Introduction

In recent years, I have written countless articles on the defense industry. That’s mainly because of two reasons:

- I have owned almost every major defense contractor at some point since the pandemic. Currently, I own just three aerospace & defense companies, none of which are pure-play defense companies.

- The defense industry is home to some of my favorite dividend growers that consistently grow their dividends, buy back stock, and offer a highly favorable risk/reward, backed by a lot of anti-cyclical government funding.

Okay, I was lying. There’s a third major reason:

- Defense companies have been at the center of a number of “Big Picture” developments. Initially, I bought most of my defense exposure in 2021 when supply chain issues, high inflation, and budget uncertainty pressured most of the established players. Many of these problems lasted, causing frequent sell-offs in the industry.

In this article, I am going to do a few things with you. For starters, I’ll give you a full overview of the industry, as the biggest players all reported their earnings in the past trading week. This includes:

- Lockheed Martin (LMT): The producer of the F-35 and F-16 programs, along with many other mission-critical platforms for NATO and its allies.

- Northrop Grumman (NOC): A slightly more diversified player with major exposure in areas like aeronautics and missile defense. It owns the B-21 Raider platform.

- L3Harris Technologies (LHX): A supplier that has become a large disruptor by focusing on niche growth markets through a series of M&A deals and new spin-off and divestiture plans to perfectly position the company for the modern defense environment.

- RTX Corp. (RTX): This company has 50/50 commercial/defense exposure through subsidiaries like Pratt & Whitney, Collins Aerospace, and its pure-play defense platform, Raytheon.

- General Dynamics (GD): This company produces the Abrams tank and the Gulfstream jet platform, and it has a duopoly with Huntington Ingalls (HII) when it comes to building ships and submarines for the U.S. Navy.

- Boeing (BA): This company may not be a pure-play defense stock, either, yet it is working on a recovery after years of operational issues. It’s also a major producer of defense equipment, including the F-15 and others.

Now, I’ll walk you through these companies, explain what they are seeing, why it matters, and how we can potentially benefit from it.

So, as I almost made a total mess of this intro by making it 70% bullet points, let’s quickly get to the main part of the article!

I Sold, But That Doesn’t Make Me Bearish

For most of the time since 2021, I owned Lockheed Martin, Northrop Grumman, L3Harris, and RTX Corp. I sold all of these except for RTX. I added GE Aerospace (GE) and TransDigm (TDG). GE Aerospace is the company that produces engines with a market share of roughly 75% in the commercial space. TransDigm is a supplier of various parts. Most of these are aftermarket parts with limited to no competition.

That move was entirely based on buying growth instead of income. It better fits my strategy, as I am 30 and not yet looking to retire, as you can imagine. And, besides my age, I love my job too much. I also did it to improve pricing power, as there’s one big disadvantage to owning defense contractors, which is that the government is their biggest client.

On the one hand, the Department of War (it was recently renamed) has no other place to buy equipment. On the other hand, it has pricing power and influence. This creates headlines like the one below, where President Trump made clear he does not favor massive shareholder distributions for shareholders with money that should be spent on production, according to recent public statements (I’m paraphrasing – here’s the full article).

For now, there’s no news on this, which means defense contractors are fighting it, and no official laws have been passed. It’s a risk that we’ll have to deal with for a while.

What I do know is that the latest results give us a clear picture of an industry that offers a lot of opportunities despite ongoing challenges.

What The Defense Industry Is Telling Us

The most important thing to discuss first is demand. As important as margins and all these other things may be, without positive demand developments, it is very hard to be bullish on a stock in this industry.

