Investment Thesis

Amplify CWP International Enhanced Dividend Income ETF (IDVO) and Amplify CWP Enhanced Dividend Income ETF (DIVO) are twin brothers whose investment concept is founded on high-quality stock selection and conservative use of options, though they differ primarily in terms of geographic investment concentration. If DIVO is a fund that works with US securities, than IDVO was created with the aim of transferring this successful strategy to foreign markets in Asia, Europe, and other regions. Consequently, the following interesting question arises: “Where is it better to invest?” Should you invest in an ETF that works with US assets? Should you choose a fund that allows you to capitalize on the growth of foreign markets? Answering this question depends on comparing the key quantitative metrics and qualitative indicators of IDVO and DIVO. My opinion is that the best solution in the battle between the two funds is to choose both at once in order to diversify your portfolio.

Fundamental similarities between IDVO and DIVO

IDVO and DIVO’s main similarities are their affiliation with the same CEF family, Amplify Investment, along with the fact that they’re built on the same strategy from the Capital Wealth Planning team. These funds’ main investment philosophy is built around the idea of working with stocks that show dividend growth. These funds seek out companies that not only provide investors with high dividend yields, as well as companies with substantial free cash flow, minimal debt, as well as a history of consistent dividend growth. Additionally, there are a number of other fundamental characteristics that make IDVO and DIVO similar ETFs:

- Each fund employs an options strategy based on tactical covered calls. Options are not taken on the entire index, however, they are taken on individual stocks, but only during periods when volatility creates an attractive premium. In general, no more than 15%–20% of the portfolio is covered by options, so the growth in profits is capped at a beta of 0.8x–0.85x.

- These funds’ teams follow an active management style rather than just blindly copying any indices. Stock selection is done manually, and so is the decision-making on option hedging. That’s what lets IDVO and DIVO be flexible when markets are super volatile.

- These funds’ portfolios aren’t really focused on broad diversification, so they have a high concentration of assets. That’s because, in line with their investment philosophy, these funds go for the best ideas, but there’s a limited number of them to choose from.

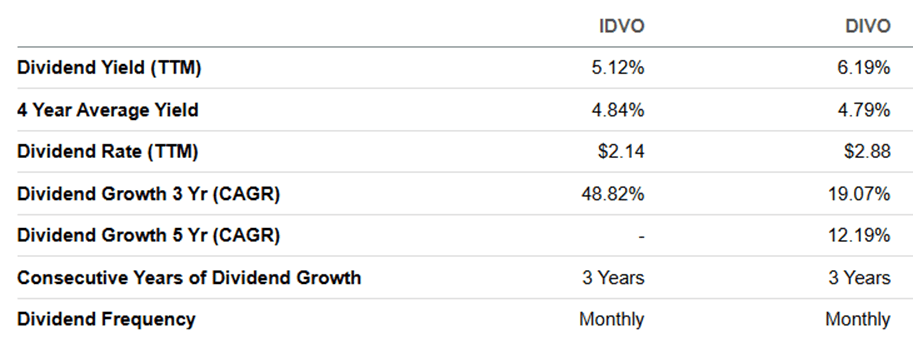

- These funds have a similar dividend policy with monthly payments, making them convenient for retired investors who live off such dividends. Yields differ by 1.07%, but IDVO’s average annual dividend growth rate is more aggressive than DIVO’s. This does not, though, mean that their dividend policy concepts are any less similar.

