Introduction

Pinterest, Inc. (PINS) is still being compared to social media platforms like Meta (META) and Reddit (RDDT), but that view breaks down once you look at how the business actually makes money. Most social platforms monetize time spent, interaction, and engagement. Pinterest users, however, typically use the website with a specific planning or purchasing goal, and advertising is built around monetizing that intent. Analyzing Pinterest as another engagement-driven network leads to a misunderstanding of both profitability and valuation.

Operating Metrics Have Improved, But The Earnings Base Is Still Shallow

Macro Trends

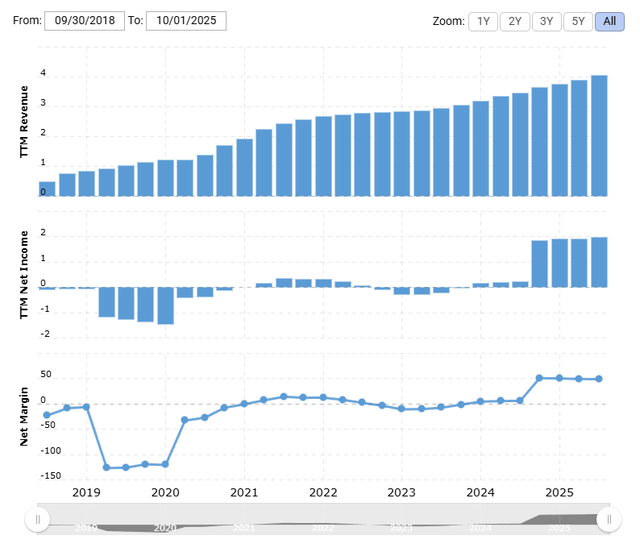

For much of its public history, Pinterest either operated at a loss or near breakeven. Recent quarters, however, have seen a significant improvement in both margins and revenue. The last four quarters have seen mid double-digit margins against a backdrop of steadily increasing revenue. Further cost-cutting measures are planned, as the company looks to downsize its workforce by around 15%. According to Evercore, this could save some $175 million per year.

At the same time, the company has little international revenue and the monetization base is therefore relatively narrow. In the quarter ending September 2025, Rest of World made up only 6.7% of revenue. Europe did some heavier lifting at 18.3%.

This is set to change, though. European revenue grew by 41%, and Rest of World by an impressive 66%. At the same time, Average Revenue Per User is increasingly rapidly in these regions. European ARPU rose by 31% and Rest of World was up by 44%. With MAU growth of 8% and 16% respectively, this is a clear indication that the company is doing better at monetizing existing users.

Margin Expansion Reflects Operating Leverage, Not Just Cost Cuts

Pinterest’s recent margin expansion is often dismissed as cost-driven, but that understates the role of operating leverage in the model. As advertising tools have improved and monetization efficiency has increased, higher ARPU translated into stronger incremental margins. This dynamic is consistent with an intent-driven platform, where ad relevance improves pricing power without requiring higher engagement intensity.

This also ties monetization more closely to predictable commercial cycles such as seasonal shopping, home improvement, fashion, or travel planning. Pricing power comes from context and relevance, not from how long a user stays on the platform in a given session or even how much they interact with other users.

Pinterest’s model is narrower than that of Meta or Reddit, but it’s more predictable in the sense that it monetizes specific user intent rather than broad social activity. That does not guarantee faster growth, but it does reduce reliance on daily engagement metrics, which helps explain why revenue durability matters more than raw user expansion.

Why Pinterest Looks Cheap And Expensive At The Same Time

The stock appears inexpensive on earnings-based metrics and fair on revenue-based measures as the market waits for proof of durability. The stock looks exceptionally cheap on TTM GAAP earnings especially. It trades at around 7.8 times TTM earnings, compared to Reddit’s massive 108x and Meta’s 30x. The sector median is at around 17.4x. Pinterest is also not expensive on revenue multiples relative to peers. TTM Price to Sales is only 3.8x compared to Reddit’s 18.5 and Meta’s 8.9, with price to book painting a similar picture.

A comparison to the Seeking Alpha sector median paints a different picture. The 41.8x TTM EV/EBITDA in particular is way above the average of around 9.8, and so is the FWD GAAP P/E at 35x versus 18x. The valuation discount is thus concentrated almost entirely in how the market capitalizes its newly improved margins, in my view

Earnings appear cheap because margins have only recently moved higher, while EV/EBITDA looks elevated due to the lack of EBITDA history. Forward multiples, meanwhile, suggest a level of normalization that the market is not yet willing to underwrite.

The valuation also depends on which companies one is comparing it to. The broader sector median is less useful as a benchmark because the company has a relatively unique advertising model. The sector median is composed of engagement platforms, ad-tech, and marketplaces, whereas Pinterest does not fit cleanly in any of these categories.

What The Market Still Needs To See

The market is very much taking a wait-and-see approach to Pinterest’s recent profitability. In order for the valuation discount to close, the market needs evidence that the company’s earnings base is sustainable, and led by revenue growth. Most importantly, the market wants to see that earnings can hold up during a downturn, proving the model is resistant to weaker advertising demand.

None of this requires accelerated growth, but rather persistence. If revenue continues to grow steadily while margins remain structurally positive across a weaker cycle, current earnings will become more capitalizable. Until then, the market is likely to value Pinterest conservatively, not because the business model is in doubt, but because its improved economics are still young.

Conclusion

Pinterest is not being discounted because its business model is misunderstood. The platform is already valued reasonably on revenue, reflecting the market’s recognition of its positioning and revenue durability. The remaining skepticism is concentrated in how aggressively investors are willing to capitalize a relatively new earnings base. If margin stability and international monetization continue to develop as current trends suggest, the valuation framework applied to Pinterest is likely to shift

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.