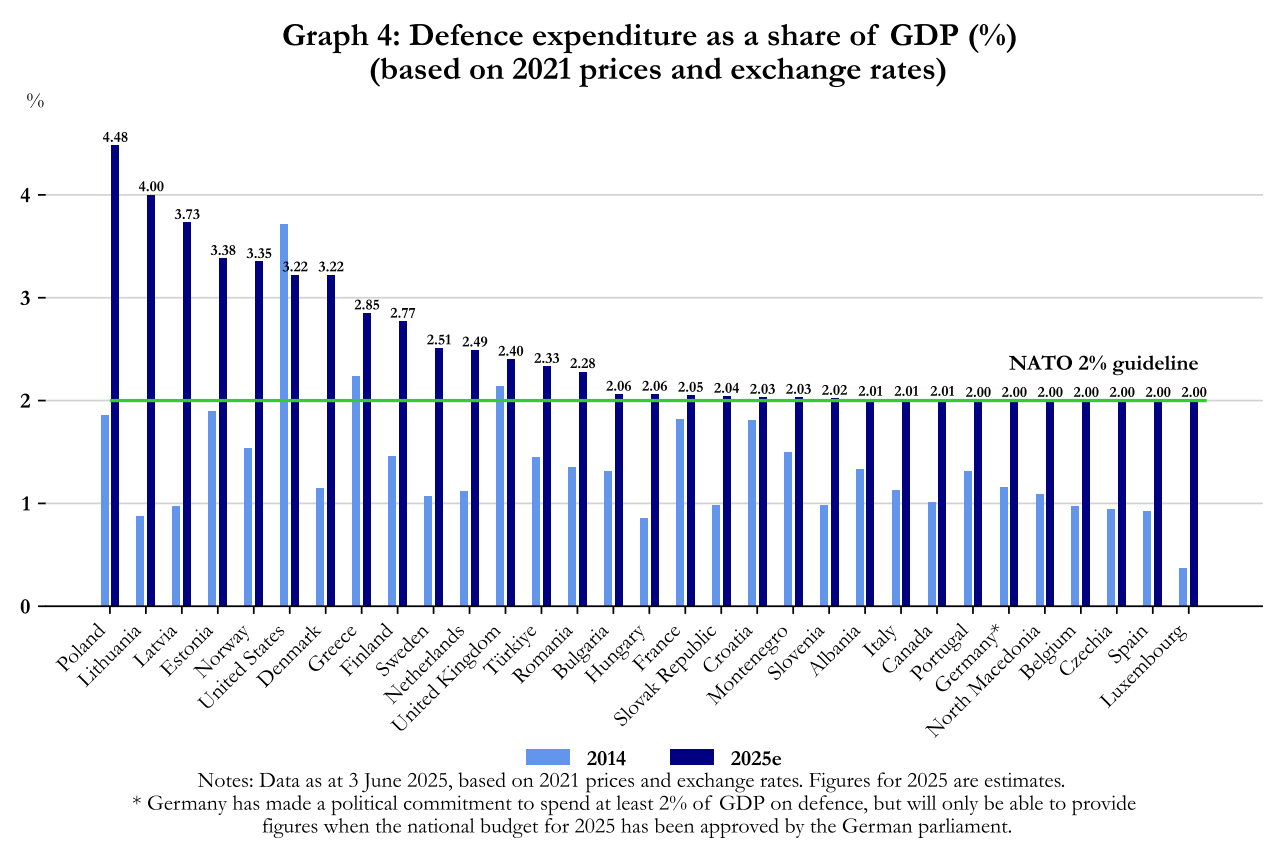

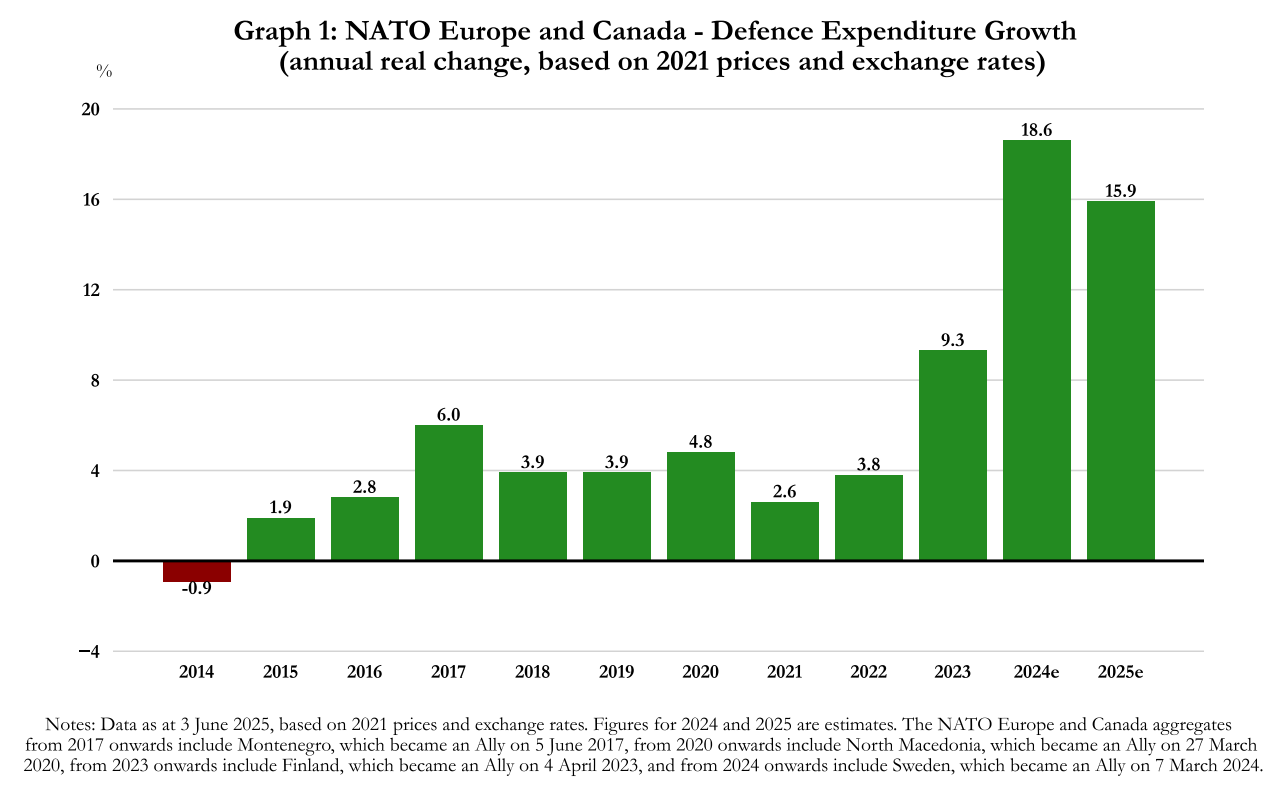

When it comes to demand, I get one thing from these companies, which is that demand is even less cyclical than it was. Now, it’s all about getting the best tools as quickly as possible. That makes sense, given that we have been in an elevated threat environment for years.

L3Harris, for example, made the case that pace and urgency were key, as customers mainly care about advanced capabilities at speed and scale. By the way, you can check all of this in their earnings calls. I’m just paraphrasing here.

Lockheed, meanwhile, confirmed this, as it is ramping up production. For example, its PAC-3 MSE missile, which is a missile to defend against ballistic missiles, will see production rates rise from 600 to 2,000 per year. That’s just one key segment that’s critical to NATO’s defense.

