Introduction & Investment Thesis

If you feel that the AI trade is not making much sense lately, you are not alone.

In fact, last week was a roller coaster ride, with yet another brutal sell-off in SaaS amid growing fears of Agentic AI disruption. The damage was limited to software only, with chip makers such as AMD (NASDAQ:AMD) and hyperscalers like Microsoft (NASDAQ:MSFT) and Amazon (NASDAQ:AMZN) all caught in the cyclone of colliding AI narratives.

While part of the volatility could be attributed to the deleveraging in the crypto and metals complex that is straining liquidity conditions, along with the nomination of Kevin Warsh as the next Fed chair, who is perceived as a “hawk,” there is also a major underlying regime change in AI taking place. Since February, the Global X Artificial Intelligence & Technology ETF (AIQ) has been underperforming the S&P 500, now down (1.5)% YTD, compared to a 1.3% gain for the S&P 500.

I believe the regime change is being spearheaded by Anthropic’s Claude Code and Cowork, which marks an inflection point in Agentic AI and is forcing investors to reassess valuation multiples across companies in the AI stack.

Note that this isn’t at all bearish for the AI trade in the long term, as is validated by TSMC’s (NYSE:TSM) earnings call, where management described AI as a multi-year “megatrend,” while hyperscalers continue to expand their capex much faster than expectations in order to build capacity for serving their accelerating AI backlog.

However, in the short term, investors are increasingly cautious towards companies that have disproportionate backlog exposure towards OpenAI, fearing potential execution or financing risks, while capex growth is facing a lot of scrutiny on potential ROI concerns.

It is at these times that price action becomes increasingly more about emotion than valuation, and that is what we are seeing across various pockets of the AI trade today.

While Friday’s bounce was a partial relief after the wave of forced selling, I will point out that it doesn’t mean that the system is healthy again. Quite the opposite. With the price action earlier in the previous week, there was some major technical damage, with several market leaders breaking long-term trendlines.

While this does not alter the long-term AI thesis, it does not eliminate short-term volatility that investors need to be prepared for. In this post, I will outline the current state of the AI arms race, explain the growing divergence in the AI trade, and describe the scenarios that investors should plan for in the case of heightened volatility.

The AI Train Is Not Slowing Down

It started with TSMC reporting their Q4 FY25 earnings, when management explicitly called AI a multi-year “megatrend,” with management raising their forecast for AI accelerators to grow at a high 50% CAGR over the next five years (up from their previous forecast of 40% CAGR).

Not only that, but the company also raised their capex guidance for the full year FY26 to grow at roughly 32% and expects it to grow significantly higher over the next three years, underlining management’s confidence in the long-term AI demand.

The thing is that TSMC’s earnings serve as one of the most important sources of truth for the overall demand in the AI value chain. This is the case as the company sits beneath tens of trillions of dollars in market capitalization, with customers including Apple (NASDAQ:AAPL), Nvidia (NASDAQ:NVDA), Broadcom (NASDAQ:AVGO), AMD, and Google (NASDAQ:GOOG), that are pursuing AI through a different mix of merchant GPUs, custom silicon, and software all converging at the same point, that is, TSMC.

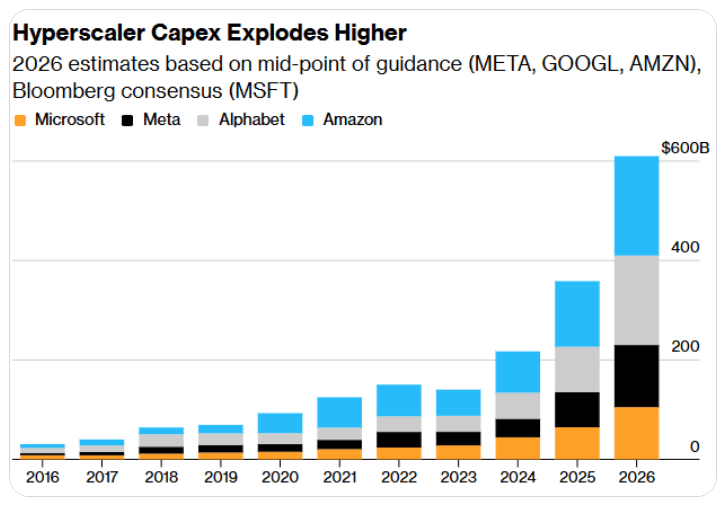

TSMC’s conviction in the AI megatrend was further confirmed when the hyperscalers consisting of Microsoft, Meta (NASDAQ:META), Amazon, and Google also raised their capex projections much faster than expected over the last two weeks, with total spending expected to reach over $680B that will be allocated to data centers, chips, and infrastructure as the AI race intensifies.