Dividends

Fundamental differences between IDVO and DIVO

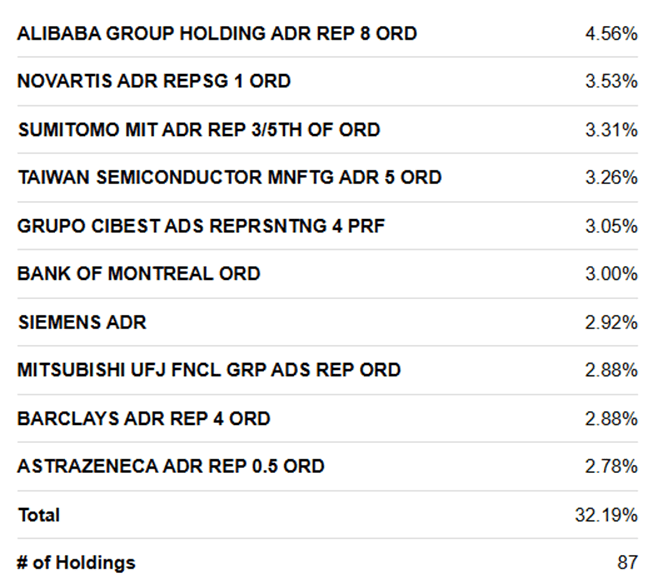

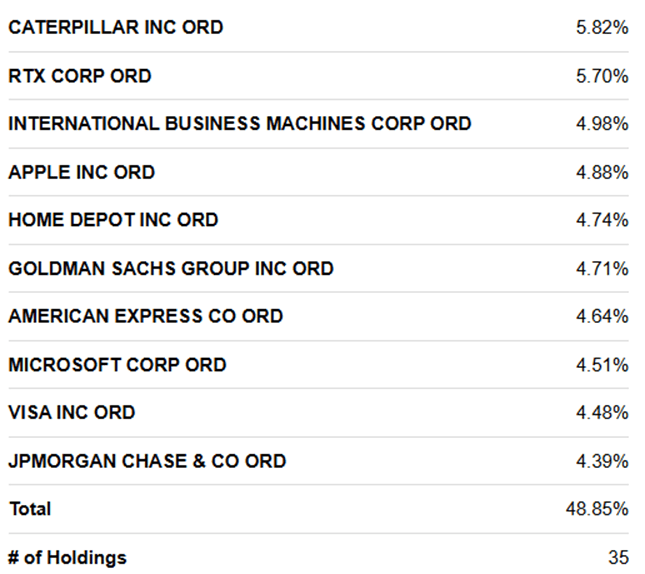

That’s where the fundamental similarities between IDVO and DIVO end, though. A closer analysis of the funds reveals criteria that distinguish them from each other. Firstly, their portfolio composition differs significantly. While DIVO invests in large-cap US companies, the IDVO portfolio consists of international companies, whose market capitalization is often ten times smaller. However, in terms of portfolio concentration, IDVO has the advantage, because its investments are directed at 86 holdings with a concentration level of the top 10 assets at 32.19%. DIVO’s portfolio is more concentrated and consists of only 33 companies. Due to this, top 10 asset concentration reaches 48.85%.

Holdings Breakdown of IDVO

Also worth noting is that the IDVO portfolio is focused primarily on companies in the old economy, including manufacturing, energy, and finance. Like most large US funds, DIVO’s portfolio is focused primarily on assets in the technology and consumer sectors.

Holdings Breakdown of DIVO

Given that IDVO’s portfolio consists of international companies, important to note that they invest not directly in stocks, however, in ADRs. The reason for this is that fund managers operate on US exchanges. The disadvantage of investing in ADRs may be the additional foreign tax on dividends, withheld by the issuing countries. It can be offset in certain cases through a tax credit in the US. Therefore, there is an advantage to DIVO in that there is no risk of an additional tax burden on investors. Nevertheless, these are not the only limitations of IDVO, because in addition to tax efficiency issues, it is important to consider the impact of currency instability.