Northrop noted the favorable funding environment. They even brought up President Trump’s proposal to boost defense spending to $1.5 trillion per year. That would be an increase of more than $500 billion. Here’s what they said:

Importantly, they have got this request with funding, and this creates an immense opportunity for Northrop Grumman. We are encouraged by the recent $1.5 trillion FY ’27 budget recommendation, which indicates the potential for historic growth in defense spending. And in support of this approach, we are bringing proposals forward to accelerate our program, embrace new ways of working and partner more effectively with our customers. – NOC 4Q25 Earnings Call

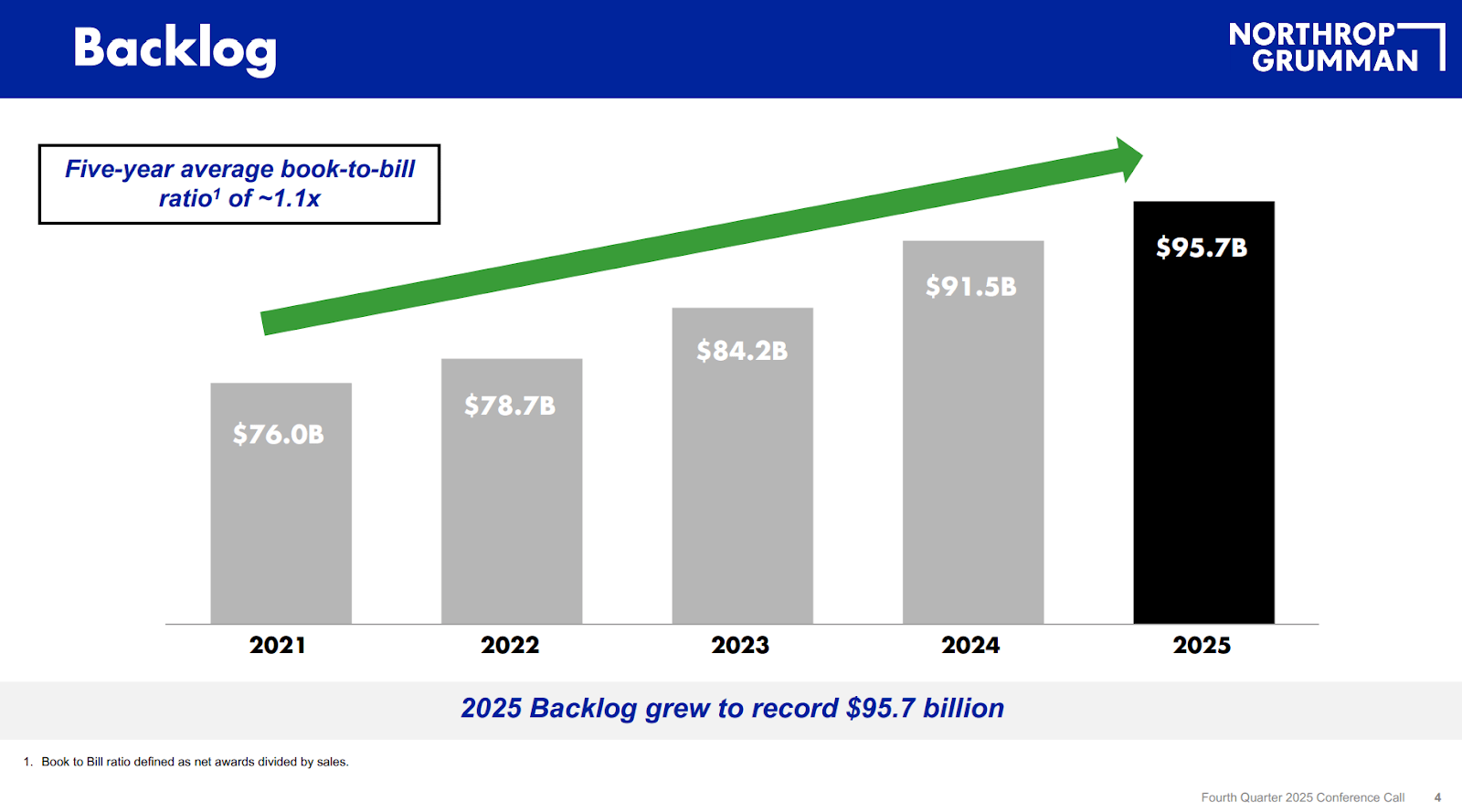

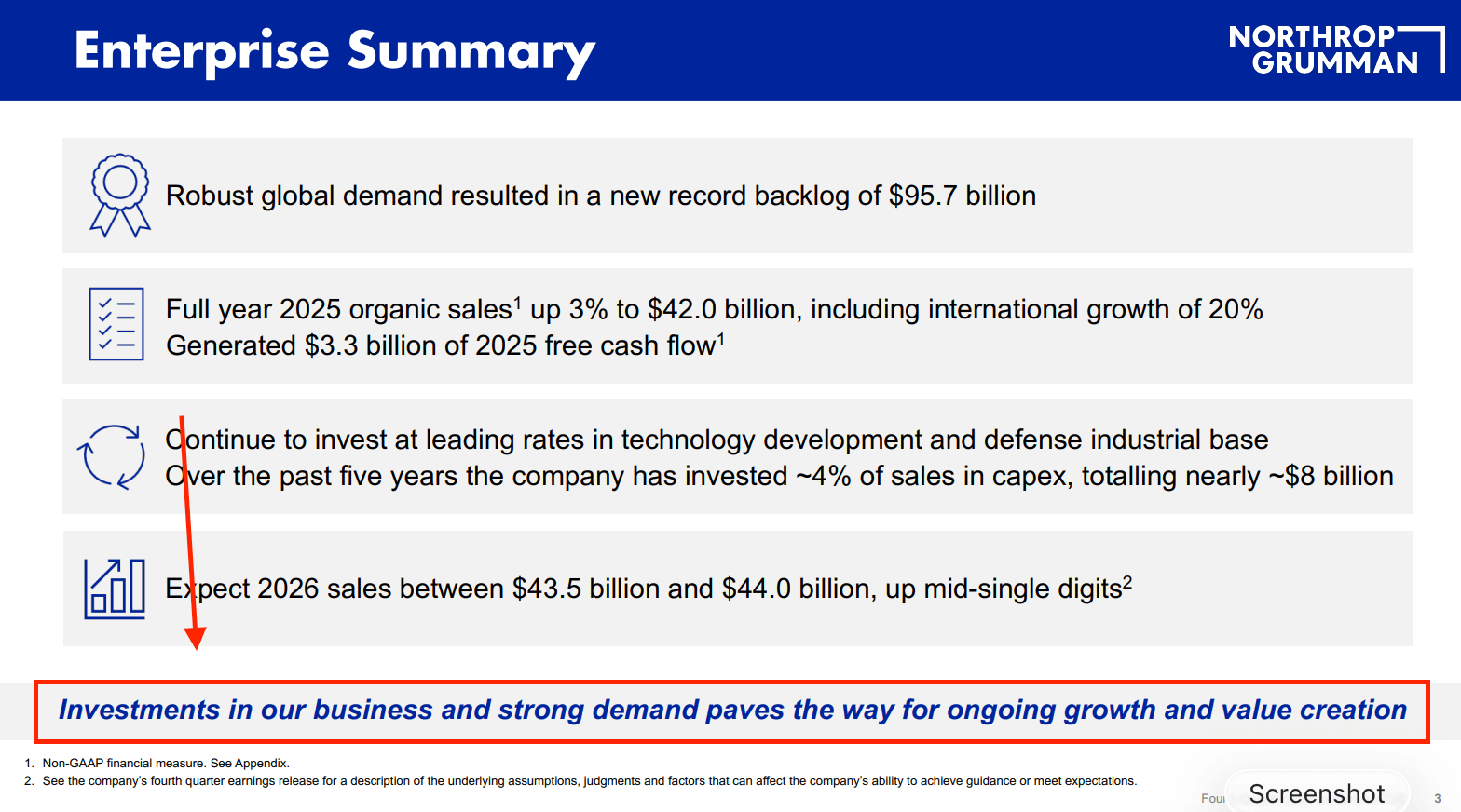

They now have a backlog of close to $100 billion. That’s almost $25 billion more than in 2021. Also, as its book-to-bill ratio is 1.1x, it indicates $1.10 in new orders for every dollar in finished work. That’s bullish for future revenue growth.