Source: Bloomberg, Hyperscaler capex projections in FY26

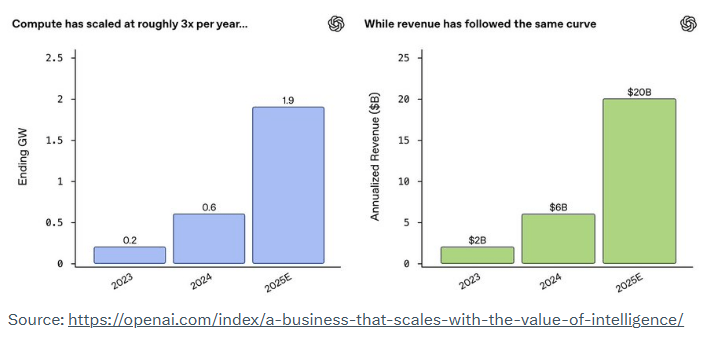

As Ethan Choi, Partner at Khosla Ventures, points out in his blog, revenue growth at AI labs such as OpenAI has generally scaled in line with their compute capacity, with ARR 3x’ing YoY in line with their GW growth, as can be seen below.

Source: OpenAI, Positive correlation between revenue and compute capacity

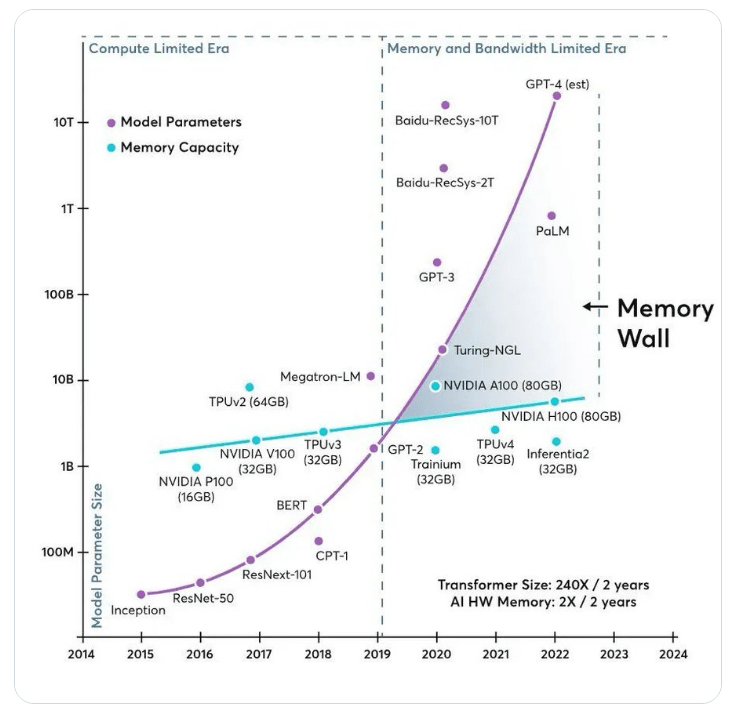

But it is not just about GPUs when it comes to scaling AI. Sure, this is the area that the markets have been the most focused on over the last 2-3 years. However, GPUs without memory and storage are useless.

As Shay Boloor from Futurum Equities points out, AI scaling has reached a Memory wall, where the teal line (memory) is nearly flat while the purple line (model size) goes exponential, suggesting that GPUs are increasingly starved for data because memory simply can’t feed them fast enough.

