have risen the most and fallen the most since its launch.

Returns since the lauch (DB, Bloomberg, JP)

On the other hand, I admit that what caught my attention most were not the winners, but the losers. In this sense, the asset that has lost the most value since then has been WTI oil. We must remember that oil is the most inflationary asset in the world, and its price under control is a great indication that the FED will have more room to cut interest rates, which should boost the American stock market even further .

Therefore, the low price of WTI oil is a catalyst for a benign scenario for US stocks. However, many investors have concerns about the labor market. In this sense, I bring an interesting graph that could be the beginning of a better, robust trend. This is because temporary hiring in the US is reaccelerating, and this tends to be a great indicator at the beginning of the cycle that the scenario for the job market will improve.

Temporary Hiring (Steno, Bloomberg and Macrobond)

If we have a scenario in 2026 with controlled oil prices and the job market reaccelerating, this makes me believe that the American stock market could rise even more. Additionally, we have another relevant event, which is the election at House , and I will talk about that below.

Impact of Elections for House in 2026

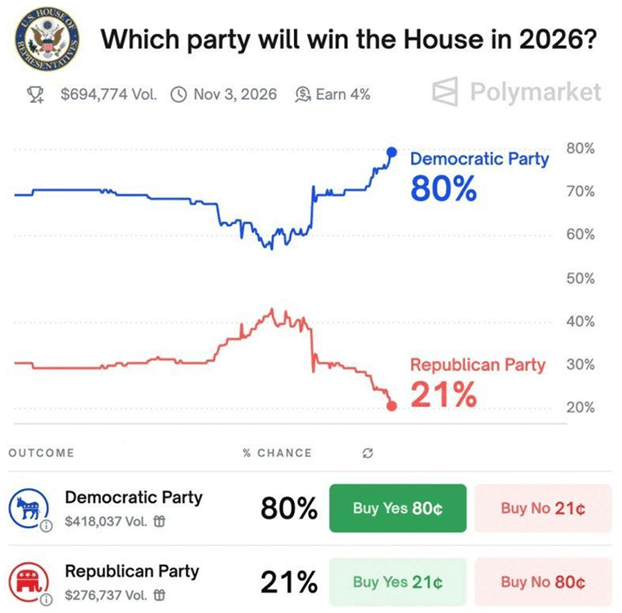

Recently a very important prediction was opened in Polymarket, which basically estimates the chance of the Democratic or Republican party winning the majority in the election for the house in 2026.

Which party will win the house? (Polymarket)

As we can see, the prediction market estimates that the Democratic Party has an 80% chance of achieving a majority in the House in 2026. But what is the impact of this on your investments? Well, below I bring a graph that estimates the annual returns on the stock market when political power is concentrated in the hands of Democrats, Republicans or divided between both. Let’s analyze.

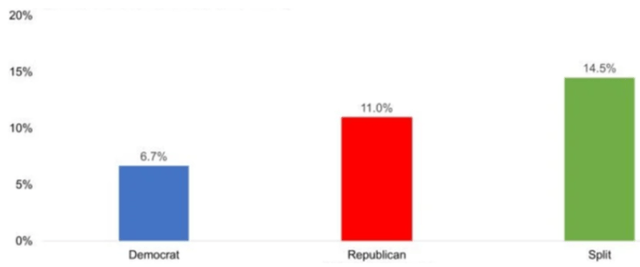

Average Equities Anual Return (Zerohedge)

As you can see, on average, annual returns are higher when there is a balance between the power of Republicans and Democrats, in this case, with Republicans dominating the presidency and possibly Democrats dominating the house . If Republicans achieve a majority in the House, we have an interesting scenario of an average return of 11%, but if Democrats win and gain a majority in the elections in the House, we have an average return of 14.5% per year, and this corroborates my positive view.

Target for the S&P 500

A few weeks ago I published a robust study with a target of 8126 points for the S&P500 in 2026. However, to add value to the reader, I like to bring different metrics weekly to estimate the S&P500 target, and it will be no different this week. Below we have statistics on the return of the S&P500 one year after 7 consecutive months of growth with gains of more than 20%, as we saw recently.