I also believe that Northrop is a prime example of how the U.S. wins when allies ramp up their spending. Currently, its international orders are growing by 20%, as it has capabilities that foreign nations need to rely on due to its technological advantage in programs.

Demand signals remain strong, and we anticipate continued growth in 2026 and beyond. The global appetite for our technology is fueling this demand, particularly in air and missile defense system, advanced munitions, radars and a diverse array of airborne capabilities. We’ve now received formal requests to acquire IBCS from over 20 countries and we are seeing notable progress on multiple other opportunities, including ground-based radars where we are expecting contracts from customers in the Americas, Middle East and Asia Pacific. The robust global demand environment supports our 2026 guidance, which is consistent with the outlook we provided to you in October. – NOC 4Q25 Earnings Call

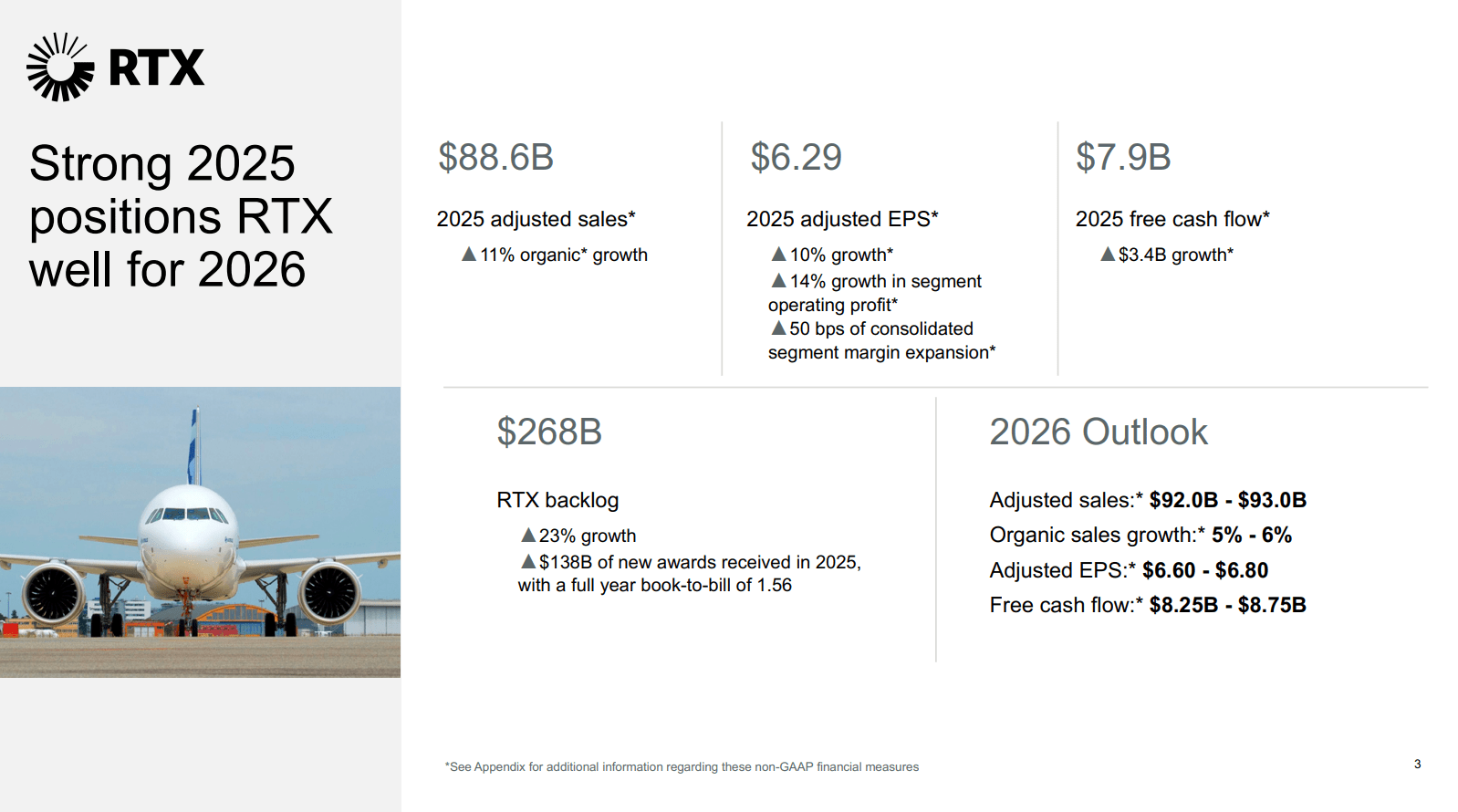

L3Harris had a book-to-bill ratio of 1.3x, which is even better. RTX had nearly $270 billion in backlog and a book-to-bill ratio of 1.56x. That’s a mind-blowing number if you ask me.