Source: Shay Boloor on X, AI’s Memory Wall

IDC is now calling it a “memory shortage crisis.” It’s the first time in 30 years that DRAM, NAND, and HDDs are all constrained simultaneously; that explains the pricing power and exploding margins of companies like Micron (NASDAQ:MU), Sandisk (SNDK), Western Digital (WDC), and Seagate (STX), benefiting their stock prices.

Similar to the memory and storage bottleneck, we are also simultaneously facing a bottleneck in advanced packaging, where the goal is to stitch together multiple components of an AI accelerator that include CPUs, GPUs, and HBM as densely as possible to remove latency and energy losses. TSMC is aggressively expanding its CoWoS capacity, with estimates pointing to roughly 125,000 wafers per month, where customers like Nvidia have already secured 60% of TSMC’s CoWoS allocation for its Blackwell and Rubin architectures, and Goldman Sachs pointing out that 2026 capacity is already sold out, despite the doubling of capacity.

So, to circle back to TSMC’s stance on AI, it is a multi-year megatrend, as we are still in the early phases of buildout where demand is outpacing supply, creating bottlenecks at various points in the AI ecosystem, a trend that will not slow down over the next couple of years, especially as AI inference demand is projected to explode higher, making up potentially 40% of data center demand by 2030, as per Mc. Kinsey’s estimates.

Yet The AI Trade Is Diverging

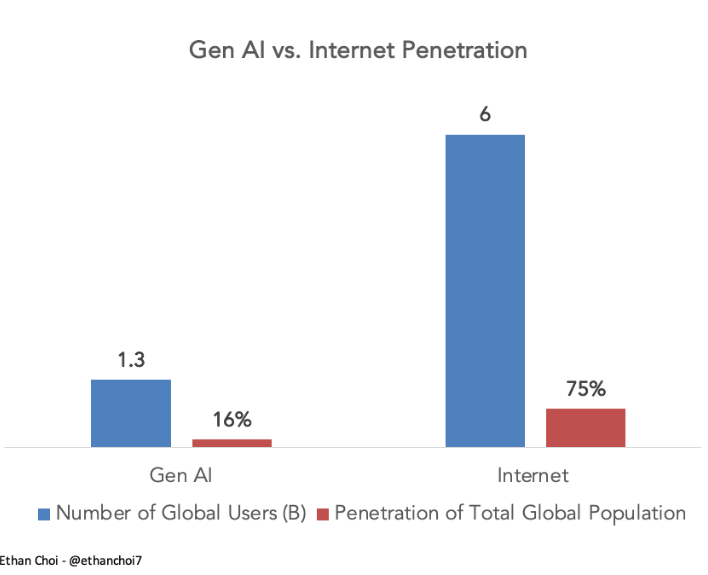

Yet, many fear that the capex investments to build out the AI infrastructure could turn out to be excessive, especially if demand does not show up. On that front, it is worth pointing out this study from Microsoft published in January, which shows that we’re only about 16% penetrated across the global population of ~8.2B people, implying that we have about 1.3B Gen AI/LLM users today.

Source: Microsoft, GenAI vs. Internet Penetration

In other words, AI penetration still remains low.