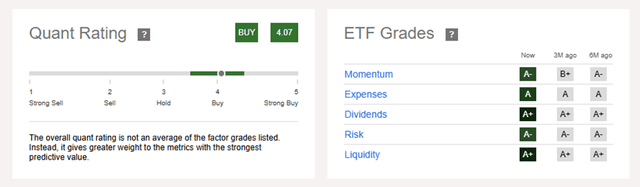

So, as the results suggest there is an expectation of an average return of 6.33% after one year. And that would mean a target of 7,304 points for the S&P 500 by the end of 2026. Well, I’m sticking with my target of 8,126 points, but I would say that both scenarios are positive and support a positive view on American stocks, especially, with the Quant recommendations from Seeking Alpha also recommending to buy.

Quant Rating and Factor Grades (Seeking Alpha)

Potential Threats To The Bullish Thesis

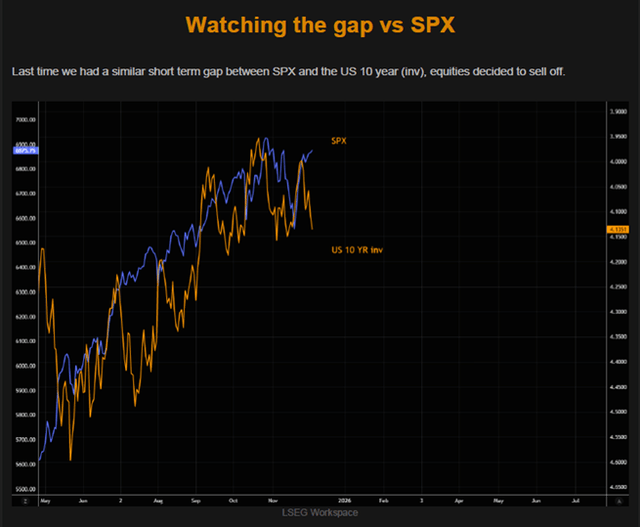

There are several risks to the thesis, as we talk about weekly. One example is that we are seeing a large reversal between the performance of the S&P 500 and the 10-year treasuries. The last time this happened, shares fell to close the gap.

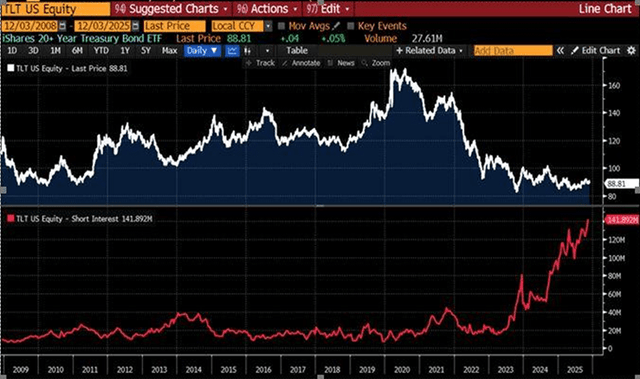

In parallel, the short interest in the 20+ Year Treasury Bond ETF soared to levels never seen before, that is, the investor presents a pessimistic view about the fall in long interest rates in the United States.

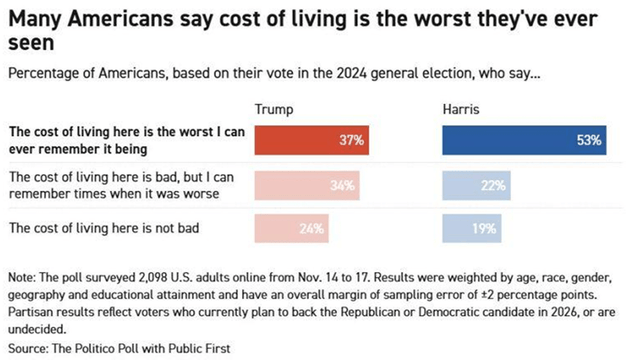

Finally, a survey conducted by Politico indicated that the cost of living is the worst ever seen, and as we know, the population’s perception of the economy is one of the best indicators of a leader’s success.

The Bottom Line

Investors remain confident, which is an important feeling to keep prices at high levels. The graphs of the put/call ratio and also of foreign purchases show this feeling very well.

At the same time, the price of oil is under control, an important driver for maintaining expectations of interest rate cuts. Additionally, the increase in temporary hiring may be an indication of a revival in the job market.

Based on this analysis, I reiterate the recommendation to buy assets that track the main American indices. In my opinion, the risk-return ratio remains extremely attractive regardless of the outcome of the elections in the House in 2026.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.