Needless to say, the stakes are high, as President Trump wants to see output growth, as he even made the case for buyback halts to finance higher output, which we already briefly discussed. Boeing made this clear by saying that the Department of War is super focused on on-time delivery.

That said, the government is increasingly important. Not only does the DoW (formerly DoD) account for the majority of orders for companies like Northrop and Lockheed, but they are increasingly active when it comes to changing the industrial playbook. This is something I have written on quite a bit in recent years, as supply chains are shifting, geopolitical powers are changing, and the threat levels are simply higher.

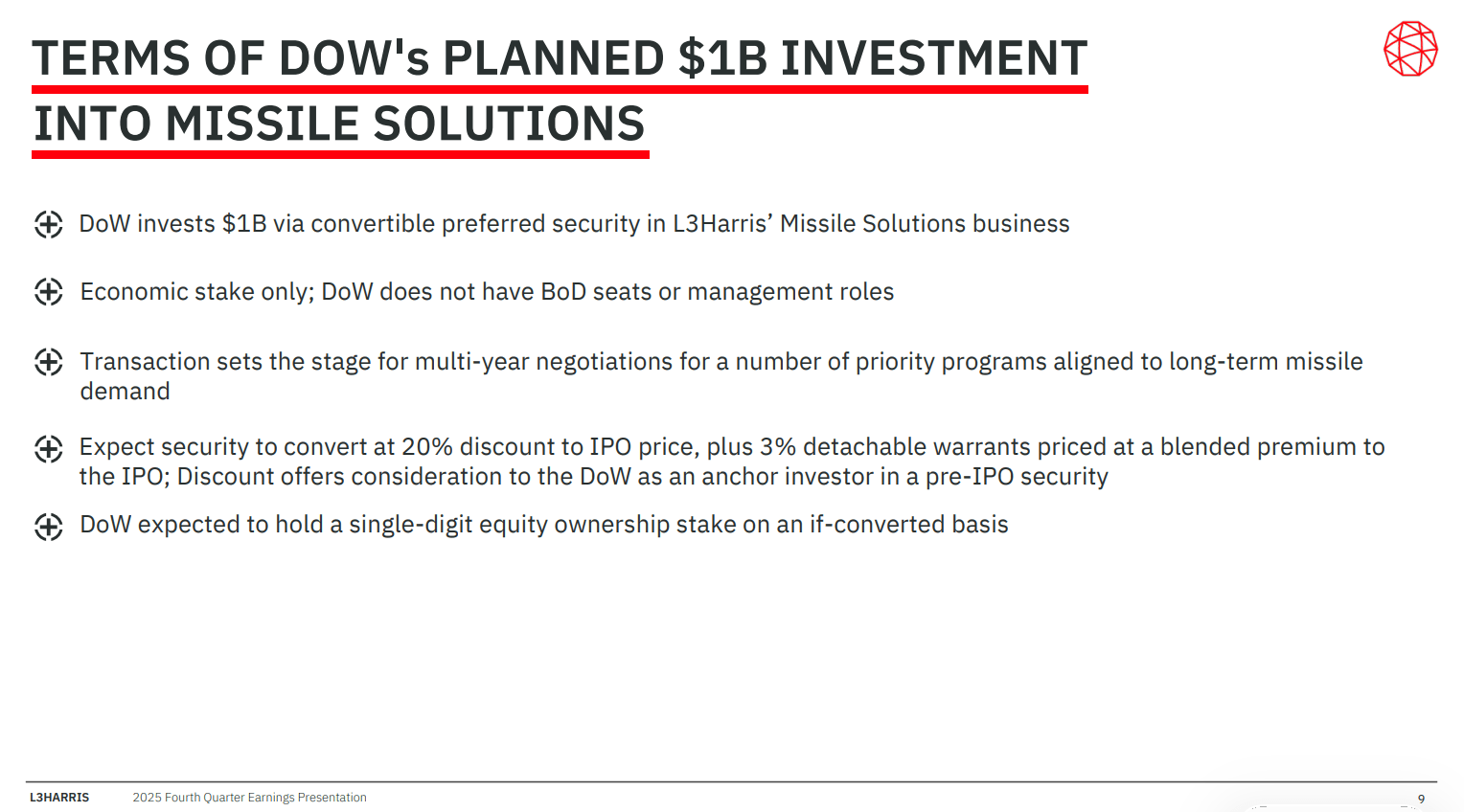

To give you some examples here, L3Harris is getting a $1 billion preferred security investment for its Missile Solutions business. The government is getting directly involved the same way it is buying stakes in semiconductor companies and rare earth mining projects.

Some of you may dislike or like the government involvement, but that’s the environment we’re in. The government has clear strategic goals, and it’s not wasting any time when it comes to achieving them. Defense is a prime example of that.

The quote below shows what Lockheed said. Note that this was in light of its massive PAC-3 missile output boost:

These types of agreements fully support the Department of War’s Acquisition Transformation Strategy, and we look forward to continuing our partnership with the U.S. government to definitize the contract and unleash a renewed era of innovation, accountability and execution across the defense industrial base. – LMT 4Q25 Earnings Call

Northrop confirms this, as the company doubled production capacity for tactical solid rocket motors. They will now add another 50% to this capacity. Northrop dialed back buybacks to increase CapEx. While that may not sound great for shareholders, it’s a good way to boost output and eventually accelerate buybacks, assuming we see no legal restrictions.