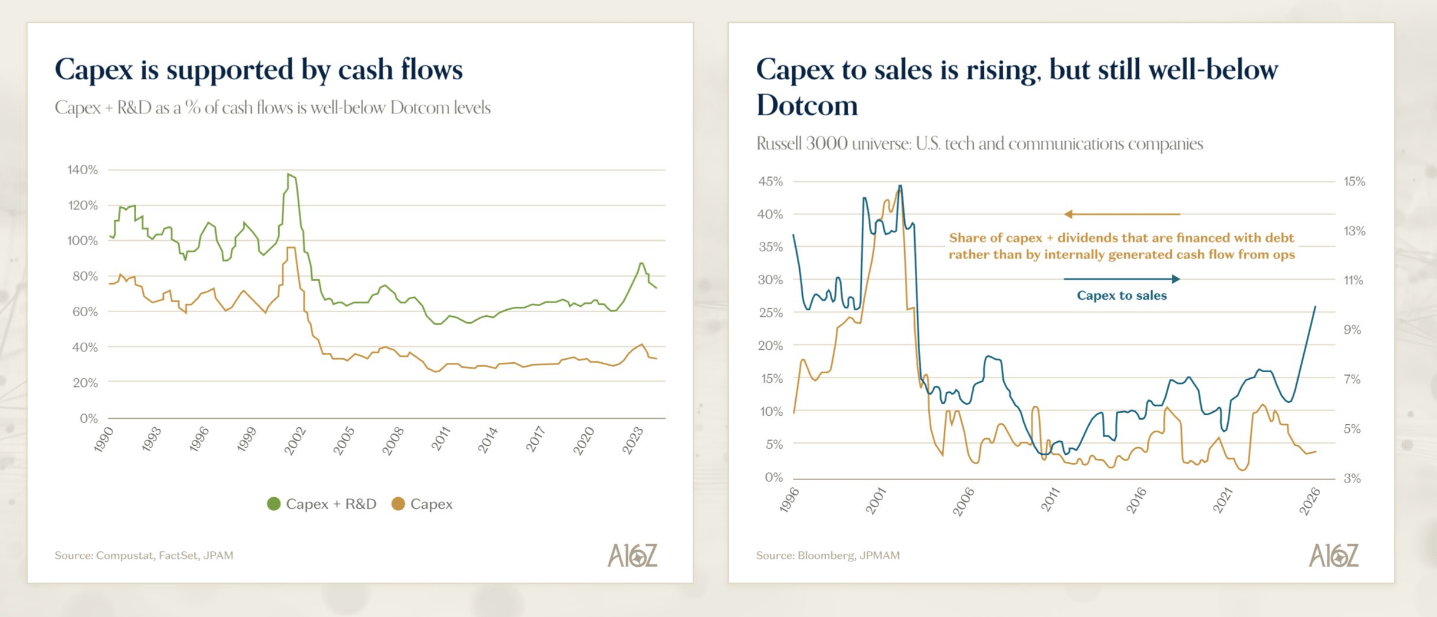

Meanwhile, to those who think that the current AI buildout resembles that of the dot-com bubble, here are two charts from A16Z that demonstrate that the current AI buildout is still mostly supported by cash flows, with capex-to-sales ratios well below the dot-com levels.

Source: A16Z, Capex is strong, but not unsustainable

Then, why the sudden sentiment shift in the AI trade?

Well, one can point to the deleveraging in crypto, straining liquidity conditions, as one of the contributing factors to the sell-off in risk assets.

But that is not all.

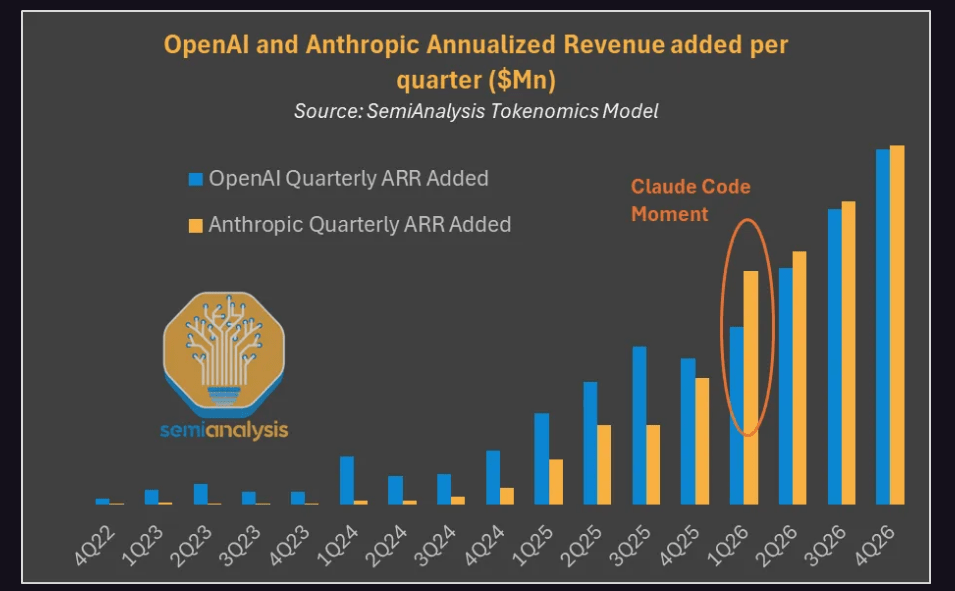

What I believe is happening is a major platform shift, with Anthropic Claude Code and Cowork directly rewriting the status quo on knowledge and coding. As SemiAnalysis pointed out, Claude Code marks the inflection point for AI agents that is set to drive exceptional revenue growth for Anthropic in 2026.