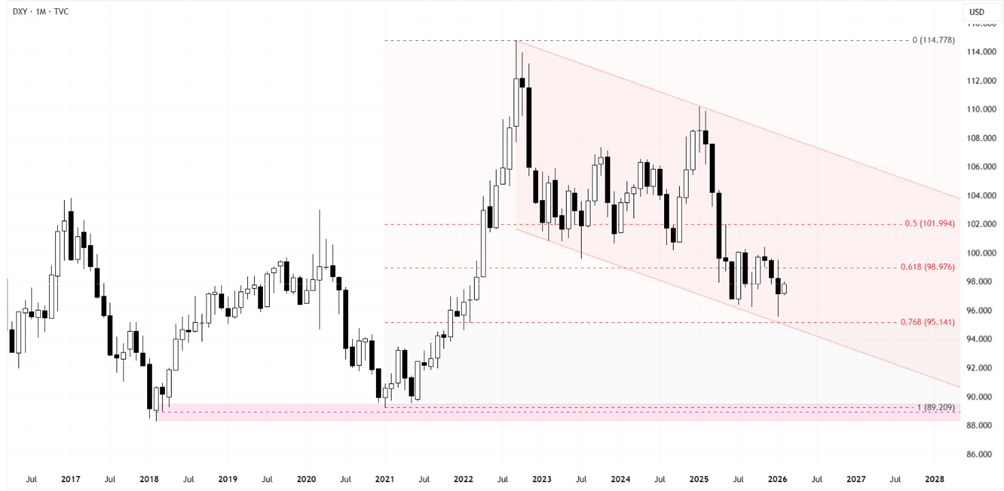

The negative side of currency volatility will be discussed later in the “Risks” section, whereas here I would like to focus on the advantages for IDVO investors. In fact, such investment implies a positive impact of the US dollar depreciation on the IDVO portfolio yield. This means that the stronger the US currency devalues, then the higher the return on the IDVO portfolio compared to DIVO. The fund managers could eliminate this problem through currency hedging, according to the IDVO prospectus, however, this is not being used. Consequently, as the dollar index (DXY) falls, it provides additional momentum for the IDVO portfolio to increase the value of its assets.

A look at the monthly DXY chart reveals that the price is moving within a global downward trend channel. Should the downward potential continue to develop, DXY will seek to test the strength of the key support zone (88.25 – 89.53). Nevertheless, please note that the price has corrected according to the Fibonacci grid to the golden ratio level of 0.618. It may now act as a stopping zone, following which there will be a technical price pullback, such as to the upper boundary of the trend channel (108.20).

Technical analysis of DXY timeframe 1M. Source: Tradingview.

Comparative table of IDVO and DIVO

The table below provides a comparison of the main criteria that distinguish IDVO from DIVO. Both qualitative and quantitative indicators are presented here.

| Criteria | IDVO | DIVO |

| Issuer | Amplify Investments LLC | Amplify Investments LLC |

| Sectoral imbalance | Financials / Energy / Materials | Tech / Health / Consumer |

| Number of Holdings | 86 | 33 |

| Assets in Top 10 | 32.19% | 48.85% |

| NAV per share | $41.17 | $46.28 |

| P/NAV | 1.00х | 1.00х |

| Expense Ratio | 0.66% | 0.56% |

| AUM | $884.14М | $6.34В |

| Dividend Yield (TTM) | 5.12% | 6.19% |

| Dividend Growth 3 Yr (CAGR) | 48.82% | 19.07% |

| Dividend frequency | Monthly | Monthly |

| Return of Capital | 98.1% | 92.0% |

| Total Return, 6М | 24.53% | 12.84% |

| Total Return, 1Y | 38.44% | 15.97% |

| Total Return, 3Y | 81.23% | 51.51% |

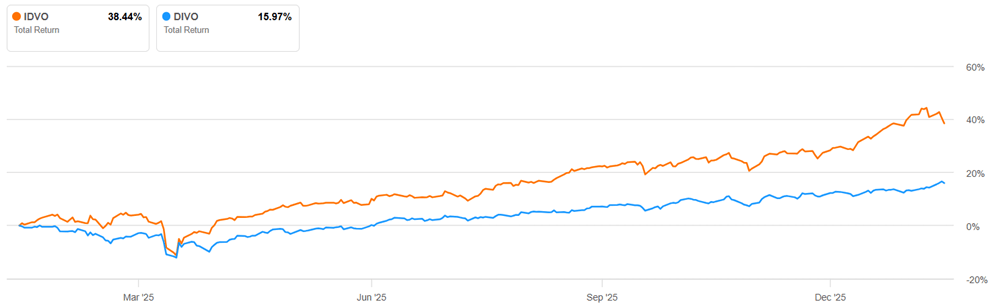

When comparing funds, my primary focus is on Total Return figures. When it comes to IDVO and DIVO, the results for the last year show a positive difference. Whereas DIVO demonstrated a Total Return of +15.97%, that of IDVO was more than twice as high at +38.44%. The same advantage of IDVO can be seen in both the short term (6 months) and the long term (3 years).