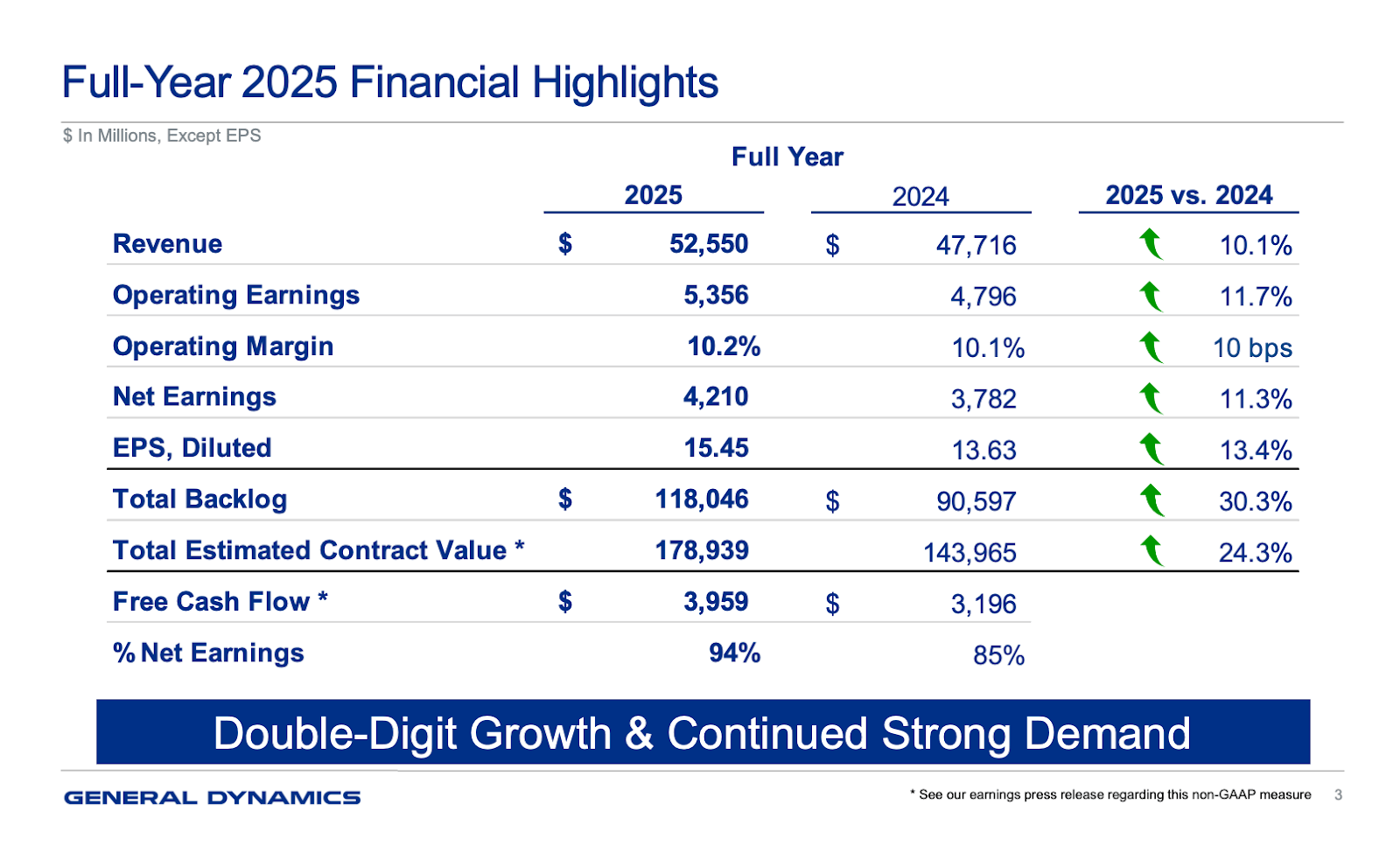

On a supply chain front, things are also improving, as General Dynamics, which deals with ultra-capital-intensive ship production, saw 13% tonnage output in its submarine segment.

On a full-year basis, operating margins improved by 10 basis points. That’s not a lot, but it’s a step in the right direction. It allowed 10.1% revenue growth to turn into 11.3% higher net earnings. Also, its backlog grew by nearly a third, which is absolutely impressive.

Furthermore, 94 cents of every dollar in earnings ended up as free cash flow, which is up from 85% and a sign of high-quality earnings, as there’s little “waste.”

If we zoom out a bit, these companies are telling us there’s a clear roadmap to higher output. While this may pressure free cash flow in some areas due to higher CapEx (costs related to higher output), these companies see a path to reinvestment upside and stronger growth on a long-term basis.

That’s why Northrop is sacrificing buybacks for it. They know if they invest in capacity now, the ability to reward shareholders (again, if legally allowed) will be much greater. That’s the long-term thinking I like, as I don’t simply chase stocks that can buy back stock now and dump the ones that reduce buybacks. That’s not a “management/owner mindset.”