Since more compute translates to more revenue, as I discussed earlier, here is a chart from SemiAnalysis that compares future ARR growth from Anthropic and OpenAI, where Anthropic’s quarterly ARR additions have overtaken OpenAI’s since Q1 FY26, as Anthropic is adding more revenue every month than OpenAI.

Source: SemiAnalysis, Anthropic catching up to OpenAI’s revenue with Claude Code marking an inflection point

FYI: Claude Code reached a $1B annualized run rate just six months after launch, a growth rate that superseded that of ChatGPT.

In case you are wondering what Claude Code is, SemiAnalysis put it as follows:

“Claude Code is a CLI (command line interface) tool that reads your codebase, plans multi-step tasks, and then executes these tasks. It might be incorrect to think of Claude Code only as focused on Code, but rather as Claude Computer. With full access to your computer, Claude can understand its environment, make a plan, and iteratively complete this plan, the whole-time taking direction from the user.”

But there is more.

In 2026, Anthropic is accelerating even faster with the launch of Cowork (which is built using Claude Code) and targeted towards knowledge workers as an autonomous collaborator for general business tasks, with specialized plugins for legal contract review, financial research, and marketing workflows.

This, SemiAnalysis claims, could expand the TAM (total addressable market) of Agentic AI far beyond LLMs, especially as the autonomous task horizon expands with growing compute. In other words, we are looking at a future (not so far away) where the price of intelligence collapses, as illustrated below.

“The cost of Claude Pro or ChatGPT is $20 dollars a month, while a Max subscription is $200 dollars respectively. The median US knowledge worker costs ~350-500 dollars a day fully loaded. An agent that handles even a fraction of their workflow a day at ~6-7 dollars is a 10-30x ROI not including improvement in intelligence.”

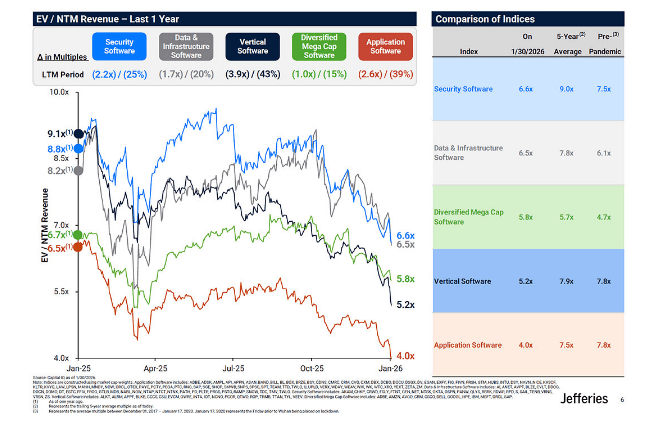

Enterprise SaaS has been the biggest casualty of this platform shift, with over $400B in market cap decimated since the start of the year, with a particularly brutal sell-off last week after the launch of Claude Opus 4.6, Anthropic’s most intelligent model to date with a 1M token context window.