Total Return, 1Y

Forecast thesis

The choice of IDVO and DIVO for comparative analysis is not related to my expectations of the continuation of the AI supercycle in 2026. This is, in large part, due to the choice of assets that would help diversify the risks associated with investing in the technology sector. And a comparison of the composition of the IDVO and DIVO portfolios allows us to find that very profitable ETF sector asset that would reduce dependence on the largest US IT companies. Therefore, I conclude the article by choosing one of the two funds, though my recommendation for both would be “Buy.”

Actually, events in 2025 showed that the growth trends in the financial markets of the US, Europe, and Asia can be different. These markets are influenced by the results of the reorganization of the international trade system, for example, affecting the competitiveness of manufacturers from certain countries in the global markets for goods and services. Currently, US economy appears to be the winner in this story, since the negative trade balance has begun to decline (it amounted to -29.2 billion dollars and -56.8 billion dollars in November and December 2025, while in January 2025 it was -131.4 billion dollars). Nevertheless, it does not play a significant role for the major companies with the highest concentration in the S&P 500. What’s more, as US trade policy changes more actively, there is a higher probability of market turbulence, affecting primarily MAG-7 assets. The IDVO provides a unique opportunity to invest in an ETF that trades on US exchanges and invests in international companies. Portfolio composition is diversified not only by sector but also by country, reducing the potential risks associated with individual stories, such as DIVO, from negatively impacting overall investment returns.

Risks of the investment thesis

There are a number of risks associated with investing in Amplify Investment funds such as IDVO and DIVO. This includes both general and specific risks. These include:

- Actively managed risk, since the performance of these funds’ portfolios depends on the decisions of portfolio managers. In the event of mistakes, this could result in investors not getting the full return.

- Limited potential for market growth returns, because the funds’ strategy uses covered calls. If the market rises sharply by 10%, portfolio returns may be only 6% to 8% (since the strikes will limit profit growth).

- There is a risk of high portfolio concentration, given that the top 10 assets in the IDVO and DIVO portfolios account for 32.19% and 48.85% of the total portfolio, accordingly.

Besides general risks, you should check out the specific risks for each ETF.

Specific risks for IDVO are mostly because the fund’s portfolio has international assets that bring currency risks. Since the IDVO strategy does not provide for currency risk hedging, the cycle of strengthening of the US dollar will lead to a decrease in the portfolio’s return (and this is even if the price of international assets rises). Also, because IDVO uses ADRs instead of direct share ownership, its positions have lower liquidity. As a result, a severe market shock could widen the spread between ADRs and underlying shares, which would lead to additional costs for the fund. Additionally, geopolitical stability around the world affects IDVO’s portfolio. Any escalations, international conflicts, escalations, or wars could lead to capital outflows from regions experiencing crises. Under these scenarios, the IDVO would be a more volatile ETF than the DIVO.

DIVO’s specific risks are primarily related to its sensitivity to Fed interest rates. If the US economy faces challenges that slow down the rate cut cycle, I think it could hurt the value of the stocks in this fund’s portfolio. Take inflation, for example, it’s a big threat and could go up because of the long-term effects of trade policy. Basically, anything that could mess with the US economy could hurt the value of the assets in the DIVO portfolio. How much it makes depends on the domestic market, how people spend their money, and how businesses are doing. So, when there’s a higher chance of a recession or the Fed raising interest rates, things could get tougher for the DIVO portfolio.

Conclusion

Direct comparison of Amplify Investment funds reveals both fundamental similarities and differences between them. Both funds receive a “Buy” recommendation. If I had to choose a favorite between them, I would currently opt for IDVO. Not only does this fund have an advantage over DIVO in terms of quantitative metrics, it also allows me to diversify geographically by adding IDVO shares to my income-oriented portfolio, as my investments in DIVO duplicate many of my other positions in the US stock market. Thus, the IDVO and DIVO are not mutually exclusive assets, rather they are complementary instruments. Moreover, such risks as the instability of the US dollar exchange rate observed since 2023 are a positive factor for IDVO’s overall return. Considering the ongoing attempts at de-dollarization in the global economy, IDVO investments may continue to generate additional returns from investments in international companies

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.