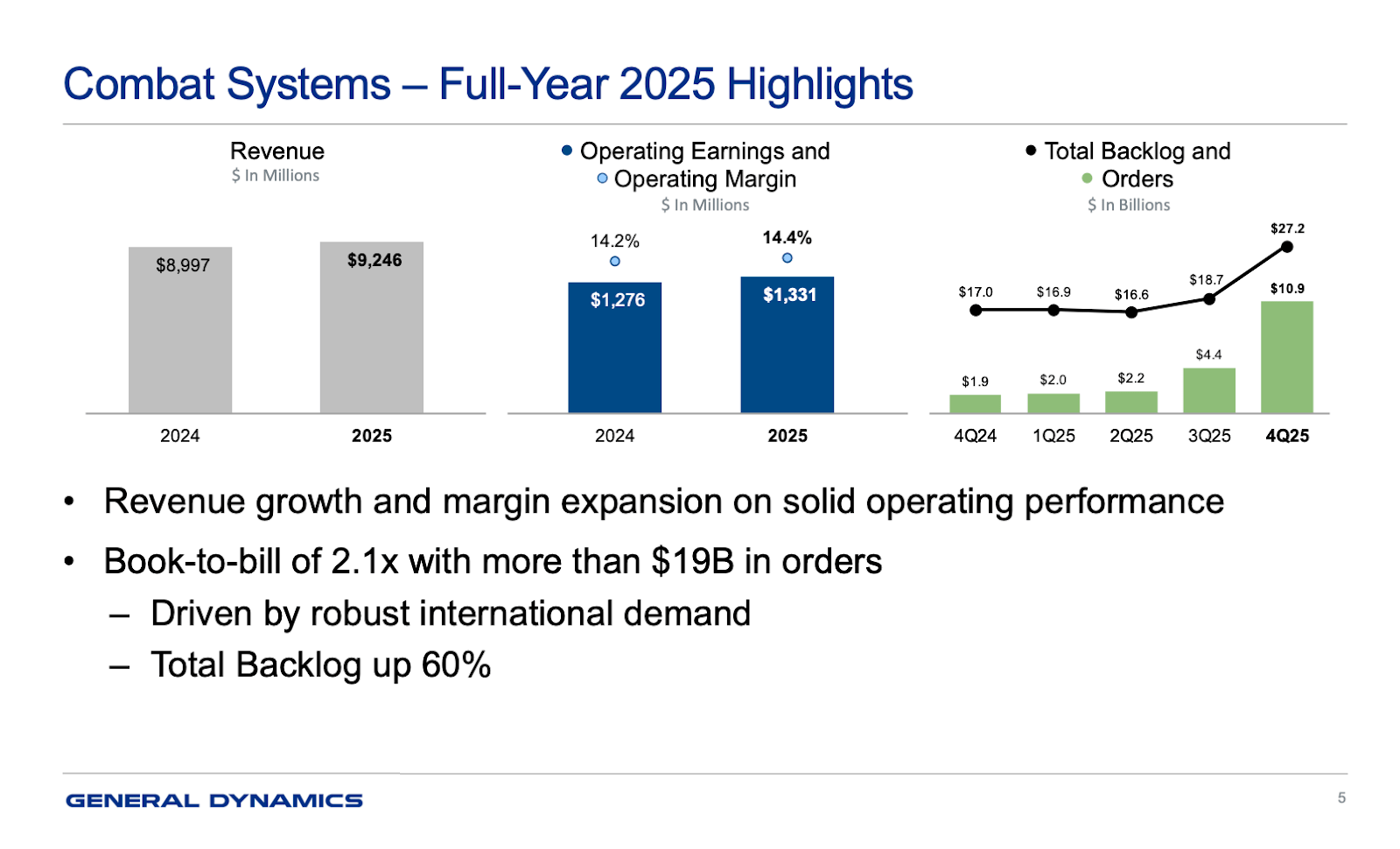

General Dynamics, for example, had a book-to-bill ratio of 4.3x in its Combat Systems segment. That’s the segment that produces the Abrams tank and other hardware like the Stryker. On a full-year basis, that number is 2.1x, meaning orders are coming in twice as fast as finished work is leaving the factory.

That’s what I like to call a “war economy,” which is even stronger in Europe, where even car companies are now producing drones. I wish that wasn’t necessary, but it’s the new environment we live in, and that requires a lot of capital for high future payouts.