Source: Jefferies, Multiple contraction across all the entire SaaS complex

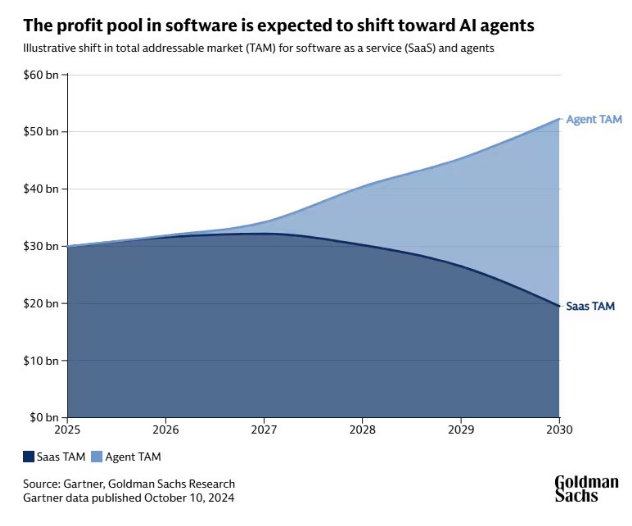

With the predictable “seat-based” pricing model of Enterprise SaaS under threat, investors are now applying lower terminal values, lower free cash flow projections, and higher discount rate assumptions, with Goldman Sachs now predicting that the profit pool in software will shift towards agents, as can be seen below.

Source: Goldman Sachs, Profit pools in Software to shift towards Agentic AI

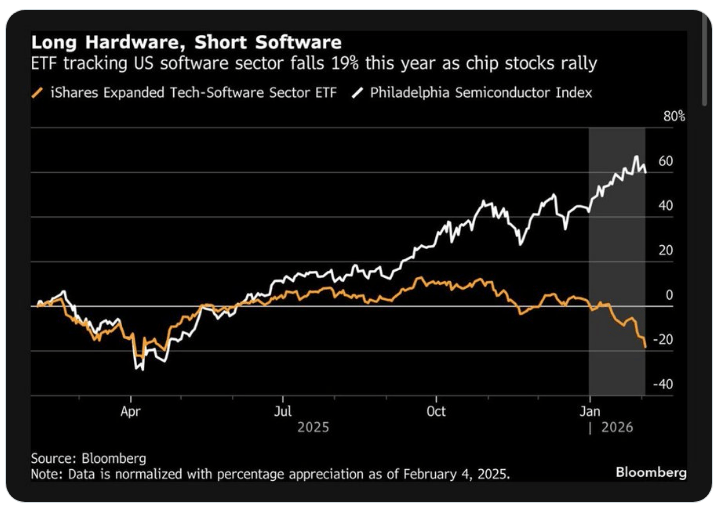

This has created one of the largest divergences between semiconductors and software complexes, which has reached a peak, when both of these sets of stocks have typically moved in line with each other in the past, signaling a major regime change is in progress.

Source: Bloomberg, Growing divergence between Software and Semiconductor performance

The AI Sentiment Has Worsened In These Names Too

But the decimation is not just concentrated in Enterprise SaaS but also in hyperscalers such as Microsoft and Amazon, along with chip makers like AMD, where investor sentiment has soured despite a solid beat and raise to full-year guidance.

When it comes to Microsoft, the stock is down 17% YTD as investors are wary of the company’s 45% backlog exposure to OpenAI, along with a major competitive conundrum where its Office 365 product suite powered by Copilot directly competes with OpenAI and Anthropic, the same companies that are leveraging Microsoft’s Azure cloud to train and deploy their models.

Similarly, when AMD reported their earnings last week, the stock also dropped more than 14% after earnings despite beating both top and bottom lines and management reiterating their long-term targets to grow at more than 60% annually over the next several years. There are a couple of reasons for that.

First, even though data center revenue grew ~40% and beat estimates by a wide margin, that is still well below the more than 60% growth rate AMD is targeting longer term. Second, investors are growing increasingly cautious around the bull case that is now tied to OpenAI (similar to Microsoft and Oracle), fearing potential financing and execution risk ahead. AMD has secured important commitments, including multi-gigawatt deployments, but the reality is that the ultimate scale and timing of those projects is still uncertain, not just for AMD but for the entire AI infrastructure ecosystem.

In all of this, The Information published an article explaining why big tech companies are racing to invest in OpenAI. As the reporter points out, cash-rich companies are providing financial breathing room for OpenAI, which faces increasing competition from Google’s Gemini and Anthropic, allowing it to hold out until revenue and profits become sustainable or at least until it gets close enough for the market to open the funding tap.

As this X thread points out, “Big Tech is not valuing OpenAI at $730 billion because they want to. They have realized that if they don’t give OpenAI $100 billion, $1 trillion will vanish from their own market capitalization.”

The truth is market narratives are colliding with each other, where on one hand there is growing fear that AI will disrupt traditional SaaS, while on the other hand, there is rising skepticism about ROI on rising AI capex, unless unit economics are rapidly improving, as in the case of Meta.

Appointing Kevin Warsh Signals A Regime Change In The AI Arms Race

Meanwhile, what has further complicated the AI narrative is the nomination of Kevin Warsh as the new Fed Chair, where he is perceived to be “hawkish,” with markets now expecting higher-for-longer interest rates (fewer cuts) and a smaller balance sheet.

But I don’t think it is quite as straightforward.

The reason being, Warsh is also deeply optimistic about AI and views it as a structurally deflationary force. This should set the stage for easier monetary policy. What is also important to note is that Warsh would likely not be able to meaningfully shrink the size of the balance sheet, according to Lyn, especially with the current standing where banks are near the low levels of their ample reserve range, which has already prompted the Fed to shift towards balance sheet growth.

As this X thread points out, shrinking the Fed’s balance sheet would immediately strain liquidity, where 75 percent of all transactions revolve around refinancing existing debt. It would also raise an unavoidable question: who will absorb the trillions of dollars in new US debt issuance?

“A debt-driven system, in which GDP growth increasingly depends on ever-expanding debt, can only remain stable if debt sustainability is ultimately ensured by the central bank, a regime of fiscal dominance. Moving decisively in the opposite direction, while interest expenses are already projected to surge, risks turning pressure into outright explosion.”

Put it simply, in order for the AI trade to keep roaring, we need easier monetary policy and ample liquidity in the financial system. Until the market gains clarity on the incoming Fed’s stance on monetary policy and balance sheet controls, markets will remain cautious on the AI trade in general.

S&P 500 Is Priced To Perfection, Leaving No Room For Error

Entering 2026, analysts are very optimistic about the S&P 500’s (SPY) growth rate of 2026 earnings per share, where FactSet expects it to accelerate to 14%+, compared to a projected 11%+ for 2025, with a bottom-up 2026 year-end price target for the S&P 500 at 7,968.78. That represents an upside of 15% from current levels.

Meanwhile, at its peak close to the end of January, the S&P 500’s forward PE ratio stood at 22x based on FY26 earnings per share estimates, which is 1.8 above the 5-year average (20.0) and above the 10-year average (18.7).

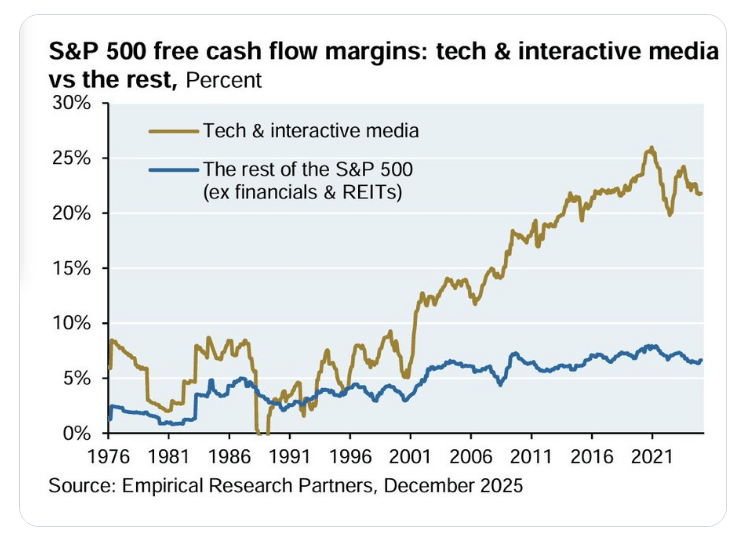

While the S&P 500’s valuation may seem stretched, inducing fears of a “bubble,” here are three charts that I would like to draw your attention to.

The first chart shows that S&P 500 FCF margins for technology companies have grown much faster than the rest (ex-financials and REITs) since 2001.