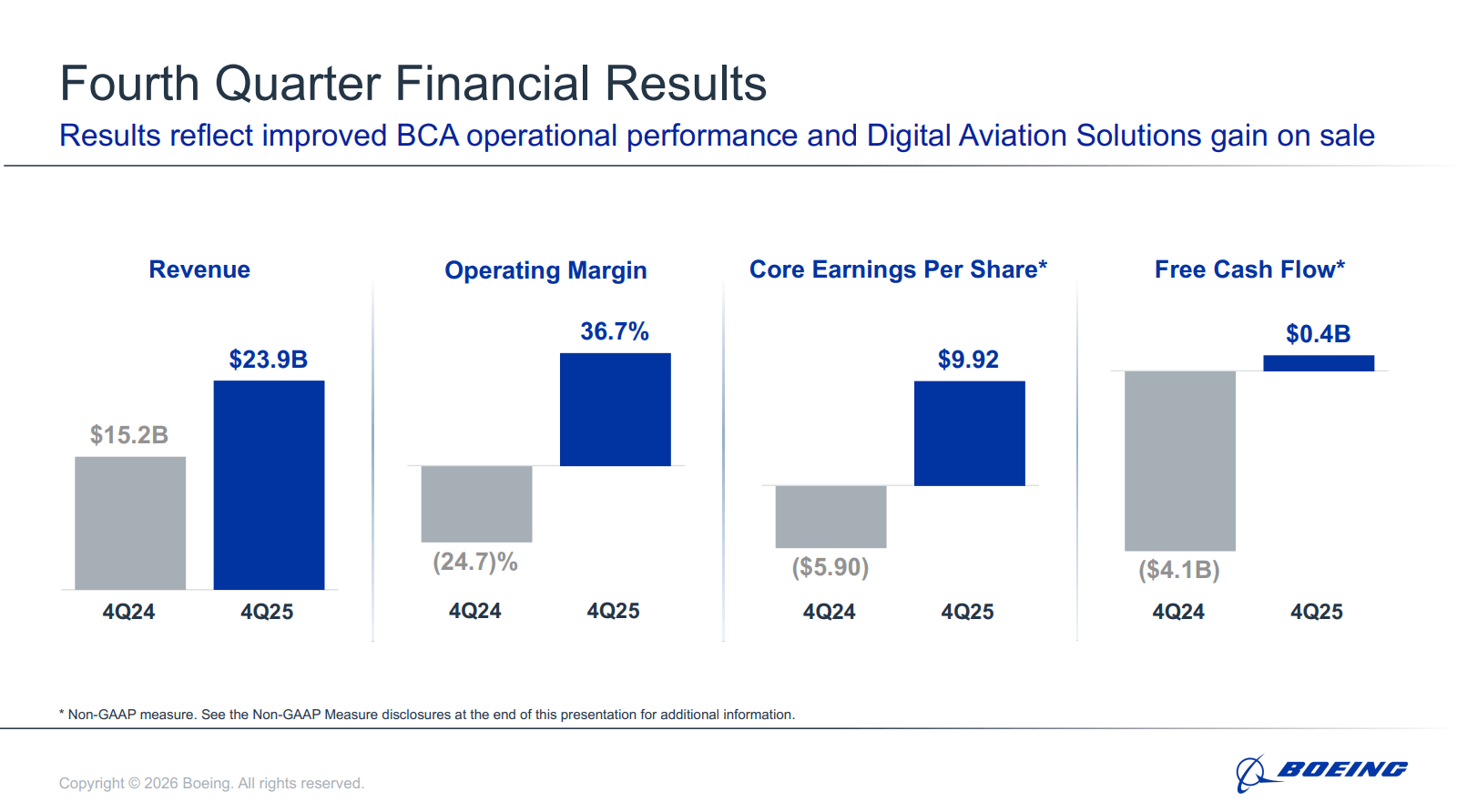

On a side note, Boeing was free cash flow positive in 4Q25. Its stock price is up 32% over the past 12 months as the market has realized that its massive backlog of $567 billion (that’s 6,100 planes) may result in higher cash flows than initially expected. That can help Boeing to lower net debt and become a much healthier and streamlined company.

In other words, investors see a path for Boeing to return to its former glory.

Right now, it obviously helps that defense demand supports the business. The timing could not be better, if you ask me.

The Most Important Things To Keep In Mind

To me, the most critical thing is that defense companies have gone from being vehicles where people like me go for consistent dividend growth to becoming key pillars of the new industrial base. Nearly all defense contractors are now focused on working with the DoW on long-term growth programs. They are working on partnerships to be more innovative and finding ways to fight disruption from new players like Anduril.

L3Harris is my favorite example, as it is, by far, the most active player among the big guys when it comes to reinventing itself. I also like it for exposure to the Golden Dome missile shield.

The second takeaway is related to the one above. Capacity expansions are no longer a headwind. While defense companies focused on becoming leaner in recent years, it’s now all about boosting production capacity. This is driven by the DoW and supported by strong demand.

As these are not software companies that can just scale by copying and pasting software code (I’m painting with a broad brush here), they need new facilities for defense output, as most NATO nations have neglected defense modernization for decades.

Now, we’re in the perfect storm for demand.

However, that brings me to point three. Having a big backlog isn’t enough. Honestly, I don’t care if a company has a $100 billion, $500 billion, or $900 billion backlog. These numbers are meaningless if we don’t look at them from a book-to-bill point of view and if we include operations.

For example, if the DoW were to give a random defense contractor a $10 billion deal for a fighter jet and unexpected operating headwinds from inflation and material supply were to result in $11 billion operating costs, it’s a waste of capital. Obviously, I’m painting with a broad brush again, but that’s the gist of it. Investors like me found out the hard way how annoying this can be at times when margins are pressured due to large programs.

Eventually, it turned out well, but that’s a risk. Especially in this environment where efficiency is key and even more money is spent on large programs, I expect these risks to last. In fact, if inflation rebounds, these problems could get bigger.

So, in order to excel and generate alpha, we need players with favorable book-to-bill ratios, rising margins, and a high likelihood that programs stay out of trouble. Personally, that’s why I invest in companies that are not dependent on a few major programs. It’s why I own RTX Corp. and why I have more exposure to suppliers like GE Aerospace and TransDigm than actual defense contractors.

Going forward, I believe this healthy mix remains the way to go.

Unfortunately, a lot has been priced in. None of the stocks I just mentioned is “cheap” by any means. The only stock I would add to more aggressively is TransDigm, but that isn’t of much value, as it wasn’t part of the discussion.

RTX Corp. and L3Harris are my favorites to buy on weakness among the major defense contractors. Lockheed, I avoid because of past issues and high reliance on major programs like the F-35. Northrop, I like a lot, but I simply prefer L3Harris when it comes to being positioned as a disruptor.

This brings me back to my original idea, which is to own a mix of major contractors and suppliers. I own RTX, GE, and TDG, but other constellations work as well. I would feel comfortable owning LHX, TDG, and GD, which also has disruption, aerospace, and a supplier with strong pricing power.

Needless to say, I’ll continue to monitor single picks to provide more intel.

For now, this is the bottom line:

Takeaway

To me, this earnings season confirms the thesis we have been working on for years. We’re in a new era for defense companies. They have officially gone from steady-Eddie dividend growers to being the backbone of a new industrial base.

Demand is strong, future funding looks to be even stronger, and even margins are improving despite aggressive CapEx plans.

This confirms the long-term bull case. The problem is that, right now, I wouldn’t deploy a lot of capital. However, I believe we should all be watching this sector, as I think corrections make for great buying opportunities, as I’m convinced it’s still a place for long-term alpha.

Risks To Keep In Mind

There are two main risks. The first one is political. As a long-term investor, I know I will have to deal with various administrations. Since the pandemic, we have dealt with three. Trump I, Biden, and Trump II. Future administrations may be less bullish on defense demand or even cut funding.

Other risks are supply-focused, as new disruptions could easily cause surges in costs across the entire supply chain.

A third risk is disruption. Because of AI, I believe established players can be more easily disrupted by tech-focused players that have leaner business models to adopt more easily.

My thesis has been that most major defense players are protected by big moats. So far, this has been confirmed. However, it’s a risk worth mentioning.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.