Source: Empirical Research Partners, S&P 500 free cash flow margins are growing faster for tech

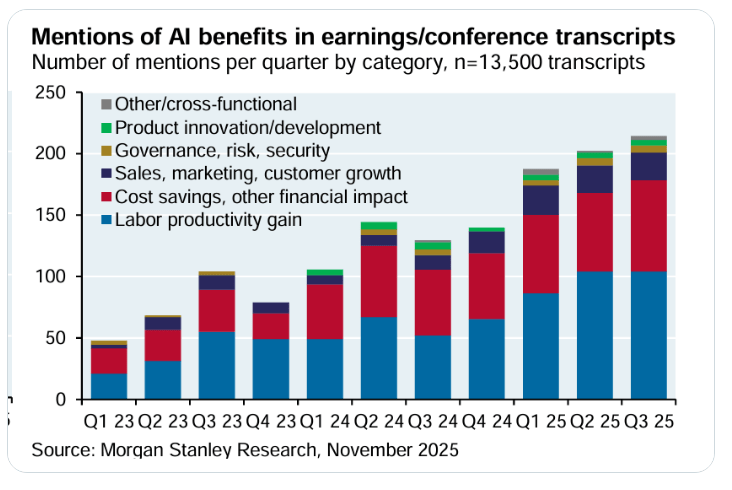

Second, the mentions of AI benefits on earnings calls continue to grow, largely driven by a) labor productivity gains, b) cost savings, and increasingly, 4) sales, marketing, and 5) customer growth.

Source: Morgan Stanley, Mentions of AI benefits in earnings calls

Finally, the US is still much more profitable than Europe, Japan, and China, with higher ROAs and ROEs, thus deserving higher valuations.

Source: Bloomberg, Higher return on assets and equity in the US compared to other geographies

Moving forward, these are the following most likely scenarios that I believe can play out for the S&P 500 in no sequential manner that investors need to manage their risk appetite for.

- Productivity Acceleration: In this scenario, the earnings per share of the S&P 500 grow at par or higher than the 14%+ range, driven by acceleration in AI monetization (from growing inference) as well as efficiency gains captured, expanding operating leverage. The macroeconomic environment remains stable, with inflation trending lower, resulting in the Fed lowering their interest rates. This in turn fuels further economic growth, allowing companies to continue investing in capital expenditures, which keeps the flywheel in motion. In this case, we may see the S&P 500 indeed rise to 8000, which will translate to the current forward PE multiple expanding from 22 to close to 26, assuming no change in current forward earnings estimates.

- Status Quo: In this scenario, we assume that while the bullish trend remains intact, markets will continue to remain cautious over concerns about the future direction of monetary policy, ROI on AI capex, and earnings growth rates, which will keep multiples anchored at current levels. In this scenario, the S&P 500 could remain rangebound within the 6720 and 7200 range, representing an upside/downside potential of +/-4% from current levels.

- The Setback: If the current uncertain narrative around AI meets with earnings that just meet expectations or worse, tighter liquidity conditions than what is currently priced in (in the form of fewer rate cuts, 10-year yields rising, growing inflation, etc.), we can expect a severe compression in forward price-to-earnings multiples, as the equity risk premium goes up. Assuming that it reverts to the 5- or 10-year average PE ratios of 20 and 18.7, respectively, we can expect a 10-20% decline in the S&P 500 from current levels, which gets it down to 5900-6400.

- Deflationary Recession: The most likely worst-case outcome, barring a financial or credit-related event next year, is the onset of a recession. While such an event is likely a low-probability occurrence in 2026, a scenario like this would likely lead to more severe earnings disappointment and market repricing. If such were to occur, a valuation contraction toward 18 times earnings is possible, with a price decline in the index towards 5100-5200, taking markets back close to the 2021 peak, or a 26% correction.

Conclusions

The way I see it, the probability of a “deflationary recession” is quite low in our opinion. However, we need to be prepared for a 10-20% correction in the S&P 500 in 2026, which could take place if we break the support at the 6800 level, with a big air pocket in between, that could take us all the way down to 6400. As a result, we have been actively raising cash in our portfolio to over 25% by trimming positions into strength and cutting losses/exiting the ones where our conviction is not at the highest. This is also a time where our existing portfolio allocation size, cost basis, and investment horizon play important roles in determining our trading actions.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.